UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

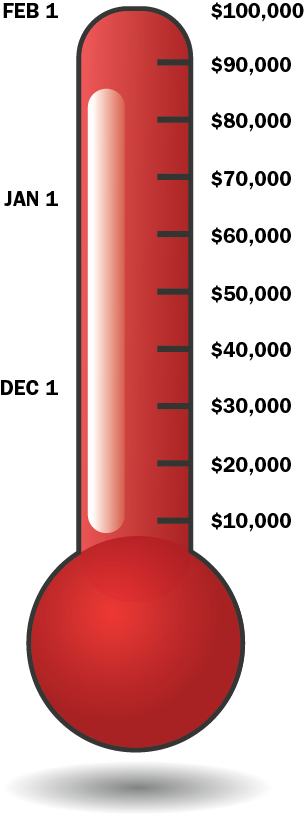

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

ADSC has some smart people, I am assuming they have discussed and weighed the benefits of trying?

@GwEvil

No no no! It was something about when the case was filed, that for example one could not continue to take exorbitant penalties until it was cleared whether this procedure was constitutional or not. Something like that- that once sued, one had to stop and wait for the outcome of the suit. ( Sorry – sometimes my english is very poor. I dont speak english all day.)

exciting news,

republicans overseas, in their facebook page, say they raised enough money for thier lawsuit

https://www.facebook.com/republicansoverseas

Just saw this (Aug 2014 article):

http://business.financialpost.com/2014/08/18/canada-u-s-dual-citizens-could-be-worse-off-if-fatca-lawsuit-succeeds/

I would be to differ from their conclusion. If the IGA is voided, US persons could bank at local banks with no US connection. Am I right to conclude that a bank with no US business could, if there were no IGA, ignore FATCA?

@Polly – hm ok that I can’t answer to. Will have to wait for the legal experts to weigh in. Same with @FromTheWilderness’ last question.

@Fred

“Am I right to conclude that a bank with no US business could, if there were no IGA, ignore FATCA?”

My understanding–I may be mistaken though–is that FATCA, if fully implemented, divides the world into the FATCA-compliant part and the FATCA-non compliant part. Any time money flows from the FATCA-compliant part of the world to the FATCA-non compliant part, 30% must be withheld and sent to the IRS. Part of the definition of being FATCA-compliant is to agree to perform this withholding.

So, yes, if there were no IGA a bank in Canada could choose not to comply w/FATCA. But then if you were working for a Canadian company that banks with a FATCA bank, that FATCA bank would withhold 30% of your paycheque and send it to the IRS before direct depositing your paycheque in your non-FATCA Canadian bank.

Countries with much fewer ties to the USA than Canada does could probably get away more easily with having one or two FATCA banks but otherwise ignoring FATCA. The one or two FATCA banks–in such countries–could cater to the few people/companies with US dealings with the rest of the banks handling local transactions. In Canada this would be a much more difficult proposition meaning it has to (IMHO) be dealt with at the government or federal court level–hence my support of our lawsuit.

@GwEvil “that would be an injunction and would be great, I’d love that! But that would cost us a lot more money and could end up not being granted.”

But that would be the one way to ensure that people are protected. What’s the point of this lawsuit if the Canadian government sends the data in July of this year? If the matter is not settled by then, and the data is allowed to be sent, the damage is done. What’s the point of giving then? Assuming the lawsuit is won, it will only benefit future generations.

First, I just noticed that I have been using two screen names! Forgot which I was using for this site. “Japan T” and “Tinjapan” are the same, me.

@ noone says

And injunction alone, I believe, is not possible as it is a hold on activities pending the out come of the lawsuit. Although close, they have not yet raised enough money for the lawsuit only. I’m guessing that they feared adding the cost of an injunction would raise the amount needed to an unattainable level.

For future generations, my child, is exactly why I am sending money. I’m toast once they get down to my file on the stack. All my info was sent to the Treasury dept. by the State dept. When I renewed my passport two years ago. Searching for answers on several illegal statements on the application, I discovered that without changing my activities that I went from law abiding citizen to criminal and that my spouse and our child are also on the hook. I don’t have the funds to fight this on my own and my only hope for my spouse and child is for this to be stopped before they are hauled in. I’m already aboard and in the holding tank, will you please help us cut the net and free our children before they are hauled aboard?

I do not know what the extra cost would be to get an injunction but it would be the ideal route to take. It would put the kibosh on all the ruin that is presently being caused.

It might be that the Bopp litigation would have the best chance at an injunction due to the very slippery legal ground Treasury is on in twisting arms to sign IGAs. Because without an IGA FATCA cannot succeed in any country. What they are doing is illegal in most sovereign countries , they knew it and know it now and it is the primary reason they strong armed Countries into signing. Canada knew it and all they had to do was say NO.

It was and is the banks who are spending hundreds of billions in FATCA compliance issues when none needed to be spent at all.

The Canadian government signed the IGA to protect the BANKS not the lawful citizens and residents of Canada.

Hence this lawsuit!!

Jim Bopp could have the best chance to stop this for the whole world in getting an injunction against Treasury and their criminal activities around the world all done with out advise and consent from the Senate.

It would be interesting to know what the added cost would be for an injunction, yes. It would come as a major surprise to me if it were significantly more than the cost of the underlying lawsuit because I thought that an injunction was, essentially, a fairly simple request to stay the implementation of some law or activity pending the outcome of a lawsuit–but based on exactly the same underlying legal arguments as the lawsuit itself.

I would have thought that, at least by legal standards, requesting an injunction would be a relatively simple matter. Predicting the outcome of a motion for an injunction, however, isn’t something I’d even hazard a guess on–but I’d like to see it happen if it were feasible.

I’m very glad to hear that the Republicans Overseas have the $ for the lawsuit challenge to the Supreme Court of the United States. Not only does this mean that important lawsuit can go forward, but it also means no one has to be conflicted any longer between funding that lawsuit or our Canadian one. We’re behind the other lawsuit in terms of funding only. As Tricia Moon pointed out, our lawsuit is filed, the defence has responded, and we’re in the discovery phase. Let’s help this lawsuit reach its funding goal, and make Canada sovereign again!

When I take a step back to think about it, FATCA was designed from the very beginning to “force” banks worldwide to sign individual agreements with the IRS to report on anyone and everyone with traces (indicia), and therefore suspected of being, a US person.

FATCA was purposely designed to bypass national governments in order to prevent their demands for reciprocity.

Then FATCA was stealthily slipped into a bill for veteran benefits that all lawmakers were politically “afraid” not to sign.

Then national governments told their banks that agreeing to FATCA would violate constitutional privacy laws so the US Treasury sends Robert Stack on a world-wide tour to pressure such governments into signing IGAs, while the banks along with the compliance industry (Roy Berg and friends), lobby the national governments to throw their tainted citizens under the bus.

Those Democrats are sneaky bastards! And dirty too.

I really hope the Republicans block FATCA entirely and embarrass the Democrats in the eyes of the rest of the world.

Dear Brocker colleagues,

Perhaps it may be a good moment in time for the Brock Swat Team to start actively commenting on the Facebook pages of key US legislators, in particular the House Ways and Means Joint Committee on Taxation members.

These are the people who hold the key to US Tax Reform. Using Facebook may be a very worthwhile strategy for enlightening those ignorant “door in the ass” type lawmakers about the ills of CBT along with their FB followers, while also thanking those members who have already seen the light.

Its just an idea, but I have to admit, I really believe the Brock Swat Team made a big difference in changing the narrative of a previous 100% hostile meme infected media. In fact, an easy way to do it would be to copy/paste many of the already existing comments Swat Team Members have already made, both here and from the various articles.

The point being is that IBS made great progress with the media, so why not try a similar strategy right inside the “belly of the beast,” the House Ways and Means Committee members themselves.

It doesn’t matter if we use real FB accounts or fake FB accounts — its the message itself that is important.

http://waysandmeans.house.gov/about/members.htm#4

Assignment of Members to the Joint Committee on Taxation:

Rep. Paul Ryan, WI — empathetic towards expats

Rep. Sam Johnson, TX — ???

Rep. Kevin Brady, TX — ???

Rep. Sander Levin, MI — Carl “FATCA” Levin’s brother

Rep. Charles B. Rangel, NY — a tax cheat himself

@Dash1729,

“So, yes, if there were no IGA a bank in Canada could choose not to comply w/FATCA. But then if you were working for a Canadian company that banks with a FATCA bank, that FATCA bank would withhold 30% of your paycheque and send it to the IRS before direct depositing your paycheque in your non-FATCA Canadian bank.”

A Canadian bank transaction, from one Canadian bank to another, would have a US requires 30% witholding on a Canadian’s paycheque? Wanna’ see pitchforks and torches? That may be the way the Americans WANT it to work, but I could never see that happening. The transaction would have zero to do with the US, the US wouldn’t even know about it, per my understanding of current Canadian bank clearing. It remains an in-country transaction. Also, my understanding is that even with FATCA, witholding relates ONLY to US sourced income/transactions…like financial products, not paycheques. What would be next? GST rebates? CPP payments?

I note from the Republicans Overseas Facebook page that the decision to proceed with the US lawsuit has been made, and they are seeking plaintiffs. I assume that Jim Bopp is the lead attorney but the RO posting did not mention that. If it proceeds and is filed and aggressively prosecuted it will be helpful but like the Canadian suit, on-going funding will be needed. I am not sure if the suit will attack just FATCA or CBT and/or FBAR penalties as well.

Re: fatcalegalaction concerns US law. Let’s say FATCA is derailed. That is no guarantee that it or parts of it won’t come back in future years under a different name. A real guarantor to protect US persons abroad are the tax treaties. Right now they are doing a very poor job of this with Canada’s better than most. This is where the ADCS lawsuit comes in and it will highlight how Canada has blindly accepted US law as its own to the detriment of Canadians and Canadian Sovereignty.

Further to what I wrote above is the possibility of commenting directly on the FB pages of the RNC and DNC Party Chiefs.

RNC: Reince Pries

DNC: Debbie Wasserman Schultz

The Democrats are still licking their wounds from the their loss of the Senate so they may actually be open for suggestions.

http://thehill.com/blogs/ballot-box/223434-report-dnc-to-launch-top-to-bottom-review-of-midterm-strategy

@All:

Perhaps it is important for us to remember that the Canadian government had choices in drawing up the IGA. And they were given no less than 6 amendment suggestions by opposition MPs ( NO conservative MPs made ANY amendment suggestions and shot down all ideas that would have made the IGA both viable for the banks and protect citizens and residents.

The amendment to exclude Canadian Citizens and Permanent Residents ( as the Charter protects) from the IGA would have been a perfect remedy and it was rejected 6 times out of hand.

Particularly egregious was the rejection comment by Conservatives that “Congress has spoken”

THAT more than anything told everyone that Canada was taking orders from the IRS and the US government , acting as their lackeys.

They might as well be George Soros during the war pointing out Jews to the Nazi’s and profiting from that betrayal., making millions doing it and undermining free peoples and sovereign governments to this day.

Essentially our Conservative government made a deal with the devil promising to point to any and all victims they could find and saying “Yes, Master” while they do it!

IF they had included the amendment in the IGA there would be no lawsuit today.

But they did not and there IS a lawsuit.

One of the most important, if not THE most important lawsuits on the planet!

@Furious.. Can you tell me exactly who the MP’s were that shot down all of the amendments that would have protected Canadian citizens? I want the list for a T-Shirt I am creating. Thanks.

@NativeCanadian

EVERY Conservative member of the Finance Committee. EVERY SINGLE ONE.

The Finance Committee:

Name Title

Rajotte, James Chair (Conservative)

Brison, Scott (Hon.) Vice-Chair (Liberal)

Cullen, Nathan Vice-Chair ( NDP)

Adler, Mark Member ( Conservative)

Allen, Mike Member (Conservative)

Caron, Guy Member (NDP)

Keddy, Gerald Member (Conservative)

Rankin, Murray Member ( NDP

Saxton, Andrew Member ( Conservative)

Van Kesteren, Dave Member (Conservative)

Every single Conservative voted against all six amendment submissions which essentially excluded Canadian Citizens and Permanent Residents from the IGA.

Forgive me if someone has already connected these dots, but I am very heartened by today’s news that Canada’s Supreme Court has ruled that the Mounties have the right to form a union if they wish, and that the legislation banning the Mounties from doing so (dating back to the 1960s) violates the Charter guarantees of freedom of association.

http://www.cbc.ca/news/politics/rcmp-officers-have-right-to-collective-bargaining-supreme-court-rules-1.2912340

The decision was 6-1, and of the 7 sitting justices, three (yes 3) are Harper appointees. Even his own appointees are putting the Charter rights of Canadians ahead of political ideology and/or expediency.

The court was particularly not impressed by the government arguments about national security and safety requiring restriction on the Mounties’ bargaining and association rights. I don’t think it’s too much of a stretch to extend that argument to the claims that the government had no choice on the IGA because the banks have over-exposed themselves to investment in and bullying by the US.

There has been a string of Supreme Court decisions recently which, on Charter matters, have decisively rebuffed the current federal government and legislation that contravenes Charter protections.

That encourages me to believe that if the FATCA/IGA Charter challenge gets to the Supreme Court, if not before, there is an excellent chance that Harper, Finance, Justice and the CBA may very well have the IGA rug yanked out from under their feet.

Donate to the Charter challenge fund (ADCS fund) to help make this happen. We can do it, folks!

@NativeCanadian: At Finance Committee, the Con MPs who voted against the amendments were: Mke Allen, Gerald Keddy, James Rajotte, Andrew Saxton, Susan Truppe and Dave Van Kesteren. Susan Truppe is not a regular member of the committee. I believe she was attending that day in the place of Con Mark Adler.

Vote at 16.43.

Thus, on your T-shirt,NativeCanadian, should be the names

@Blaze and @Calgary411:

Thanks for that video, Blaze. I was thinking we could use video of the Finance Committee, particularly when the amendments were introduced and the comments from the Conservative members, the smirk on the face of the Bank rep, Lynne’s submission and the vote.

And Calgary, thanks for that clarification. I thought there was a substitute member that day.

After watching that video again, I am enraged anew. This should be top of and accompanied by the post regarding donations and how much we still need.

Important points for me were the bloodless way the cons spoke and the idea that the IRS might not like it if Canada amended the IGA to uphold Canadian law and privacy.

In addition it was made clear that not only so called US Persons but those married to US Persons were heavily impacted made NO impression on those blockhead con mps.

The “Congress has spoken” comment that so enraged us all is really a lie because Congress did NOT speak on FATCA. TREASURY spoke and did not ever get ratification by Congress. Thereby making FATCA illegal! The ONLY way to push it on sovereign governments was bully their way to get them to sign an IGA ( an Intergovernmental Agreement between a sovereign nation and Treasury is in NO way a treaty).

If Canada had stood their ground on that matter alone OR had accepted the amendments submitted our sovereign protections would remain intact and the US could work out the FATCA mess on their own.

Any Canadian citizen born and raised in Canada who is married to or associated in business with a deemed “US Person” has their financial information and their savings completely at risk of confiscation by the IRS!