UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

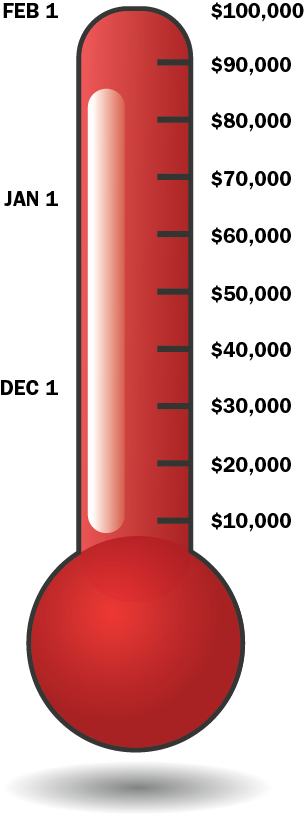

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

AnonAnon,

Thanks for your reminder,

I’ll second that thought. The account that I hold for my son, a Canadian Registered Disability Savings Plan that the Canadian Conservative government states is *exempt* is exempt only for the financial institution’s reporting to the Canada Revenue Agency. It is an account that I hold for my son (and he the beneficiary when he is 62), on which I had to pay to the US IRS $US3,661. This is the way the Canadian RDSP (and the Registered Education Savings Plan, RESP) is taxed by the US for US Persons in Canada:

Most of all, thanks for your continued donations to ADCS-ADSC even after you have completed your journey of expatriation out of US citizenship and its CBT hell.

See more at: http://www.rdsp.com/2014/03/10/rdsps-and-fatca-warning-to-people-with-disabilities-with-any-connection-to-the-u-s/

Thanks for the comment

BUT

I’m still proud to be a us citizen.

I’m ashamed of course of my country to be so primitif with CBT and FATCA.

The USA needs to abolish CBT and adopt RBT if it wants to save the US economy

Is there no good counsel willing to take this on the merit of the case alone? I’ve donated and I have no skin in the game anymore, will likely donate again but it seems we need a counsel willing to take this on because what’s being done is wrong.

@Stateless Man

Would be great but we have never had a single offer that I know of.

@Stateless Man,

You are asking whether a good counsel would have taken on our case, which will likely go to the Federal Court of Appeal and the Supreme Court, free of charge and pay all legal expenses, salaries, disbursements, etc. When we were seeking out and comparing litigators and organizations we did of course ask, but as expected no one agreed to take on our “complicated” case and pay the costs just for the “merits”.

Money was not the only problem: There were some firms that probably would have been qualified but would not take on the case for any amount of money. You can guess why.

At the end we chose Joe Arvay, on the basis of his track record and on the strength of strong recommendations from his Canadian peers. His fee is “high”, but it was negotiated.

It is heartening to see support for the ADCS legal challenge both from those with their CLNs, and those without.

On the topic of ‘skin in the game’.

I have my manumission papers – I obtained/bought out my freedom from the US at what was a great cost for myself and my Canadian family (not in US taxes as I owed NONE and barely met even the taxable threshold in Canada. I and we paid an unacceptable and useless price in stress, wellbeing, state of mind, compliance costs, legal local entirely Canadian generated savings, and financial resources, which posed a significant threat to our Canadian family. Even though I am no longer a US citizen, that did not make me want to put this aside.

If anything, it further strengthened my opposition to FATCA – because as one with now even NO possible US relationship (other than the birthplace that I cannot do anything to change), I am still potentially dogged by my US national origin, potentially forced to travel and bank with CLN at the ready, AND, most important of all, FATCA and the FATCA IGA still hurts my country of CANADA, my fellow citizens (both solely Canadian citizens, and also Canadian citizens and residents of US national origin/parentage/status).

I refuse to accept the extortion and economic sanctions the US is wielding as a weapon, and the subversion and suppression of our Charter and Constitutional laws and rights, due to the weak traitorous and self-serving actions of those Canadian politicians, agencies and business interests (ex. the CBA and IIAC) who chose to become US FATCA collaborators conspiring against their own people and country.

Therefore, far from having less stake in this, I find that I have the same or more. FATCA imposed by force and threat on Canada is still an unwarranted extraterritorial and unacceptable intrusion into Canadian sovereignty, and burden on ALL Canadian taxpayers – who will see Canadian tax revenues diverted to pay for the US free lunch, and via US CBT, diverted to pay down the US national debt.

Any dollar of Canadian resources that the Harper government wastes in imposing and defending the ‘right’ of a foreign country to impose extraterritorial taxation on Canadian taxpayers, either directly, or by using the CRA and the financial sector as IRS and US Treasury proxies is a dollar illspent. Any Canadian dollar spent by the Canadian federal government to defend their illegal and unjust legislation and signing of the FATCA IGA against Canadians who demand that our Charter, Constitution and sovereignty be respected and upheld by the very government who is sworn to do so, is a dollar of our own Canadian taxpayer money that is being used against the rights and best interests of Canadians. Any dollar of our own Canadian taxes misspent on collecting, transmitting and thus making our personal and financial data vulnerable to the US Homeland Security and Patriot Act laws, and the US Treasury, is a travesty.

That the CRA is now generating baseless and misleading assurances about FATCA – full of empty and disingenuous drivel is adding further insult to the already significant injury: http://www.cra-arc.gc.ca/tx/nnrsdnts/nhncdrprtng/ndvdls-eng.html

Example:

” 3. Does my financial data remain confidential?

Yes, it does. The information is exchanged in accordance with the provisions of the Canada-U.S. tax treaty. The treaty contains robust safeguards to make sure that the IRS treats as confidential the taxpayer information that it receives and that it uses the information solely to administer tax laws.

4. What does each government do with the information it receives?

The CRA and the IRS use the information they receive primarily to assess risk and to make sure that taxpayers properly report their income from accounts they hold in the other country.

The Canada-U.S. tax treaty limits the use of information received through exchanges such that it can only be used to administer tax laws. For example, the IRS cannot share the information it receives under this agreement with non-tax authorities. Also, the IRS cannot use the information to administer non-tax laws such as the U.S. Bank Secrecy Act.”

Fund the ADCS challenge so that we are not forced to be subject to more deliberately disingenuous crap in the same vein.

badger,

So well said. More of your most effective thought-provoking words should go to CARP (and media). CARP didn’t listen to anything I said or respond to what WhiteKat said. The newsletter, “CARP Action Online”, could ask questions based on what you say about any dollar of our own Canadian taxes misspent on collecting, transmitting and thus making personal and financial data vulnerable to the US Homeland Security and Patriot Act laws and the US Treasury — what would other Canadians read, digest, think about and determine? What do other Canadians care about this country’s sovereignty?

@badger,

CRA is drinking the koolaid. And frankly, the US govt, particularly under the Obama administration, routinely ignores the law. I am currently reading “No Room to Hide” and it is sickening. Breaking the law means absolutely nothing to them. It is extremely depressing.

FWIW, the defining parameters about who/what the IRS may share info with are found in 26 U.S. Code § 6103 – Confidentiality and disclosure of returns and return information

Of course there is a long, long description containing various definitions and so on with the basic idea that information may be released under certain circumstances if criminal or terrorist actions are suspected.This is the section I think is most relevant to our concerns:

(i) (7)(B) Disclosure to intelligence agencies

(i) In general Except as provided in paragraph (6), upon receipt by the Secretary of a written request which meets the requirements of clause (ii), the Secretary may disclose return information (other than taxpayer return information) to those officers and employees of the Department of Justice, the Department of the Treasury, and other Federal intelligence agencies who are personally and directly engaged in the collection or analysis of intelligence and counterintelligence information or investigation concerning any terrorist incident, threat, or activity. For purposes of the preceding sentence, the information disclosed under the preceding sentence shall be solely for the use of such officers and employees in such investigation, collection, or analysis.

(ii) Requirements A request meets the requirements of this subparagraph if the request—

(I) is made by an individual described in clause (iii), and

(II) sets forth the specific reason or reasons why such disclosure may be relevant to a terrorist incident, threat, or activity.

(iii) Requesting individuals An individual described in this subparagraph is an individual—

(I) who is an officer or employee of the Department of Justice or the Department of the Treasury who is appointed by the President with the advice and consent of the Senate or who is the Director of the United States Secret Service, and

(II) who is responsible for the collection and analysis of intelligence and counterintelligence information concerning any terrorist incident, threat, or activity.

(iv) Taxpayer identity For purposes of this subparagraph, a taxpayer’s identity shall not be treated as taxpayer return information.

This is the definition of taxpayer return information:

(b) Definitions

(2) Return information

The term “return information” means—

b(3) Taxpayer return information

The term “taxpayer return information” means return information as defined in paragraph (2) which is filed with, or furnished to, the Secretary by or on behalf of the taxpayer to whom such return information relates.

b(6) Taxpayer identity

The term “taxpayer identity” means the name of a person with respect to whom a return is filed, his mailing address, his taxpayer identifying number (as described in section 6109), or a combination thereof.

After digesting that, it appears to me no one can assume their information will be safe because any agency who wants it can simply slap the label criminal or terrorist on it and voila! Out it goes. One certainy can imagine that Homeland Security, USCBP, the CIA and the FBI will certainly be able to obtain what they want. Re-listening to Abby Deshman’s talk at the FATCA Forum puts it out in plain terms.

https://www.youtube.com/watch?v=ij2I9dHWuUE

ABOUT “GOOD COUNSEL”:

From everything I’ve read and heard about Joe Arvay, he will be worth every loonie, besides which he was willing to negotiate the price. Also, he believes that the gov’t should help with the costs. I think that if we fail to make the Feb. 1 (or any) deadline, he’ll give us the extra time and wiggle room, realizing we WANT to pay him as soon as we can.

Below is an excerpt from an article that came out in May, 2014 (the article link was probably posted somewhere else on this website but I don’t know where):

http://www.biv.com/article/2014/5/joseph-arvay-freedoms-fighter/

Arvay has also been fighting to get the government to pay the costs of citizens challenging the charter.

“I believe that if we are going to have an equal playing field when we are litigating the charter, the government should be required to pay the cost of not only the government lawyers but the lawyers on the other side of the case, because one of the greatest impediments to justice or the access to justice in Canada is our legal costs,” he said. “Governments don’t have any problems finding the money to defend laws when they are being challenged, but citizens have a huge amount of difficulty.”

@Tricia Moon

Basically everyone including everyone in our gov’t except perhaps the janitor… will have our info without a warrant… every letter of the alphabet agency…. Hey… maybe they will put the info on those crappy HD they normally use… u know… the ones with the missing emails…. As I recall… there was a discussion about this…. US gov’t stated all this info did not fall under the privacy act…. lets all be honest… do u trust them…. I know I no longer trust anyone in gov’t….

@ Jan

Thanks for finding that article about Joseph Arvay. He said, “I just enjoy anything that is actually complicated and complex.” That’s this case in spades. I’ve felt from the beginning he was a good choice and now I’m completely convinced.

@Tricia Moon,

I too am concerned about the way an individual’s information can get labelled “criminal or terrorist” and then the agency can do anything with it. If we just look at what’s happened to Mexican-born people who resided in the U.S. since childhood or adolescence, they’re being deported to Mexico in record numbers for the slightest infraction, even if they have gainful employment and pay taxes, for being “law-breakers”. In the last several years, the way the U.S. treat people from its bordering countries–both Canadians and Mexicans that once lived–as people without any rights, people who are “law-breakers” sometimes just because they make it too expensive or too dangerous to risk going afoul of their laws in the first place.

Observe this article in the Economist @ http://www.economist.com/news/briefing/21595892-barack-obama-has-presided-over-one-largest-peacetime-outflows-people-americas

It begins with the story of a 33-hr.-old father of 3 U.S.-born children who, though he had lived in the U.S. since he was 16, was deported for buying a social security card so he could get legal work. The article goes on to say:

[A law passed Congress passed in 1996] reclassified several misdemeanours as “aggravated felonies” if they were committed by an illegal immigrant, lowering the legal barriers to deportation. The expanded list included stumbles that undocumented migrants are quite likely to make, such as failing to appear in court or having fake papers. It also removed time limits on these offences, so that crimes committed by teenagers could lead to deportation 20 years later. One government lawyer in San Antonio says that some of the cases he argues stretch back decades. “You can be in your 40s or 50s and have a marijuana conviction from 20 years ago and be deported for it,” explains Doris Meissner of the non-partisan Migration Policy Institute.

[The deportations significantly increased] after the September 11th 2001 terrorist attacks when, by an odd jump of logic, a mass murder committed by mostly Saudi terrorists resulted in an almost limitless amount of money being made available for the deportation of Mexican house-painters. America now spends more money on immigration enforcement than on all the other main federal law-enforcement agencies combined.

Much of that spending has created a border agency that can operate throughout the country. Before the September 11th 2001 attacks it was considered a threat to liberty for agencies to share too much information. After the report of the 9/11 Commission the opposite became true. The result is that Immigration and Customs Enforcement (ICE), the agency charged with doing the deporting, can now quickly determine whether someone serving a prison sentence for a serious crime is eligible to be deported when their time is up. More controversially, it also allows ICE to see whether someone charged by the police with relatively minor offences can also be deported.

BACK TO JAN: In the following case, a Guatemalan-born construction worker and father of U.S.-kids who had lived in the U.S. “two decades” was deported because his car license plate had expired. Its seems that federal agencies are so aggressively removing “law-breakers” (especially of Mexican or Central American origins) that they jump on any minor infraction they can find to boost their quotas. It doesn’t matter if they deport peaceful people who are working hard to support their loved ones, just like the immigrants from Europe who had arrived in New York’s Ellis Island generations ago. Obama’s recent executive order has bought many of the ones who haven’t been deported some time, but it doesn’t solve the problem. Immigration reform is sorely needed.

http://www.theguardian.com/us-news/2014/oct/15/immigration-boy-reform-obama-deportations-families-separated

@Em Bee, Yes, that quote you put in bold is a great one, he is certainly taking on a case that is “complicated and complex”.

Yes, that quote you put in bold is a great one, he is certainly taking on a case that is “complicated and complex”.

I simply used Google to help me find it!

Also this one: “I believe in my clients’ causes,” he said. “That’s how I feel about every case that I do. Once I take on a case, I fight very hard for my clients and believe in the rightness and the justness of their cause.”

@US_Foreign_Person

I have no illusions about the fact they already have so much on everyone. Of course I do not trust them. What’s to trust?

Canada is not much better. They aid the NSA’s efforts as one of the “FiveEyes” (FVEY; Australia, Canada, New Zealand, UK & US). Probably why the govt doesn’t even bat an eyelash when we bring up privacy issues regarding our banking info. After all, they read our emails, listen to our phone conversations, etc. What’s the big deal, eh? The question is whether we will EVER be able to get this turned around.

@Tricia, and @all, I was remembering comments by Arthur Cockfield, which if I understood correctly, mean that the CRA and the Finance Dept. assurances are baseless re privacy for info collected under the FATCA IGA regardless of the tax treaty, for a number of reasons, including because:

“…….As previously noted by Canadian policy reports from the Office of the Privacy Commission of British Columbia and other privacy commissions, any personal information about Canadians that is sent over the U.S. border may be accessed by U.S. authorities under the Patriot Act, without a warrant or notice.27

Tax information provides another source of information that the U.S. government could use for anti-terrorist or anti-crime purposes even if no crime has been committed in Canada……”……

(footnote 27; “27 See David Loukedelis, “Privacy and the USA Patriot Act: Implications for British Columbia Public Sector Outsourcing” (October 2004), online: http://www.oipc.bc.ca/special-reports/1271.”)……..

“……….It bears mentioning that the Privacy Act itself has been criticized as offering insufficient protections for Canadian privacy rights.68 For instance, once the CRA transfers taxpayer information to the IRS there are no provisions within the Privacy Act that would seek to provide this information equivalent protection as afforded under Canadian law. Accordingly, there is nothing in the Privacy Act to prevent the mismanagement or improper use of personal information once it is in the hands of the IRS. This places Canadian taxpayer privacy interests at risk as the CRA may be disclosing personal information in ways that the taxpayer may never have considered when the information was initially collected by Canadian banks.”…………”Because of the large amount of data on potentially hundreds of thousands of Canadian taxpayers, a privacy concern arises to the extent that errors will be made that could lead to improper audits and investigations by U.S. authorities. In addition, false positives will expose Canadian financial institutions to potential legal liability to the extent they negligently or inadvertently transfer incorrect information to the CRA pursuant to the IGA.”……………..”Under the IGA, all joint account holders with U.S. persons will have their account information transferred first to the CRA and then onto the IRS. Accordingly, U.S. authorities will regularly collect information on Canadian citizens who are not U.S. persons under the IGA….”…………..

from:

Cockfield, Arthur J., FATCA and the Erosion of Canadian Taxpayer Privacy (April 1, 2014). Report to the Office of the Privacy Commissioner of Canada, April 2014. Fulltext available at SSRN: http://ssrn.com/abstract=2433198 http://ssrn.com/abstract=2433198

Prof. Cockfield’s report bears reading and re-reading as there are many other gems such as the description of the potential for privacy breaches on business and corporate accounts. There is also this one – (which the CRA’s masters and the Dept. of Finance are certainly very well aware of):

Cockfield says;

“…… Importantly, FATCA is only superficially consistent with the ongoing trend toward automatic tax information exchanges to inhibit illegal tax evasion and aggressive international tax avoidance, for which Canada has pledged support.38 The OECD and the G20 recently endorsed automatic tax information exchange as the new global standard, while reaffirming the fundamental norm that underlies income taxation the world over; namely, that the jurisdiction to tax on the basis of residence is not appropriately applied to non-residents, and that non-residents should be taxed on the basis of source.39…”.”…..

Contrast the observation above by Prof. Cockfield – which notes that the OECD CRS is based on the “fundamental norm” which is based on residence – NOT citizenship, birthplace, parentage, expired greencards, etc. as the FATCA IGA has as a basis for determining who is a ‘US taxable person’ in Canada) comment about the OECD automatic tax information exchange with this BS coming from the Dept of Finance about the FATCA IGA:

“…Will Canada be signing similar agreements with other countries?

The IGA is consistent with the Government’s support for recent G-8 and G-20 commitments to multilateral automatic exchange of information for tax purposes. In September 2013, G-20 Leaders committed to automatic exchange of information as the new global standard and endorsed an OECD proposal to develop a global model for automatic exchange of information. The model being developed is based on due diligence and reporting procedures similar to those in the Canada-U.S. IGA…..” from ‘Frequently Asked Questions: Foreign Account Tax Compliance Act (FATCA) and the Intergovernmental Agreement for the Enhanced Exchange of Tax Information under the Canada-U.S. Tax Convention’ at http://www.fin.gc.ca/afc/faq/fatca-eng.asp

For readers here who have not read this report by Prof Cockfield ( http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2433198 ), and this one co-authored with Prof. Christians ( http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2407264 ), they are MUST reads which illustrate why this legal challenge is so critical.

Read them, and;

Donate to support the ADCS legal challenge!

As Stephen Kish says (and I like to repeat because it is so very true);

“Our cause is just”!

@Jan

That article is depressing and I am sorry for the families that are being torn apart. I honestly cannot understand how the US has become so heartless. I know people think breaking the law is unacceptable and so on but they are also obeying the law by paying taxes and making an honest living by working and supporting their families. I will never understand how balancing out all the factors fails to outweigh ridiculously strict application of “the law.”

There are a few very interesting comments on this article : http://www.forbes.com/sites/robertwood/2014/11/20/london-mayor-boris-johnson-politely-gives-irs-the-finger/

FromPatriotToExPatriate FromPatriotToExPatriate 1 month ago

This is an interesting problem for the IRS. If they pursue him it will advertise America’s idiotic taxation policies. If they don’t pursue him, then well, why would any “U.S. born person” who left the USA at a young age bother to pay either.

If nothing else, this is a great thing to advertise the injustice of U.S. tax laws and the U.S. notion of what U.S. citizenship actually is.

Who knows. Maybe America will come to its senses and engage in tax reform.

If he accepts your offer to act for him, what would you advise Boris to do?

The way that citizens relate to governments lies on a continuim from slavery at one extreme to freedom at the other. Where along that line do those born in the U.S. lie?

Reply

Author

Robert W. Wood Robert W. Wood, Contributor 1 month ago

I find it hard to imagine the U.S. will pursue him for the reasons you note. The IRS is probably more likely to chase Rev. Al Sharpton, and that may be unlikely too!

THIS ONE is especially interesting :

Lynne Swanson 1 month ago

Does your offer to “volunteer” as BJ’s lawyer only apply to powerful millionaires or does it extend to accidental American stay at home mothers or elderly pensioners who were told they “permanently and irrevocably” relinquished US citizenship decades ago?

What is your prediction about what the IRS will do about the King of Thailand and Sweden’s Princess Madeleine? The King was born in the U.S. 88 years ago when his father attended Harvard. Princess Madeleine lives in New York with her American husband. Their baby daughter, Princess Leonore, is an American citizen because she was born in New York.

Will the IRS FATCA the accounts of these Royals held in Thailand and Swedent?

LIKE THIS ONE TOO :

Pastbeyond60 1 month ago

This is most probably a ridiculous question. As the mayor Mr. Johnson has fiduciary responsibility for the city of London. Does this fall under the same rules of having signing authority in a business and thus requiring reporting to the IRS?

Reply

Author

Robert W. Wood Robert W. Wood, Contributor 1 month ago

Actually, it is a ridiculous question from my viewpoint. Arguably Mayor Johnson’s biggest exposure is FBAR exposure, not tax debts or even tax evasion. The FBAR penalties, whether civil or criminal, are far worse.

Reply

Pastbeyond60 Pastbeyond60 1 month ago

Are the accounts of the City of London exposed to FBAR? Is a city any different than a business or a family trust?

Reply

Author

Robert W. Wood Robert W. Wood, Contributor 1 month ago

This is a great point, and I don’t know the answer. It may depend on the legal status of a city. But as a municipal corporation, I would guess yes. Of course, this may only be an entirely technical issue, since there doubtless would never be an enforcement effort.

My thought :

If everyone is not treated equally, then there is no law.

If Boris Johnson get’s away with it, then so should we.

Pas de deux poids deux mesures

@Jan and Tricia – the way the US is “becoming heartless” reminds me deeply of the psychological model of male vs female approach to life described so well in the 1982 Carol Gilligan work titled “In A Different Voice” (see https://en.wikipedia.org/wiki/In_a_Different_Voice). The US, and perhaps the entire world, seems to be moving ever faster to an uber-male stance/approach to all moral/ethical issues – – that is, the rule of law, whether it harms people or not, MUST be followed to the letter of the law and to H**L with the individual personal consequences standing in the way of “perfection”.

To Lake Superior Guy or Dash no party will accept the economic penalty if USA applies the 30% withholding. Think how much trade is done with USA. Can you imagine a placard stating my dad lost his job, so you dual citizen who refuse to renounce will not get a nasty letter from IRS. The rest of Canadian will demand the ability to travel (the 30% withholding will mess up most people plans) and invest in USA as well. I assume if a Liberal/NDP government get elected, they will impose the non withstanding clause if the American apply the sanctions. Look at all the major western government of various political stripes that have signed on.

It would have been much smarter to go after the 1995 Canada USA tax treaty if it was overturned by Supreme Court, the USA would have not be able to impose 30% sanctions. Most western countries do not have this treaty.

@LM, I’d never heard of that book. Fascinating!

Yes, LM and Tricia, it is heartless. It is also completely insane. Here we see the U.S. policy that confers automatic citizenship on EVERY baby born within the U.S. borders. There is no inexpensive, sensible way to get rid of that citizenship even if the baby doesn’t stay in the U.S. very long. Ask our plaintiffs, Ginny and Gwen or Boris Johnson, the Mayor of London.

At the same time, foreign-born parents of U.S.-born infant citizens have no inexpensive, sensible way to obtain U.S. citizenship so they can be sure to provide for their babies. Instead, especially if they are from a neighbouring country like Mexico, Guatemala, or El Salvador, they are at risk of being deported at any moment (until and except for the temporary reprieve Obama gave two months ago). How does this make any sense? Their babies become automatic U.S. citizen when born within U.S. borders, but they have little chance of becoming citizens with Social Security Numbers and necessary documents so the family can stay together! Absurdly, the U.S. spends money JAILING parents if they are deported but are caught sneaking back over the border (to see their children)! How can they be blamed for trying?

Unjust laws against a large class of people are doomed to failure. One winter day in 1955, a respectable, Christian lady named Rosa Parks refused to give up her paid-for bus seat to a man of another skin colour. Her tight-knit community–and soon many people across the nation–stood behind her. Now look how far black people have come — claiming top awards, salaries, positions in the NFL & NBA, even the presidency.

It’s obvious that one day, the hispanic children of deported parents are going to have the resources and power to change those unjust laws and collect large settlements in class action lawsuits. We don’t need a crystal ball to foresee this.

@Steven, “if Boris gets away with this, then so should we.” Yes, we should.

1.6K/day for 26 days

That’s a formidable amount. Can we do it? I think we can … I think we can … I think we can.

Please everyone, focus on that February 1st deadline. Soon it will be only 3 weeks away, then 2, then 1, then zero.

I just got this e-mail from Freedomworks

FreedomWorks

Steven, it’s coming down to the wire.

You’ve sent over 13,000 messages. You’ve made thousands of phone calls to Congress, urging lawmakers to vote to replace John Boehner as Speaker.

But we can’t let up now. Republicans need to know that you won’t accept two more years of Boehner’s failed leadership. Funding ObamaCare, raising taxes, increasing the debt – Boehner supported all this and more.

It’s time for Boehner to go. And Republicans must choose a principled leader.

Make sure you visit the Facebook pages of the following congressmen. Tell them to vote for a principled conservative for Speaker of the House. Please, tell the congressmen below to remove Boehner!

Representative Ken Buck’s Facebook

Representative Gary Palmer’s Facebook

Representative Barry Loudermilk’s Facebook

Representative Bruce Poliquin’s Facebook

Representative Ralph Abraham’s Facebook

Representative John Ratcliffe’s Facebook

Representative Jody Hice’s Facebook

Representative Alex Mooney’s Facebook

Representative Jeff Duncan’s Facebook

Representative Tom Graves’ Facebook

These representatives haven’t come out against John Boehner as Speaker. They need to know where grassroots conservatives like you stand.

We want Boehner gone. And you deserve principled leadership that won’t surrender to Obama.

Tell them to remove John Boehner now.

In Liberty,

Matt Kibbe

President & CEO, FreedomWorks

P.S. If you haven’t told your representative to remove John Boehner as Speaker, make sure you send a message now.

I HAVE POSTED THE FOLLOWING MESSAGE IN THE COMMENT SECTION OF EACH ONE OF THEIR FACEBOOK PAGES

Stop Obama, he’s killing the US economy abroad with FATCA du to CBT. FFI’s no longer want to open ordinary bank accounts for americans or receive american investments abroad. This situation is putting the US economy in great danger, to say nothing of the descrimination that ordinary americans living abroad have to face. Google up FATCA, find out about what’s going on. FATCA is the worst law that no one living in the United States knows about and it’s illegal to the US constitution.

Obama is acting like an African dictator in the White House passing on laws that don’t even go through congress to say nothing of them not being ratified by the senat

Revised post to include @EmBee’s update and update on January 5, 2015 communications between Joe Arvay and Government.

@EmBee’s update is more important.

The government has 33,000 documents and more to come? Should we be worried? Sorry, I know nothing about litigation so this is a steep learning curve for me.

I pledge another good donation before the deadline. It is time to get things shifted into high gear. I am heading downtown to a custom t-shirt maker to get some shirts made. We should seriously think about selling them online. This could be the break our fundraising needs. Focusing on other minority groups to show them how we became second class Canadians and how tax money is really spent!