UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

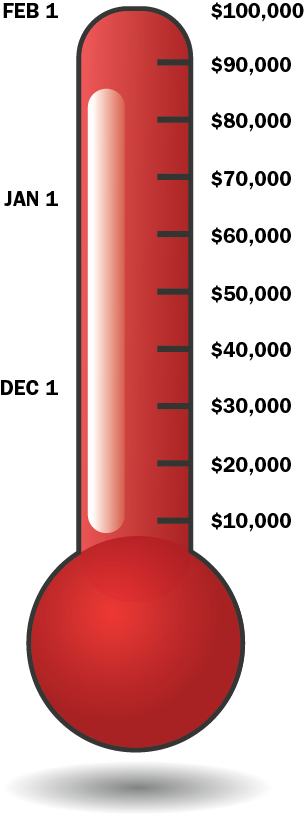

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

@Steven, thank you for reminding us of Roger’s important contribution to these efforts -which he had been making for decades. I miss his comments and his wise and informed observations – which I very much looked forward to seeing every time I visited IBS during the height of his regular participation here. His accumulated wisdom will live on, preserved here and elsewhere (as in that tweet and his submissions to the US government) – and give us assistance even when he himself is gone from us. I wish he had been able to live to see the successful legal challenge brought (and to be WON!!!) by the ADCS plaintiffs and team.

I recall that Chester12 warned us about Moody’s in Mar 2012

As the Brits would say, I’m gobsmacked that Roy Berg wants to “fix” FATCA to further entrench it — even though FATCA goes against several rights in the U.S. Bill of Rights, and even though FATCA amounts to financial terrorism including invasive prying and penalties, which in turn alienates Americans and people who love freedom, and compels financial institutions abroad to implement international currency exchanges without the U.S. dollar.

Roy Berg may be thinking this will help his business to boom, but sooner or later, he’s headed for a bust.

Mr Berg is the fox in the hen house… he is an american living in Canada, he gains nothing but money… he is here to make money off the mis-fortunes of fellow canadians… we need to show him & any other vulture coming up here….no matter how hard they try… we are not slaves of the US… if we don’t win because of the lack of money…. then the US wins over all of us in the world… help stand up to the US by donating what u can to this very worth while cause… time to take a stand against the US since no one will help us stand up for us…

Persons who connive or contrive to benefit when larger powers mash down people thus enabling the connivers to pick the flesh from the carcasses are called “John Crows” in Jamaica.

“John Crows” are a type of vulture that feeds on the carcasses of dead creatures. The application of the label to certain people seems most appropriate in my view.

It is important to monitor, if the Obama’s IRS applies the 30% withholding to foreign bank with transaction in USA who have not signed up.

I wonder if we have or can make a “broken families” thread. My options are very few and divorcing my wife to protect my personal information from the Americans is looking like my only option. There must be others who are born in Canada Canadians(first class) who are married to a second class Canadians and need to speak of their issues they have now learned about. I will write the PM and ask him if a divorce is my only option….

@ NativeCanadian

You are not alone in considering the divorce option. My formerly American husband and I discussed this a few years ago when he believed he was putting me at risk. He gallantly offered me a paper divorce (we would remain together in actuality). Since that time he has obtained a CLN which I hope upgrades him to Canadian first class. I tried to sever my GC connection but failed to get a stamped I-407 so now I am the one who is putting him at risk. I feel I need to be equally as gallant as he was and, if need be, offer him a paper divorce. Being born in Canada to Canadian parents and being raised, educated, employed and retired here does not guarantee first class status anymore. I am a subset of second class — truthfully I feel more like an alien in my home country, my Canadian identity has been sullied. Even though you are unlikely to get a response from the PM (everything I sent him was ignored) I hope somebody has an answer to the divorce option question.

On a much brighter note …

@ ADCS team

As long as the donations pick up in the post-Christmas drive to that February 1st deadline I should be able to take care of one day’s worth of donations before the end of January.

The issue of divorce is an important one because it has forced so many couples to at least consider that option. In many cases it actually CAUSES divorce depending on the attitude of the spouses involved.

So much damage caused and continues to be caused because of Canadian governmental lack of backbone. Not just marriages, spouses, children, grandchildren but splits in corporate and small business partnerships.

One cannot completely comprehend the harm this has done to the societal fabric in Canada and around the world. Insidious evil octupusing it’s black and inky way into every fabric of life and society is a monster that must be slayed as knights did to dragons in days of old.

The lawsuit IS the sword and our plaintiffs and the lawyers are our Knights in Shining Armour!

There will be increased costs to healthcare as well. “US Persons” and their families will be going to their doctors for treatment of stress and depression. The Bank sending a letter or a phone call to a suspected “US Person” will certainly be a shock for those unaware of the US claim on them. Countries around the world have opened the door to the enemy.

Cross-posting from MapleSandbox.ca:

From Lynne Swanson (Blaze) at MapleSandbox.ca: FATCA in Canada 2014: Year in Review

Go to the link above and look at all Lynne has enumerated (including her links therein) — the amazing things of 2014!!!

If you, like me, want successful Canadian litigation against the legislation that enables US FATCA law to override Canadian laws and are as thankful for Lynne’s list of events and accomplishments for the year we leave behind, please give as generously as you can in support of ALL Canadians who are also US (and Canadian)-defined *US Citizens Abroad*. Whatever it take in the New Year, 2015, let’s do it: http://www.adcs-adsc.ca/.

WE’LL BE READY FOR ALL IT HOLDS, INCLUDING JUSTICE FOR ALL !

Murray MacLauchlan’s “Let the Good Guys Win” has been my favourite New Year’s song (one of my favourite songs, period) since it came out in the 80s … and it comes to my mind in the context of our court challenge as well.

Ring the old year out,

Ring the new year in,

Bring us all good luck,

Let the good guys win!

Better yet, this year MAKE the good guys win! – Contribute to ADCS-ADSC!

Happy new year and freedom to all!

@ pacific777

I’ve never heard that song before. I really like it and wouldn’t change a word of it. This part particularly …

When you see something wrong try and make it right.

Put a shadow world into the bright sunlight.

Thanks for always being here — watching, guiding, fixing and advocating.

Happy new year everyone!! This is the year of change. This is the year we will ramp up the actions towards the public. A good way is to start a “public awareness” campaign to show Canadians the truth about fatca and expose the government cover-up of the facts that would make ALL Canadians fall of their chair. I am seriously contemplating going out in the public if this is what it takes. The options need to be on the table and Canadians need to know.

@ Native Canadian and all,

I concur: This is the year we will ramp up the actions towards the public. Perhaps there could be a new IBS page on which we all can list our IBS/FATCA/ADCS new year’s resolutions as to what we WILL make an effort to accomplish. As part of that, maybe there could also be a review what has and has not been successful so that we (1) don’t keep spending our time/energy attempting approaches that end up just being a waste of time and (2) see what has worked and encourage more of that.

Along with helping to organize a John Richardson evening presentation (Hamilton, Ontario – March 26), one tack that I am starting to take is to connect with other US Expats around the world to let them know about IBS and, more importantly, ADCS and the only-currently-active-litigation-against-FATCA. This is being accomplished through joining EpatBlog (http://www.expat-blog.com) and starting conversations on forums as well as some messaging to specific active Expats there who have indicated their US origin. Is this “gentle spam”? Maybe, but we’ll see what expanded support can be garnered…..

As well, I continue to hand out my FATCA flyer to lots of people as I go through day to day life. For example, when my plane-boarding was delayed an hour just before Xmas, I handed these out to lots of folks at the airport; I quietly, respectfully walked around with a file folder boldly labeled “Are you a US Person or do you know anyone who is?” and anyone who looked up and seemed interested, I handed them a flier. Had a few good conversations…

Lastly, I want to add my sincere condolences to you, NativeCanadian, for the recent loss of your mother; may her memory be a blessing to all who knew her.

Happy new year to all of you from France

Maybe you should try and contact some journalists to get interviewed about FATCA on the radio and of course TV (but that will probably be difficult)

Try starting off with a local radion, newspaper or television programme.

I may give it a try here in France with economic news programs.

Main problem is the time to get the articles and documentation together to make a strong case and translate them into french.

I found the IGA agreement signed with France on 14 november 2013.

Interesting to notice the added annexe 2 that points out all the accounts that are not concerned by FATCA at paragraphe 3 page 6 (scroll down to last page).

http://www.economie.gouv.fr/files/usa_accord_fatca_14nov13.pdf

I have what they call a “Plan de retraite Madelin” (Madelin retirement investment) that IS NOT subject to FATCA.

Is that the case in your IGA agreement in Canada ?

If not, you may be able to use the french IGA agreement against your gouvernment

Maybe it would be interesting to compare several IGA agreements

Just a thought

Stephen the Canadian IGA is identical. Somehow treasury was able to twist arms in 100 different countries and impose the same agreements right down to the most minute detail- always in US $ -rather than the local currency.

Also of interest, reporting must always be in English which of course would be inappropriate in most countries but especially France.

Retirement accounts are exempted in each agreement including Canada’s

@ Steven RE “Maybe it would be interesting to compare several IGA agreements”

This is a REALLY interesting idea. It would require a lot of reading and comparison, probably lots of collaboration, but does anyone know if this sort of review and comparison has been done by anyone else, even in a cursory manner, at this point?

Oh, if only we knew some Ecomonics or History or Political Science PhD graduate student who was, right now, looking for an interesting current-events thesis project…….

LM they are all the same. Every one.

Is the information that all IGAs are the same from the IRS IGA negotiators or has anyone outside the US actually examined these IGAs? Certainly various countries have various types of financial accounts (with varying rules) that are, for example, different from the RRSPs in Canada. Just checking…..

https://www.facebook.com/TheAntiMedia/photos/a.156753707783006.14385.156720204453023/399283210196720/?type=1&theater

Yes I agree that there probably is a different annexe for each country specifying specific investissement plans that are not targeted by FATCA

Pingback: It’s time to “Seize the day” – Don’t let FATCA obscure the need to abolish U.S. extra-territorial taxation | Alliance for the Defence of Canadian Sovereignty

Pingback: The Isaac Brock Society | It’s time to “Seize the day” – Don’t let FATCA Obscure the Need to Abolish U.S. Extra-Territorial Taxation

@Steven and others, I just want to remind you that the fact that retirement accounts are exempt from FATCA reporting under IGAs does not mean that such accounts are necessarily exempt from taxation by the U.S. The real enemy for U.S. persons abroad is CBT. FATCA is just a new tool that the U.S. is trying to use to find U.S. persons who have not been filing the required tax paperwork and have not been paying the taxes that the U.S. claims they owe it.

Myself, being now a CLN-certified U.S. non-person, I have nothing to gain financially from having the IGA, FATCA, and U.S. CBT abolished. Nevertheless, I have just made another contribution to the ADCS lawsuit because the Canadian FATCA/IGA has indeed surrendered Canadian sovereignty over financial and tax reporting to the U.S., and I strongly object to that. If the lawsuit should help to make FATCA enforcement impractical and thereby undercut U.S. CBT, that would just be a good side bonus for me.