UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

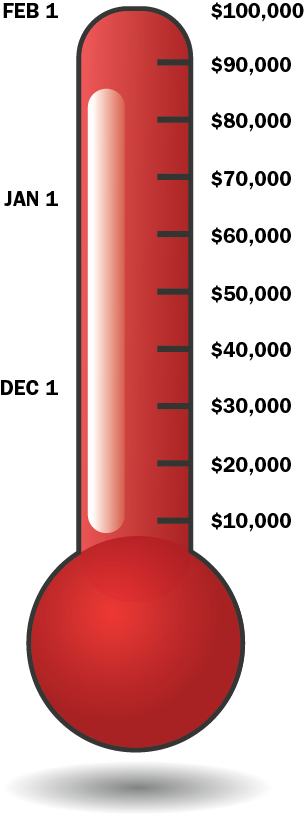

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

Feb 1st if fast approaching. What happens if we don’t make the deadline?

Marie — excellent question that we ALL need to ask ourselves!

We WILL meet the deadline! Come Hell or High Water, we WILL do this!

Come and join us knowing you join a sacred cause that will have far reaching ramifications for us, our children and grandchildren, those yet unborn and those freedom loving souls outside our own borders!

If we stop this HERE it will boost the efforts elsewhere and the momentum builds. A little means a lot when there are many of us so no matter the size of the donation it all counts SO much!

I, for one, question the progress of the mirror litigation in the US. I have heard no word beyond the plea for funds ( they need $500,000USD) so their page said, but that was some time ago and I wonder if anyone knows how it is going?

I have another question as well: What about injunctions?

For both efforts. Will there be a move to get an injunction to stop things while these issues slowly move through the courts?

Irreparable harm can and will come in the interim.

@ Stephen Kish

“… a special joint meeting of the Directors …” LOL! That made Mr. EmBee’s day. He went out the door to do some errands with a big smile on his face.

Here’s my small connection to those wooden Isaac Brock medallions. Back in September, Mr. EmBee was away doing a driving tour of the national and state parks of western U.S.A. — possibly his last trip there. Meanwhile here at home we got an early, heavy snowfall (over a foot deep) which resulted in a big limb of one of our green ash trees breaking off and falling across our front pathway. (I had saved all the other trees on our property by whacking the snow off them with a 10 foot pole but I didn’t get to the front in time.) While the snow continued to fall, I sawed the limb into 3 manageable parts and dragged them out of the way. Several days later when the snow had melted away (love those 20 degree weather mood swings) I trimmed all the leaves, twigs and secondary branches off the limb; cut it into 4 foot lengths; and added the wood to our woodpile. A month or so later Mr. EmBee hauled that wood inside, cut it into slices and started making “something useful” out of the misfortune of our green ash tree. This is much like how Brock, the Maple Sandbox and ADCS are attempting to turn the travesty of FATCA and the betrayal of the FATCA IGA into a positive change in the U.S.A.’s treatment of its overseas citizens. May the force of fairness be with us. May the ADCS contributions keep fueling the force of fairness.

Thank you for the latest update, Stephen — quite a quick jump to $55,936 needed in 46 days!

Bravo for generous donors who made that happen. And, Mr. and Mrs. EmBee are awesome, creative and resourceful (and their resources so often go to ADCS-ADSC). Wish we could all see a picture of those Alberta early winter storm medallions. (Not being at all creative, all of our yard debris went to our firewood pile and to the dump where it will be ground for Calgary trails.)

I just saw the donation figure go from $62,136 to $55,936. THANK YOU “very kind and committed supporter”.

@ calgary411

Look in your e-mail box.

Ask and you shall immediately receive — when EmBee is involved!

I just tweeted this :

U.S. #Expats Find Hope in Senate Finance Tax Reform Proposal against unfair #CBT law http://www.wsj.com/articles/BL-272B-182

Do you think the U.S. needs to rethink its taxation rules for nonresident U.S. citizens?

Yes 92% 160

No 8% 14

ALL VOTE YES AT THE END OF THE ARTICLE

Hats off to Mr Embee for his creative genius in constructing the Isaac Brock medallions. They are truly fabulous and also to Embee for cutting down the branch.Heck of a job during a storm! A great souvenir for our cause. Thanks also to our generous supporter who brought us down below 60 and I include all the others as well who have contributed to our second go round. Wishing you all the best in the New Year. It’s our year to win.

@Embee

Ohh… that is so pretty… tell Mr Embee… he did a wonderful job… my dear one & myself are pretty decent with diy in the home.. but got zero creative genes… if u ask me to draw a pretty picture.. it would look like stick figure hanging… all uneven… lol…

Just a note to all. We WILL make the deadline for this challenge. In fact, I truly believe we will make every deadline. This was the first challenge and will set a precedent on sovereignty and how powerful the citizens of a country can be. I pledge to never give up this fight and also to keep donating all I can. My 5 year old daughter really wants to go to Disney in Florida. I have told her we cannot go until we are allowed to go to the US again. I can’t be honest with her and tell her that the US leader, Obama, has made her mom a fugitive of the USA and that I must break any law that threatens her well being. My vacation fund will be my Christmas present to all of you who are in this fight for justice. The donation will be made the day before Christmas. The world is watching!

http://money.cnn.com/2014/12/15/pf/accidental-american-expat-tax/index.html?sr=twmoney121614accidentalamerican1245story

@ Embee How wonderful, your husband is certainly talented.

@ NativeCanadian So sad that a 5 year must be denied because of the immoral behaviour of the US.

@ All

Before I head to the eastern hinterland of this great country to celebrate the week of Chanukkah (the celebration of winning the first historical war for [religious] freedom), I just wanted to wish you all well for the holidays and to say Mazel tov on moving the red line closer to the half-way mark for this quarter. As Native Canadian stated, We WILL make the deadline for this challenge.

Every place you go this holiday period you might meet someone who is interested in knowing more and may be willing to help support this effort; last night at a holiday dinner I met 4 people who were US-related but unfamiliar with (and then very interested in) IBS/ADCS activities. So print up and carry some flyers with brief but clear information about FATCA and IBS and ADCS with you at all times!!!

Just to mention one last audacious activity of yours truly the intrepid ‘Jane Appleseed”, we fly out of Toronto’s Pearson Airport in the early afternoon tomorrow and I am taking my flyers with me. While our gate may be filled with Canadians just heading off to an eastern province for the holidays, the gate next to ours may be filled for a flight taking Canadian residents off to visit their families in the US. HMMMMMMMM – – JUST THE TYPE OF PEOPLE WHO NEED TO SEE THESE FLYERS, DON’T YOU THINK?

Enjoy whatever end-of-year pleasant activities that bolster your soul and I look forward to an exciting 2015 working with you great, courageous, articulate, feisty, purposeful, wonderfully sarcastic, seeing the irony, and perceptive plus quick at the keyboard (making appropriately rebutting comments) guys/gals. Onwards….. Bit by bit…….

Bit by bit, for sure, LM.

As Furious AC also clearly said for many of us:

Happy Holidays — I am visualizing you, LM, helping a flight attendant hand out snacks, along with a copy of the flyers you have brought on board. And, how about those *US Person* flight attendants and pilots (which we have addressed at Brock some time ago).

Onward into the Holidays and charged up for what 2015 brings. Best wishes all.

What can we think of that might capture the imagination of a five-year old’s and provide the same *wishes* that would take a family any place (within budget)? (What a huge conglomeration / big business Disney turned out to be — advertising to our young ones at its best. http://en.wikipedia.org/wiki/Walt_Disney_Parks_and_Resorts.)

Just like nine-year old Janne (http://isaacbrocksociety.ca/2014/12/16/dear-president-of-america-from-nine-year-old-janne/), your five-year old cannot understand the absurdity of her mom being a fugitive of the USA, NativeCanadian. And, your little gal sure would like to go to Disneyland the same as her five-year old peers! So very absurd!!!

Yes, we will make the challenge — for individuals, for families and for children who have no understanding of any of this! Keep the donations coming: http://www.adcs-adsc.ca/.

@Calgary411 –

Well, you imagined a bit more that I did — I hadn’t though about the attendants on my flight, tho I did connect with a flight-person at the eatery near our gate. Also met 4 other individuals when wandering around the waiting area carrying my file folder with “looking for US Persons” written in big letters on the front. And one fellow on the flight who, when he saw the file folder, asked about it saying he was just a Newfie, to which I replied, “Hey, there are lots of US Persons in Newfoundland given it’s not-too-distant history” and I gave him the fliers too. It was fun and I will do it again on the way home; I’ll remember the attendants too. Have fun over the holidays and may it be a time of sharing (in lots of ways)

Awesome and onward, LM! Glad your journey was not boring.

Just posted on CNN to allow homelanders to see what this is doing to all of us. 1notstupid1.

LM: I am absolutely in awe of what you do! Absolutely in awe!

I just read this great comment that shows FATCA is illegal “Further, these IGAs are NOT treaties since the Treasury Department does not have Treaty-making powers. What a sham they have perpetrated on the world, making everyone else frightened into obeying.”

http://news.wbfo.org/post/american-expats-living-canada-fighting-us-tax-law

Full comment :

Mr. Karpenchuk – It is good to have FATCA hit the NPR News, but it would be better if all the information presented was correct, fair and balanced.. FATCA did come into effect this past July 1, but it is NOT a global tax law; rather, it is a US tax law that has, imperialistically, been forced down the throats of other sovereign countries under threat of severe financial penalties if they did not comply. Sounds like economic sanctions, extortion and Mafia-type tactics to me.

Also, it was initially aimed not at expats but at rooting out Americans living INSIDE the US borders who were hiding money overseas. No one in the Congress or the Treasury Department seemed to think through the devastating consequences of this poorly articulated law to the 7 million US “persons” living abroad. These expats are not allowed to do their banking in the US (because they do not have a residence there) nor, now, in their country of residence (because these “foreign” banks don’t want to have to deal with this US extortion and complex amazingly expensive compliance requirements so they are just shutting their doors to anyone with “US taint”).

This includes missionaries and English-as-a-2nd-language teachers, overseas medical teams, businessmen in Europe and Mexico. And what will the US Government say when ISIS gets into Lebanon’s largest bank and demands the list of Americans that they have gathered in order to be compliant with FATCA; what will the Congress and Mr. Obama say when this US-required FATCA information-dragnet permits ISIS to quickly find and behead these US Persons?

FATCA is not yet in effect in 80 countries; this is mere PR from the IRS. Rather, while many more IGAs have been signed, there are currently only about 5 countries where it is currently fully in effect.

Many in Canada are “Accidental Americans” who were born in the US merely because it was the only local hospital and, since age 1 week old, have never lived or worked in the US. Why should they be deemed permanently taxable by a foreign country (that is, the USA)? Others may have been born and raised in the US but came to Canada 40 years ago and took out citizenship here at a time when to do so meant automatic loss of US citizenship; now, these individuals are being told that the US rules changed in the 1980s and their citizenship (and tax obligation) was re-established on their behalf (whether they wanted this or not – – they certainly were not informed of this back in the 1980s or any time since).

Further, it is not just “US persons” which these “foreign” banks are being expected to hunt down and rat on to the IRS;. Fully Canadian spouses who hold joint accounts with their US spouse, or Canadian business partners who hold joint accounts with their US partners or fully Canadian adult-children who have signing authority over their aged US-born parent’s banking account are, also, all being dragged into having all their private financial information sent over the border to the IRS. And just recently the IRS has warned all these “foreign financial institutions” to be alert RE scammers presenting themselves as IRS operatives demanding all this FATCA information. Who would have thought????? Well, it certainly was predictable!!!! How would anyone like this arrangement for their own financial matters.

In the IGAs, the US Treasury Department promised reciprocal information to all these foreign tax authorities regarding hidden earnings within the US; there was no discussion about this with US banks and some are now closing the accounts of foreign nationals living or banking in the US. Further, these IGAs are NOT treaties since the Treasury Department does not have Treaty-making powers. What a sham they have perpetrated on the world, making everyone else frightened into obeying.

The majority of the US tax cheats LIVE IN THE US. The majority of the US expats living outside the US borders are just regular Joes and Janes who have never owed any taxes even if they did file all 200 pages of forms each year that are required (costing $1,000 and up at the accountant’s office).

FATCA is going to backfire on the USA. This is not the way to win friends and influence nations, especially expats who are (under this legislation) deemed to be tax cheats, money launderers and guilty until proven innocent. The heros of 1776 would turn over in their grave if they knew how much of their Bill of Rights was being disregarded.

@Steven

Reading this lengthy post, I thought “gee, this seems familiar!!”

Then I realized that I wrote that on a day when I was really pumped and ready to verbally rage. I don’t do too much commenting on media sites but that day took my cue from all the other great Brocker commenters and let it flow

Glad you found it and tHanks for honouring it here on IBS (it is pretty good, isn’t it!)

LM. (Aka Exexpat)

@LM, Awesome comment. One of the best I’ve seen. I tried to link it in a comment to the Huff Post article but I don’t do Facebook but no luck.

Steven: Thanks for link. I must have missed this one when it showed up in September.

LM: Wonderful a comment under your other alias!

I also liked this comment: “Americans living in the homeland take note… You are now economic prisoners of your own country. With U.S. citizenship-based taxation’s draconian measures aimed squarely at expats and FATCA to enforce them, you no longer have a realistic choice to make a life anywhere outside the U.S. It’s a big, wide wonderful world. And behind your economic Berlin Wall you personally do not have access to it.”

“Homeland Americans” take note: *You* will benefit from Ginny and Gwen winning their lawsuit against the Canadian government. A win for Ginny and Gwen will represent the lid being lowered on the coffin of America’s citizenship-based taxation. All that will remain is for the United States to nail it shut by officially removing CBT from its law code. Please help us win this case and donate to our cause!