UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

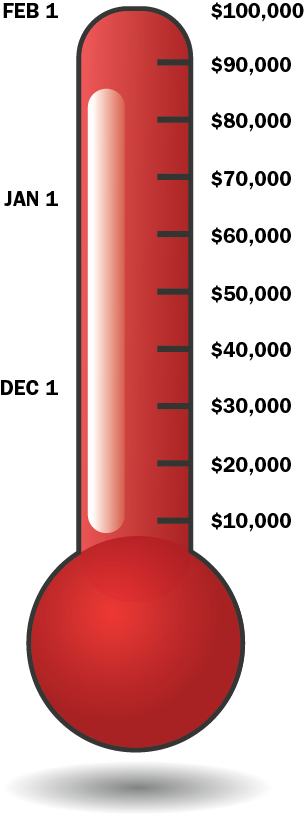

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

RE Roger Conklin’s comment “As far as I know neither Cuba nor any other nation has erected a sign in front of its Interests Section building in Washington or an Embassy, highlighting how this Exit Tax constitutes a violation by the United States of the UN Universal Human Rights Declaration”

I’m not sure what an “Interests Section building” is but maybe we could consider doing this in front of the Canadian Embassy in DC or the US Embassy in Ottawa (or other national capital)?

Washington, DC in late April is lovely and only a 10-11 hour drive from Toronto……

On an entirely different issue, it is very interesting that IBS has not had many (any?) commenters from the US-Person-living-in-Mexico group, especially since there are reportedly more US expats there than in Canada. Anyone have any idea how we can connect with these folks? They must be having an awful time since some of their banks are closing their doors to US Persons.

There was discussion in this thread about the ACA CBT Debate video. I just sent this message to Charles Bruce, Executive Director if ACA Global Foundation:

@Blaze

Great letter — no punches pulled there. You really are back in fine form. Deckard1138 did a great job of videotaping the Toronto Forum too. He’s the man for this job for sure. Thank you @Deckard1138 for volunteering to do this when I’m sure you are busy with other things too. Here’s hoping Mr. Bruce accepts this gracious offer because I think the longer the wait for this video, the more eager we have all become to see it. It would be fantastic to see it released with a “Dedicated to the memory of Roger Conklin” intro.

Thanks for composing and sending this, Lynne, and thanks also to Deckard for volunteering his time and expertise to get the long-overdue video published and even posted to a YouTube channel for ACA (or otherwise). I hope your suggestions bring the resolution needed to make the video available to all who attended the May 2nd Forum and, more importantly, all who were unable to attend.

I very much love EmBee’s suggestion to have the video dedicated to the memory of Roger Conklin, a long-time member of ACA.

@L M:

Try http://flvoters.com/mexico.html where I posted 559 Florida registered voters with mailing addresses in Mexico. Can you use more, from other States?

@LM

How good is your Spanish? There are surprisingly few visas issued by the Mexican government for Americans (tens of thousands only), so a lot seem to be dual nationals. I looked at the Mexican data on U.S. born people in Mexico and the striking thing is how Mexican they are. Their median age is early teens and they are growing up in families headed by Mexicans. Whether they are interested may depend on how the IRS treats the afores accounts of those who are old enough to have them and whether they, being relatively young, simply decide to move to the U.S.

@ Publius – Thanks for the info on US-folk in Mexico. My Spanish is nonexistant [and French is rusted through from decades of disuse, sad to say]. In any event, I had (perhaps mistakenly) heard that there were patches of communities in Mexico where retirees from the US had enclaves (or maybe they were just winter homes?). Even so, some major Mexican banks closed down accounts that had US-taint back at the end of June so there must be some effected there even if only businesses with a US partner.

Anyone out there speak Spanish and interested in somehow doing an outreach?

Here is the response from Charles Bruce about the video:

Thanks for posting the reply you received, Lynne. Sometime next week — we certainly hope so! Thanks again for your good work.

Thanks, Blaze.

ACA Global could probably do some good… if they chose to.

@LM

Here is a message I posted back in February. Mr Fernandez is still the president of the Mexican public accountant’s association.

“In August 2012, the head of the Mexican public accountant’s association was arguing that FATCA violated Article 1202 of the North American Free Trade agreement by violating provisions guaranteeing most favoured nation treatment for all members and by violating provisions against discrimination in favour of local firms. His name is Jose Luis Fernandez, Comision Fiscal Internacional del Instituto Mexicano de Contadores Publicos (IMCP).”

Robert “Lies” Stack in VANCOUVER, BC RIGHT NOW!!!!

At the Vancouver Convention Center:

http://www.ctf.ca/ctfweb/EN/Conferences_Events/2014/Programs/2014_Annual/14ACPROGRAM.aspx#

Stack is attending a conference sponsored by the Compliance Vultures. Imagine that.

On the bright side, one of the 2 1/2 hour workshops at that convention is on the issues surrounding U.S. citizenship renunciation for Canadian residents.

Does anyone know if renouncing USA citizenship will be grounds to having your NEXUS card NOT renewed? As a dual, my NEXUS was given to me as a Canadian citizen. The USA border guard asked me what country I wanted the NEXUS card to be processed under, Canadian or USA, I said I didn’t care and he then picked Canadian.

I want to renounce but travel often for short trips to the States and am worried about losing NEXUS.

@Phil: just in case you haven’t seen this old post:

http://isaacbrocksociety.ca/2013/02/22/renunciant-wins-foia-case-over-trusted-traveler-program-card-denial/

A 2003 renunciant was later denied a NEXUS card and sued State under the Freedom of Information Act to get them to release his “consular lookout” file. The denial smelled like retaliation for the renunciation, but we never learned for sure.

Here is a wild idea to neutralise CBT.

Canada enacts that its citizens, or residents for more than five years, who are US Persons, are subject to additional Canadian Tax that mirrors the US tax laws, on Canadian source income. THEREFORE, as per the tax treaty Canada gets first right of taxation and no tax is owed to the US. Then Canada gives back that tax with a mechanism named income supplement (or anything else than tax credit). In reality it could be that no money is actually exchanged, yet Canada could work the tax treaty to the protection of Canadians. I think it could work to thwart CBT. Yet it is still not an answer to compliance including FBAR and FATCA 8938, yet could work a treat for retirement or disability accounts.

JC: Interesting thought, but it would have to be very carefully designed so that the payments wouldn’t fall under the US definition of income. We had an analogous problem in HK a few years ago when the government decided to give cash handouts of HK$6000 to every permanent resident. The IRS declared that it was not a gift, nor did it qualify for the general welfare exclusion, and therefore US Persons in HK owed US tax on it

https://en.wikipedia.org/wiki/Scheme_$6,000#Taxation

@Eric,JS,

The US definition of income is such that it just exempts certain forms and anything else is taxable.

Steal a dollar: Taxable

Find a dollar: Taxable

Sell illegal drugs for a dollar: Taxable

Receive candy worth a dollar: Taxable.

According to http://cas-ncr-nter03.cas-satj.gc.ca/IndexingQueries/infp_RE_info_e.php?court_no=T-1736-14 the plantiffs filed a response in the suit on Nov 20.

Does anybody have it?

@Just a Canadian,

Here is the link to the Plaintiff’s reply:

https://adcsovereignty.files.wordpress.com/2014/11/2014-11-20-reply.pdf

The reply is on our ADCS blog:

https://adcsovereignty.wordpress.com/2014/11/10/the-government-of-canadas-statement-of-defence-to-adcss-statement-of-claim/

The reply is very generic and is only three sentences long. There was no need, in fact, for the Plaintiffs to provide any response to the Statement of Defence.

I see that the gross page views will top 14.6 million (13.993 Million + old site of 0.6 Million) tonight or maybe tomorrow. The views are getting larger and larger quickly …. hopefully this means that word is spreading farther and farther around the world. Keep on truckin’ folks.

NervousInvestor: Better than keeping truckin` is to keep on donating.

I especially ask those who have not yet given to do so soon. We need everyone in this battle to win it.

@ nervousinvestor – NEAT-O!!! The word is getting out. And the S**t is hitting the fan. Lots of OMG moments. Let’s hope these folks also have lots of friends and some jingle in their pockets that they would like to share for a good cause. Bit by bit………

Do folks know of these people ? This is how they describe themselves:

The International Civil Liberties Monitoring Group is a national coalition of 38 Canadian CSOs that defends human rights in the context of the ‘war on terror’.

Apparently they are based in Ottawa and have a web site iclmg.ca