UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

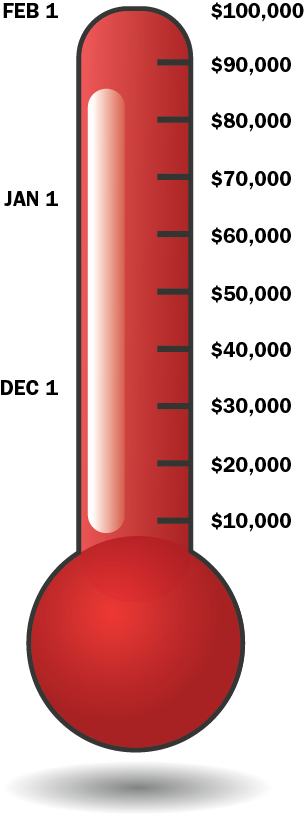

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

Steven,

Perhaps you’re looking for the one that EmBee provided: http://www.rifters.com/crawl/?p=5387.

Anybody remember there was supposed to be a video of the symposium on citizenship vs. residence-based taxation held on May 2, 2014 in Toronto?

ACA Global Foundation organized the symposium and committed to producing the video.

There’s still no video. And ACA Global now appears dead in the water, to look at its website. Clicking around it feels like poking through an abandoned, half-constructed shack in the bush. I’ve visited repeatedly, and the website is unchanged since Aug. 24, the latest date when the video was as still promised (try imagining Brock with no activity since August!).

http://acaglobalfoundation.org/

There’s been speculation about suppression of the video on other threads. But I’d say despite their apparently good intentions and ambitious start, there now are just no horses doing any ACA Global work.

I don’t see the video ever being produced without them receiving offers of help, if anyone has the capability and feels so inclined.

@ Shovel

Stephen Kish has written to them consistently for many months — no action. I believe offers of help have been given — again no action. What a pity!

@calgary411

Thanks for the link

Here is what I have tried to do regarding the elusive video. It remains a mystery.

@calgary411 Thanks for being on top of this… good suggestion you gave to ACA Global.

Deckard and I edited hours of video from the House Finance Committee to 18 minutes. We did this over a weekend and Deckard had in a final format within a few days.

Give Decard the video. He will edit it.

Or better yet, post it like it is. Just like Deckard did for the FATCA Forum.

If ACA had allowed Deckard to video like he offered, I can assure you there would have been NO delay in releasing either a full or edited version. He’s a professional who does FATCA videos as a volunteer.

I don’t buy the line that there is no conspiracy. Just get it done. If ACA can’t or won’t do it, give it to Deckard NOW!

@DecKard: I hope you don’t mind that I volunteered you!

Is anyone following the announcements from the major banks regarding closure and lay offs outside of Canada? Like Mexico? Other locations? Scotia Bank announced closures several weeks ago and now RBC. I have a friend who buys and trade stocks who mentioned to me that he read that the five major banks have all been involved in off – shoring in various locations, mostly exotic. He thinks CIBC may have been caught? It involve credit cards?

@Ann #1

What the US thinks is off-shore to them… is considered normal business for others…. Like the Swiss… they didn’t violate their laws in their country… but the US says they violated the laws of the US… did I fall asleep & miss the part that the US gov’t now runs the world? Hopefully chinese money will replace the US dolllars in the near future… US will be crying… hey… why did u do that… they will never figure it out…

A couple links:

http://www.thestar.com/business/2014/11/04/scotiabank_axing_1500_jobs_twothirds_of_them_in_canada.html

http://www.calgaryherald.com/business/Royal+Bank+leads+Canadian+banks+hedging+bets+Caribbean/10405952/story.html

@ US …no, no this isn’t about all our accounts being deemed off shore…this is about actually hiding money…and using a credit card to do it…CIBC is already on their radar?

@US_Foreign_Person

That’s been my problem from the start. I do not have any foreign bank accounts, so what does FATCA want with me? If I had an account in the US, that would be foreign. I’m thinking now of how much money we can save over here by disbanding Parliament, seeing that our laws are emanating from overseas and imposed on us under threat of sanctions.

Business is business, and in order not to disrupt business, the banks and their governments went along with this. But you can bet that at the moment they are all exploring ways to decrease and limit their exposure to the whims of what is seemingly becoming a rogue state. This will speed up the decline in the US dollar being used as the default world currency.

And you’re right, they never will figure it out…they won’t even notice until after it’s too late.

Re: the video, and the Oct. 20 email from ACA Global to Calgary411 (see above)

On the one hand , Ms.Hornung-Soukup asserts, “…not that we wanted to cut content but A VIDEO THAT LONG just takes so much bandwidth and IS SO OFFPUTTING…”

On the other hand two, paragraphs later, “there is no conspiracy of silence here, just a limited number of overwhelmed volunteers and MANY HOURS OF INTERESTING TAPE.”

So, are those elusive hours of tape “offputting”, or are they “interesting”?

We also learn that what ACA Global DOESN”T want is to “actually detract from the message.”

How about letting viewers decide what “the message” is? Maybe Blaze is right.

I think he was talking about this article. http://www.cbc.ca/how-canada-s-banks-help-money-move-in -and-out of-tax-havens.

@Ann #1

If u make the money elsewhere & it never touched US soil, taxes are paid if its required by the gov’t of that country… how is that hidden? I take after tax money to invest somewhere else to have a nest egg just in case the economy tanks… how is that hidden… instead of buying something, I have banked it for safe keeping… If my family didn’t do that during the war… we would have never survived…

@ProudAussie

With today’s society… we are all mobile… we can work anywhere in the world with internet… I know US people who have been cut out of new business ventures or lost good paying jobs because of fatca… All this is doing is ensuring that US persons can’t make a living… invest… live like a normal person…. This has created a wall…. if they want the US persons to return or go to the US… they will… to live on gov’t hand outs… Because of Fatca… doors are closing for US persons… but the US don’t realize that… they figure everyone wants their passport… I know I don’t… cause in a terrorist situation… who do u think they will kill first? US passport or other passport holder?

@ US I wasn’t talking about our situation, but about Canadians living within Canada hiding the money like US residents living in the USA were hiding money in Swiss banks. I am wondering if Canadian banks are afraid of being found out by Canada. Also, I am wondering if the closures of Canadian banks in other countries has anything to do with the cost of implementing FATCA. Sorry, I could have explained myself better.

Shovel,

Blaze is right. I know that Deckard *has a plate full* until after the New Year, but we can ask him then and give another request to ACA Global. We are offering to take this off their hands and find a way to get the May 2, 2014 video published. This has taken absolutely too much time and makes no sense. I will keep on it (after my plate is less full of commitments I have in the next couple of days).

I’ve looked up for student associations on Twitter and found one of the Sorbonne’s university ones here in Paris and people who are talking about working in the USA.

I’ve tweeted directly to them “Thinking of working in the USA, think again #FATCA and #CBT will be after you”.

I’m getting retweeted

I find it to be a good angle of attack to let students and people who are dreaming of the great USA to let them know why the green card and american citizenship is toxic.

As you may know the fight against FATCA is on here in France thanks to deputy in parliement Frederic LEFEBVRE : http://www.frederic-lefebvre.org/fatca/

You see, here in France, there are 12 legal representatives for French citizens living abroad and Frederic LEFEBVRE is the french citizen represantative of north America.

He has spoken up several times in French parliement about the hasty IGA agreement the French gouvernment signed in November 2013 and the consequences on French citizens that have worked or lived in the USA, taken on a green card or US citizenship, and are now caught up with FATCA while residing in France again.

The word is getting around. I’ll try and contact Borris JOHNSON mayor of London to get something of the similar going on in the UK.

I’ve had a few exchanges with him through mail and he has kindly givin me his support if I need any help with the FATCA situation.. In France, banks can not close down bank accounts to ordinary citizens because there is a law that forbids them to do so. This is the country of human rights. Thanks dad for bringing me here in 1975.

Re: ACA CBT debate video

One possible explanation is that ACA is kaput as the “go to” organisation for expats because too many of its members have renounced US citizenship and no longer care enough about US personhood issues.

Another possible explanation is that ACA has become too cozy with the enemy since they moved their HQ from Geneva to Washington. They now serve as a controlled opposition of sort that makes enough noise to appear legitimate but careful not to rock the boat to upset their comrades in congress, hence their advocation of a “FATCA same country exemption” as some kind of faux solution for all things wreaking havoc on expats.

A third possible explanation is that ACA has been co-opted by the compliance vultures who display their banners all over the ACA website marketing themselves as being “here to help.”

A fourth possible explanation is that ACA board members have just plain out of touch with the plight of their fellow expats and are too lethargic to spend a weekend editing a video recording which may just create enough of a shit-storm among scholars of taxation to break the current inertia that barely holds the idea of CBT together.

Regardless of what the explanation really is, ACA has clearly dropped the ball for ALL of the expats they claim to represent and has therefore lost credibility in a big way among them.

More impetus to fund the ADCS challenge:

It appears to me after reading the posted email (see below) at MapleSandbox that rather than asking themselves why Canadians and others are opposed to FATCA imposed on Canadians and the rest of the globe by US extortion, they choose to discredit/discount our sovereign Canadian exercise of the rights of Canadian citizens and residents to enjoy autonomy in OUR OWN HOME country, and the Rights conferred on us by OUR laws and OUR Charter and Constitution by appealing to OUR courts. We’ll see if the DA make a correction to the misinformation in the email reproduced at Sandbox.

Just read the DA email posted over at Maple Sandbox. See this thread there;

‘ADCS Asks Democrats Abroad to Correct Misinformation’

Posted on November 25, 2014 by Lynne Swanson

http://maplesandbox.ca/2014/adcs-asks-democrats-abroad-to-correct-misinformation/comment-page-1/#comment-213012

“…..In a recent e-mail to Brazil Democrats Abroad, Regional Vice Chair – Americas and Vice-Chair Democrats Abroad Canada conveyed some glaring inaccurate information about the Canadian lawsuit….”

Donate to ADCS. There is no other way to ensure the sovereignty of Canada in this matter, to protect Canadian citizens and residents, and to restrain those Canadian collaborators (ex. the Harper government, the CBA and their investment kin, etc.) who would bow to US extortion and arrogance and betray their own countrywo/men by bending and subverting our own native laws and values – at Canadian taxpayer expense.

@badger

That explains it, DA (party of FATCA) and ACA are one and the same.

The CBT debate video was most likely deep-sixed a long time ago.

No Ann #1 – “they” are after every one of us and our bank accounts whether just down the street or in another country …. so long as the account is OUTSIDE the US. The US seems to want to corner the market for offshore banking … for all of us around the globe.

@Nervousinvestor…somehow I am being misunderstood…I am not speaking of the situation we all finds ourselves presently in or some mandate made by the US State Department, but of Canadians with no US taint who may have been hiding money overseas with the help of Canadian banks.The article has nothing to do with the USA or CBT. It is all about the Canadian banks money laundering…this has nothing to do with ordinary people living life with normal bank accounts, a necessity of life, but people using shell corporations and a secure credit card. I am wondering if the big banks are getting nervous at being exposed in this “new era of transparency” and if anyone else has read the article. Also, wondering if the closures could be because the cost to implement FATC has been a lot higher than originally projected.

@Ann #1

I don’t think I am making myself clear either… what u are saying about *tax evaders* in Canada… they are saying about us… u don’t have a clue about their situation… but we are living in a glass house… so we should not be tossing stones with assumptions either…