UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

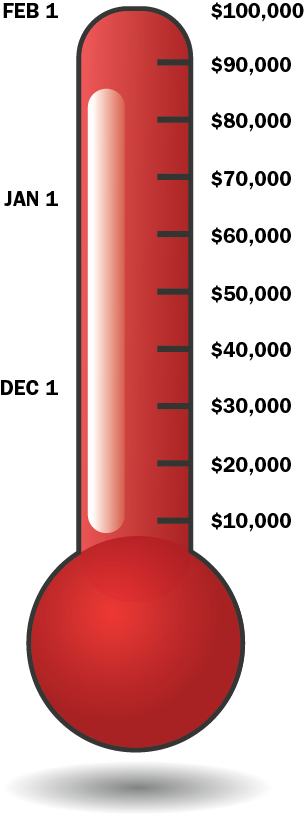

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

Those are really good suggestions, Steven. I especially like your idea of posting on Embassy Facebook pages and checked out Canada’s and both the Toronto and Vancouver consulate’s. You can write a review at embassy’s and Toronto’s consulate, and the Vancouver Facebook page allows you to make posts.

It was Abraham Lincoln who wrote: “the best way to have a bad law repealed is to enforce it strictly”.

@ Bubblebustin – thanks for making us all aware of the Embassy and Consulate FB sites

And ALL – I do not do FaceBook but, for those that do, I encourage you to look into putting things up on these sites. bit by bit…..

Ginny and Gwen have a new fan and ADCS has a new contributor …

http://www.rifters.com/crawl/?p=5387

Peter Watts writes:

I just sent a mail to the Sorbonne university here in Paris about CBT and FATCA :

Dans le but d’informer les étudiants, je pense qu’il serait bon de leur faire connaître les implications de la taxation par citoyenneté et de la loi FATCA qu’applique les Etats Unis d’Amérique à leurs citoyens et aux institutions financières (idée de thèse).

A lire :

http://lexpansion.lexpress.fr/actualite-economique/americains-ils-renoncent-a-leur-citoyennete-pour-echapper-a-la-loi-fatca_1435387.html

Au Canada, les Canadiens attaquent leur gouvernement en justice pour avoir signé un accord gouvernemental “IGA” avec les Etats Unies qui est contraire à leur constitution ainsi qu’a la notre bien sûr. http://isaacbrocksociety.ca/

En France le député Frédéric Lefebvre se bat contre FATCA et intervient sur le sujet au parlement pour défendre les Français qui ont pris la nationalité ou une carte verte américaine et qui, en revenant en France, se trouvent pris au piège.

http://www.frederic-lefebvre.org/tag/fatca/

Beaucoup de banques ne veulent plus de clients ni d’investissements américains. L’économie américaine commence à être toucher par se phénomène.

Je suis prêt à venir faire un exposé aux étudiants sur le sujet en Powerpoint en partant de l’histoire de la révolution américaine dû aux taxes de l’empire Britannique à nos jours en passant par l’application de la taxation par citoyenneté lors de la guerre de sécession.

Merci de me dire si vous donnez une suite à l’information des étudiants sur ce sujet très sensible

Cordialement

Steven TRACY

@Blaze

The story in Robert Wood’s Forbes column is awesome – what a coup!

There is a very sympathetic BoJo article now out in the UK’s Financial Times by Lisa Pollack!

She sounds like a US expat living in UK. You can tweet her: @lspollack

Her email at FT is below. Suggest you send her Ginny’s letter and Wood’s article as well.

I’ll write to both these journalists later today to encourage more coverage.

http://www.ft.com/cms/s/0/456dec30-7372-11e4-a257-00144feabdc0.html

“Notebook: An American expatriate shares Boris Johnson’s tax pain”

by Lisa Pollack

lisa.pollack@ft.com

Twitter: @lspollack

“‘Oops-Americans’ need to be warned that they face a life of torturous paper-pushing”

“As something of a bleeding-heart leftie, finding myself cheering for Boris Johnson is awkward at best. At worst it has potential to trigger a mild identity crisis and with it a sudden urge to personally thank a National Health Service nurse, become a member of a co-operative and possibly even join a union. Maybe this will make me feel better about the air punching I did when I heard London’s Tory mayor tell a US radio host that a bill from the American tax authorities was “absolutely outrageous” and that he’s not going to pay it. “I support Boris in his refusal to pay capital gains tax in the US on the sale of a primary residence in the UK!” – is that a punchy enough slogan for a T-shirt? I may get one printed anyway.”

Here’s a free article to share that will be a lot more efficient :

Why FATCA is Bad for America – Update

https://americansabroad.org/issues/fatca/fatca-bad-america/

I’m posting this on the Facebook page of the american embassy in Paris

@Steven en France. Perhaps you could translate the PDF file that is located on this site and place it on bulletin boards at the University for students and faculty. I have posted the one with the tear off slips that drive people to our site and ADCS at the local library, grocery stores, post office or anywhere there is a public bulletin board. I do check periodically and notice the slips are torn off so I know that our cause is slowly getting out there. I believe if one person is informed then five others will soon be as well and so on down the line. Good luck with all your efforts, Steven.

Wow! Some fantastic media coverage today that is certain to help fill the coffers for our lawsuit! Firstly, a great letter by Ginny printed by Robert Wood in Forbes which garnered, right off the top, one of the best comments on the situation I have ever read. And, secondly, Peter Watts’ article posted in EmBee’s comment above. If you skipped by that link (just 3 posts up) go back and read it. Our beleaguered community is collecting allies. The word is spreading!

Gwen’s friend is pretty cool. It’s unfortunate in his extreme dislike of Harper that he gives our banks a pass when he wrote: “Two governments push; the banks go over like a pile of bricks; Harper’s henchmen collect the financial records of a few million private citizens and, tail wagging vigorously, passes it all on to Uncle Sam.”

From what I understand, the push in Canada to accept the IGA was primarily from our banks. Either way, it’s indefensible though.

FINALLY A piece of good news from ACA American Citizens Abroad :

ACA makes progress on Residence-based taxation (RBT)

Share on tumblr

Share on google

Share on linkedin

Share on twitter

More Sharing Services

Residence-based taxation (RBT Proposal) for overseas Americans is “on the table.” ACA has been working for over 18 months, meeting with legislators and key offices in Washington, DC — Senate Finance, Ways & Means, Joint Committee on Taxation. Our efforts have paid off. Residency-based taxation has been cited in two key reports. The first is the Joint Committee of Taxation report summarizing submissions sent to the Ways & Means Working Groups on Tax Reform. The ACA RBT proposal is referenced on page 521 of this submission.

The second report is one in a series of white papers by the Senate Finance Committee, this one discussing International Competitiveness. Item IV of this report cites the proposal for RBT as well as the elimination of the FEIE. FEIE can be viewed as unnecessary if Residency-based taxation is accepted. However, there are some in Congress who are still calling for elimination of FEIE only and ACA is keeping pressure to oppose such elimination as an isolated measure. ACA continues to dialogue with these offices and with legislators and we are encouraged by the fact that the RBT proposal is being reviewed and seriously considered.

Full article with video to share : https://americansabroad.org/issues/taxation/aca-makes-progress-residency-based-taxation-rbt/

Thanks, EmBee / Thanks, GwEvil!

And, he HAS awakened a couple of people, commenters to his piece.

Congratulations, GwEvil (also known as Gwevin, so I see where “GwEvil” comes from)

A good start to MY morning! Suggest the link Em provides can be passed on to all of our “old friends” to wake some more up.

When folks have been in the front lines for so long one can be excused when receiving good news for responding “Praise the Lord and Pass the Ammunition; the enemy remains in front of me”. Excellent coverage in Forbes, have not been able to see the Financial Times one yet. Excellent that “Residency Based Taxation is on the table” in Congress. One more step forward. Taxation however is NOT the whole story as to the evil that is FATCA / GATCA. Taxation is the PR spin justification to mobilize support for FATCA. FATCA needs to be repealed wholesale.

Unfortunately that ACA report hasn’t been updated since we discussed it here in 2013. As far as I know, there hasn’t been any progress on RBT since then.

@Steven – RE the letter you sent to the Sorbonne

Could you translate this into English? Who knows, it may be something that others in other countries might want to copy/send off to other universities/colleges. And to whom, exactly, in the Sorbonne did you send this to? Don’t forget to let us know of any reply.

Hi Bubblebustin – Sorry to hear that the ACA thing is old. As you say Still the Forbes one was excellent indeed including that fantastic comment that almost an article in itself. Have been trying to do the twitter thing … who knows how far afield those tweets get to. Maybe a brigade of twitterers could tweet at least once every day with some short line followed by links to the ADCS, the Brock, the Sandbox or other relevant sites.

Still the Forbes one was excellent indeed including that fantastic comment that almost an article in itself. Have been trying to do the twitter thing … who knows how far afield those tweets get to. Maybe a brigade of twitterers could tweet at least once every day with some short line followed by links to the ADCS, the Brock, the Sandbox or other relevant sites.

Ok, I’ll translate it into english when I get a moment to do so.

I sent ot to the media and journalism service of the Sorbonne.

Wait and see…

The reasons why we are all here and just how important this fight really is for all of us. In Canada and around the world.

@ Furious AC- I watched this documentary a few days ago and strongly recommend it.

CRA shows how well it handles privacy…

http://www.cbc.ca/news/politics/canada-revenue-agency-privacy-breach-leaks-prominent-canadians-tax-details-1.2849336

@LM

Here’s the translation of what I sent to the Sorbonne university in Paris :

In order to inform students, I think it would be good to let them know the implications of taxation by Citizenship and FATCA applied by the United States of America to their citizens and financial institutions (idea thesis).

Read:

http://lexpansion.lexpress.fr/actualite-economique/americains-ils-renoncent-a-leur-citoyennete-pour-echapper-a-la-loi-fatca_1435387.html

In Canada, Canadians attack their government to court for having signed a government agreement “IGA” with the United States that is contrary to their constitution and ours of course. http://isaacbrocksociety.ca/

In France Frédéric Lefebvre UMP deputy in parlement fights against FATCA and intervenes on the subject in parliament to defend the French who took the US citizenship or a US green card and, returning to France, are trapped.

http://www.frederic-lefebvre.org/tag/fatca/

Many banks no longer want American customers or US investment. The US economy is beginning to be touched by the phenomenon.

I am ready to come to brief students on the subject on Powerpoint starting from the history of the American Revolution due to taxation of the British Empire to the present day through the application of taxation by citizenship during Civil War.

Thank you for letting me know if you give following information to the students on this very sensitive subject

kind regards

Steven TRACY

Have a look at what I just posted on Twitter : https://twitter.com/StevenTRACY1965/media (a 49 year old remembering when he used to listen to AC/DC at the age of thirteen in a free world).

(a 49 year old remembering when he used to listen to AC/DC at the age of thirteen in a free world).

Especially the picture I made.

Also visible on Facebook : https://www.facebook.com/steven.tracy.754

Check it out print post and share.

Listening to AC/DC while doing this

Now I know what AC/DC meant by saying “just keep on breaking the rules, get ready to rule”.

Actually I went up to superior calsses at a drum school in Paris way back in 1987. To bad the famous Canadian group UZEB broke up in 1991. I’ve got their last concert on dvd, 2 hours 30mn of joy

Say yeah to freedom and fight the shit out of imperialism wherever it comes from.

I’m going to give the american gouvernment hell on this FATCA business. An american has no fear of americans.

What’s the adress of you blog ? Can’t find it

Steven, are you asking for the address of Isaac Brock Society? http://isaacbrocksociety.ca/

@ calgary411

No, but in your last comment there was no link so I didn’t understand wich blog you were pointing at.