UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

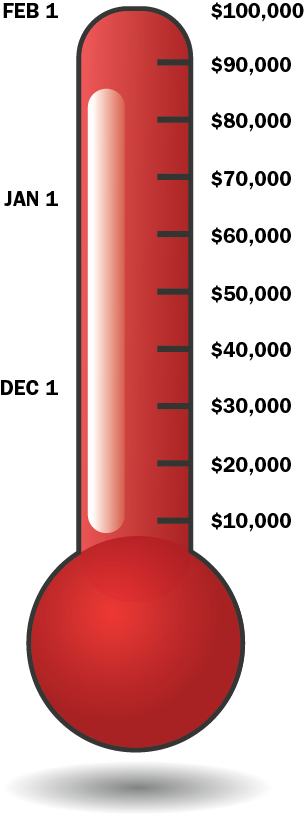

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

@Anne Frank – Thank you yet again for cool, informed, rational analysis. I am (and I am sure others are) deeply grateful for your clarity.

Let’s Not Forget.

In Flanders fields the poppies blow

Between the crosses, row on row,

That mark our place: and in the sky

The larks still bravely singing fly

Scarce heard amid the guns below.

We are the dead: Short days ago,

We lived, felt dawn, saw sunset glow,

Loved and were loved: and now we lie

In Flanders fields!

Take up our quarrel with the foe

To you, from failing hands, we throw

The torch: be yours to hold it high

If ye break faith with us who die,

We shall not sleep, though poppies grow

In Flanders fields

At this Remembrance of the sacrifices offered by others to protect our Freedoms … I remember one Grandfather who served in WWI in France amongst Canadian Forces and the other who served in the same conflict in France amongst the British Forces. Both returned from the War but I am sure were carrying their wounds inside – both are now deceased from natural causes but one was said to have been re-fighting his battles in France whilst on his death bed in the 1970s. Neither ever spoke to me of their experiences. I thank them and the multitudes from around the world who served with the Allied Forces and indeed others who have fought for Freedom from Tyranny over the centuries.

@Stephen Kish – thank you. Truth be told, my paragraph-by-paragraph comments were essentially directed at his team as I know they will be in the phase of gathering up and processing comments in order to consider their next steps. Let me try a few more comments of a more general nature aimed at a more general audience.

As I noted earlier, there really is nothing new here and indeed considerable reason for optimism that an early hearing will be possible as I see little sign that Justice intends to delay while it seeks to gather evidence from experts or otherwise. They seem happy enough to make their fairly basic arguments from the grounds that they have. So let’s examine the case through Justice’s lens for a moment if we can.

This is a Charter case. Every Charter case essentially involves a two step process. One, is their a prima facie or “at first blush” breach of the Charter? Onus on the plaintiff. If so, can the breach be justified under s. 1 (onus Justice). Where the Charter breach is discrimination, for example, does the statute discriminate? Well, of course, ALL statutes discriminate to some degree and obviously not all discrimination is prohibited by the Charter. People under 19 may not purchase alcohol. Black people may not sit at the front of the bus. It is not hard to see that both discriminate, but one is founded upon potentially reasonable pubic policy, the other on unreasoned bias. Both are subject to examination.

When the dust settles, the Crown’s essential case boils down to two assertions:

1. Information exchange is not harm per se (no prejudice); and

2. We had to do it because the consequences would have been worse.

Of these, only the second is really substantive.

Information exchange is harmless. The assertion can’t stand up. A search warrant to open up my banking records or cell phone records for audit and inspection clearly violates my right to privacy and yet amounts to no more than an “exchange of information” between the police and my bank or cell phone provider. Drug dealers, child pornographers, even jihadists routinely complain that evidence of ACTUAL violations of Canadian law obtained in breach of their privacy rights must be excluded from court because it was obtained in violation of the Charter. Violating my privacy rights to investigate an actual breach of Canadian law requires that safeguards be respected. Warrants to examine all banking records of all Canadians are not obtained. Individuals against whom there are reasonable grounds for suspecting complicity in the commission of an offence are named in a warrant. A judicial official examines the evidence and issues or refuses the warrant. Even tax treaty exchanges of information are subject to a prior filter:

Under the tax treaty, information only applies to “such information as is relevant for carrying out the provisions of this Convention or of the domestic laws of the Contracting States concerning taxes to which the Convention applies insofar as the taxation thereunder is not contrary to the Convention.” Bear in mind that under the Convention, all residents of Canada are entitled to a deduction from US tax for all taxes paid to Canada on the same income whereas limitation under US tax law (including AMT) deny those deductions in whole or in part to Canadian residents. Also bear in mind that bank account, life insurance and stock broker account information as to ASSETS (as opposed to, for example, interest income in the year of the sort referred to on a T-3 or T-5) is not information regarding income. Assets might be relevant to COLLECTION of course, but the Defence quite adamantly denies that collection is in view here.

We are way outside the collection of information that is in the scope of existing treaty. This is a quantum leap beyond that. I can’t emphasize enough that FBAR, FINCEN and the like are NO PART of the tax treaty. They ARE information sweeping exercises. I would argue that they likely breach US law given the original purposes of those statutes and the completely different use to which they have been put in relation to non-resident US Persons. That, however, is for another day. The point is that Canada has agreed to collect data for the US in relation to US taxes under the Convention and, given the promise of full tax credits for Canadian-source income, there is every reason to believe that only a fraction of the people whose information is being exchanged would have any TAX obligations whatsoever. They MAY have FINCEN, FBAR violations of course – but Canada has never agreed to collaborate on that. So what we have is the functional equivalent of turning over all cell phone records so that drug dealers can be searched for.

The other argument on “where’s the harm, it’s just information” of course is common sense. Why on earth do you think people are declining to provide their names, are interviewed in the press under pseudonyms, etc? Their fears are not irrational – they believe that disclosing their private information to the US will lead them to be in real peril of jail or personal financial ruin. Congress and the IRS want the information in order to act upon it. They way they want to act upon it can be amply illustrated by a sampling of OVDI stories. Collection is the whole point of the process – gather more money. The money is earned in Canada by Canadians who have fully complied with Canadian law. We protect drug dealers and jihadists from violations of their right to privacy when our own government is pursuing them and yet have to argue for protection of Canadian law from being pursued by a foreign government?

Remember, Charter rights at their core are always about balancing the state’s interest in something against the individual’s. The Charter puts the onus on the state to justify, which onus is tougher to discharge the more important the individual interest. Privacy is one of those “per se” interests. I have a right to keep my privacy and I have very little need to justify that to you or anyone. Where the state interest is so slight that we won’t even enforce the obligations to the foreign state that we are helping them to discover, how do we justify overriding the individual’s right to privacy?

What are some of the harms that come from breach of privacy even if not accompanied by assistance in collection?

– receipt of demands for payment and risk of enforcement of those demands in other countries;

– threats of penal sanctions which may limit mobility even within Canada. If the US puts someone on their warrant list, they can cause planes from Toronto to Vancouver to land in North Dakota (depending on jet stream movements, Canadian flights may routinely chose to fly over US airspace to conserve fuel).

– impairment of credit rating and financial freedoms in Canada caused by such demands,

– threats of fines and penalties unless data of one’s employer or business partner are disclosed under FINCEN and FBAR regulations and loss of career opportunities in Canada that follow from this obvious disability

I suspect our community could fill out that partial list pretty quickly.

The second argument – in essence the lesser of two evils, the devil made me do it, extortion, what have you – this is where the heart of the matter lies. The problem for Justice lies in the fact that they have left themselves open to W.C. Fields rejoinder (I think it was he). After asking a woman if she would sleep with him for a million dollars, he famously quipped “now that we know what you are, it’s just a matter of price”. At its core, Justice is alleging that the FINANCIAL cost to Canada of not enforcing US law in Canada was too high. Accordingly, Justice claims, it carefully sacrificed as few Canadians and their rights as they thought they could get away with in order to avoid the threatened sanctions. Stated differently, the commercial interest of Canadian financial institutions in carrying on “business as usual” in New York was worth more to Canada and the Canadian economy than the rights of the one million or so Canadians potentially offered up as sacrificial lambs to the US enforcement machine.

The problems with this argument are many. Charter rights are not about counting pennies or comparing my loss to your gain. We can’t put shoplifters to death because it costs too much money to put them in jail. Even shoplifters have a right to life and security of the person. It would be a LOT cheaper if we dispensed with most trials and simply declared guilty all people who are PROBABLY guilty or about whom there is some evidence. This business of trying people before judge (and sometimes jury) and proving beyond a reasonable doubt is pretty darned expensive. Why not just have a prosecutor review the file and sentence everyone who looks guilty? Finding innocent people is really expensive and time consuming and lets some guilty people go free. You can see pretty quickly how the money argument – it would have cost too much to do it differently – is not going to carry a lot of weight in a Charter case. A Canadian court will not easily fall into the WC Fields trap.

This does not mean the argument is silly and will be tossed summarily. They will be coming up a pretty steep hill though. They will try to argue that sanctions would have brought Canada to its knees, but I will bet good money that they wasted almost NO time in trying to figure out alternative means of mitigating or avoiding that harm.

I would argue that the sanctions threat was always a hollow one. As noted earlier, commerce would NOT dry up if the world just said no. We can do business in C$ and let US banks come here to buy them. We can do business in Euros, Renminbi or whatever. The Bank of Canada could set up a clearing agency to handle fx transactions as a middleman and avoid sanctions on Canadian banks. Canadian banks could sue for confiscation of their investments in the US contrary to NAFTA. Or the US might have blinked faced with the utter hopelessness of imposing their will on a world economy that simply says “no” to say nothing of the very real risk of sanctions on US interests (impose a special tax on US FI’s equivalent to all witholding tax paid the prior year by Canadians). There were many roads not taken – a cross-examination of Finance officials will doubtless show that the other roads were not even examined.

Finance may have feared the harm of not complying with FATCA to Canadian banks. I doubt that they properly counted the harm of FATCA compliance to Canada though. Canada is spending billions to comply and that money is going to result in higher costs to consumers and lower taxes to government (those compliance costs are deductible of course resulting in lower taxes to Canada). That is not Mr. Arvay’s argument to make of course. He will be focusing on the fact that you can’t sacrifice Peter’s privacy and anti-discrimination rights to Paul’s commercial interests in New York. The fact that Canada spent so little energy trying to avoid the collision of Peter and Paul’s interest – by lobbying seriously to block FATCA a la James Jatras’ advice, by considering or implementing countermeasures, etc will make their argument untenable.

Here is where the contrasting approach of Canada to logically identical foreign laws of Eritrea and the US can be made use of. Eritrea has almost no economic clout that it can wield against Canada. Thus, when Eritrea seeks to collect “information” from its diaspora with a view to demanding taxes, Canada reacts with outrage. Eritrean Canadians have a right to protection from Canada. Eritrean diplomats are expelled unless they promise not even to suggest that Eritrean Canadians comply with Eritrean law. Even distributing forms from the Consulate and telling people how to send money from abroad is cause for sanctions. When the US seeks Canada’s help in making far more serious demands of its far more numerous diaspora in Canada, Canada’s reaction is entirely different. It is hard to avoid WC Fields’ accusation on those facts.

Interesting as well is the one thing the Defence did NOT say: go ahead and renounce. That insulting rejoinder, oft repeated in Parliament, must appear a whole lot less attractive as an argument now that the US has effectively impeded if not banned renunciation by jacking up the fees and adding year long waiting lists.

More time and expertise spent on your analysis for us, Anne Frank. I am indebted for all you contribute in in the name of the whole of us.

I am so thankful every day for the significant generosity and expertise of many here, time taken from busy careers and lives — it is amazing and an important part of the story of this fight.

Anne Frank, I appreciated your skills in retorting to this “defence” because I couldn’t finish their pathetic document and I just read your take on it. And yes, I felt like I was called a mudblood.

I mean, look at #11 from this thing:

“FATCA is not narrowly targeted at identifying the accounts of U.S. citizens in Canada or any other country. FATCA provides the U.S. Internal Revenue Service (“IRS”) with information for tax compliance purposes about non-U.S. financial accounts held by actual or potential U.S. taxpayers, including U.S. entities, individuals resident in the U.S. (whether citizens or non-citizens and whether or not also resident in another jurisdiction), and U.S. citizens who are resident in jurisdictions other than the United States, including Canada.”

Did I read it right? They admit: “FATCA provides the U.S. IRS with information for tax compliance purposes about non-U.S. accounts held by [people in Canada whether citizens or non-citizens]. ” INFORMATION FOR TAX COMPLIANCE PURPOSES! So of course, the preceding sentence is garbage; if the goal is to “provide information for tax compliance purposes” then of course, that means the U.S. expects IGA treaty partners to identify the accounts of so-called U.S. citizens and US persons. Duh!

Never mind the IRS has any moral standing or right to financial information in Canada held by Canadians reflecting money earned and acquired in Canada. Never mind that no other country requests such a thing. Never mind that the IGA singles out and targets anyone deemed to be US person or sharing an acct. through marriage with such a person. Never mind what the IRS will do to cow Canadians whose accounts are flagged (or their banks) to extract money from them. Never mind that the US is likely to broaden its definition of US persons to widen its nets and try to raise more money through even more outrageous penalties!

Why is the Defence so blind and deaf to all this? Don’t they realize how much money will be forfeited to the U.S. for agreeing to all this? Not to mention the fact that they’ve proven themselves to be worthy of zero respect and zero trust?

@Anne Frank

Very impressive.

The timing for FBAR does indeed strongly suggest that it was about keeping money from flowing out of the country (which had been a concern all the way back to JFK, if not Eisenhower). The Bank Secrecy Act passed in October 1970, before the Nixon Shock of mid-August 1971, in which the U.S. essentially defaulted by ending the convertibility of dollars and imposing a 10% tax on imports.

I only briefly reviewed the government response and have no experience of Canadian charter challenges but I had two observations.

There was a point in the response where the government claimed that individuals in Canada had surrendered their right to privacy by virtue of the fact that their bank was a third party. This was almost certainly inserted by the US government. The so-called third party doctrine is the basis for much of the NSA’s domestic spying program. The theory is that if person A calls person B and uses a commercial telephone service provider then neither person A nor person B has a reasonable expectation of privacy in relation to certain information because the telephone number dialed, time of day, duration of phone call etc. was captured by a third party provider in connecting the phone call. Because they surrendered this information to a third party, there is no reasonable expectation of privacy. Here the Canadian government states that the bank is a third party except I only count two parties, the bank and the customer. The third party doctrine is irrelevant and there can be no suggestion that the right to privacy is surrendered by virtue of the fact you have a bank account.

There was a passage where the government claimed that the information provided under the IGA was done so under the protection of a clause in a previous information sharing agreement that stated the information could only ever be used for tax purposes. Given the statements from Sen. Levin (I think it was) that FATCA data should be widely disseminated and made available to all law enforcement agencies it seems rather unlikely that all of this information would be used by the US in accordance with that agreement.

Kudos at least to the government for admitting that the result of the FATCA sanctions regime was “crippling”.

Anne Frank wrote:

“The US is in fact the repository of billions if not trillions of “safe haven” funds being hidden from governments of countries all over South America, Africa, Asia etc.The US banking policy is “don’t ask and certainly don’t tell” and FATCA has not changed that. The US has more foreign deposits than Canada does to be sure and is in no hurry to lose them.”

It should be noted that the old QI system as well as FATCA was designed to be only between the IRS and the FFIs without an FFI’s government getting in the middle. The reason for this was precisely to try to avoid potential demands for reciprocity on the part of the FFI’s respective governments.

Both QI and FATCA were intended to be one way streets for information. IGA’s only came about as a matter of necessity.

I would not be surprised if the Canadian government defense team had US lawyers helping them draft their defence.

@FromTheWilderness

This wouldn’t come as a surprise, as we know that the Canadian government went south to get advice on how to implement FATCA. From John Weston, my MP:

“I have taken the initiative among Government Caucus members to consolidate information concerning this matter and have worked closely with the Honourable Jim Flaherty, our Minister of Finance, who has taken our concerns forward effectively. Among other things, I arranged for prominent US tax attorney Mark Matthews to come to Ottawa on May 30, 2012 to brief Caucus members concerning these matters. Mr. Matthews not only works with Canadians who have US tax problems but he also served previously as Deputy Commissioner at the IRS.”

http://isaacbrocksociety.ca/2012/06/26/a-response-from-john-weston-mp-on-fatca/

FromTheWilderness and bubblebustin,

I wouldn’t be surprised either. Betrayal upon betrayal — and a whole lot of manpower against so-called Conservative-defined (with the assistance of the US?) *US citizens who happen to reside in Canada* (CANADIANS!) and are raising money to get back the rights they’ve lost from both of governments concerned.

Continue supporting this litigation, everyone. http://www.adcs-adsc.ca/

@Anne,

This thread will contain lots of comments on a variety of topics. As @EmBee says, it would be helpful if we also had comments such as your detailed analyses posted on a thread focused only on the Statement of Defence. If not, good suggestions will be lost.

I have copied your two detailed analyses to our ADCS Statement of Defence blog post and hope that you and others will do the same (re-post on the Alliance blog) when you continue your analyses.

I posted both of your comments here and hope others do the same:

http://adcsovereignty.wordpress.com/2014/11/10/the-government-of-canadas-statement-of-defence-to-adcss-statement-of-claim/comment-page-1/#comment-137

http://adcsovereignty.wordpress.com/2014/11/10/the-government-of-canadas-statement-of-defence-to-adcss-statement-of-claim/comment-page-1/#comment-138

Let me see..,

We are told the Tax Treaty does not allow Canadian courts to render a judgment in favour of IRS against a person who was a citizen of Canada when the tax was incurred, and that the Tax Treaty does not allow any judgment at all for FBAR penalties because FBAR PENALTIES ARE NOT TAXES.

Well, if FBAR penalties are not taxes, and account info gathered under the FATCA IGA can only be used in USA …FOR ENFORCEMENT OF TAXES, would it not follow that such data cannot be used to detect FBAR delinquents?

Could I be the first person to think of this?

I live in France since 1975. I’m not going to file in any IRS form, I never have and never will. I’m going for French nationality and just won’t renew my american passeport. I don’t care, i’ll never go back to the states anyway, I don’t even have an american social security number, what for the social security in France is a a lot better.

BUT, there is one thing that counters citizen based taxation for american citizens residing, living and working abroad and that is RECIPROCITY. Its written in the US constitution.

The US gouvernment CAN NOT ask american citizens living abroad to pay taxes because they have no benefit in doing so. When you live in a country, you use the roads, schools, protection etc…

Can someone tell me how an earth the United States is going to make me benefit from taxes payed to the IRS over here in France or in Canada or anywhere else in the world ? None. Plus we allready pay taxes in the country where we live, so, as far as I’m concerned, the IRS can go and fly a kite on Mars because FATCA violates the 1st, the 4th and the 8th amendments of the United States constitution.

Read about the fight here : http://www.washingtontimes.com/news/2014/may/5/superlawyer-jim-bopp-takes-on-mccain-backed-tax-ac/?page=all

By 2017 at the latest FATCA will be Repealed.

Untill then the damage to the american economy is going to be huge. Bravo OBAMA lol.

@ Anne Frank – I’m so grateful that IBS has clear and detailed legal-analytical thinker/writers like yourself to fully evaluate and articulate what so many of us felt when reading the kiss-off swift-dismiss Gov’t response. Thank you so much for providing us with your excellent insights.

Can Arvey call people such as US tax attorney Mark Matthews as witnesses to facts?

@Anne Frank

“People under 19 may not purchase alcohol. Black people may not sit at the front of the bus. It is not hard to see that both discriminate, but one is founded upon potentially reasonable pubic policy, the other on unreasoned bias.”

Both are unjust discrimination. There is no reasonable public policy behind it. It is a hate crime.

In Germany, the signs read Juden Verboten and in Canada they read, No Minors Allowed. You expressed your off-topic opinion so I expressed mine.

.Because minors are really persecuted in Canada by not being allowed to purchase alcohol…..

Fail. (eyeroll)

Infrequent poster here…

It seems to me that some of the statements made by the Government of Canada in this response could be potentially damaging to its image in the next election, should the average Canadian on the street hear about them. In particular, I wonder what people across this country would think/say if they knew that the GOC thought they had no inherent right to privacy in their financial matters. Also, what would the people of Canada (the nation of supposed peacekeepers and all round nice guys/gals) think/say if they knew that their government sold out the basic civil rights of a significant minority of its people purely to protect the US-derived profits of the big Canadian banks?

Since these are quite damning revelations by the GOC that ALL Canadians should hear about, where is the press in all this? Where is Patrick Cain of Global, etc. to report this shocking arrogance, immorality, and contempt of the rule of law to the people? Can we get someone, anyone, in the Canadian press to report on their response to the lawsuit? Also, I notice that the fundraising is not going as well since meeting the last goal and some good press could really kickstart things again. Does anyone have any contacts in the press they can call on?

@ refugeefromamerica: Is this information, sent to Arvey & his office for review and rebuttal, and for the clients to be informed of, something that could or should be made public via the press? At this time? Later? What would Mulcair or Trudeau do with such info – – in our interest or just in their interest. Who can we trust to do such political action well without damaging our legal aims? Anyone?

@LM: Someone correct me if I’m wrong on this, but I think the claims by the plaintiffs and the response to said claims by the defendants are open public information. Now, as to the politics of if/when/how to release such information in the House of Commons, in he press, or on the campaign trail, I must admit that I’m no expert…being sly and politically adept are NOT my fields of expertise!

It is clearly US influence regarding this nonsense about the bank being a third party. Perhaps the Finance Committee has heard of PIPEDA? For crying out loud..

Tom, no sorry, the issue of Title 31 vs Title 26 is an old one………….

What hits me the most is the hypocrisy with Eritrea. How can one decide one way with one country and another with another country? If it is all about the money in the end, then I cannot imagine that a charter in Canada OR a constitution in America would or could actually rule that the money wins.

@refugeefromamerica

I dont even think 1million people is such a “minority”. There are 35 million people in Canada. Surely 1 million of that isn’t small enough to be considered such a minority- and then add to this that most likely a huge part of the 34 million left are also ethnic something-or-others and have similar rights to protect.

@Polly: Last time I checked, a sample comprising less than one half of any whole is, technically, a minority. So, by any rational estimation, 1 million out of 35 million is absolutely a minority. Also, 1 million is a much more significant number than, say, five. So, my original statement stands…the people affected by the FATCA IGA in Canada comprise a “significant minority” of the total population. It is a minority that is not insignificant, hence it is significant. My description comes from pure mathematical reasoning in relation to the topic at hand and makes no comment or judgement whatsoever about any other group or their rights or their worth. All people should be treated equally under the law, period.