UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

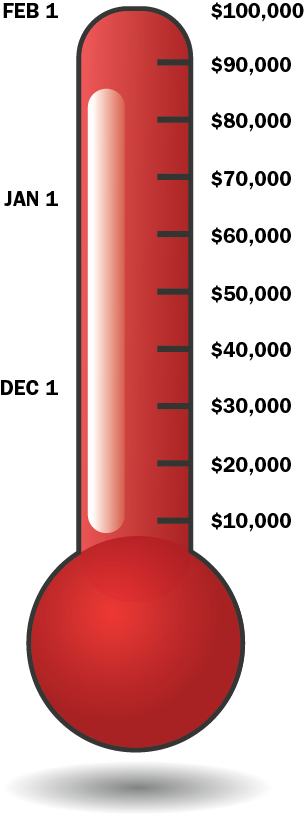

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

RE: KIJIJI

I don’t mind standardizing but I think the only reason Kijiji allowed us to post under two categories was the slightly different content wording, title and different primary image. If the same ad pops up all over Canada (even with different postal codes and accounts being used) they might just drop them all. They really want these ads to be local, to the point where if you check your area for a FATCA ad, you have to clear your cookies to look in another area. I’m obviously not a kijiji wiz so what do others think?

@NorthernShrike

We can get a “purer” file out for the logo; many images don’t reproduce well via copy/paste.Thanks for pointing that out.

Where one puts the listing? I almost always use “Community” whether it is a general info-only ad or a specific one such as the Info Sessions.There are subsections within Community such as Events, Groups, etc. We can experiement; if everyone keeps a record of views in the various sections, we can compare and see what works best.

The first kijiji I did was for the FATCA Forum in December 2012. There were some 400 views. Whether one sees direct results or not, that’s 400 more who are warned/informed. You can keep track of views and can set the listing up so that only you see that number. At any rate, I have always used as the main image for general ads, the common “No FATCA” image. Will try to insert in this comment; not sure I can do that. Kijiji also offers the option of a video for free.

Enhancing the ad depends what it is for and of course, on one’s pocketbook.If one can do it fine, if not, fine as well. At this point, I would rather not get into funds being disbursed from ADCS-ADSC (primarily bc we need every penny for the litigation fees). There are differences in the prices in different areas. For example, for Info Sessions, the homepage banner is a must. For info-only listings, high-lighting or top ad are good options. Kijiji keeps them up for 90 days, enhancing is good if possible.The prices are different in different areas.

The Metroland sites offer an option – dynamic ad which is one of those scrolly things on the sidebar. There are also top page listings, etc Again, I have always used the No FATCA graphic to build as much consistency as possible.

@Tricia Moon

The other advantage of an “electronic news kit” is that you can burn it to CDROM (cheap) and hand to any journalist or other potential supporter you encounter.

PDF copies from key published mainstream articles can be added to a CDROM, and also key Finance Committee briefs (such as the Christians & Cockfield, Lynn’s, John’s etc)

@EmBee

I am not implying standardizing to the point you may be envisioning. Perhaps your point about the image could matter and we won’t be able to do that. But as far as copy goes, I don’t think a few recognizable phrases are going to cause kijiji to pull all the ads. We could try to time them a bit if you have concerns about that.

I have never had to clear cookies to view ads in another area. I wonder if being registered as a user makes any difference here? I have an ongoing account with kijiji and have never had issues posting to other areas. Woud this make a difference?

See Post above which has link to November 10 Government Statement of Defence.

@ Tricia

Okay, as I said I’m not a kijiji wiz. I’ll go with the flow. I’ll get Mr. EmBee to post whatever is best. You or LM can go to the Lethbridge area (search FATCA) to see if there is anything he should edit, otherwise we’ll leave them as is. It won’t be long before they’ll need to be replaced anyway. At least it’s FREE. BTW, I’m having a hard time accessing Brock today. Maybe it’s our bad weather here.

“She wants to protect her children, but she knows that Canadians never ever lie to banks. What should she do?”

IMHO the ethics of her and her family’s particular situation depend a lot on her intentions at the time her kids were born.

Did she have her kids enthusiastically wanting them to be US citizens–because US citizenship was seen as a good thing at the time–and has she only later come to regret that decision when FATCA and related assaults on expats started?

Or did she have her kids thinking they would NOT inherit US citizenship–because in her own heart and mind she had already relinquished–and only later did the US government refuse to recognize her relinquishment and foist unwanted US citizenship on her and her kids?

Legally these two situations may be fairly similar but–if the question is what her ethical obligations might be–I think there is a world of difference between the two situations.

@StephenKish @All

First off–congratulations to you, the plaintiffs, and the Arvay/Gruber team on holding the Gov’t to the 30 day deadline on this iteration!

Of course it is predictable that the Gov’t is resisting the claims. I haven’t had a chance to review in detail–and of course I’ll be limited in the fact that I’m not a lawyer. However one thing in particular that caught my eye:

The Gov’t asserts that the IGA eases the burden by “providing that terms generally should be interpreted according to Canadian law, not U.S. law.” Yet elsewhere they say that the Gov’t is aiming the enforcement provisions of the IGA only at “are aimed at individuals who are, or who may be, liable to pay U.S. taxes.” How can a determination as to who is liable to pay U.S. taxes be made except via U.S. law? Doesn’t this put the lie to their assertion elsewhere to be following only Canadian, not U.S., law?

I’m sure others will have much to say but this is something that quickly caught my eye.

@ All – Wow, this Kijiji/advertising thing is hopping! Bit by Bit!!!!!

EmBee, I really like the image you have of the overlapping flags with the blue piggy-bank with wary eyes; If you send it to Pacifca@iasacbrocksociety.ca, she could put it up on the Publicity and Protest materials page for others.

For visuals, I’ve just been using the one with the piece of paper being shredded (with the word Privacy” on the paper) plus the Charter of Rights and Freedoms image, but sometimes also the tombstone…. And always the YouTube from the parliament hearings. I figure having the visual of “NO FATCA” may not catch the eye or mean anything to someone who doesn’t yet know about FATCA.

BTW, one can check how many visits one has had at Kijiji by going to “My Kijiji” – – I don’t think this ads to the “Visits”. And you don’t have to list your address – – a listing of your postal code is sufficient.

I agree with EmBee in not having these ads too-standardized. Juggle the heading and description wording a bit, put up different visuals (or make different ones the “Main” or do an “Edit” in a week to slightly change these things and delete/re-post every 2-3 weeks to keep it fresh and near the top of the ad page. I stayed with Community/Discussion ads since I figured I wasn’t selling any legal or financial services (and I didn’t want anyone to flag the ad for being in the wrong section); I was just asking folks to read and think about this issue (and share the info and join the discussion).

Maybe at the end of November we should all post here how many “visits” we have gotten – may be surprising!!!

Gosh – it is going to take some time and analysis to compare the Claim and the Response. Wow ! I hope that Mr Arvey and crew can deal with this. I think that we need Prof Christians and her colleagues to assist.

In the meantime, the statement above:

“In response to paragraph 84 of the amended statement of claim, the defendants say that any privacy interest in Accountholder Information that may exist is minimal.

The plaintiffs, and other U.S. Persons, have pre-existing obligations to provide account information themselves to U.S. taxing authorities and, in addition, the majority of the Accountholder Information was already in the hands of a third party – the financial institution.”

is a miserable nasty statement.

Not minimal to persons that get identified as “US Persons” and their information gets leaked to some Jihadist …. Not minimal to persons that get identified as “US Persons” and their information gets leaked out of the US Official database and their identity stolen …. Not minimal to persons that get identified as “US Persons” and their retirement savings get wiped out …. Not minimal to Canada when those extorted tax dollars get sucked south of the border and the families thus decimated become charges on the Canadian Government purse.

So the extortion threat is big enough to scare the Canadian Government out of honoring the Canadian Constitution and its Charter of Rights. By God we need someone with testicular fortitude like a Sir Winston Churchill to stand up to this insanity.

What nasty cynicism to claim that because your financial accounts are with a Bank then you have lost rights to privacy of that financial information …. is the author of the Response insane ?

As for the nonsense about pre-existing conditions …. If a person escapes slavery in another country and flees to Canada should Canada then repatriate that person to the slave owning country when it finds out that the slave broke the law there in escaping ? Perhaps all Eastern Europeans (and their descendants) who escaped the Nazis or the Communists and ended up in Canada ought to be repatriated to their original countries as they doubtless broke the laws there in the process of escaping? What tripe. So Canadian policy is henceforth that no matter how evil the regime that one is existing under one may NOT break their laws or rules and seek refuge in Canada ? What horse pucky.

Then to compound matters:

“In response to paragraph 82 of the amended statement of claim, the defendants deny that the Impugned Provisions expose the plaintiffs to a deprivation of liberty or security of the person.

In the alternative, if the Impugned Provisions expose the plaintiffs to any deprivation of liberty or security of the person, which is denied, such deprivation occurs in accordance with the principles of fundamental justice.“

My God I never dreamed that I would see such nonsense written by a Canadian Official …. such vicious, cynical (or ignorant perhaps – I dont want to use the term deceitful) mis-application of principles. I am sure that Arvay can tear the author of this tripe a new poop chute (metaphorically speaking of course).

@Dash1729

The mother in question is me. It never even occured to me that my children could be US citizens. Over the years, when people found out I was a US Citizen, first they all thought that was great, and they ALWAYS inquired whether or not my children had inherited citizenship. I have alway said no. I have not registered their births. Even though I knew I still held US citizenship, I saw no logic in passing this on to them. How could one pass on citizenship, having left the US as a 3-year-old, and started having children 24 years later? Today, I learn we must be very careful, since they may be considered US citizens by the US government. We do not, and will not, claim it.

@ LM

About what I call the “worried little pig” image. I don’t know where I got it from (I collect these things willy-nilly with screen shots — probably shouldn’t do that) so maybe it’s best that only Mr. EmBee gets in trouble for using it.

RE: Government’s Response to Mr. Arvay and his team

Aren’t “crippling tax and commercial consequences” five weasel words which simply mean “economic sanctions”? Ron Paul once stated that economic sanctions are an act of war.

http://rt.com/shows/sophieco/sanctions-war-ron-paul-769/

Stephen. You say above that “The Arvay team has ten days to file a reply — IF they consider that any reply is necessary.” What is the procedure if they do NOT consider a reply necessary:

1.Proceed to argue the matter orally in front of a judge or a panel of judges (surely not a jury) (if they consider the Government case so weak or see other strategic purpose)?

or

2.Abandon the case due to the “strength” (if so b the case – I cannot tell as I am not a lawyer) of the Government’s case?

If they do not respond then how do their rebuttals and argument as to superiority of their case appear in the record for the Supreme Court … as transcripts of the oral argument? Presumably there is no further opportunity to introduce additional facts or positions after the court of first instance?

I noticed this in a quick skim of the government’s response:

“…22. The Agreement sets out a commitment between Canada and the United States to

work with partner jurisdictions and the OECD on adapting the terms of the

Agreement and other agreements between the United States and partner

jurisdictions to a common model for automatic exchange of information,

including the development of reporting and due diligence standards for financial

institutions. Canada and the United States, as members of the G20, have endorsed

and committed to implement the OECD’s Common Reporting Standard for

automatic exchange of information, which includes provisions that would result in

a common reporting and due diligence standard…”

As far as I know, The US declined to join that OECD standard, just in the past week or so. I am sure Professor Christians or Professor Cockfield will pick up on that in more detail.

“How could one pass on citizenship, having left the US as a 3-year-old, and started having children 24 years later?”

I think it is pretty clear in your situation that your kids are NOT US citizens.

@Embee – You and I are on the same page there with the “weasel words” and the clear terror evident in the minds of the Government. Brutal Economic Sanctions used as a bludgeon to impose terror in otherwise free people. These may well be viewed as a form of modern warfare. I wonder how the Media will play this? Honestly or as a rah rah section for the Banks?

@Only a Canadian – you are correct …. the news reports were that the US declined to participate in GATCA. Now there is another can of worms.

Similar to the Government of Canada statement in Finance Committee / Parliamentary meetings regarding the U.S. “PROMISE” of reciprocity. Bull — it should have been absolutely dead in the water until the U.S. legislated that — no wishy-washy USA “promise”. How stupid was our Canadian government??

http://www.bdo.lu/uploads/files/BDO%20Luxembourg%20Tax%20Alert%20-%20October%202014%20-%20Tax%20transparency.pdf

@ Dash 1729 re passing on citizenship to children. You are right in most cases and there have been discussions in other threads on this subject. The rules are different for an unmarried woman passing on her US citizenship to her children. I am not sure what the circumstances are for this particular woman. Someone from Quebec mentioned that it was common there for couples not to marry. There are many that disagree with the US defining its citizenship outside its borders. The children still have a non-US birthplace and have more ability to remain hidden. The difficulty for any of us with children is that the financial institutions are not familiar with the US citizenship laws and just because you have a parent with US citizenship does not necessarily mean the child is afflicted with it.

@Dash1729 (and Heartsick, you are right)

(I actually posted a reply earlier but it didn’t appear.)

I will spare everyone the details of my personal life, but where I live, people don’t necessarily marry to have children. So, yes, they may very well be US citizens – in the eyes of the US government only. And how many others accross Europe and Canada (especially Quebec) are wondering the same thing about their children?

Just another good reason to support the lawsuit. You never know when the US will come looking for more…

Here’s a thought … if anyone has an interesting angle re: the lawsuit and the response why not take a minute to repost it at http://adcsovereignty.wordpress.com/2014/11/10/the-government-of-canadas-statement-of-defence-to-adcss-statement-of-claim/ where John can find it without scrambling through our ramblings here? I only had a tiny one but I stuck it in there anyway. Truthfully I have a better chance of eventually sussing out kijiji than I do any legal document. But we have Brockers who are really very capable of doing this and I’d like to make sure John reads your thoughts. Not to say, don’t post and discuss here, of course, but do realize things get buried pretty quickly here.

@heartsick @LivingToRenounce

I didn’t know about the possibly different rules if the child is born out of wedlock–so thanks for clarifying.

However there is an additional point that I think needs to be made if you are (as I think you are) referring to 8 U.S. Code § 1409(c):

http://www.law.cornell.edu/uscode/text/8/1409

I note that this section refers only to US nationality, NOT US citizenship. US nationality and US citizenship are NOT the same thing. Since that section makes no mention of US citizenship I still say you can safely say that your kids are NOT US citizens. In practice US nationals and US citizens are not the same thing, and one difference is that US nationals don’t need to file US taxes.

Of course it is true that the US gov’t can change their rules at any time, and the Canadian financial institutions don’t know all these nuances, so the best thing remains to support the lawsuit.

The Canadian Gov’ts response to this is the same tosh we’ve been hearing all along.

– We have to do FATCA to save the banks from the 30%

– We have to do this because of the OECD obligations

– Oh nobody is being discriminated against all people in Canada are subjected in the same manner

Paragraph 39 about neither US citizen or Canadian citizen is treated differently is just legalese.

For me the same two acid tests apply:

In the back office of the bank or CRA is ‘data discrimination’ taking place?

Unless the Government can stand up and say ALL Canadian citizen’s banking data is sent to the IRS – it’s discrimination pure and simple.

Don,

And, if not the same for ALL Canadians, then it is all ‘weasel words’ as Em states.