As most of us will recall from our school days, an iceberg is a deeply deceptive thing since 90% of its mass lies hidden beneath the waves. Like an iceberg, the full reality of FATCA remains largely hidden from view, even now, a mere 20 days before its implementation.

As most of us will recall from our school days, an iceberg is a deeply deceptive thing since 90% of its mass lies hidden beneath the waves. Like an iceberg, the full reality of FATCA remains largely hidden from view, even now, a mere 20 days before its implementation.

Much attention has been paid to FATCA’s most visible aspects – the growing numbers of both signed and “in substance” agreements – as well as the more than 77,000 FFIs which have entered the Portal of Mordor and received their shiny new IRS deputy badges. As Robert Stack, deputy assistant treasury secretary for international tax affairs crowed, “The strong international support for FATCA is clear, and this success will help us in our goal of stopping tax evasion and narrowing the tax gap.”

But appearances are indeed deceiving with FATCA, and the imminent danger lies not so much with what is already seen, but that which remains to be seen, still lurking in the shadows beneath the surface.

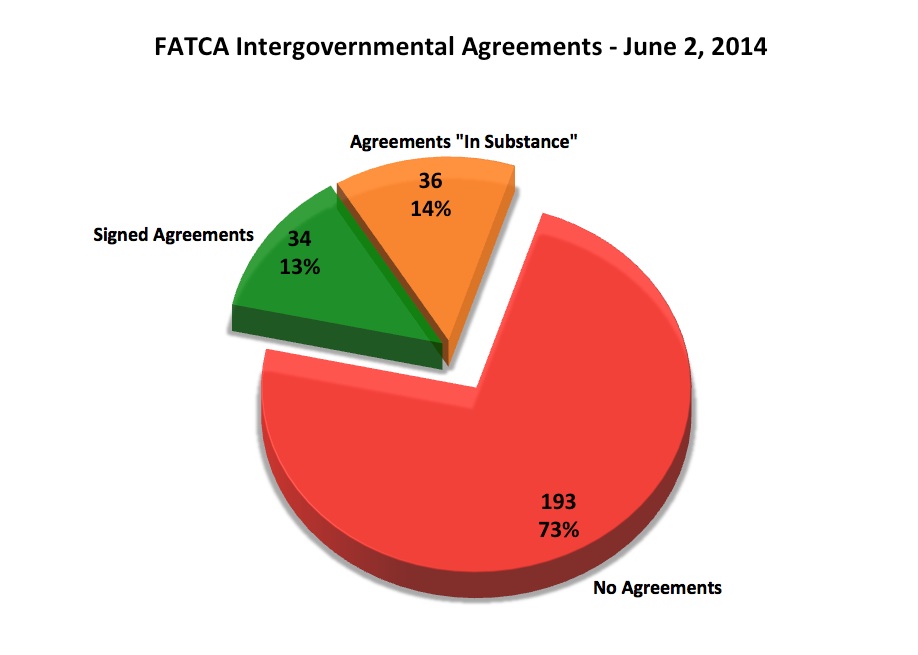

The IRS itself recently realized that progress was going painfully slowly on officially signing-up the 263 tax jurisdictions which it recognizes (196 Independent States in the World and 67 Dependencies and Areas of Special Sovereignty) to its list of IGAs. It therefore decided to lump together all the full-terms (signed agreements) with the preemies (“in substance” agreements) to suddenly come up with a combined list of 70 more-or-less IGAs. Well, here’s what that actually looks like:

Conversely, here is the current list of jurisdictions which have no FATCA agreement of any kind (with some notable entries highlighted in bold):

Afghanistan

Akrotiri

Albania

Algeria

Andorra

Angola

Anguilla

Antarctica

Antigua and Barbuda

Argentina

Aruba

Ashmore and Cartier Islands

Bahrain

Baker Island

Bangladesh

Belarus

Belize

Benin

Bhutan

Bolivia

Bosnia and Herzegovina

Botswana

Bouvet Island

British Indian Ocean Territory

Brunei

Burkina Faso

Burma

Burundi

Cabo Verde

Cambodia

Cameroon

Central African Republic

Chad

China

Christmas Island

Clipperton Island

Cocos (Keeling) Islands

Comoros

Congo (Brazzaville)

Congo (Kinshasa)

Cook Islands

Coral Sea Islands

Côte d’Ivoire

Cuba

Dhekelia

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Ethiopia

Falkland Islands (Islas Malvinas)

Faroe Islands

Fiji

French Guiana

French Polynesia

French Southern and Antarctic Lands

Gabon

Gambia, The

Georgia

Ghana

Greece

Greenland

Grenada

Guadeloupe

Guatemala

Guinea

Guinea-Bissau

Guyana

Haiti

Heard Island and McDonald Islands

Holy See

Howland Island

Iceland

Iran

Iraq

Jan Mayen

Jarvis Island

Johnston Atoll

Jordan

Kazakhstan

Kenya

Kingman Reef

Kiribati

Korea, North

Kyrgyzstan

Laos

Lebanon

Lesotho

Liberia

Libya

Macau

Macedonia

Madagascar

Malawi

Malaysia

Maldives

Mali

Marshall Islands

Martinique

Mauritania

Mayotte

Micronesia, Federated States of

Midway Islands

Moldova

Monaco

Mongolia

Montenegro

Montserrat

Morocco

Mozambique

Namibia

Nauru

Navassa Island

Nepal

New Caledonia

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Oman

Pakistan

Palau

Palmyra Atoll

Papua New Guinea

Paracel Islands

Paraguay

Philippines

Pitcairn Islands

Reunion

Russia

Rwanda

Saint Barthelemy

Saint Helena

Saint Kitts and Nevis

Saint Lucia

Saint Martin

Saint Pierre and Miquelon

Saint Vincent and the Grenadines

Samoa

San Marino

Sao Tome and Principe

Saudi Arabia

Senegal

Serbia

Sierra Leone

Sint Maarten

Solomon Islands

Somalia

South Georgia and the South Sandwich Islands

South Sudan

Spratly Islands

Sri Lanka

Sudan

Suriname

Svalbard

Swaziland

Syria

Tajikistan

Tanzania

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad and Tobago

Tunisia

Tuvalu

Uganda

Ukraine

Uruguay

Uzbekistan

Vanuatu

Venezuela

Vietnam

Wake Island

Wallis and Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

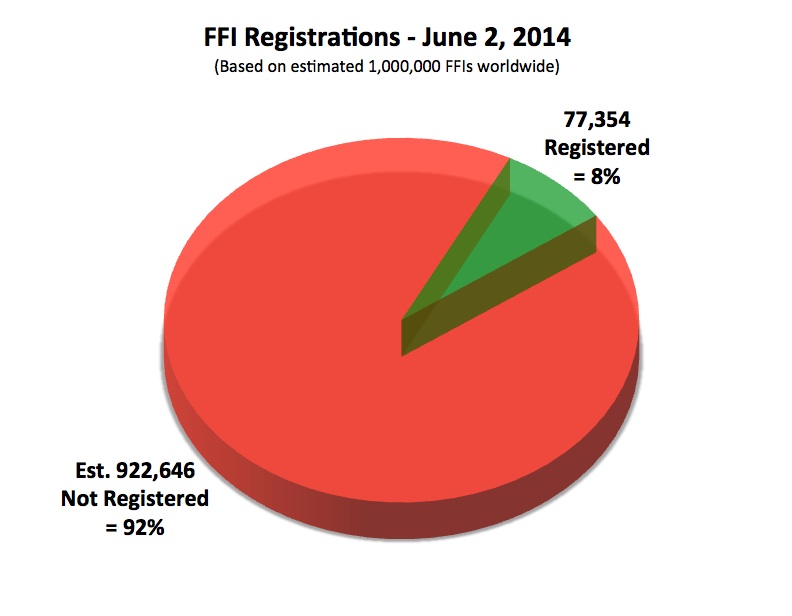

Meanwhile, the number of FFIs which have registered with the IRS currently stands at 77,354. The total number of FFIs worldwide (all financial institutions outside of the U.S.) is unknown, but estimates have ranged from several hundred thousand to the low millions. A common estimate has been one-million, which looks like this:

As you can see from both charts, the red areas represent large zones of uncertainty and danger in the imminent rollout of FATCA. The language is quite clear in the IRS documentation: 30% withholding will begin on July 1st for FFIs which are not deemed to be FATCA compliant. Because of pass-through payments and the desire to avoid all possible risks associated with FATCA regulations, there is every reason to believe that FATCA-compliant financial institutions will immediately begin large-scale withholding on transactions with thousands of non-compliant FFIs from hundreds of jurisdictions with no IGAs in place.

It is also becoming clear that the nations and territories which will bear the full brunt of FATCA withholding are amongst the poorest and least-prepared in the entire world, especially Africa. FATCA will crack open both historic and brand-new fault lines between rich and poor nations everywhere. Read the list again, and extrapolate our very near future.

Like an iceberg, FATCA’s greatest danger lies well beneath the surface; unseen, and patiently awaiting its moment of destiny. July 1st will most surely go down in the history books as a day of tragic infamy and the beginning of a calamity whose outlines we have only begun to discern through dark and troubled waters.

Additional references:

The FATCA GIIN list analyzed by IGA and by countries

There is no “international support”. What there is is coercion by the US in the form of threats to apply withholding tax. If nations didn’t use the dollar as a base the whole thing would have fallen flat on its FATCA face.

Some interesting stats here and a email address to get some more:

https://finance.yahoo.com/news/3-things-americans-living-abroad-163226499.html

Thank Greenback Expat Services but 70% of Americans abroad really don’t need your services because they feel the IRS should disappear from their lives. They only want to be accountable to the tax authority in their country of residences.

Renunciations will skyrocket beyond current levels if the IRS starts hassling ex-pats with letters, fines, or criminal proceedings. People will vote with their feet.

Every single American should get a second passport because the USG is turning the US into a police state.

@LM Christian Aid UK has noticed the bias against poor countries with the OECD’s more multilateral automatic exchange of information, so they would be interested in FATCA.

@Don Greenback actually circulated information on the anti-FATCA petition in one of their newsletters earlier in the year and they are clearly trying to put us in a more sympathetic light. I am a lot more upset by a certain lawyer who puts out lots of press releases making it seem like the OVDP is the only option.

I see this whole business as similar to hearing a severe storm warning or tornado watch on the radio. You know some areas are going to be devastated and you just hope it doesn’t wind up being your own neighborhood. Time to batten down the hatches.

Congress doesn’t have the foggiest idea what they have unleashed upon the world. If they don’t even care about US expats, then they sure as hell don’t care about small third world countries.

I hope the USA does not apply the sanction to these countries. When we win our supreme court case, I do not want the government of the day apply the non withstanding clause. I also wish the Supreme Court rule that USA CBT is unconstitutional and all tax treaty and extradition treaty involving them are null and void,

I think this will speedily raise “awareness” among non-Americans who invest in the US about the deadly effects of the monstrosity that the Congress passed in a moment of sheer unconsciousness. This will be a true wake-up call and will have those who prefer to invest in US banks doing a double take and heading for the door lest their most personal info be shipped to the collections agency of their non-choice. This too is when the FFIs who’ve signed up to this idiotic enterprise will prick up their ears bc they will be hit in the pocketbook. Watch the backlash mount and cascade, guys and gals:

“Fatca Is Not Just a Worry for American Investors” (June 8, 2014)

http://www.iexpats.com/fatca-just-worry-american-investors/

The Economist article is interesting since it highlights the continuing trend within the Justice Department. They want the financial sector to assume legal liability for the actions (or inaction) of their customers. We saw this in Switzerland where Swiss banks were told that if they had one US citizen customer who was not fully compliant with tax reporting and FBARs then the bank had to declare itself as aiding and abetting tax evasion. It’s the functional equivalent of holding GM responsible for a crash caused by someone driving a GM vehicle.

Of course, the US is pursuing a gargantuan fine against BNP at the moment. There were a couple interesting articles related to the topic recently.

– http://www.bloomberg.com/news/2014-06-11/ecb-s-noyer-says-bnp-may-prompt-shift-away-from-dollar.html?cmpid=yhoo

– http://www.bloomberg.com/news/2014-06-12/europe-bankers-cringe-at-rising-u-s-fines-amid-bnp-probe.html

The first article suggests that the Governor of the Bank of France and ECB member, Christian Noyer, is advising European companies to shift away from US Dollars for settlement. ““We could say that companies would have maximum interest to do the most possible transactions in other currencies,” Noyer, who is also a member of the European Central Bank’s Governing Council, said yesterday on BFM television. “Trade between China and Europe — do it in euros, do it in renminbi, stop doing it in dollars. This is an affair that will leave marks.”” Given the level of outrage over the US’ proposed $10 billion fine, this may be posturing but it’s a pretty damaging statement nonetheless.

The second article talks, amongst other things, about a book recommendation made by Douglas Flint, the Chairman at HSBC at a recent international industry event. “At a June 4 meeting of the Institute of International Finance’s board, Flint, 58, advised participants including Barclays Plc Chief Executive Officer Antony Jenkins to read former U.S. deputy national security adviser Juan Zarate’s “Treasury’s War: The Unleashing of a New Era of Financial Warfare,” according to two people who were present.

In his book, Zarate recounts how U.S. foreign policy is increasingly targeting financial activity by criminals, enemy states and individuals in sanctioned regimes. Caught in the middle are international lenders, whose desire to avoid business and reputational risk assures their cooperation.”

Douglas Flint is clearly an intelligent person. I hope others will make the connection and also come to see FATCA is being fully intertwined with this.

@Sally – The Americans only understand one language – when it hits them in the pocket. To scale FATCA back the world needs to get Wall Street squealing about FATCA and how it’s become Washington’s new sales prevention law.

A trader in New York notices some deal is now being done in RMB or Euros that’ll be the start of the end for FATCA.

Once they see their commissions drying up, Washington will act.

At the end of the day, why does the world need to use USDs attached with a 30% sanction risk? Would the risk be any worse in RMB or Euros?

The USGs only hope is the other main currencies in the world will sign up to FATCA madness. However it’s in China’s best interest to play lip service to FATCA and build up the RMB to takeover from the USD.

China and Russia have already signed an oil and gas agreement which will be conducted in other than US dollars. Either Rubles or Yuan backed by gold.

That and FATCA should be two nails in the coffin of the US dollar.

It is not to be taken lightly. What that means for the Canadian dollar one can only speculate. And the speculation does not bode well.

What Canada and Canadian banks ought to be doing is hiking up their skirts, skeedaddaling across the border, drawing up the bridge and arming the Keep to the teeth. It is said that several if not all of the major Canadian banks are exposed to derivatives to the tune of millions of dollars from their US branches. They ought to close that off and get home before the other shoe drops. Even then, the CDN dollar is going to take a huge hit if the US dollar is brought down.

I see no sign the CDN government has even an inkling they need to protect the country from the coming currency crisis. Any more than they have an inkling about protecting their own citizens.

A interesting development to note…

Changes in the IGA… see what has been deleted unilaterally…

Does this mean the US has decided it doesn’t want to participate in #OECD’s #GATCA after all. It is #FATCA or nothing http://bit.ly/1n8BmHb

Humm..

@Justme

That is not how I read it. I read it as saying that the U.S. will notify countries if the most favored nation status changes (this badly-name principle means that everyone gets the same deal). This could be actually be good for poorer countries, since they don’t have the resources to monitor such changes themselves. Unfortunately, neither do they necessarily have the resources to scour the land for U.S. persons. While there are some notable tax havens on this list (Monaco and Belize), there are lots of poorer countries that would never be terribly attractive to U.S. persons or their cash. I can really see this as becoming about the multilateral GATCA v. the essentially unilateral FATCA since the standards aren’t the same.

@Deckard1138

Well, if the Holy See were affected, this might be a good thing, since if the Pope said that U.S. policies were biased and hurting poor countries and needed to be replaced with something fairer, people would listen. And it would clearly demonstrate that this is not just a fatcat problem, since people don’t become priests or nuns to get wealthy and this pope has been hard on the church’s fatcats. He is also very interested in social justice and he is from Argentina, which has problems with the one-sidedness of FATCA. In the U.S., the Catholic church has more members even than the senior citizens’ lobby. Certainly points up the absurdity of FATCA.

@JustMe:

Yes, it looks like the US has unilaterally decided not to try to cooperate with other countries’ efforts to develop a common reporting standard after all.

This is basically a big “F You” to all the countries that signed IGAs in good faith.

Just now I was thinking about all the turmoil in Iraq at the moment and how the US has to decide was to do about the situation as Mosul, Iraq’s second city has fallen to the Islamists.

This situation is a perfect example about the security of data the banks are collecting (Iraq has signed an IGA) and it’s now possible for the terrorists to walk straight into an Iraqi bank, put a gun to the bank manager’s head and demand the ready made list of ‘US persons’ living in Iraq courtesy of FATCA, President Obama, Senators Levin and Schumer.

This is a start example why ready made lists of US persons can be held by banks or other FFIs.

The terrorists have the names and addresses of local ‘US persons,’ rounds them up and executes them. Job done from their point of view.

Further to my last point about Iraq, here is the text on Data Safeguarding from the IRS website.

Data Safeguarding

When the United States signs a reciprocal Model 1 Inter-Governmental Agreement (IGA) with a partner jurisdiction, each jurisdiction receives account information from its financial institutions with respect to partner’s residents and transmits the information to the partner jurisdiction.

Data Safeguarding is an essential element of the technical platform for the reciprocal automatic exchange of information. Before the reciprocal exchange of information can begin, both jurisdictions must be satisfied that the information received will be kept confidential and that the partner jurisdiction’s laws and practices safeguard against the unauthorized disclosure of the information.

The IRS has developed an International Data Safeguards & Infrastructure Workbook (“Workbook”) for FATCA implementation.

The Workbook has been developed for the reciprocal evaluation of FATCA Partner Data Safeguards and Infrastructure. Article 3(8) of the Model 1A (reciprocal) IGA contemplates that the jurisdictions will exchange information once they are satisfied that the other jurisdiction has in place (i) appropriate safeguards to ensure that the information received remains confidential and is used solely for tax purposes; and (ii) the infrastructure for an effective exchange relationship (including established processes for ensuring timely, accurate, and confidential information exchanges; effective and reliable communications; and demonstrated capabilities to promptly resolve questions and concerns about exchanges or requests for exchanges).

In developing the Workbook, the IRS relied on internal guidance, ISO 27000 standards, and the “Keeping It Safe” Guide prepared by the OECD and endorsed by the Global Forum on Transparency and Exchange of Information for Tax Purposes.

How can any of this rubbish above safeguard against anyone putting an AK47 to my head and threaten pull the trigger if I don’t give them a list of local ‘US persons’ that some sloppy bank clerk left on a spreadsheet sitting on his hard drive at the branch or if it’s the bank’s headquarters the entire list?

@Just Me, re;

“….. Does this mean the US has decided it doesn’t want to participate in #OECD’s #GATCA after all. It is #FATCA or nothing http://bit.ly/1n8BmHb ….”

And the Harper Conservative government will end up with egg on its face, because they have specifically collaborated with and disseminated the US fiction that signing the FATCA IGA is some desirable necessary precursor to the OECD Common reporting. We already knew that the OECD specifically stated clearly that their efforts would be based on residency and NOT citizenship. We already knew that the US would not provide the same ‘reciprocal’ reporting that it is demanding of the rest of the world (politically and economically undesirable) and could not provide it (IGAs and any even faux ‘reciprocity’ was not authorized by Congress and unlikely to be). So, the Harper government is left exposed naked to the wind as the US makes it clearer that it has no intention to be bound by the terms that it demands of the rest of the world, and that it will do whatever it sees fit – despite anything it pretends to the contrary. It’s going to take quite the efforts for Canada to continue to pretend while the US makes it ever more obvious that it will search for revenue for the US Treasury while shielding US interests and data.

Good point about Iraq and Data security @Don, or any other country where being a US citizen or USP is precarious already, and will become even more so.

I’d like to hear what Professor Christians says about these changes to the IGA agreements!

Allison is already on Twitter

Allison is already on Twitter with it

Just to clarify – – does this mean that as of July 1, 2014 if one vacations in Aruba or Bhuttan or Cuba or Saint Lucia or Greece (or any of the other 97 countries listed that haven’t signed on to FATCA), and you spend money there using your VISA or MC or even Cdn$ travel checks, that these hotels or B&Bs or craft shops or restaurants will only get 70% of what you thought you’d spent there – – and the US banks will pull off a 30% confiscation?

THIS IS HUGE INFORMATION!!!!!

Do you think the Travel Industry telling it’s clients????? Do you think they have even clued into this?????

What about international aid organizations the next time there is a tsunami or major earthquake – – will every donation be diminished? Will bananas and coffee and chocolate and Macedonian Christmas crafts and flights on Icelandic Air into Europe all start costing 30% more? The whole world is going to reel and tilt!

@ Mark Twain

Yes, I know, I alerted her to the deletion 🙂

Poison bait and switch tactic.

@LM

No. Witholding refers to US source income, not foreign funds that happen to pass through a US bank.

See Questiojn 17 in http://www.deloitte.com/assets/dcom-unitedstates/local%20assets/documents/tax/us_tax_fatca_faqs_061711.pdf

17. What types of payments are subject to FATCA?

FATCA provisions apply to “withholdable” payments. “Withholdable payments” are defined as:

· Any payment of interest (including any portfolio interest and original issue discount), dividends, rents, royalties, salaries, wages, annuities, licensing fees and other FDAP income, gains, and profits, if such payment is from sources ithin the United States.

· Any gross proceeds from the sale or disposition of U.S. property of a type that can produce interest or dividends

· Interest paid by foreign branches of U.S. banks

Income effectively connected with a United States business is generally exempt from withholding under FATCA.

Certain “passthru” payments will also be subject to FATCA – a passthru payment generally includes any portion of a payment that is not a withholdable payment multiplied by the entity’s so called “passthru payment percentage”. Notice 2011-34 introduces the concept of the passthru payment percentage and provides details and examples of its calculation and application within the FATCA framework.

@Just Me

Another great example of the self-delusion of IGA signatories:

http://www.international-adviser.com/news/tax-regulation/new-zealand-wangles-sharing-exemptions-in

I don’t know how many countries now, including Canada, have convinced themselves that they were somehow treated as “special” and granted some kind of carve-out that no one else got. There is nothing in the NZ IGA that is any different from what Canada “negotiated”. For instance, New Zealand’s Superannuation and KiwiSaver schemes are essentially the same thing as our RRSP’s and TFSA’s, which are standard boilerplate exceptions in the Model agreements. Besides, any fundamental change more favorable to one IGA would have to be retroactively granted to all others under the terms of FATCA.

And then there’s that ridiculous siren call of “reciprocity” once again. It would be hilarious if it wasn’t instead so embarrassingly naïve. I wish I knew who these articles are aimed at and just who they think they’re fooling.

@Just a Canadian –

Thanks for this clarifying information!!!!! I feel (somewhat) relieved.