As most of us will recall from our school days, an iceberg is a deeply deceptive thing since 90% of its mass lies hidden beneath the waves. Like an iceberg, the full reality of FATCA remains largely hidden from view, even now, a mere 20 days before its implementation.

As most of us will recall from our school days, an iceberg is a deeply deceptive thing since 90% of its mass lies hidden beneath the waves. Like an iceberg, the full reality of FATCA remains largely hidden from view, even now, a mere 20 days before its implementation.

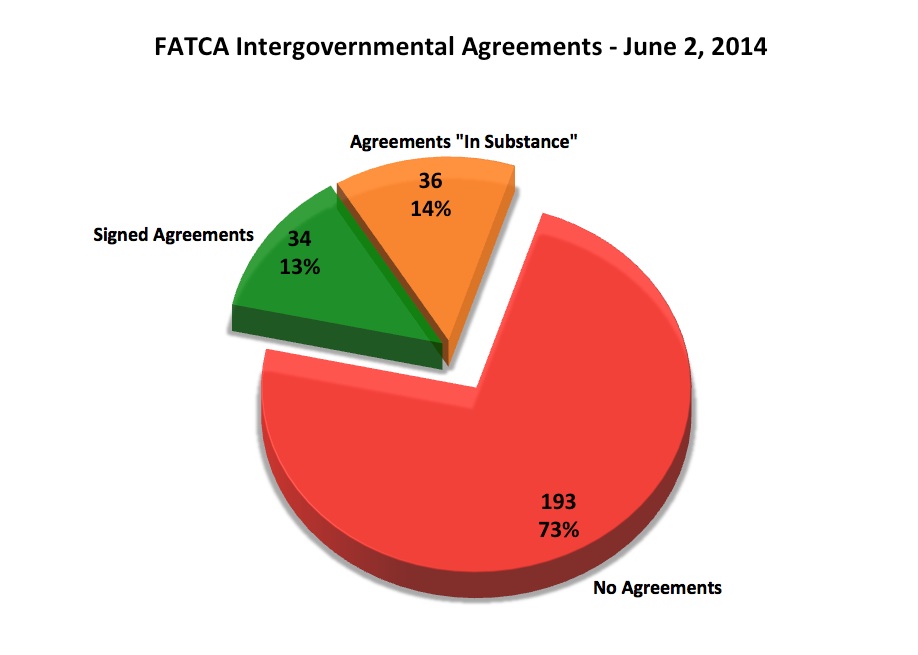

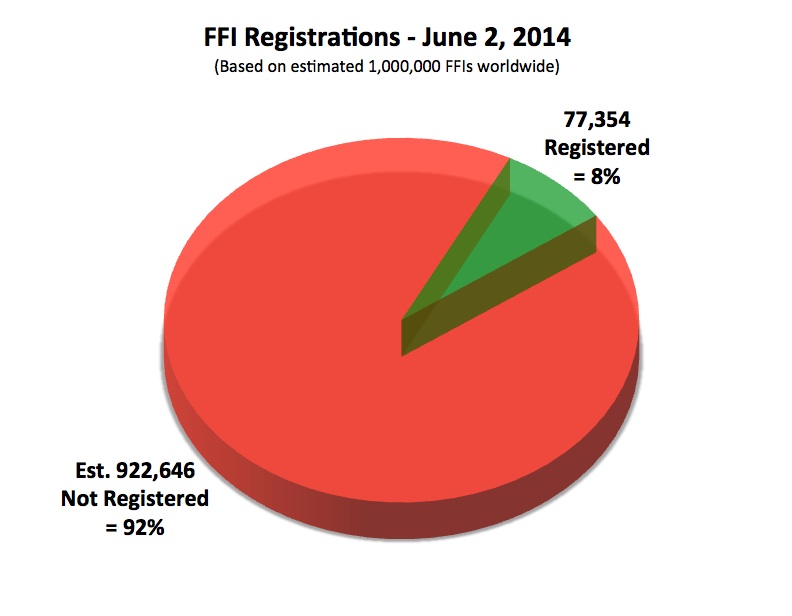

Much attention has been paid to FATCA’s most visible aspects – the growing numbers of both signed and “in substance” agreements – as well as the more than 77,000 FFIs which have entered the Portal of Mordor and received their shiny new IRS deputy badges. As Robert Stack, deputy assistant treasury secretary for international tax affairs crowed, “The strong international support for FATCA is clear, and this success will help us in our goal of stopping tax evasion and narrowing the tax gap.”

But appearances are indeed deceiving with FATCA, and the imminent danger lies not so much with what is already seen, but that which remains to be seen, still lurking in the shadows beneath the surface.

The IRS itself recently realized that progress was going painfully slowly on officially signing-up the 263 tax jurisdictions which it recognizes (196 Independent States in the World and 67 Dependencies and Areas of Special Sovereignty) to its list of IGAs. It therefore decided to lump together all the full-terms (signed agreements) with the preemies (“in substance” agreements) to suddenly come up with a combined list of 70 more-or-less IGAs. Well, here’s what that actually looks like:

Conversely, here is the current list of jurisdictions which have no FATCA agreement of any kind (with some notable entries highlighted in bold):

Afghanistan

Akrotiri

Albania

Algeria

Andorra

Angola

Anguilla

Antarctica

Antigua and Barbuda

Argentina

Aruba

Ashmore and Cartier Islands

Bahrain

Baker Island

Bangladesh

Belarus

Belize

Benin

Bhutan

Bolivia

Bosnia and Herzegovina

Botswana

Bouvet Island

British Indian Ocean Territory

Brunei

Burkina Faso

Burma

Burundi

Cabo Verde

Cambodia

Cameroon

Central African Republic

Chad

China

Christmas Island

Clipperton Island

Cocos (Keeling) Islands

Comoros

Congo (Brazzaville)

Congo (Kinshasa)

Cook Islands

Coral Sea Islands

Côte d’Ivoire

Cuba

Dhekelia

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Ethiopia

Falkland Islands (Islas Malvinas)

Faroe Islands

Fiji

French Guiana

French Polynesia

French Southern and Antarctic Lands

Gabon

Gambia, The

Georgia

Ghana

Greece

Greenland

Grenada

Guadeloupe

Guatemala

Guinea

Guinea-Bissau

Guyana

Haiti

Heard Island and McDonald Islands

Holy See

Howland Island

Iceland

Iran

Iraq

Jan Mayen

Jarvis Island

Johnston Atoll

Jordan

Kazakhstan

Kenya

Kingman Reef

Kiribati

Korea, North

Kyrgyzstan

Laos

Lebanon

Lesotho

Liberia

Libya

Macau

Macedonia

Madagascar

Malawi

Malaysia

Maldives

Mali

Marshall Islands

Martinique

Mauritania

Mayotte

Micronesia, Federated States of

Midway Islands

Moldova

Monaco

Mongolia

Montenegro

Montserrat

Morocco

Mozambique

Namibia

Nauru

Navassa Island

Nepal

New Caledonia

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Oman

Pakistan

Palau

Palmyra Atoll

Papua New Guinea

Paracel Islands

Paraguay

Philippines

Pitcairn Islands

Reunion

Russia

Rwanda

Saint Barthelemy

Saint Helena

Saint Kitts and Nevis

Saint Lucia

Saint Martin

Saint Pierre and Miquelon

Saint Vincent and the Grenadines

Samoa

San Marino

Sao Tome and Principe

Saudi Arabia

Senegal

Serbia

Sierra Leone

Sint Maarten

Solomon Islands

Somalia

South Georgia and the South Sandwich Islands

South Sudan

Spratly Islands

Sri Lanka

Sudan

Suriname

Svalbard

Swaziland

Syria

Tajikistan

Tanzania

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad and Tobago

Tunisia

Tuvalu

Uganda

Ukraine

Uruguay

Uzbekistan

Vanuatu

Venezuela

Vietnam

Wake Island

Wallis and Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

Meanwhile, the number of FFIs which have registered with the IRS currently stands at 77,354. The total number of FFIs worldwide (all financial institutions outside of the U.S.) is unknown, but estimates have ranged from several hundred thousand to the low millions. A common estimate has been one-million, which looks like this:

As you can see from both charts, the red areas represent large zones of uncertainty and danger in the imminent rollout of FATCA. The language is quite clear in the IRS documentation: 30% withholding will begin on July 1st for FFIs which are not deemed to be FATCA compliant. Because of pass-through payments and the desire to avoid all possible risks associated with FATCA regulations, there is every reason to believe that FATCA-compliant financial institutions will immediately begin large-scale withholding on transactions with thousands of non-compliant FFIs from hundreds of jurisdictions with no IGAs in place.

It is also becoming clear that the nations and territories which will bear the full brunt of FATCA withholding are amongst the poorest and least-prepared in the entire world, especially Africa. FATCA will crack open both historic and brand-new fault lines between rich and poor nations everywhere. Read the list again, and extrapolate our very near future.

Like an iceberg, FATCA’s greatest danger lies well beneath the surface; unseen, and patiently awaiting its moment of destiny. July 1st will most surely go down in the history books as a day of tragic infamy and the beginning of a calamity whose outlines we have only begun to discern through dark and troubled waters.

Additional references:

The FATCA GIIN list analyzed by IGA and by countries

Well…77,000 sounded like a large number until it was laid out baldly in that graph…This certainly shows that the emperor has no clothes!

I think that with the dollar as the number one reserve currency in the world, America would have this kind of power anyway. ( Of course FATCA makes it more applicable.) I`m guessing that the answer to the riddle is for another currency to rival the US dollar. That might be the only thing to put this horror into a more normal perspective. No one country should have absolute power over all the rest.

From what I have seen in what I have been able to read of the FATCA articles, people in the countries that don’t have an agreement in place are really beside themselves at the moment. Some countries are very dependent on remittances from the U.S.: El Salvador and Guatemala get over 10% of GDP in remittances, around 90% from U.S. It seems like a lot of U.S. persons from hotter countries go back in the winter (very common among Filipinos) or to retire. Some of these national economies are so dependent on the dollar that I don’t see how they are going to make it if 30% is taken. Some of them are not really making it now as it is. I am not sure that I have seen any FATCA articles from African countries. At least one country on the list has a fully-privatized pension system that could count as a foreign trust in the absence of an IGA.

Pingback: #FATCA – A US law to keep the poorest nations poor | Citizenship Counselling For U.S. Citizens in Canada and Abroad

While withholding starts July 1, Reporting for 2014 accounts isn’t due until March 31, 2015.

To be fair there does seem to be a continual stream of countries signing IGA’s daily.

Our hope that the US government pushed to hard this time with it’s bullying but if they get enough counties they win. I guess we could quantify that by analyzing the trade deficit with that country. This will tell you the number of US dollars that have to be invested by other nations in treasuries each month.

The question becomes can those dollars get to places that don’t get hit by the 30%. This would include countries that have an IGA and the availability of grandfathered treasuries.

So how many dollars go to counties not signed up vs. those that are? We know China is the big guy for dollars and not signing up.

We might be able to get a sense of what’s going on by looking at the spread between a grandfathered treasury and one that’s not after 1 July.

This is really exciting.

Nothing short of an act of war against the rest of the world.

All they know about tax evasion could be summed up with one statement. There are millions who have taxable incomes and have never filed a tax return. The marxist Income Tax (Marx called for a progressive income Tax in the second chapter of the Communist Manifesto) is the most evadable tax ever devised. It is a tax that the honest people pay and the dishonest evade. The U.S. Tax code is 77,000 pages of gobble degook, cobbled together to garner the maximum campaign contributions for the congressmen and women on the House Ways and Means Committee. None of them understand it and more committee chairmen have gone to jail for criminal conduct than any position in the congress. Those who didn’t go to jail left congress in disgrace just ahead of the Lawmen.

If it were not for campaign contributions we’d have had the FairTax 15 years ago when it was first proposed. I am old and the FairTax may not make it in my lifetime but it will be the one thing that saved the U.S.A. from a Communist dictator’s iron fisted IRS.

I hope this starts “financial world war 3” with the USA. Canada has caved in to terrorists. Yes, the USA ARE TERRORISTS and need to be stopped. Russia can set a precedent here along with China. I never thought the USA would wage war on the world, but it has happened…

@ Deckard1138

This is a compelling analysis! Especially the 2nd pie chart.

Suggest everyone email a link and follow-up suggestion to “The Economist” magazine – this is right up their alley.

http://www.economist.com/

email: letters@economist.com

Or tweet it to the Economist:

https://twitter.com/TheEconomist

The USA is indeed looking (and acting) more and more like a totalitarian state. It’s somehow fitting that the IRS has recently issued its “Bill of Rights” for taxpayers. The worse a rogue nation gets, the more reliant it becomes on propaganda and hollow phrases like that. It wouldn’t suprise me if Obama got re-elected with 99% of the votes. (Please refrain from any silly references to the US constitution which would prevent him from running again, the USA is far beyond giving any weight to that old scrap of paper.)

the distribution of non-IGA nations is much like the old North-South divide of the1960’s and the non-aligned nations of the cold war era. Add China and Russia to form a vast trade area ripe for the creation of a de-dollarized Trade Association which uses the Yuan and Euro for international contracts. Much of Europe and the Mediterranean region could form an another overlapping de-dollarized trade association. Canada should push for the use of other currencies for settling trade accounts in all free trade agreements including TPP and any agreement covering the Americas. The US claims all trade in dollars passes through the port of New York and subject to US regulation. The US accounts for only 20% of international trade, there is no rational reason that 80% of world trade to be subject to US law.

I’ve been working on this post for a number of days now and just saw Allison Christians’ excellent pictorial article, “The World According to FATCA, In 3 Maps”. I’ve provided links to it in the additional references section of this post. Seems we’ve been working in parallel to visualize the same data set and we both came to similar conclusions – that FATCA will disproportionately affect the world’s poorest nations.

Robert Stack is nuts. Strong international support? The USG puts a 30% sanction tax to everyone’s head threatening to pull the trigger and 77,000 FFIs caved in before 1 July 2014 and he calls that ‘strong internaitonal support?’ It’s more like blackmail in my book.

BTW – regarding The Economist and their observations:

take a look at http://econ.st/1iqzeaV

Deckard: I agree with Wondering. Your charts expose chilling evidence of what the USA is actually up to and they should be published in the Economist and every other reputable financial publication. The millions of words which have been expended on this subject have not succeeded in stopping the FATCA juggernaut. Perhaps it’s time to start throwing pie (charts) in their faces!

Don: You’ve hit the nail on the head. That’s exactly what FATCA is … blackmail!

Thanks for this telling analysis, Deckard!

i wonder if there’s any way to play the market volatility that FATCA will generate in the 73% of jurisdictions that the US Treasury will rape come July 1.

@groucho

Lol! You bet if there is, the Americans are in on it! A lot of moving parts here though.

I believe the USG will play it this way. They’ll say FATCA is now implemented, but delay the 30% sanction tax to avoid upsetting the 73% of jurisdictions that have not signed up to FATCA.

Does the IRS even have the infrastructure in place to handle all these banks filing returns to get their money back? I doubt it. I think it’s going to be a case of the USG saying we really really really really it this time!

Like it was said in an earlier post, the best way to get rid of a bad law is to enforce it. If they start taking the 30% it’s going to cause a lot of resentment and hatred towards the USG and accelerate the process of bumping off the USD as sole reserve currency.

One only has to look at how the USG has treated Canada, the $10B fine fiasco with France, and now the USG is going to start confiscating FFI’s money? This is how the USG treats their friends?

Goodbye New York and hello more friendly financial centres in the world not using USDs. Hey even Expedia is going to start accepting BitCoin. How about trading stocks in BitCoin?

The following paragraphs are extracted from a marketing email by a Deloitte Tax Consultant (as might be expected, Deloitte is selling attendance at a webinar where a panel will discuss these issues):

_____________________________________

Beginning July 1, 2014, U.S. taxpayers that make payments to foreign persons are required to analyze and report information regarding payments both to foreign financial institutions and non-financial foreign entities (NFFEs) under the Foreign Account Tax Compliance Act (FATCA), which was adopted as part of the HIRE Act of 2010. To date, the impact of these rules on foreign financial institutions has been widely discussed, but the rule’s broad impact on NFFEs has received less attention.

The FATCA provisions—Chapter 4 of the Code (§§ 1471 et. seq.)—may require 30% withholding on “withholdable payments” to foreign entities that have not provided an appropriate withholding certificate (such as Form W-8 or W-9) or other acceptable documentation. Withholdable payments include payments of U.S. source FDAP income (basically, all gross income other than income from the sale of goods), and in 2017, gross proceeds from the sale or disposition of assets that produce or can produce U.S. source interest or dividend income. However, there are broad carveouts that apply to many payments made by NFFEs, including interest and OID on short-term obligations and payments for the following: the use of property, office and equipment leases, services (including wages and other forms of employee compensation), software licenses, freight, transportation, and interest on outstanding accounts payable arising from the acquisition of goods and services.

The withholding tax may apply whether the foreign entity receives the payments as beneficial owner or as agent for a client and whether the beneficial owner is a U.S. or foreign person. The withholding tax applies to many items not otherwise subject to FDAP withholding (e.g., portfolio interest and capital gains of foreign investors) and cannot be reduced or eliminated by treaty.

___________________________________________________

Please note the final sentence regarding Treaty effect … or lack of effect …

i just send a link to Patrick Cain of Global, who published a story in April (using several of us Brockers as examples), on How to Get Rid of your US Citizenship. He likes charts and maps!

On this page, please fix the link to the 3 maps. I have been able to see them by clicking “are amongst the poorest and least-prepared in the entire world” in the text but not by clicking “The World According to FATCA, In 3 Maps” at the bottom of the article.

This is REALLY important information for us all to communicate to anyone, especially news (TV, NPR, magazines) and other organizations (such as world health/education charities/aid programs, religious organizations, churches/synagogues/mosques, etc ) who are +++ concerned about the needs of impoverished nations – – they probably have NO IDEA this bomb is about to drop and are about to have an OMG moment (or, more likely, 257 moments).

Anyone interested/willing to join me a coordinated emailing of this article + a FATCA Fact-sheet to such groups (in Canada? In Europe? In Australia/NewZealand? Elsewhere?) additionally providing links to IBS and ADCS-ADSC?

I’ll start with Rabbis across Canada., mentioning also that they should let their US-connected congregants/friends know about this government-approved move to legally-established 2nd class citizenship in Canada (with special “rights” of invasion of private financial and personal data to be forwarded to the Orwelian-invader-country for further scrutiny and possible further search/seizure/punishment…….).

Fixed the link. Thanks for catching that, LM — this is a terrific post, really great idea to distribute it widely.