As most of us will recall from our school days, an iceberg is a deeply deceptive thing since 90% of its mass lies hidden beneath the waves. Like an iceberg, the full reality of FATCA remains largely hidden from view, even now, a mere 20 days before its implementation.

As most of us will recall from our school days, an iceberg is a deeply deceptive thing since 90% of its mass lies hidden beneath the waves. Like an iceberg, the full reality of FATCA remains largely hidden from view, even now, a mere 20 days before its implementation.

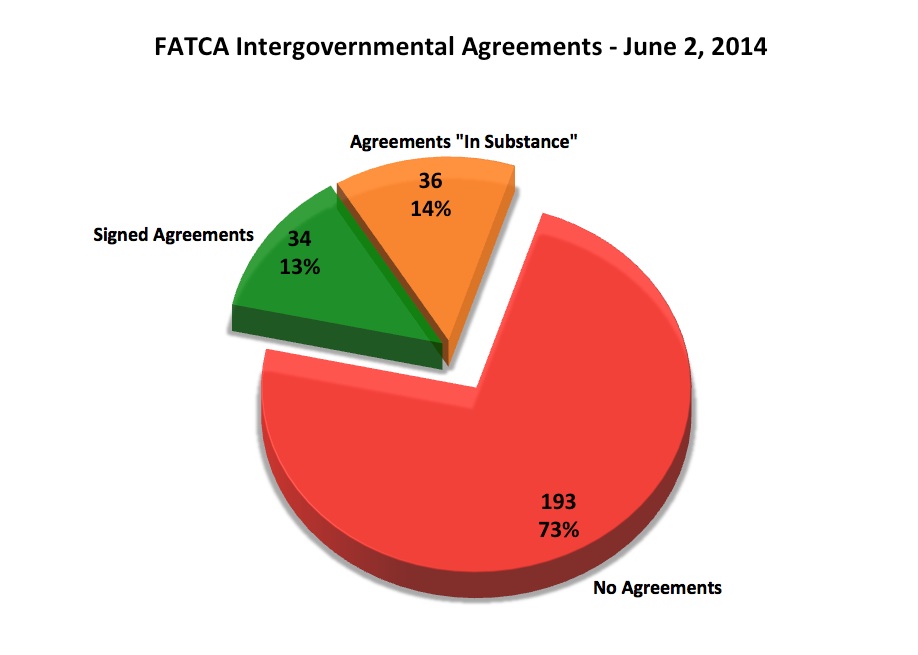

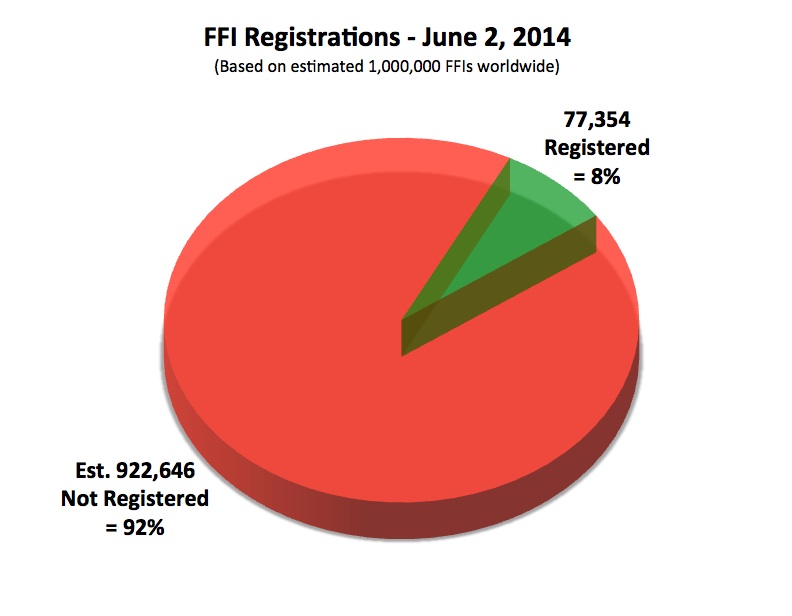

Much attention has been paid to FATCA’s most visible aspects – the growing numbers of both signed and “in substance” agreements – as well as the more than 77,000 FFIs which have entered the Portal of Mordor and received their shiny new IRS deputy badges. As Robert Stack, deputy assistant treasury secretary for international tax affairs crowed, “The strong international support for FATCA is clear, and this success will help us in our goal of stopping tax evasion and narrowing the tax gap.”

But appearances are indeed deceiving with FATCA, and the imminent danger lies not so much with what is already seen, but that which remains to be seen, still lurking in the shadows beneath the surface.

The IRS itself recently realized that progress was going painfully slowly on officially signing-up the 263 tax jurisdictions which it recognizes (196 Independent States in the World and 67 Dependencies and Areas of Special Sovereignty) to its list of IGAs. It therefore decided to lump together all the full-terms (signed agreements) with the preemies (“in substance” agreements) to suddenly come up with a combined list of 70 more-or-less IGAs. Well, here’s what that actually looks like:

Conversely, here is the current list of jurisdictions which have no FATCA agreement of any kind (with some notable entries highlighted in bold):

Afghanistan

Akrotiri

Albania

Algeria

Andorra

Angola

Anguilla

Antarctica

Antigua and Barbuda

Argentina

Aruba

Ashmore and Cartier Islands

Bahrain

Baker Island

Bangladesh

Belarus

Belize

Benin

Bhutan

Bolivia

Bosnia and Herzegovina

Botswana

Bouvet Island

British Indian Ocean Territory

Brunei

Burkina Faso

Burma

Burundi

Cabo Verde

Cambodia

Cameroon

Central African Republic

Chad

China

Christmas Island

Clipperton Island

Cocos (Keeling) Islands

Comoros

Congo (Brazzaville)

Congo (Kinshasa)

Cook Islands

Coral Sea Islands

Côte d’Ivoire

Cuba

Dhekelia

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Ethiopia

Falkland Islands (Islas Malvinas)

Faroe Islands

Fiji

French Guiana

French Polynesia

French Southern and Antarctic Lands

Gabon

Gambia, The

Georgia

Ghana

Greece

Greenland

Grenada

Guadeloupe

Guatemala

Guinea

Guinea-Bissau

Guyana

Haiti

Heard Island and McDonald Islands

Holy See

Howland Island

Iceland

Iran

Iraq

Jan Mayen

Jarvis Island

Johnston Atoll

Jordan

Kazakhstan

Kenya

Kingman Reef

Kiribati

Korea, North

Kyrgyzstan

Laos

Lebanon

Lesotho

Liberia

Libya

Macau

Macedonia

Madagascar

Malawi

Malaysia

Maldives

Mali

Marshall Islands

Martinique

Mauritania

Mayotte

Micronesia, Federated States of

Midway Islands

Moldova

Monaco

Mongolia

Montenegro

Montserrat

Morocco

Mozambique

Namibia

Nauru

Navassa Island

Nepal

New Caledonia

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Oman

Pakistan

Palau

Palmyra Atoll

Papua New Guinea

Paracel Islands

Paraguay

Philippines

Pitcairn Islands

Reunion

Russia

Rwanda

Saint Barthelemy

Saint Helena

Saint Kitts and Nevis

Saint Lucia

Saint Martin

Saint Pierre and Miquelon

Saint Vincent and the Grenadines

Samoa

San Marino

Sao Tome and Principe

Saudi Arabia

Senegal

Serbia

Sierra Leone

Sint Maarten

Solomon Islands

Somalia

South Georgia and the South Sandwich Islands

South Sudan

Spratly Islands

Sri Lanka

Sudan

Suriname

Svalbard

Swaziland

Syria

Tajikistan

Tanzania

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad and Tobago

Tunisia

Tuvalu

Uganda

Ukraine

Uruguay

Uzbekistan

Vanuatu

Venezuela

Vietnam

Wake Island

Wallis and Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

Meanwhile, the number of FFIs which have registered with the IRS currently stands at 77,354. The total number of FFIs worldwide (all financial institutions outside of the U.S.) is unknown, but estimates have ranged from several hundred thousand to the low millions. A common estimate has been one-million, which looks like this:

As you can see from both charts, the red areas represent large zones of uncertainty and danger in the imminent rollout of FATCA. The language is quite clear in the IRS documentation: 30% withholding will begin on July 1st for FFIs which are not deemed to be FATCA compliant. Because of pass-through payments and the desire to avoid all possible risks associated with FATCA regulations, there is every reason to believe that FATCA-compliant financial institutions will immediately begin large-scale withholding on transactions with thousands of non-compliant FFIs from hundreds of jurisdictions with no IGAs in place.

It is also becoming clear that the nations and territories which will bear the full brunt of FATCA withholding are amongst the poorest and least-prepared in the entire world, especially Africa. FATCA will crack open both historic and brand-new fault lines between rich and poor nations everywhere. Read the list again, and extrapolate our very near future.

Like an iceberg, FATCA’s greatest danger lies well beneath the surface; unseen, and patiently awaiting its moment of destiny. July 1st will most surely go down in the history books as a day of tragic infamy and the beginning of a calamity whose outlines we have only begun to discern through dark and troubled waters.

Additional references:

The FATCA GIIN list analyzed by IGA and by countries

it would be useful if we all kept a running tab on those banks that explicitly do not deal in US dollars….

Well you can cross Egypt off the list. One of your bold ones as well.

It’s game over if china signs.

@Deckard1138, Excellent post! Thanks for sharing those pie charts, and your analysis with everyone. It’s interesting that Allison Christians came up with something similar around the same time – great minds think alike I guess.

That’s strange. The news says 90% of Egypt banks have signed up for FATCA and something called Egypt Post.

http://www.zawya.com/story/Egypt_Post_signs_US_FATCA_Tax_Deal-ZAWYA20140615051712/

National Postal Authority. I wonder if that’s like National Savings and Investment in the UK that was probably original part of the GPO.

There are several institutions in several countries that will open accounts (bank and brokerage) entirely through the mail, even for Americans. These institutions are financially solid and in countries exercising sound monetary practices. All are non FATCA participants, and none have any US locations, placing them entirely out of US jurisdiction. See for yourself: swisssolution.webs.com

@Gman

Countries are having banks track where the money goes. The U.S. cracked down on Israel partly because it found out that the Swiss money was moved there. Some of the Israeli money went to Dubai, and the Israelis now are taking notice. If you move an account from somewhere like Switzerland to a non-signatory like Belize or Monaco, you can’t even plead that this was some long-forgotten account or that you didn’t know what you were doing.

The options, however, even the legitimate ones, are getting really limited. Today I received a letter from Fidelity Investments US, where I have a small Roth Individual Retirement Account left over from when I lived in the U.S. and worked there. Although the UK government doesn’t like its residents owning foreign mutual funds,it is o.k. with IRAs because they are pensions There is nothing fishy about my owning this. I had planned to cash out once I was old enough to do so without penalty anyway.

According to this letter, due to my residing outside the U.S., I will neither be able to buy more funds nor exchange out of the fund I have after 1 August. Now, I file married separately due to the foreign spouse and earn well above $10,000, so contributing more has never been on the cards. It still rankles since IRAs are supposed to be an available option for U.S. taxpayers overseas, since we are all going to move back to the motherland in our dotage in their fantasies (or should that be their nightmares?). Anyway, keep your eyes out for irate Fidelity customers!

Also see: http://isaacbrocksociety.ca/2012/07/22/fidelity-investments-refuses-to-service-to-u-s-persons-abroad/

@Publius

Just the tip of another iceberg. We’ve focussed a lot on the big banks, but I believe it’s the investment houses and life insurance companies that are going to create the most grief for many expats since they traditionally manage the primary nest-eggs.

@Publius,

I guess the advice to Americans moving abroad is to change the address they have on file at US banking institutions to some relatives living in the US.

When I left my country of origin as a student, then got a job in the US, I always kept my address on file for my small bank account in my country of origin bank at my parents, where it’s always been, since they opened it when I was a kid.

You can keep doing online banking. Don’t most people do that? Why would you change your address to a foreign address? Looks like it’s asking for trouble.

http://haydonperryman.wordpress.com/2014/06/15/further-analysis-of-77353-registrants-on-the-irs-list-of-june-2nd-2014/

IMPORTANT

Only 5841 FFI’s are relevant:

“Regarding the IRS List published June 2nd 2014

22 are registered in a country called “Other”

13,425 appear to be Participating FFIs i.e. they have what appear to have a valid GIIN and are in a IGA Model 2* jurisdiction.

57,425 appear to be Registered Deemed Compliant FFIs i.e. they appear to have a valid GIIN and are in a IGA Model 1* jurisdiction.

54 have a GIIN that does not match their country

5,841 are from jurisdictions that have no IGA* at the time of writing

586 are in the US or US territories

Some 92% of those registered on this list are in IGA* countries. One could reasonably conclude that registration may have a close correlation to the jurisdiction having an IGA.”