Deb says:

…while I wanted to actually mention Harper and the Conservatives, I agree with Chears that that would probably be hard to get submitted.

So I made the ad as generic as I could while still getting the gist. At least I hope so.

The layout is like the one Chears ran and is intended as a starting point. Input from everyone is welcome and appreciated.

There is other advertisement discussion at http://isaacbrocksociety.ca/2014/03/28/breaking-news-tories-hide-fatca-law-in-budget-act/comment-page-2/#comment-1318170.

(Note: I’m just putting this in one place in case people want to discuss options of what they’d like to do. I am not the coordinator for this effort, just the poster.)

Deb’s NEW VERSIONS:

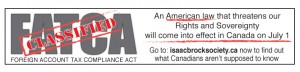

[ Click on image for larger / clearer look. ]

[ Click on image for larger / clearer look. ]

****************************************

REPLACEMENT OF FINAL VERSION of ad from Chears:

Newer ad from Chears, the first being the “final” / the final FINAL above:

Original ad from Chears:

The problematic part of this law is that FATCA does not require just the US person to report his/her financial dealings, but the Canadian spouses of said US person. My gut says that the banks will knuckle under and send everyone’s file out to the CRA to screen to pass on to the IRS. So Chears is not wrong in stating that ALL Canadians could potentially be affected by this law. Better to make people aware of the situation and have their anger up. I don’t think it is deception. And frankly the United States has been sowing the deception that we’re wealthy taxpayers. Can anyone tell me how someone like my wife who makes $21K an year maximum is considered WEALTHY? Because that doesn’t jive.

I think it is important for this add to address Canadians- and not let them think “Oh that doesn’t pertain to me.” So how about something along the lines: a new law that will allow America to tax Canadian citizens? THAT should get everyone`s attention.

Love the ad / arty work Deb. Look forward to seeing my “personalized version” to try to get onto local media in Jamaica – which by the way has a Charter of Rights as a section of the Jamaican Constitution that has language that purports to give similar “protections” that there shall not be discrimination based on place of origin.

One thought. FATCA threatens our rights and sovereignty AS WELL AS threatens our economy with SANCTIONS if we do not bow down and pay tribute to the US.

Is there any way we can write a well said paragraph or two with the information of how the Us is threatening Canada to do this and the Cons caved in and are giving Canada away? The headline should read “USA will STEAL over XXX Million dollars from Canada by threat” or something like that? People need to be pissed when they see what our neighbor to the south is doing to us by threats…

BTW, I like Chears ad the best….. gets my interest up right away….

In the Chears ad, at the top above the word Fatca, a possible headline to replace “coming to a bank near you” might be replaced with “Under Threat from the USA” just a suggestion.

I think you need some clever phrase like the famous British Tories’ advertiser strap line “Labour isn’t working” with a long queue of people waiting outside the Unemployment Office for benefits.

The challenge is FATCA is a fairly complicated message and trying to simplify it in a way that has high impact but meaningful and the original expectation of the message isn’t quite what it seems to be.

At the moment I don’t have any suggestions, but what I’ve seen so far seems to resemble more like warnings on cigarette packs.

What about considering some of the excellent anti-FATCA protest sign slogans here:

http://isaacbrocksociety.ca/anti-fatca-slogans-for-protest-signs/

I don’t think the passing on of information angle is enough. Think about all the people who just shrug at the NSA. I think it needs bigger impact- and thats money out of the wallet. Financial LOSS. How well would people react to being taxed by another country? To being double-taxed? Thats the real abomination here- it is CBT. It seems to me that since the canadian government has promised not to collect taxes for the IRS- one feels safe. I don’t know if one will be safe with a warrant out for one`s arrest.It means not being able to travel anymore- because countries in Europe for example will extradite. You`ll be sitting there like the swiss bankers who can’t travel anymore.

So I think thats what really matter here – the MONEY lost. And not just doubly taxed- but the penalties. These should be the focus- the issues meant to grab the attention of any canadian. America is taxing Canadians! America is taking money away from the Canadian treasury!

Wren,

Would changing “WILL” to “MAY” work? I know when I still worked those nuances often mattered in documents and correspondence.

Congratulations on this effort! Please forgive me for throwing one more text suggestion into the ring. If it’s not too late, how about:

“Canada set to adopt American IRS law effective July 1. This affects YOU!”

This is short, to the point, and will get people contacting Brock and asking questions. It gets both Canada and the U.S. into the text and puts Canada first. It is completely factual because it does affect every Canadian. If one of us loses our constitutional rights because of our origin every Canadian is under threat of losing theirs at some point in the future.

FATCA- an american law which will be implemented 1.7.2014 and allows America to tax canadian citizens on their canadian income.

FATCA- an american law which overreaches its boundaries and allows America to tax Canadian citizens on their canadian income.

FATCA- an american law which is soon to become canadian law and allows a foreign nation to tax canadian citizens.

FATCA- an american law soon to be implemented in Canada and which will deplete the Canadian treasury of much needed revenue.

or something along those lines. Because its the truth!

Polly, I think it is more data gathering, especially for Canada. The US / Canada Tax Treaty covers *most* double taxing, but certainly not all — and I have experienced that by owing the US when I owed Canada nothing. I don’t think double taxation should be the main focus although I know it is there as well.

More alarming is that this is not about taxes but about the punitive nature of the outrageous penalties and the *cost* in stress, time wasted from our lives and administration of compliance by having to hire US tax professionals (which I certainly had to do as I just could not prepare all of that myself — and any confidence at all that I would not be further penalized for mistakes). One of my explanations to people is that this is *generally* NOT about taxes.

The cost to renounce in exit taxes as if all of our assets were sold on the day before renunciation (when they really weren’t — and to include tax on the capital gains in our homes) is especially punitive.

And, of course, the US could change the collateral damage of all this by changing to RBT as the rest of the world. By not doing so, it is a cash cow for the US — not so much in double taxation (although that is the perception of most hearing about this as it is all about tax evasion) but in life-sucking penalties that can be assessed.

and I think it is more about making the american tax net ever wider and draining monies from other nations. Soon this or that will be called “american” – companies etc etc. I don’t think they would be doing this without foresight. This is a plan for America to tax the world- and I hear the huge sucking sound already. And once in place- they can change the laws again and again- take away this or that “agreement”- then the 97000$ respite on wages will disappear and a lot more. EVen now they will tax as a gift tax anything one gives to a spouse. The list goes on and on. Its like Snowden says- this is the beginning. You give up your rights one by one.

There are many excellent protest sign slogans that might work for your AD (and grab attention). Some of my faves:

FATCA — Foreigners Attempting Theft of Canadian Assets

Stop the IRS FATCA invasion of Canada

FATCA is how America finances its deficit on the back of Canadians

FATCA, a US weapon of mass Canadian financial destruction

1 Million US-born Canadians are NOT 2nd class citizens!

As a Canadian you ARE the retirement plan for Americans.

Made-in-US FATCA = Funding America (by) Taxing Canadian Assets

U.S.A. Set to Invade Canada — AGAIN!

@ Chears

I like your new ad; very clear and eye-catching.

However, it says “It’s now law…your Private Financial Information will now…..

If we are trying to catch the eye of a broad range of Canadians, but don’t want to be found as misrepresenting, I’m concerned about the words “will now”.

I anticipate that the bank will do it’s due diliegance and not EVERYONE’s account info will end up being sent to the CRA-IRS.

Perhaps the wording should be changed to “….your Private Financial information could be sent…..”

IMHO, omit the second “now” (it’s just redundant) but fully capitalize and underline YOUR PRIVATE FINANCIAL INFORMATION (to emphasize).

Now that winter is waning, I need to get outside & take some long walks. I’m going to print this (and perhaps other ad-notices) and go door to door to the businesses in my smallish town asking (1) if they know of any (broadly defined) “US Persons” and (2) if I can post this ad in their window to help make people aware. Anyone thought about placing info ads on Kijiji or CraigsList across the country?

Whoops, typing error – – IMHO (not IMHP)

@Whitekat

It IS a type of theft of foreign assets! I only have to think the the boarder baby who got a “lenient” 5% of everything she owns taken from her! And they thought they were being (((good))) to her! The very idea that this is “right” and law and “good” should be nipped in the bud. It is actually immoral and abusive! And all this talk about America being the victim. Perhaps by a few people who live in America and hide their money abroad- ok. But America is the biggest tax haven of them all, and I`d like to know how many people hide their money from the IRS IN America in the form of Trusts in Delaware and even do it “legally”. All these laws need to be changed- and among them: CBT.

Just a question – better to call it a ‘US law’ vs an ‘American law’?

LM, you will be a force of advocacy in your smallish town. Here is an ad that is running in kijiji (placed by GwEvil) for the Calgary information session coming up.

http://www.kijiji.ca/v-classes-lessons/calgary/the-problem-of-u-s-citizenship-fatca-info-session-calgary/576687173?enableSearchNavigationFlag=true

@Calgary

Oops- you mean change to RBT dontcha?

I think sometimes the panic involved blinds us.

Absolutely!!!! Will certainly change that careless mistake. Thanks!!

Steve,

I too personally prefer US law to American. I always think it so exceptional that the US population is “American” when I live in North America and so do people south of the US border.

One issue that needs to be addressed is FATCA can’t be future proof. For example, the $50,000 FATCA limit could become $10,000. The Credit Unions asset size could shrink to a $25M limit to be FATCA compliant. US Congress could suddenly change the tax rules (they have the data and they can).

The FATCA net will become harder and harder to escape. If I was the IRS that’s how I’d play it. Get all the infrastructure into place, get it working, find out the weaknesses and loopholes and attempt to close them, and once that’s done, make more and more people inclusive by ratcheting down the limits until ultimately everyone is included.

FATCA at this juncture is all about ESTABLISHING the principle.

To get everyone in the US tax net, what’s stopping the US changing the definition of a ‘US person.’ Perhaps you need only to be in the US for 14 days to become a tax resident. You go down to Florida for a couple of weeks as a Canadian born citizen, born in Canada and suddenly you’re on the hook for US tax. Of course this is an extreme example, for technically it’s possible for the US to abuse the definition of a ‘US person,’ in future to raise tax revenue.

Please think about a ‘hungry,’ desperate US even more heavily in debt, about the lose Reserve Currency status and US Senators deciding to tap into the ‘US Person,’ tax channel and take what they can. ‘US Persons,’ have zero political power and Homelanders don’t care. Tax ‘US Persons,’ to death because we have FATCA data, MLATs, and MCARs (mutual collection agreements).

The best way to counter FATCA is:

1. Use weaknesses in the current system (altered documents) to open / maintain accounts against FATCA questions and stop banks from applying US indicia to you. In my opinion even if it costs a few grand for a ‘document’ it’s money well spent to keep you from becoming a ‘US person’ on a bank’s database. At present, the banks really have no means to verify these documents, but they have to be high quality and able to pass some ‘wet behind the ears’ bank clerk.

2. Continue the Charter Challenge and raise money for the Superfund

3. Hope and pray the BRICs can dethrone the US dollar from reserve currency status. At least for the US FATCA would probably then be dead if everyone is suddenly using other currencies to buy oil, and other commodities in future. The US dollar will then be like Pound Sterling in the eyes of the world.

How about including a red circle around IRS with a bar through it somewhere?