Today, I sat down behind the computer, punched in the requested numbers and ta-dah! It rejected citizenship-based taxation again, just like it did last year and the year before that and before that and that and so on and on.

This shows that nobody hates citizenship-based taxation greater than the American people, the American government, the American Congress. Let’s face it – America hates citizenship-based taxation! If such was not the case, then this problem would have been fixed decades ago.

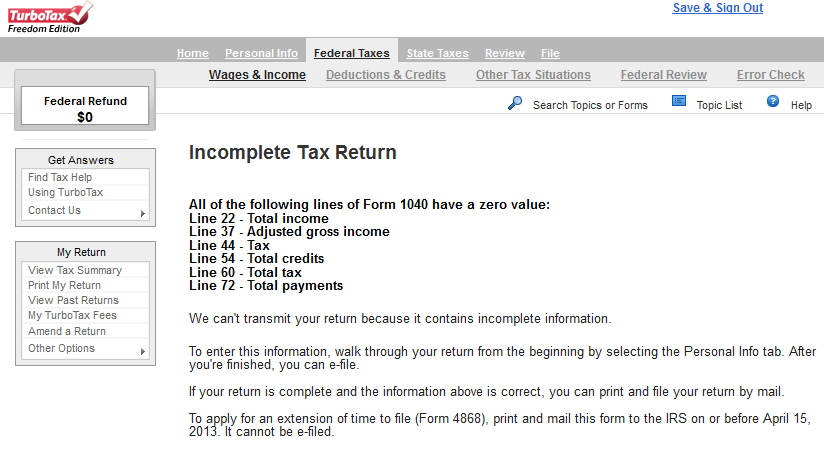

After punching in the numbers, the Error Check reported that Americans abroad cannot free-file US taxes if their income is below the Foreign Earned Income Exclusion, since they then have no “Total income”, no “Adjusted gross income”, “Tax”, etc. In other words, America recognizes that it is utterly stupid to bother people who live and work in other jurisdictions.

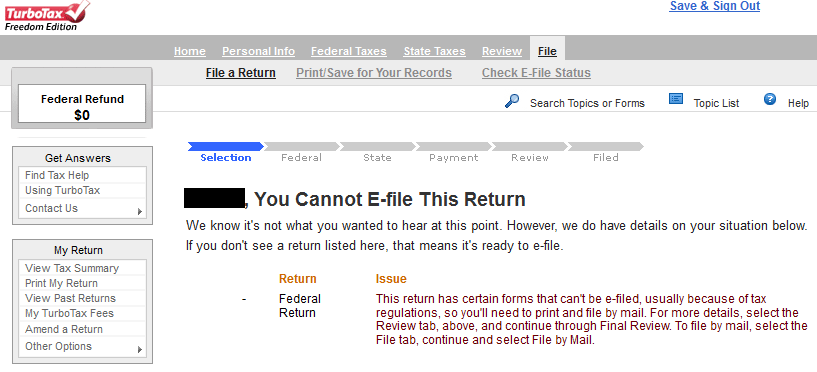

America’s unconditional hatred of citizenship-based taxation is then certified when one clicks to e-file or print the return:

Notice how it specifically states that US taxation is only for people who live in the US:

So, there you have it, folks. America is still the world’s leading hater of citizenship-based taxation, endlessly causing unnecessary trouble for its citizens living abroad to further demonstrate that citizenship-based taxation just cannot work.

America does not hate citizen based taxation, it hates to admit that some Americans chose to live and work outside the US. To score political points; politicians characterize ex-pats as less than loyal, often with the most negative terms. Few homelanders care enough to investigate the true nature and motives of Americans abroad, even fewer care to protest that we are unfairly treated by their government. like Iraqi Jews who fled Saddam Hussein, we are proud of our heritage, but live in fear and loathing of the government of the country we left

Hating to admit that some Americans chose to live and work outside the US also means that the American people hate citizenship-based taxation since they are unwilling to accept its responsibilities. Any negativity from American politicians is the direct result of their failure to abolish the citizenship-based taxation that they hate so greatly. They are basically angry at their failings and this tends to be felt by other Americans.

Must have missed the memo when turbotax.com became America. The small writing in each of those says you need to mail your return, not that you don’t need to file, big difference there.

I used one example, but there are many more and this has been going on for decades. If citizenship-based taxation is supposed to work, which it obviously can’t, then why aren’t there any Americans who want to fix it? Anyone?

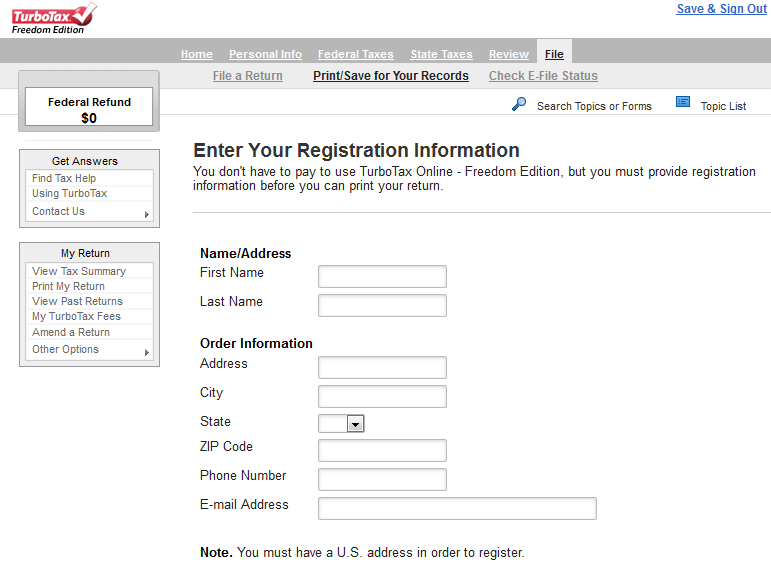

As for snail mail, the US government recommends e-filing for security purposes:

Wouldn’t one attempt to not put the security of Americans living abroad at risk if one didn’t oppose citizenship-based taxation? Again, America obviously hates citizenship-based taxation, intentionally putting the lives of Americans abroad at risk, with snail mail, to oppose its practice.

As I said a while back on here, the US doesn’t like Americans who live abroad who are not under their direct service, military, DoS, etc… Back when I was active duty, they used income tax as the carrot to work in combat zones. We pay taxes where we live, so we are of less use to them. We are not under their control so we are punished for it.

I found a zero % foreign exchange rate credit card at a US credit union I used to be a member of many years back. Even though they deal with the military, the jury is still not back as to whether they can deal with my foreign mailing address, or as to how they would deal with receiving a CLN in the future. Dealing with most things back there is somewhat difficult. I truly believe that long-term expat = not compatible with the way things are in the US. I wouldn’t say that I’m a proud American, either. I see it as something that I will never be able to escape fully, even with a CLN in hand. People will ask, where were you born. The US. So they will always link you to there, even if you don’t like it, or haven’t stepped foot there in 50 years.

Compound the US heavy hand to what is happening in Cyprus. I’m getting a scary feeling that financial assets, even cash, is becoming too dangerous to hold onto. It’s too easy for lawmakers to appropriate it back to the government for whatever reason they invent. Lastly, I see all of this whole financial mess of the world as the fault of the US. Maybe not for everything, but US definitely was the catalyst. They were the first country that started overspending greatly, letting their balance sheet go from positive to negative, and letting the value of the dollar drop like a brick. They set the example for the rest of the world. From this the “competitive devaluation” was born and the race to the bottom. Way to go ‘ole USA….

I like the point that US politicians may be using a smoke screen to hide their own inadequacies as legislators. Most people fear having their incompetence made known and use anger or false indignation to mask that fear and to divert attention away from them.

I also believe that the attitude toward us is generated by the conditions that have been created for us. The wrong assumption is that we must be doing something wrong in order to deserve being surveilled and penalized. We may even be viewed as having inherent defects for putting ourselves in a situation where we receive this kind of punishment. When a suspicion that our loyalties may not rest entirely with the US is combined with laws that at the same time punish us for living abroad, we can easily be seen as a threat just by the nature of our jurisdiction. Good legislation can never be generated by fear and anger.

@whoaitssteve

Funny, swisspinoy’s post made me think of you, and there you are.

I hate it when companies do this to people. They all rush to the e-filing, e-ordering, etc, and then can’t make sure their sites work properly to cope with it. America is especially bad at this as they make no allowances for anyone being outside of the US. Amazon et al have learned, but it took time.

Even the UK HMCR falls into the trap. They encourage you to e-file your tax and then, oops, if you’re not in the UK you need to file a paper return. If they weren’t in such a hurry to jump on the new technology bandwagon we wouldn’t have so many problems to deal with. Luckily there are ways to get around the UK filing problem, I doubt the same can be said for the US one.

Simple solution: Make shit up.

As long as it’s “passable”, it’s good enough.

I had once tried to register for e-payments so that I wouldn’t have to continue to send the required quarterly advance payments on self-employment income as registered mail. However, because my home address didn’t correspond with the address on my foreign (i.e. american) checking account from which the debits were to be taken, it wasn’t possible. Someone from the IRS called my parents (I was required to provide a US tel. number) and argued that I should just change my official address for correspondence with the IRS to be an american address. Isn’t it wonderful how helpful they are?

@notamused, the IRS is actually helping Americans abroad by rejecting the international address required for citizenship-based taxation, since all Americans unconditionally hate citizenship-based taxation.

To test how greatly Americans hate citizenship-based taxation, simply ask them if they would send 30% of their income to Iran if Iran introduced citizenship-based taxation and declared all Americans as being citizens of Iran. Each and every American would respond with “Hell no!” All Americans hate citizenship-based taxation, including Obama, Schumer, Tierney, Ross, etc.

The only reason why citizenship-based taxation has not been abolished yet is because Americans understand that the US government has become far to big and corrupt to change for the better.

Let’s face it Swisspinoy, most Americans don’t even realise their tax system is different from the rest of the world. They just know they have to pay tax, they don’t know that it’s citizenship based and not residency based. Only Americans who travel/work outside of the US will ever know the difference.

@Medea Fleecestealer

Would it be safe to say that if Americans were for the first time faced with a choice between citizenship based taxation and residency based one, most would reject the citizenship based one?

I see your angle here @swisspinoy. The current system isn’t working and all the attempts to make it work won’t change that, in fact they have made it worse for a growing number of its citizens. Unfortunately, the US doesn’t hate citizenship based taxation enough yet to admit it is wrong, as it hasn’t reached the point yet where it is willing to recognize that its own citizens are gnawing their own appendages off in order to get away from its grasp (what I call America’s dying diaspora).

Do you think that 95% of Americans have any idea the difference between their system, citizenship-based taxation and that of the rest of the world? And, those that do, well — not their problem /doesn’t affect them. I think it safe to say that, generally, Americans haven’t been taught anything about their citizenship-based taxation so it’s unlikely they’d have a clue, especially with the lazy journalism we see regarding that subject and what FATCA is.

@Bubblebustin, I agree with calgary411. Of all my US relatives only two, my American uncle-in-law who served abroad during WW2 and my British cousin who married him, have ever been outside of the US. The rest have never travelled beyond it’s borders and given how poor their part of the country is probably never will. Some have been to other states, but only a couple have briefly lived/worked outside of the state they were born in. You have to remember that, at least when I was a child/teenager, when people took their vacation time they didn’t go away. They’d work on the house or garden or car or whatever and maybe went camping for the weekend; that was their vacation. Of all our neighbours we were the only ones who went on a vacation as we know them, by travelling to other parts of our state or going to neighbouring states and staying in motels, seeing sights, going down to Texas to the seaside. Okay it’s a long time ago, but I suspect that if Amercans do take more actual vacations these days it’s still to visit a neighbouring state, or New York, Los Angeles, the Grand Canyon, Yellowstone, those sort of places. Rarely, unless they live near the border of Canada or Mexico will they probably go “abroad”. They certainly wouldn’t realise that the US tax system is any different from anywhere else.

I agree absolutely that most American’s myopic view of the world doesn’t allow for much of an opinion about either tax system, but let say that they given the fresh opportunity to decide which they would prefer. Do you think most Americans would choose a system where they would be forced to pay double taxes for living abroad and to become pariahs within the countries where they live? I believe that the USG is suffering from cognitive dissonance when it comes to citizenship based taxation. Why else have they taken measures to mitigate its effects (FEIE, tax credits) while at the same time use it as a penalty generator? The US is struggling to live with the abomination that citizenship based is, and you can see the fine mess they’ve made for their citizens in their attempts to do so.

Short answer, yes they would. Because most Americans would never consider/expect to be living/working outside of the US so it wouldn’t affect them. Plus you can guarantee that those in the know will have been shoving the “tax evasion cheaters abroad” scenario down their throats long before any vote on the issue. That’s already the view being put forth by the media so just imagine how much worse it would be if the issue was to be voted upon. It would simply be more of the “they’re unpatriotic because they don’t live here so let’s tax them more to show how patriotic we homelanders all are” rubbish. Do you really think the few fighting our corner could make themselves heard over the clamour of outrage, let alone swing public opinion our way?

Even if it happened that the US gave full IGA reciprocacy on sharing bank details, it wouldn’t necessarily change their views because those affected in the US are few. Until it hit them with further job losses and businesses closing because of FATCA and the IGA would they, maybe, think it’s not such a good idea. Of course, by then it will be too late.

As a side note, I see Stockton in California is the latest city to go bankrupt. I haven’t heard of any similar cases here in Europe; has anyone else? Or are we sticking with the bankrupt countries only model.

Why don’t we ask Whoaitssteve the homelander? I am assuming that if given to vote between both tax systems, Americans would make some kind of effort to familiarize themselves with both. Steve: Given a fresh opportunity to vote between residency based and citizenship based taxation, which would you vote for?

47 million Americans rely on food stamps to get through the day. 15% of Americans are living below the poverty level. 35% of Americans have a passport and 20% are foreign-born (most with passports?). 5% go on vacations beyond US borders. After spending the second set of 10 years in the US, I couldn’t imagine leaving but was economically forced to pack my bags and hit the road.

America is huge. For most Americans, it is a big adventure to travel to another state and the US media is heavily US-focused with poor international coverage, pleasing the interests of the average American majority. Some Americans even experience cultural shocks when they leave the country and seek refuge in the nearest McDonalds.

So, many Americans generally know very little about the world and tend to fear leaving the country, especially for employment purposes. They have little or no motive to understand how the world is seen beyond US borders and millions cannot imagine working abroad. It is thus pretty much impossible to educate them about citizenship-based taxation. Yet, if they do become educated about it, then they quickly learn to hate it.

What I like the most about not living in America, is that I get to enjoy the many things that many Americans know nothing of. The urban density, the transportation choice, pedestrian mobility, the language mix, the clash of customs and cultures, etc. Heck, maybe it is best if Americans stay in America so that I can continue to enjoy the world without them!

@swisspinoy

Your comment made we flash on how many Americans identify themselves abroad by having their noses stuck in a Rick Steves book.