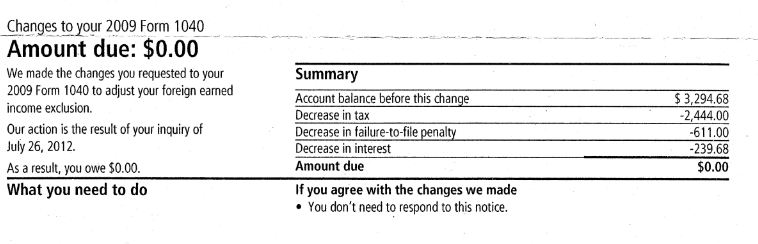

As you folks know, the IRS decided that since I didn’t fill the first part of my Form 2555 out correctly, that I must owe them a bunch of taxes. And so they sent me a federal tax bill to my Canadian address, disallowing my Foreign Earned Income Exclusion (FEIE). Today, at last, after several tries at sending them the properly filled out form, the IRS has decided that I don’t owe them anything after all. I’ve only had to deal with this 2009 tax issue for quite awhile now–readers can retrace the multiple threatening letters and bills that I received from the IRS just by clicking the above link and the links in that link, and the links in those links. The IRS has wasted its time with me. I’ve been wasting my time. I owed no tax. Zero zip nada. I am not a rich tax evader but a Canadian taxpayer and I renounced my US citizenship because I hate the hassles, the threats, and the intimidation that comes part and parcel with being an US person.

Protection

Am I filled with love and feelings of patriotism now that the United States has decided I don’t owe anything for 2009? Hardly. Those who think it is worth the hassle of paying for a tax specialist every year and remaining in compliance, instead of relinquishing US citizenship as I did, should consider that the only “service” that US citizens abroad receive in return for their continued patriotic payment of taxes without representation is the “protection” of the United States. We are learning however that even a duly appointed ambassador of the United States, after repeated requests for protection, will not necessarily receive anything, and that the President of the United States is willing to allow an ambassador to be murdered. Kelly O’Donnell writes

Here is a brief description of what we know: US Ambassador Christopher Stevens traveled from Tripoli to Benghazi, Libya. Nervous over rising unrest in this Muslim African Mediterranean nation, Stevens asked repeatedly for more security but was refused. On the day of the attack he’d asked again. He was attacked after dark, and seven hours later he was dead, along with three others. And it now appears the US had notice of the event, time to respond, and resources within reach to mount a counter-assault. What is not clear is why the American military was not sent in to save our Ambassador. (The time-line of the attack is well laid out at Powerline. (Benghazigate: The state of the story)

Now let me ask the question: If the ambassador doesn’t receive protection from the enemies of the United States, than from whom is the US citizen abroad receiving “protection”. The answer: the compliant US citizen abroad is receiving protection, in principle, from the IRS threats of fines and imprisonment. The IRS has become the biggest threat of all to our well-being and security: bigger than the combined threats of Al Qaeda, Russia, China, and Iran, and any other threat you can think of. Thus, this is mafia-like protection money, very similar to the Sopranos criminal racket of protecting business in case a window might get broken, as shown in this scene:

Hurricane Sandy

Finally, Hurricane Sandy in the United States promises to do billions of dollars of damage. Will this be the straw that breaks the fragile back of the US economy? The problem is that the debt levels at Federal, state, municipal, corporate, business, and personal levels are so overextended that they have very little flexibility. The US economy is not resilient, as Chris Martenson of Peak Prosperity says. This means that things like hurricanes and droughts may push the US of the fiscal cliff–and spiraling hyper-inflation, when the Feds decide to infuse even more hyperbolic stimulus to try to rebuild what will be destroyed in tonight’s storm.

US persons abroad also face US border guards who are starting to put pressure on all those who have a US place of birth to travel only on a US passport, even if the person has not been a US person for decades–an arbitrary change of policy making those who relinquished citizenship into would-be loyal taxpayers to a profligate government that has to borrow 40 cents on every dollar its spends.

@ConfederateH

Certainly was not suggesting that you would enjoy it. Just thought, given your experience, it might interest you.

BTW, It is not only swifting wealth from suburbs to Cities. The shift amongst States has been going on for a long time.

I lived in Alaska, and watched Uncle Ted Stevens milk the Federal government for years and years to subsidize those Last Frontier Conservative Champions of Individual liberty and self reliance, and I never saw them stand up on principle, and say, “Oh, we don’t want your money!”

Instead, they just stashed away their oil revenues into their Permenant Fund piggy bank, passed out Dividend checks each year to all residents and said. I will use your Federal dollars instead to subsidize my rural and independant life style, thank you very much!

Most folks know about the infamous “bridge to nowhere” but that was nothing compared to the all the other goodies like the continuing “BY-pass” mail program that supplies all groceries and goods around the state at a very nice 4th class mail rate, flown in by the airlines at a very profitable subsidy. But never mind. Everyone has their hands out, including our so called Liberatarian Sarah Palin type Alaskans. And so it goes.

Lisa,

What a night mare. I hope you have contacted Nina Olson directly, at the TAS. She would be able to help or direct you. I think you will find her email is the standard IRS email format. Probably Nina.E.Olson@IRS.gov

@Just Me, don’t forget Alaskans pay the highest marginal tax rates, at least when I was growing up there, as a result of the Federal government not making cost of living adjustments to the tax brackets. Thus, Alaskans felt that whatever was coming to the state was their due.

But you are right, the whole system stinks, and everyone has their hands out. This is why I advocate smaller government everywhere; this would result in reducing the moral hazard all around. As a result of the size of government, the western democracies have become extremely corrupt–in scale, if not proportion, compared to the worst petty tinpot dictatorships in the banana republics around the globe.

Yea, but no income tax. Very low sales taxes depending on the city or region, and everything else in the way of infra struture is Federal Government subsidized, including the huge foot print of the Military especially Anchorage and Fairbanks. It is a government State, and they all love it! Rugged Individual Mythology trumps reality up there!

@Just Me:

“I lived in Alaska, and watched Uncle Ted Stevens milk the Federal

government for years and years to subsidize those Last Frontier

Conservative Champions of Individual liberty and self reliance”

Well you tip your hand on that one. Apparently in your mind only parasitic liberals dependent on the state for welfare or their state salaries are allowed to get anything out of Washington. Conservative wealth producers are only allowed to pay taxes and get nothing back in return. And besides, I don’t accept at face value any statistics out of washington including tax flows. A lot of those flows are related to things like military and EPA. If secession was allowed like the constitution was designed then Alaska could leave the US and take back the %95++ percent of the land occupied by the federal government.

@ConfederateH

I am not sure how I tip my hat on anything! I am just pointing out, that in America, it is an equal opportunity dependency populace. Acceptance of gratuities from government trumps partisan ideology!

@Just Me, the state of Alaska consists mostly of Federal Government land, with a few isolated pockets of State, native and private lands. If it largely belongs to the Federal government, it is hardly any wonder that it is set up as a dependency of the United States. I am sure that the Alaskans for Independence would be very happy to take over the state so that it doesn’t remain a burden to the Lower 48.

*@Just Me, The Free and Independent Republic of Alaska, with all its massive petroelum resources, would indeed be a Gold Mine State. It would put Kuwait to shame in terms of massive wealth.

*@offshore bank, you wrote “US persons abroad also face US border guards who are starting to put pressure

on

all those who have a US place of birth to travel only on a US passport,

even if

the person has not been a US person for decades–an arbitrary change

of policy

making those who relinquished citizenship into would-be loyal

taxpayers to a

profligate government that has to borrow 40 cents on every

dollar its spends.”

So very true. And this is the kind of trauma that results when the government decides to enfoce laws that have been on the books for years without enforcement. Dual citizens who live in countries with which the US does not have a Visa Waver agreement, or have become natruralized citizens of a different country in good faith believing they automatically lost their US citizenship when they did this have not, unlike Canadians, been able to enter the US using a foreign passport that indicates they were born in the US, unless they were able to present a CLN when appliying for the US entry visa. US consulates abroad would insist that the person must have a valid US passpot to enter the US and would not stamp a US visa in such a person’t foreign passport.

But just like FBAR, somebody made a decision to enforce this law on those Canadians who the US considers to still be US citizens. Who is to say that someday someone in authority in Washington might decided that the time has come to start applying the Reed Amendment to the 1996 Immigration Act which allows the Secretary of Treasury to blacklist persons who have renounced their citizenship for tax reasons; thus barring such persons from ever visiting the US again for any reason. Nothing coming out of Washington relating to US citizens and ex-citizens living abroad surprises me any more.

*@Petros,

I’ve been lurking for awhile and have noticed you say several times that the Canadian government will not force you to pay penalties for not filing FBARS – this implies that other countries will. I live in Switzerland, so you can guess my situation is a bit sensitive. Any opinion or knowledge about other countries would be greatly appreciated.

@Just Me:

“I am not sure how I tip my hat on anything!”

Northernshrike recently came out and admitted that she is a liberal who believes in “tax fairness”. Bubblebustin voted for Obama in 2008 but is still indignant that I dared call her a liberal. Your disdain for people who you label as “Champions of Individual liberty and self reliance” tips your hat. It is so hard to pin you guys down, my guess is that in your collective inner souls that you realize how absurd it is to support the theft of the fruits of other people’s labor by the state while moaning and bitching when that theft hits you in a manner in which you are no longer willing to support their “democratic rights”.

@Sierra, Thanks for the comment. I say with confidence that FBAR fines will not be collected in Canada because the government of Canada has made a point to make an announcement to that effect. This is what has given me the audacity to thumb my nose at President Obama.

It is seriously doubtful that other governments around the world would collect such ridiculous fines. In any case, it would have to be argued in a court of law in the respective country. Then, it also seems doubtful that the thugocracy of the US is going to try to argue FBAR fines in foreign courts. They will instead focus on low hanging fruit. However, if you are worried, it may be good to consult a lawyer in your country of bank accounts.

Thus, if you have no assets in the United States, there is not much the US can do to you, IMHO.

@CH,

That is part of the beauty of the Isaac Brock Society. The campaign against the injustice of “citizenship-based taxation” has brought together both Progressives and Libertarians.

My question to you is, is it more productive to continuously provoke discord among Isaac Brock Society bloggers or direct that energy towards lobbying and/or politically pressuring the “powers that be” into waking up and fixing the problem before Americans abroad become extinct as a species?

@Boston T. Party,

Thank you.

@Sierra

You say:

“I’ve been lurking for awhile and have noticed you say several times that the Canadian government will not force you to pay penalties for not filing FBARS – this implies that other countries will. I live in Switzerland, so you can guess my situation is a bit sensitive. Any opinion or knowledge about other countries would be greatly appreciated.”

The reason that the Government of Canada will not collect FBAR penalties is based in the US/Canada tax treaty. The terms of the treaty do NOT obligate the Government of Canada to collect penalties for things unrelated to tax. FBAR is under Title 31 of US law. The tax laws are under title 26. The Government of Canada is not obligated to assist with the collection of penalties that are not tax related.

To determine the situation in Switzerland you would look to any Swiss/US treaty.

@BTP: I gather from your handle that you must be a believer in the US constitution. Surely you must see what progressivism and liberalism have done to the US system of government, unless of course you are wearing liberal blinders. So I won’t bore you with a litany of corrupt, bloated and counterproductive departments that persecute and enslave the people.

You wrote:

“direct that energy towards lobbying and/or politically pressuring the

“powers that be” into waking up and fixing the problem before Americans

abroad become extinct as a species“.

I have already been forced to renounce. I filed my fbar’s and 1040’s for decades before the ever increasing compliance burden became so great that I renounced. It is one of my contentions that the majority of people who claim that they did not know about their filing obligations are guilty of willful ignorance. This is common among the hypocritic left who somehow seem blind to all the blatant evidence of the welfare states abject failure.

Now as to how to “fix the problem” it is my contention that extra-territorial taxation, FBAR, and FATCA are merely symptoms, not the problem. Voting for Obama while ranting about these is the same kind of willful ignorance I was talking about above.

So when I write here I try to talk about ideas and reality, not the PC blinded fantasy land that the media and the left had built for the progressives in order to assist them with their willful ignorance. Liberals are aware of the contradictions between what the welfare state has become and what they think they are supporting. So they refuse to discuss it and pretend it doesn’t exist, just as they pretended that they didn’t need to file their 1040’s.

As a Swiss I am so glad that we avoided the EU bullet shot at us by the socialists in the EU and the ones in Switzerland. They tried to cajole and coerce us into the EU, and they have never given up. The US, the EU, and all their international organizations like the UN, the IMF and the OECD are waging a war against the fundamental human right of financial privacy and Switzerland is the enemy number one. The Canadian women who post here seem very uninterested in financial privacy because they believe in the state as they believe in progressivism. They want the state to have the power to steal wealth, they are just upset because the state doesn’t do it “fairly”.

And this gets me to one of my pet peeves, Canada. The Northern Star

of “successful” liberalism. Where “hate” speech is outlawed and every

member of every extended immigrant family gets free healthcare too and

where they cannot fathom how backward the US is because it doesn’t do

the same. Once again liberals put on their blinders over this and refuse to acknowledge that the US is broke and cannot afford even the healthcare system it already has.

So to summarize, “the problem” that you speak of is the liberals themselves, who given a choice between two progressive candidates never fail to pick the more progressive of the two. Who belly ache when they are asked to pay “fair” taxes for “services they don’t receive”. It’s not called progressive taxation for nothing, slave.

@ConfederateH

So why is it so important to you to label or “pin down”? Is there some first filter requirement in your brain that has to separate Liberal from Conservative, before you are open to consider what they have to say? I don’t understand that mentality to always look for someone to “tip their hat”, as you say. If your filter requirement is meant, then does that mean you are no longer open for input or discussion. I ‘tipped my hat’, so you can now discount? .

You interpret my comments as “Your disdain”. My disdain is for the hypocritical positions of those that take on those labels of “Champions of Individual liberty and self reliance” use to describe themselves, and yet quite happy to suckle on the government tit when necessary or desired.

Frankly, I have said before, if you need a categorization, I am Conservative on Fiscal issues, and Progressive or Liberal on Social issues. I am not a member of any party. So not sure where I fit into the great Liberal / Conservative divide that you need to “pin down”?

I am not a believer in ideological Certainty. There is a lot I like and agree with on the Libertarian side of the equation more so than just the Republican conservative variety or Democratic progressive side.

So, my hat is tipped, and you can ignore any further comments I might have.

@Just Me: I don’t really know what a “conservative” is anymore and I certainly wouldn’t qualify as one anyway. I think whatever qualifies as “conservative” in Canada and Europe is really nothing more than a less hard socialism when compared to the left.

You write that you are a “Progressive or Liberal on Social issues“. These social issues are precisely the ones for which progressives demand big liberty robbing government solutions and big income taxes to finance. Someone has to pay and by your support you have ceded sovereignty over fairness to this government, so if you want progressive government then don’t whinge about taxes. But even worse, progressive government never solves any of the problems, they just make them worse so that their plundering can become self perpetuating. Paying a government agency to solve a problem merely guarantees that it will never be solved.

As far as your cries of hypocrisy because “Champions of Individual liberty and self reliance” dare accept a handout from the welfare state you should take it up with them, I doubt they would agree with me on many issues. I think the issue here is how clear it is that government corrupts everything it touches. If there were no handouts and no income taxes then these champions would not be hypocrites, nor would you. It should all be voluntary. If you want to help your neighbor out of a tough spot, then you do it on your own! Don’t demand that the government steals the fruits of my labor from me so that your pal gets a handout.

Finally, I bear you no malice and have a lot of respect for you. I just want to point out the errors in your thinking and I could not do when you wouldn’t “tip your hand”.

@CH,

For the record, I consider myself to be a paleo-conservative libertarian. From my perspective, only the weak and parasitic are interested in receiving government handouts. So I can empathize with some of the themes you write about.

However, to be blunt, your approach to many of the bloggers on this site is unhealthy and toxic. It is that of an Agent Provocateur of sorts and sabotages the merits of anything worthwhile you may have to share. Slave!

@Just Me, the criticism of individualistic Alaskans who clamor for handouts from the Federal government is ultimately unfair. Consider my own situation. I don’t believe in socialized medicine, but if I want health care I have to use my OHIP card, and get it for free. I’ve paid my levies into OHIP through my employer, so really I don’t have money left to pay for my own health care (and it is likely too that the physicians in the area would have to refuse me as a patient if I refuse to present my OHIP card). It is true that everyone sucks at the government teat, but libertarians do so against their principles because of the situation of dependence that is created by the system.

Shall the kidnapped slave refuse food from his taskmaster and thus die of starvation?

@the Ayn Rand lovers- I for one love socialized medicine. I seriously doubt that there any Libetarians out there who if they were suffering with a life threatening illness, would want to know that their private insurer wouldn’t pay for their treatment.

The myth about private health insurance is that the policy belongs to the insured. The truth is that much like any insurance policy, the policy never belongs to the insured but the insurer. The purpose of the insured is to protect him/herself against loss. The purpose of the insurer is to protect the company against loss. The two parties are totally working at cross purposes with each given that one wants to shift losses off his books to the books of the other, who can only survive by keeping losses from landing on its books.

Socialized medicine is the most humane of options. Not because it eliminates losses but because it is the ultimate medium for the sharing of losses while providing access to a service for which there is no substitute. Given the well researched fact that countries with national health plans have both lower per capita and GDP health provision costs and longer life expectancies it is obvious that national health care is economically more efficient than is the so called free market.

“Socialized medicine is the most humane of options”

No. Socialized medicine is slavery for those of us who don’t want it, as Petros pointed out. You would have the government steal from the rest of us because you are either too poor or too lazy to pay for it yourself. FATCA was passed in 2010 at the same time as Obamacare because the progressives needed to fill funding gaps to pay for it. Socialized medicine, and its supporters, are the reason why we have FATCA!

*@Confederate, I thought FATCA was enacted to fund the HIRE Act, rather than Obamacare.

Qestion about Canadian Socialized medicine: Does it fund the cost of birth control pills, condoms and other products related to recreational sex, or are these sorts of things paid for by the persons who chose to use them?

@Roger, in the province I am familiar with, birth control per se is not directly covered by our government funded health program. It may in some cases be subsidized as part of other public health or community programs – for those who qualify based on income or age. There may be community programs where as part of public health initiatives (partly funded by grants from different levels of government), condoms are available free – as a barrier method of disease prevention – primarily to prevent transmission and spread of communicable diseases (ex. Hepatitis, AIDs) – which benefits everyone – and proactively decreases our health expenditures initially rather than after the fact.

There may also be low cost birth control available for specific portions

of our communities; ex. low income persons, or the homeless, or those

using street health mobile services.

This funding is not designed to subsidize recreational sex and birth control for individuals, but is in recognition that though individuals may make certain choices for themselves, the consequences eventually affect an entire community and society at large. No society has ever been successful in preventing individuals from engaging in recreational or other expressions of sexuality and reproduction, but the whole group benefits from targeted harm reduction initiatives. These are investments in the public health of the larger group rather than a subsidy of an individual’s personal sexual choices.