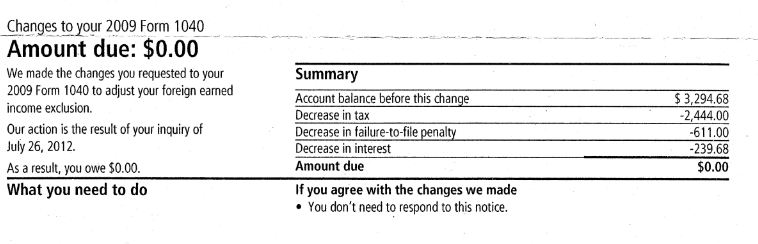

As you folks know, the IRS decided that since I didn’t fill the first part of my Form 2555 out correctly, that I must owe them a bunch of taxes. And so they sent me a federal tax bill to my Canadian address, disallowing my Foreign Earned Income Exclusion (FEIE). Today, at last, after several tries at sending them the properly filled out form, the IRS has decided that I don’t owe them anything after all. I’ve only had to deal with this 2009 tax issue for quite awhile now–readers can retrace the multiple threatening letters and bills that I received from the IRS just by clicking the above link and the links in that link, and the links in those links. The IRS has wasted its time with me. I’ve been wasting my time. I owed no tax. Zero zip nada. I am not a rich tax evader but a Canadian taxpayer and I renounced my US citizenship because I hate the hassles, the threats, and the intimidation that comes part and parcel with being an US person.

Protection

Am I filled with love and feelings of patriotism now that the United States has decided I don’t owe anything for 2009? Hardly. Those who think it is worth the hassle of paying for a tax specialist every year and remaining in compliance, instead of relinquishing US citizenship as I did, should consider that the only “service” that US citizens abroad receive in return for their continued patriotic payment of taxes without representation is the “protection” of the United States. We are learning however that even a duly appointed ambassador of the United States, after repeated requests for protection, will not necessarily receive anything, and that the President of the United States is willing to allow an ambassador to be murdered. Kelly O’Donnell writes

Here is a brief description of what we know: US Ambassador Christopher Stevens traveled from Tripoli to Benghazi, Libya. Nervous over rising unrest in this Muslim African Mediterranean nation, Stevens asked repeatedly for more security but was refused. On the day of the attack he’d asked again. He was attacked after dark, and seven hours later he was dead, along with three others. And it now appears the US had notice of the event, time to respond, and resources within reach to mount a counter-assault. What is not clear is why the American military was not sent in to save our Ambassador. (The time-line of the attack is well laid out at Powerline. (Benghazigate: The state of the story)

Now let me ask the question: If the ambassador doesn’t receive protection from the enemies of the United States, than from whom is the US citizen abroad receiving “protection”. The answer: the compliant US citizen abroad is receiving protection, in principle, from the IRS threats of fines and imprisonment. The IRS has become the biggest threat of all to our well-being and security: bigger than the combined threats of Al Qaeda, Russia, China, and Iran, and any other threat you can think of. Thus, this is mafia-like protection money, very similar to the Sopranos criminal racket of protecting business in case a window might get broken, as shown in this scene:

Hurricane Sandy

Finally, Hurricane Sandy in the United States promises to do billions of dollars of damage. Will this be the straw that breaks the fragile back of the US economy? The problem is that the debt levels at Federal, state, municipal, corporate, business, and personal levels are so overextended that they have very little flexibility. The US economy is not resilient, as Chris Martenson of Peak Prosperity says. This means that things like hurricanes and droughts may push the US of the fiscal cliff–and spiraling hyper-inflation, when the Feds decide to infuse even more hyperbolic stimulus to try to rebuild what will be destroyed in tonight’s storm.

*Congratulations, Petros. At least, after all the blood, sweat and tears that you have gone through, you have been totally vindicated. I can fully understand why you have no desire to ever step across the border again into the US, but at least you are now officially free of this false accusation so, should you do so, you can do it without fear of arrest.

Small compensation indeed. But at least you have been vindicated and I congratulate you for your persistence and your ultimate but long delayed final victory.

Thanks Roger, but remember, the FBAR statute of limitations is six years. Since I have stated publicly at this website that I am depending on the assurances of the Canadian government that they will not collect FBAR fines, I must still wonder if the US is just waiting for me to cross the border so that they can arrest me.

Also, the good 30-year IRS vet said that the IRS is watching this site and I have made myself a target. Though, perhaps he was just speaking hyperbolical-like to scare me.

Congratulations, Peter.

Your dispensation from the IRS is wonderful news and completes your long and insane process. I hope you’ll make use of that for at least one more visit to your remaining family in the US.

Reading your comment to Roger and on second thought…maybe not!

Yours has been a learning experience for those here to continue stand up for ourselves — even when you think it is all over with.

Those are very good looking zeroes, Petros, but they are long overdue

too. Perhaps the IRS, at times, lives up to the assessment of Winston

Churchill who wrote:

“You can always count on Americans to do the right thing — after they’ve tried everything else.”

You have every right to resent the hassle and the long wait.

@Calgary, that’s just 2009. I still have no word from the IRS concerning my 2010-2011 taxes, which an cross border tax specialist told me privately that I was crazy for using over the counter software (TaxAct). Then there is the 2011 taxes and 8854 which I filled out invoking Fifth Amendment privilege.

This is far from over. I think I will finally be able to visit the US again in 2018–unless of course the US is still arresting people or putting them on the “no-fly” list for making online comments against the tyrannical regime in DC.

@Em, thanks. But Churchill of course was referring to the America that we all knew as it was decades ago. He wasn’t referring to the America that sent his bust back to the British Embassy.

*Fortunately for Winston , whose mother was American thus making him a dual US citizen, he left this “vale of sorrow” before the US begain its program of financial imperalism by levying and colllecting taxes beyond its own borders and within the sovereign borders of other countries. Had congress made that law retroactive, like it did the massive tax increase in the Tax Reform Act of 1976, then perhaps they could have gone back and assesed taxes on his estate. But I guess it is a little late for that now.

*

Peter, I’m pleased for you!

*Petros, Yeah!! Great News!!

Dear Peter,

SIGH

Told ya so. I had that exact same experience, and then one more on top. I made an error on the 1116, which took 1.5 yrs to clear up. I would never had known it was cleared, had I not read here to send a $1 check instead of a registered letter. I received no response but I finally got a fresh $1 check back from the gubbermint.

Note again that there are no good gubbermints on this one. The Norwegian gobt not only made a $30,000 error on my taxes, they first only corrected half of it, then confiscated $15,000 from my following year refund while they waited another 8 months to fix it. And the Norwegians have screwed up my return 5 yrs in a row.

Congratulations, Petros.

the Bengazigate link thing doesn’t work too well. Either it is overloaded, jammed from the Whitehouse, or self-jammed-for-better-effect.

Congrats for 2009 Petros.

@petros…

One small tactical victory in a never ending battle for enduring freedom from the bureaucratic nightmare called the International Revenue Service.

@Petros, As you know I also won a FEIE dispute with the IRS, in my case for the year I expatriated, and I agree that the entire affair only increased my disrespect for those thugs.

But I don’t agree with this statement:

“The IRS has become the biggest threat of all to our well-being and

security: bigger than the combined threats of Al Qaeda, Russia, China,

and Iran, and any other threat you can think of.”

I have spent time in jail due to the war on drugs for having possession of a very small amount of a controlled substance. I have been denied entry to the US until I acquire a special visa for this reason. There are millions of homelanders rotting in jail due to this perpetual and misbegotten “war”. I think the DEA (and the DHS, DOD, CIA, FBI, …) are equally sinister to the IRS. In fact, the IRS is merely the symptom of all these self-perpetuating and uncontrollable departments’ never ending thirst for more wealth to feed the welfare state.

So to all you progressives and liberals who worship or believe in the welfare state, Canadian, US or any other, I say: Selberschuld, slave.

Actually, I don’t think it is a victory at all. The IRS did what they had to do. Once you provided the complete information, they acted as they should to determine the correct liability. What was offensive is how they immediately imposed penalties and how threatening their letters were.

Just so you know, I have a similar battle going on with the IRS, which is proving more difficult to deal with. Within OVDI, all payments for outstanding taxes were posted to 2007. OVDI instructions required that all returns be sent to OVDI in Austin, Texas. The IRS has had my payments for more than one year. I am owed a USD 5000 refund for a year that I filed timely. As the IRS and OVDI are not coordinated, I started receiving letters from the main IRS that I had not filed and paid taxes due for that year. So I sent them copies of all returns sent to OVDI and information about the payments made. What did they do? They started collection proceedings on the year I am owed a refund. It was like a comedy of errors that was not funny at all because of the consequences. They would send a letter threatening penalties that arrived after the date they told me to respond. I would respond with the same information I had already sent only to get a letter the next month with higher penalties. The last one said that I owed USD 12,000 in tax and penalties.

I have received assistance in stopping the threatening letters for a few months, but it appears that nothing can be fixed until an OVDI examiner takes my case. I have just read something which says there is up to a one year delay in assigning cases.

This is a clear violation of my rights. By disregarding the payment distribution instructions I sent with my OVDI submission, the IRS has violated my rights because “[w]here a taxpayer makes voluntary payments to the IRS, he does have the right to direct the application of payments to whatever type of liability he chooses.” Salazar v. CIR, T.C. Memo 2008-28, *34 (February 25, 2008); Estate of Wilson v. CIR, T.C. Memo 199-221, *14 (July 6, 1999); Muntwyler v. U.S., 703 F.2d 1030, 1032 (7th Cir. 1983).

Many OVDI victims have been caught in the same bind. It is ironic. Those who most valued their citizenship and wanted to voluntarily pay any taxes if they were owed are still being treated in the worst way.

Petros, the normal process eventually worked out for you. You were able to submit the correct paperwork and were not treated as a criminal, although the letters you received were awful. Those in OVDI, many of us who were led to understand that OVDI was the only way to fix any possible paperwork footfaults, are being treated as criminals and experiencing abuse and expense that we would not have faced had we ignored the IRS instructions at the time and followed the normal process for filing returns. We should have been allowed to explain ourselves in the manner that was contemplated in the Internal Revenue Manual. We have been denied this.

@Lisa, I first learned about FBAR only after having decided to renounce as a result of the HIRE Act and the exit tax on anything about $600,000 capital gains, if you were a covered expatriate (that’s when I decided to jump the Berlin Wall before I became covered). When I learned about it I began my investigation of the subject and learned from Phil Hodgen’s blog how the IRS was treating ordinary expats in the 2009 OVDP. That’s when I decided that FBAR was a trap, and there was no way I would ever comply with it.

The articles about constitutionality of FBAR and extraterritorial taxation on the side bar at this site were the eventual fruit of my stance. I, along with minister Flaherty, have thus encouraged Canadian residents to avoid the OVDI and shrug the FBAR requirements. This remains the top reason that I am still possibly a target–because I’ve run a tax protest movement, to paraphrase 30-year IRS Vet.

Confederate, I agree. It’d be easy to add a few more: the Fish and Wildlife, Agriculture, Alcohol, Firearms and Tobacco (who gave hundreds of assault weapons to Mexican drug cartels), and U.S. Customs and Border Protection, to name a few.

*Congratulations, Peter, but it’s all just further evidence that the only way for people like us to stop wasting our lives dealing with the IRS (only to prove to them that we owe no tax!) is to renounce, or document prior relinquishment of, US citizenship. Otherwise it just goes on and on and on …

Lisa, Petros, et al –

Treated like criminals, put on the hook indefinitely, dragged through data dust chained to the tailgate of an asymmetrical power maniac, administered along into seemingly perpetual bureaucratic hell. Maybe you’d be better off in jail now, assigned proper criminal status, and lodged under the provisions of speedy trial? Of course, that speedy trial blather has probably slunk off into the deepening slough of mythology about what the failed state USed to be.

Congratulations Petros! You should probably carry that paper with your passport and CLN now too. The holy trinity. Please keep fighting for the movement. We need you!

The holy trinity. Please keep fighting for the movement. We need you!

@ConfederateH

A bit off the subject of Petros FEIE

but considering your past experience with “controlled substances”, and the incarceration complex we have in America, I think this new Documentary called In the House I Live In, would interest you. It certainly does me.

@Just Me: Actually I probably won’t enjoy it, it would bring back memories. Besides I despise the system already. However, I certainly do hope the majority of homelanders watch it. The war on drugs is such a perfect example of how warped the country has become. All those departments have turned into self perpetuating fiefs that exist only to oppress and rob us of our freedom.

On Schiff Radio there is an excellent podcast interview of Stanley Kurz over his new book, Spreading the Wealth: How Obama is Robbing the Suburbs to Pay for the Cities. He discusses how Obama, Jarret, and the left used the stimulus package to set up wealth redistribution through taxes from the suburbs (white) to the innercities (brown). By doing this the hope to eliminate tax competition and between states and regions to force fairness. It is very reminiscent of what the OECD is doing at the international level to eliminate tax competition between countries so that the welfare states can milk their respective rich.

*

@Just Me and @Confederate, I agree that the War on Drugs could present further problems, especially for a renunciant who wanted to be able to always revisit the States. On a pragmatic note, tax issues aside, my understanding

is that if anyone gets done for drugs possession after no longer being a US citizen, they could find it almost impossible to ever revisit America with any sort of criminal

record to do with recreational drugs.

.

Another reason to look before leaping…