Chris Banescu at the American Thinker laments, Win an Olympic Medal, Pay the IRS, and concludes that citizenship-based taxation puts US athletes at a disadvantage, citing American for Tax Reform:

Not only do our Olympic athletes have to pay taxes on their medals and prizes – chances are their competitors on the field will face no such taxation when they get home. Because the U.S. is virtually the only developed nation that taxes “worldwide” income earned overseas by its taxpayers, our Olympic athletes face a competitive disadvantage that has nothing to do with sports.

Thanks for this article. Roger Conklin left Brazil in 1977 because Congress wanted to tax him and his business in Brazil and the Brazillian government would not let him pay anything. He and the other expats in Brazil either left Brazil or renounced their US citizenship. Then, the French step in and gave French telecommunications companies the business that Conklin’s company would have directed to American companies. That was, he estimates, a billion dollars worth of business. Conklin has testified before Congress that citizenship-based taxation is the actual cause of the trade deficit, because it makes it impossible for Americans to compete with foreigners in an overseas setting. Congress has cut off its nose to spite its face. You people are ill-served by your legislators and need to have some smarter leadership.I’ve lived in Canada since 1986, with three year hiatus in Europe. US expats who live abroad understand what it means to be at a competitive disadvantage. That’s why I relinquished my US citizenship last year, because the IRS was after my wealth. The IRS has threatened our bank accounts with 383% FBAR fines (see “When government turns predator”). We are expats, who have normal checking accounts, retirement accounts and everything else to carry out our lives here abroad. We are not money launderers, terrorists. We are not tax cheats–so the IRS and your media has portrayed us. We are law abiding tax paying residents abroad.The relinquishments of US citizenship are in the thousands (not the puny Q2 189 that WSJ reported last week–they were using the faulty incorrect lying data that the US government provides). I think that the number of relinquishments per year under Obama is around 10,000-25,000 and hope to write an article to that effect for the American Thinker. Peter W. Dunn, Isaac Brock Society

Well, can’t we presume that US athletes are residents of the US, and thus should pay tax on their prizes and whatever else? Isn’t this the residence-based taxation that we want?

Actually you are correct about world wide income. But some countries probably don’t tax prize money. I think Canada, for example, probably wouldn’t tax the prize money. If you win the lottery in the US or your Las Vegas winnings, or even here in Canada, winnings are tax free. It wouldn’t apply to tennis payers and golfers though. I don’t know for sure about Olympians. I just think the American Thinker article is brilliant because it gives a chance to complain about our problems while we’ve got homelanders attention.

*Yes Jefferson. I understand that this is the case, provided that they don´t pay taxes in England. If they do, they will only pay taxes in the USA if the US Taxes is higher that the taxes they paid in England. Am I right?

Olympic gold medalists are obviously like nobel prize winners, you know, Gore, Carter, Obama, Krugman, Stigliz, etc. They are the PC aristocracy. They are instantly part of the elite and therefore deserving of special treatment, just ask Marco Rubio:

Rubio bill eliminates federal tax on Olympic medals

Thats fairness for you. And to think the Republicans would have us believe that Rubio is a tea-party style reformer. In reality his is just like the others, providing tax loopholes for his elitist cronies that he may rub elbows with on the cocktail party circuit.

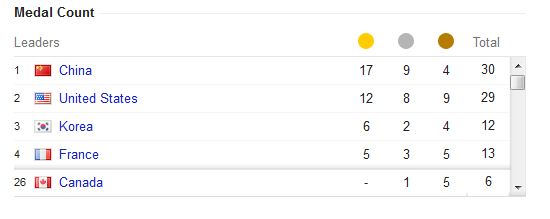

I realize now, after putting the medal count into the post, that the US is trying to find an excuse why they aren’t ahead in the medal count. BOO HOO

yeah well Petros, most greedy countries of the world tax residents on “wordwide” income. It’s just that the US doesn’t make the 6 month non-resident distiction like most other countries do. And of course, citizens of other countries are not disadvantaged by things like the FATCA and perpetual allegiance against one’s will. I’m all-for anything, like this article, that puts the spotlight on this, but unfortunately, the tax systems of most countries don’t exactly “encourage” someone winning a gold medal. This fact is a little saddening.

I don’t really understand this article – just taking part in the Olympic games in a different country doesn’t make you an expatriate or non-resident in any tax jurisdiction. The athletes all reside wherever they do normally, and have travelled abroad for a short while, and earned some money whilst they are there.

The only athletes who won’t pay tax (or will pay little) will only be paying tax as if they earned it at home, and consequently wouldn’t pay it there either.

This is a complete red herring as it has nothing at all to do with FATCA or citizenship based taxation, just the US domestic tax laws and their effect on US residents.

@p33t

I agree that this has nothing to do with citizenship-based taxation or FATCA. But, it is one more example of unbelievable overreaching and stupidity. From a sociological point of view it demonstrates what the U.S. has become – a community that is premised on envy that punishes success.

The participants in the Olympics are for the most part non-professional athletes. Their medals are not the result of some kind of business. If Congress wants to take the position that they should be taxed on their medals, then in fairness, they should accept as a deduction all the expenses incurred in winning those medals. Furthermore, since the value of the medals is taxed on top of any other income, then the deductions should be an allowable loss against any other income. (In the case of professional athletes where participation is part of their professional activity then maybe the argument is different.)

Furthermore, let’s follow the logic of this BS. Why tax only Olympic athletes? Why not tax any medal or award given by any student growing up? For example, I recently attended a high school graduation ceremony. Some of the kids received awards for a variety of things. Why should they not be required to pay a tax on the value of that award? What if a kid wins a tournament in some sport and wins a trophy? Why not tax that?

Basically, the U.S. and IRS has morphed into a society with one and only one purpose:

The purpose is to punish success plain and simple. Why? Because the country is run by “Envy specialists” like Obama, Schumer and Casey. Obama is running his campaign based on a theme of “Class Warfare”:

Vote for Obama – he will get somebody else (somebody you envy) to pay your bills!

If an athlete is a dual citizen and has a choice he/she should represent a country other than the U.S.

Only in the U.S. does health care reform require hiring a bunch of new IRS agents.

Only in the U.S. is success punished and diminished by taxing the value of Olympic medals.

https://twitter.com/USCitizenAbroad/status/231031506670329856

I also don’t understand the article. Although my experience is narrow, I haven’t seen a western country yet that does not tax on worldwide income.

The author probably heard some athletes complaining about their issues with 1116’s and 2555’s and FBARs (many of the athletes live and compete in Europe—lots of track&field athletes are in Monaco) in whatever way the athletes could express. Then the author blindly copied their complaints verbatum without research and blew the whole point in order to meet his deadline.

But even a misinterpretation is an opportunity to spread the word via other channels.

@Renounce, your point about treating training and competition as a business is extremely appropriate. Some, except those who manage endorsements, are probably losing money already to compete. The prize money, small small, is probably an opportunity to recover some costs. Taxing the medal however add insult to injury, in that it is a souvenir and should be treated as a gift not as income. The actual amount of gold and silver in the medals is minimal in any case. Imagine having to sell the medal to pay the tax on it.

The Olympics is an industry whose primary purpose is to roam through cities and countries of the world and cut ugly deals with locals who look to make a pile by forced fast-tracking of dubious megaprojects. In part this is a way to convert public money into private profits at an astounding rate.

The only host city that ever did well financially was the 1984 Los Angeles, for a convergence of good reasons, starting with being on the cusp of getting the value from broadcast rights, not indulging in insane new local infrastructure – and being in a great bargaining position because of the financial horrors of Montreal 1976 and Moscow 1980.

The governing International Olympic Committee has undisputable and multiple fascist roots. They count on ignorance, glitz, and complicity to impose absolutely one-sided contracts. Revenues are guaranteed only to them, and all risk is offloaded to host cities and governments. There is a good reason that recent host city selections have migrated away from countries with more democratic traditions. Massive repressive policing is more easily carried out in places like Sochi and Rio and Pyeongchang.

The citizens of Bern held a referendum on 2010 and said they did not want it. They knew too well the nasty corporate beast that has its hang-out just down the road – and pays no income or wealth taxes whatsoever in its Swiss “home.” A “nonprofit” with scads of money that is never publicly accounted for.

Sport of a very destructive kind – think of drug-induced body modification, think of children developed as one-dimensional machines – is the cover for a enterprise whose primary purpose is real estate and urban transformation off the backs of sucker taxpayers who may never get bright enough to see anything besides the circus.

You know when athletes in the US, such as basketball players, compete in different states they have to report and pay taxes on the portion of their income earned in each of the states where they performed. Horribly complicated for them, I’m sure. But following that logic, this is foreign-sourced income earned in the UK, obviously. So if you were resident in a country that taxes worldwide income, such as Canada, you’d have to pay taxes on it. But if you were resident in a country that does not tax foreign-sourced income, such as Belize, then you wouldn’t pay taxes on it. Of course, this is made a bit simpler than we as regular ol’ expats have it because, I would assume at least, that the UK is not charging Olympic athletes taxes on this ‘income.’ That would look way too crass for them to do.

Good point about it being prize money though. I’m not sure how that would qualify. It’s fun to think through the details, even if this is mostly irrelevant to us.

Anything that helps get this into the mainstream light is good.

Well, as long as we are ragging on the Olympics, we might as well mention the (thank God its over except in college sports) amateur slave model. Promoters made gobs of money while the athletes were threatened to not accept money or prizes. For those that were in favor, the officials looked the other way on their payments. Those that lost favor in any way were penalized and lost eligibility. Pretty much like FATCA.

On another note, I now see thru the Rubio image—- Adding another exclusion while there is free media coverage. It helps explain why he has no time or energy to answer my 8 letters.

Well here’s just one example Mitt Romney is a very wealthy man he made over 23 mill in one year and was only taxed $400 something so why is it he and others like him get to cheat the system while the rest of you who make way less then that get taxed more??? Wake up America !!

@Greg, Here is some errata. Romney paid 3 million in 2010, partly because he gave 3 million in charitable contributions:

So where did you get the $400 or something number?

if IRS tax on lottery win, does it also give credit to those who lost ? This would be same for gambling. We can look at gambling and lottery tickets purchase as investment instrument. So I think IRS should treat them just like stocks/mutual funds

@IJ, at least gambling losses are deductible in the states. But apparently not training expenses for athletes. Or?

@usxcanada, great rant. Yes, the olympics are simply a fascist/collectivist propaganda tool. Just look at how communist countries still think that the number of medals somehow covers their lack of legitimacy.

AKAIK, In order to be able to be a “professional athlete” to the IRS (and qualify for deducting expenses) you have to claim it and be able to make money at it 2 years out of 7. In principle anyone who earns a gold or silver medal knows that they will be making enough from the sport in the next few years to be able to show a profit, so they will be able to take deductions to cover their winnings just like any professional athlete.

Ok – sorry – I misunderstood the purpose of posting the article here. As I said it is a complaint against domestic tax law not necessarily the caring treatment of non-residents ;-).

Remember – these prizes are paid by the USOC, not the IOC and so are US sourced income. I don’t think that many other country’s athletes get anything at all directly for their efforts except enhanced sponsorship deals, which are taxed as income of course, so why should these payments differ? It does strike me as funny that money to the IOC derived from sponsorship of the olympics is in part paid to the in-country OCs, who then choose what to do with it. In the US this includes rewarding medal winners, so if other countries were bothered about taxing income sourced in their jurisdictions as much as the US is they may trace some of this money and demand tax from the US athletes who benefit from it financially!

A somewhat related blog post over at National Review:

http://www.nationalreview.com/corner/313014/amateur-status-nicole-gelinas

It IS a bit rough taxing their medals though isn’t it?

regarding Petros question about training deductions, just google athlete deduction tax or somesuch, and you will get links to those deductions. Of course, what comes up along with it? “ÏRS cracking down on athletes deductions” in many articles.

Boohoo, the gold medals are not even worth $500.

Fun fact here though. Not only do they NOT tax medals here in China. They are actually rewarded even more by the government. Golds give 1,000,000 RMB; Silver 500,000 RMB; Bronze 300,000 RMB. Not a bad haul at all, and it’s tax free.

Pingback: The Isaac Brock Society - Some U.S. Persons abroad are more equal than others