(Source http://www.taxesforexpats.com/expat-resources/foreign-tax-credit-american-expats.html)

(Source http://wikiposit.org/)

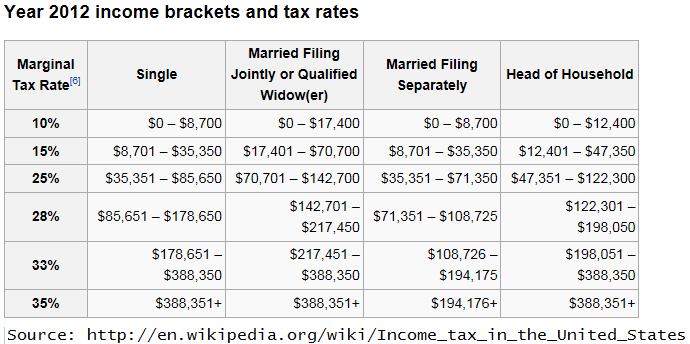

Now look at the US Federal Brackets for 2012

Just looking at these charts shows that the effect of the FEIE has been progressively eliminated both by the failure to index it to the CPI and by the collapsing dollar.

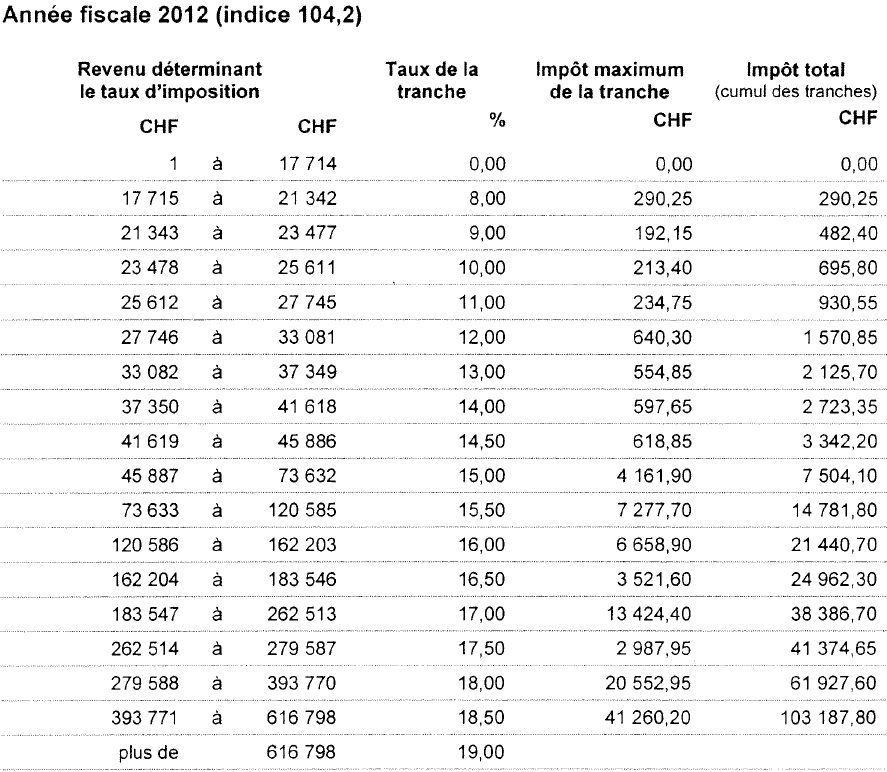

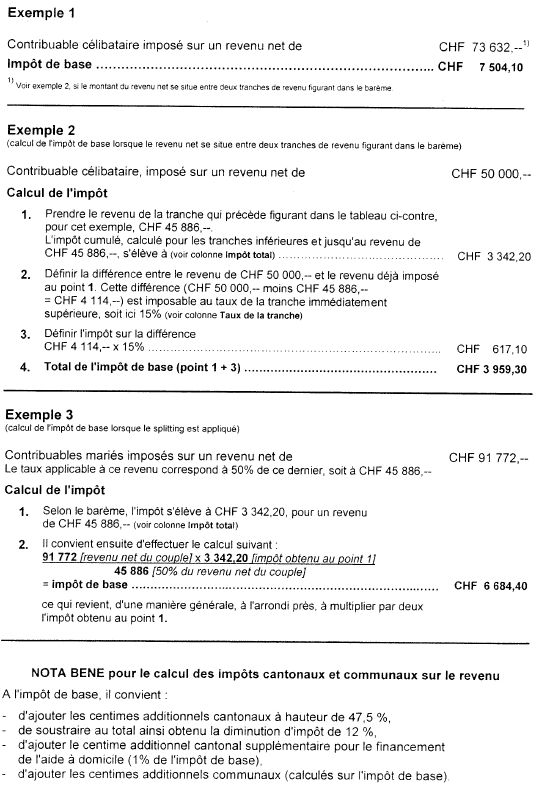

Now, let’s consider how much worse it would be if the FEIE were eliminated. Here is the calculation method for Geneva taxes (Complicated, first determine the Cantonal Tax, then the additional communal tax, then figure in the tax rebate voted some years ago to provide relief from the high cost of living). Source: http://ge.ch/impots/bareme-impot-cantonal-communal-2012

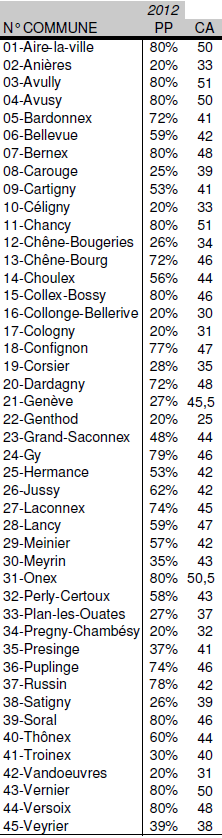

Let us use Example 3. Assume that the family has one breadwinner, a USP (Mr. Johnny Gringo), and a wife (Sophie DuPont Gringo), a non-USP who is going to school to gain skills before having a baby so as to be able to work later. The wife has no income. The family lives in Meyrin, a commune with both expensive villas and duplex homes, as well as high-rise rental blocks.

With help from @Shadow Raider (see below) we calculate base tax of 6684, add 47.5% (3175), subtract 12% (802), add 1% (67), and add the communal tax of 43% for Meyrin (2874), plus 25. 6684+3175-802+67+2874+25=CHF 12023

There is still federal tax to pay:

Source http://ge.ch/impots/bar-mes-pour-limp-t-f-d-ral-direct-sur-l

With CHF 91,772 in net income, this makes 1557 in federal direct tax. CHF 13580 total Swiss Income Tax

But wait, the base income of 91,772 was a net taxable income ! This was after deduction of social charges such as accident insurance, AVS (social security), unemployment, maternity tax, and mandatory 2nd pillar pension contribution, as well as a portion of the mandatory health insurance policy (8500-12000 per annum for the couple together, depending upon which options chosen). The gross income was probably more like CHF 110,000-120’000.

Lets say that after the standard deduction and dependant deduction of approximately USD 13,000, the USD taxable income comes to roughly USD 100,000.

Total US Tax 21890 -13580 Swiss Tax paid (assuming the near parity we have now).

————

US Tax payable after FTC 8310

And we haven’t even figured any effects of the AMT. We didn’t even count the additional US tax on the employer’s contribution (50%/50%) to the mandatory pension plan. Already, this family (if compliant) is paying 1000 Swiss Francs / Dollars extra to the US per month!!! And no housing exclusion because they don’t live in Geneva proper, Meyrin doesn’t count.

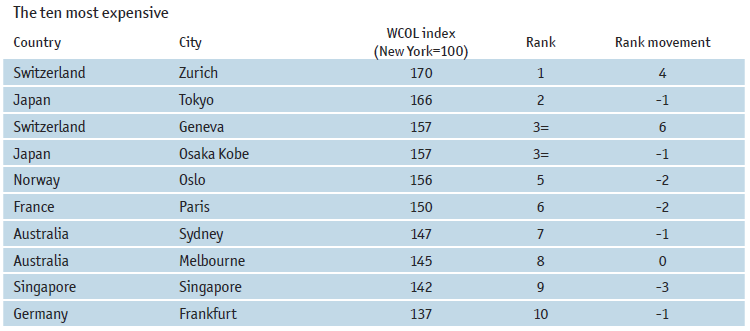

Now that you’ve calculated the tax, look at the cost of living. Geneva is more than 50% more expensive than New York, probably the US most expensive big city:

Source: http://tinyurl.com/chtdhur

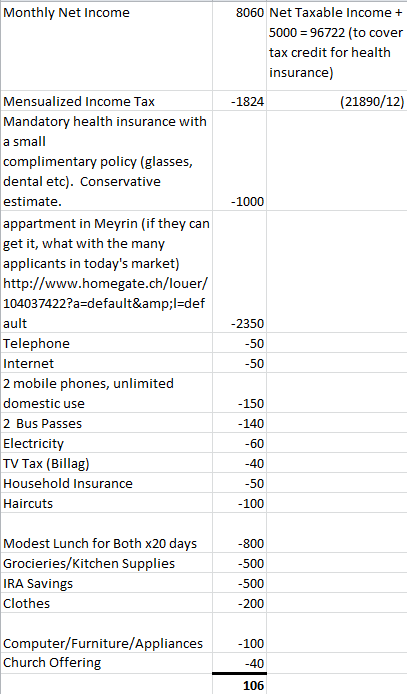

Now, let us figure a sample monthly budget for the couple. Payroll deductions such as pension plan and accident insurance, AVS have been deducted already. I added 5000 per annum for the effect of the tax deduction available in Geneva for health insurance (this is probably an overestimate):

It looks like that there are no vacations in the works, what with some 1200 francs left over per year. I forgot even to count bank fees for credit card, account, etc. And their health insurance has a 300 franc deductible, each, with 10% participation up to a few thousand francs.

This couple doesn’t have a car. Add 500 francs per month at least for the cost of the car, parking, gas and insurance– and that is a modest estimate. So, if they have a car, they pack their lunches and pay less for lunch but their grocery bill goes up. They haven’t paid the church tax to an official Swiss church (much more than 10 francs per week) because they attend an Anglophone Episcopal church in Geneva and put some money in the plate. They haven’t made any charitable contributions to Red Cross or such. Where is the money for vacation? Not much left with some 2100 francs per year. What about the baby clothes and pram? How about a ski weekend here or there? What about trips to the “homeland”. Forget it.

Oh, and Mr. Johnny Gringo becomes Swiss. He is now 28 years old. He pays about 1500 francs for the whole process. (Naturalization fee, plus all of the fees for the documents that he has to present, fees for new arrival in Geneva–wife is from the Swiss Canton of Vaud so he needs to reregister himself as a non-Genevan resident of Geneva, passport and ID fees). At the end of the year, guess what, he gets his draft book stamped “NOT CONSCRIPTED”. He is considered too old to start out as a recruit. Violà= bill of 1500 bucks more per year until age 31 for the military.

We haven’t considered another possibility. This is the real 2012 universe and the FEIE hasn’t been repealed (yet). Mr. Gringo got laid off from his job in Geneva. The unemployment office pays him 77,000 for a year. This is unearned income, so the FEIE doesn’t apply. Now has to pay USD 15270 in US taxes with only about CHF6000 in Swiss taxes to set it off. His tax bill is 1310 per month instead of 1824. Result, even if we convert lunches to grocieries at a lower rate, the couple is pretty much in the red, because he is also earning some 1600 less per month.

Swiss law states that Mr. Gringo has to look for work within 4 hours round trip of his residence, or lose his benefits. After a year, Mr. Gringo has only 6 months left on his unemployment benefits, and he manages to find a job in Lausanne that is more challenging and better paid but there are commuting costs involved. Mr. Gringo goes to work for a company in Bussingy Vaud, earns 30k more and the train/bus connections are not so hot so he buys a car. His hours are variable and sometimes he has to stay late or come early to have phone calls with other time zones. He is able to deduct the 30kCHF from his taxes in Geneva, as this is what his kilometer-based commuting expenses come to, so he still basically pays CHF 12023 in Swiss income tax as before. The 30k bascially goes for the purchase of the car amortised for the year over 6 years, gas and insurance. This is the real 2012 universe so we can write off his original 90k-odd income via the FEIE. But now he’s got 30k more not covered by the FEIE, and not taxed by Switzerland because Geneva allows deduction of commuting expenses (the US does not). That 30k is taxed between the 28% and 33% tax brackets in the US. Oops, now Mr. Gringo is NEGATIVE 10 grand per year. He is now earning less than before, and can’t even pay the bills. Then the baby comes. 2013 has already come and gone and 2014 is well underway and FATCA is starting to catch up with them.

Mrs. Gringo gets her account at Raifeissen cancelled because Mr. Gringo had signatory authority on it and the bank caught on. She is forced to sell her stocks at a loss. Mr. Gringo gets screwed around by another bank and has to bank in the Canton of Vaud at a smaller bank who only takes him because he has become Swiss. Then they discover that they were never tax compliant because they didn’t count the employer’s pension contributions as taxable income in the US. There is no money left each month after paying basic expenses to survive, and now they are in debt. The family allocations they now get for the baby are taxed by the US as unearned. The rent and health insurance go up a few hundred a month. Mr. Gringo’s company isn’t increasing salaries and bonus was nonexistant this year.

Mr. Gringo checks with the US consulate. The waiting list for renunciation is 1 year. He is not sure that he wants to give up US citizenship either and doesn’t see how he can survive in Switzerland under this double tax regime. Mrs. Gringo goes apeshit. She divorces Mr. Gringo, who finally flees to the US because he can’t make ends meet anymore. He now lives in a tiny appartment in New York with the IRS on his back, and oh, there is still the Swiss military tax to pay, and he didn’t know that New York wanted to tax his Swiss earnings as well (he grew up in New York and was resident there before moving to Switzerland with his wife who had studied in New York). New York is trying to screw him for taxes, and is even trying to go after ex-Mrs. Gringo as somebody found out that they had a standard communal property marriage. (The Swiss divorce court, in its ignorance, didn’t take into account the double tax liability). And Ex-Mrs. Gringo is now on welfare in Geneva because Mr. Gringo can’t pay the child support and she can’t find a good enough job that would cover child care, and what’s more is cronically depressed that all of this happened.

She writes the New York congresscritters, who tell her to buzz off because she is not American. She writes her swiss deputés, who snub her. She is ruined. She is now 30, has finished her education, but is essentially unemployable. She will likely never be able to work in Switzerland as she has little work experience, and if she can’t get child care now, she certainly isn’t going to get any experience before she is too old.

The Swiss bill collectors are pounding on her door for unpaid taxes and health insurance. The state of New York is even trying to collect from her via the Swiss debt collection authorities. The IRS is calling her every other week. Mr. Gringo forgot to un-register himself from Geneva so even though they are now divorced, the Swiss police are knocking on her door because he has been taxed automatically by Geneva (“taxation d’office”) as if he still had the same job, and they want to know where the hell he is, after all, he is Swiss. Mr. Gringo tries to write the Geneva autorities to get them to stop, but they are asking him for a document of population office registration in New York, which he does not have, because this does not exist in New York, all he has are his tax returns from his new job in New York. He gets responses back in French that he doesn’t understand because his wife always filled out the taxes in Switzerland.

Why has all of this happened? Why was this young couple destroyed? American extraterritorial hubris and Swiss authorities and parliamentcritters who lack nuts and conviction.

“Mrs. Gringo goes apeshit” lol Sounds about right.

You’ve clearly thought this out well. I feel for you. The only real solution to this is for the U.S. to switch to residency-based taxation.

____

“We put our energies into the tentacle of this matter that directly

affects us, learn from each other, and collectively are attacking it on

all fronts.”

Totally agree. For some it’s Canadian issues, for some it’s Swiss. For me it’s self-employment abroad. We all have our points of extra pain. But we all come together on the fact that the only solution to this is to end citizenship-based taxation.

@confH. Wouldn’t any Canadian victory be precedent for other countries?

@ConfederateH, It’s very easy to refute the “tax morale” argument. Places without income tax like the Cayman Islands and the Emirates usually have high consumption taxes, import duties and various fees (and Paraguay does have income tax). Products and utilities there are more expensive than elsewhere. These places also tend to be isolated and have poor infrastructure. It’s not really a “sweet deal”. Also, no one complains about people moving from New York or California to Florida or Texas to avoid state income taxes.

Please try to have some hope. I’m writing a bill to eliminate citizenship-based taxation from the Internal Revenue Code, and I’m more than halfway through. ACA is opening an office in Washington, DC in a couple of months to be in direct touch with congressmen, and it has already agreed to use my bill. We have very strong arguments backed by a wealth of data. It’s not impossible.

NEWS: http://www.nytimes.com/2012/07/31/us/politics/presidential-commission-sought-on-us-expatriates.html

Sounds nice, but how about saving $3 million a year and just ending citizenship-based taxation instead?

Will somebody post that NY Times Brian Knowlton article as a separate thread?

RE: NYT article — A presidential commission might just be a presidential ploy to give

hope to expats in exchange for their votes. Notice the wording — how the federal government serves those abroad. It’s like they actually imagine the federal government “serves” those aboard and chances are pretty good the conclusion will be just as they imagine it to be. However, we have to grasp at all straws at this point while continuing our individual efforts to become either free of the IRS or compliant with the IRS as quickly as possible, within the current framework and always bearing in mind that the framework could get even more onerous in the future. And let’s remember Brian Knowlton’s other article too … https://www.nytimes.com/2010/04/26/us/26expat.html

“A spokesman for the Internal Revenue Service said it did not normally comment on pending legislation.” http://www.nytimes.com/2012/07/31/us/politics/presidential-commission-sought-on-us-expatriates.html

Douglas Shulman was always ready to comment ad nauseaum on those living abroad and FATCA, while calling every ordinary bank account outside the US a ‘foreign’ ‘hidden’ asset – never addressing us at all unless describing those abroad negatively and disingenuously as cheats, criminals, fraudsters and money launderers and responsible for the ‘tax gap’ – with no proof – in the only instances where the IRS ever addressed those deemed ‘taxpayers’ ‘abroad’ at all, but on this mainly symbolic effort, the IRS can’t comment?

I appreciate the effort by Carolyn Maloney, but who would trust the rest of the Democrats or Republicans? Are Levin, Baucus, Schumer, et all going to vote for this? What about Tierney, and those who’ve been abusing us so consistently – over years?

The IRS hasn’t even released those long awaited ‘helpful’ ‘simplified’ compliance guidelines for ‘low risk’ filers – possibly so narrow that only unicorns will be able to benefit.

@Bubblebustin: Most tax agreements are bilateral, Canada may well negotiate a special agreement that only applies there, history is replete with examples of this.

@Shadow Raider: Sales taxes and “various fees” are not progressive (the “rich” won’t have to pay their “fair” share). It is so bad that anything that is not “progressive” is automatically referred to as “regressive”, as in “sales taxes are regressive”. So to argue for flat-taxes is not only not “progressive”, but is likely to get you labeled as racist if you are a politician.

@Michael: “But we all come together on the fact that the only solution to this is to end citizenship-based taxation.”

Sorry, no. The corruption is endemic, it has metastacized throughout the entire culture which is being carved up and looted by the corporatists. Just look at the London olympics as a shining example. The empire is dying, its just going to keep getting worse. Ron Paul was a last chance that the US didn’t deserve, and boobus Americanus blew it. I can’t say when it will stop getting worse, but as long as the Fed and the banker cartels control money creation throughout the world things won’t get better. The collapse of the world wide network of US military bases would be another good indicator. In any case you can expect the full on assault against your rights to continue, and enforcement of citizenship based taxation is nothing but a symptom of a far larger malaise. Just wait until hyperinflation and/or war starts and the majority of people are left destitute.

Do you really think that they will simply drop citizenship based

taxation? One tax-specialist interview posted here at IBS went into the

“tax morale” issue and how the homeland slaves get upset when they

think expats are getting any kind of a sweet deal (ie. paying no income

taxes when they live in Caymans, Paraguay or Dubai). Plus taxes are

such a convenient wedge issue for demogogs. They say what they want to

gain power, but what they actually do will be completely different (hope

and change).

Confederate, Steven: This is a very outdated argument. Aside from some anecdotal evidence in the Middle East, I can’t think of anywhere that is completely “tax free”. But even then, I doubt that there are no indirect taxes. Only using income tax as a measure of the total tax paid is showing a very miniscule part of the picture. Alas, as smart as Americans think they are, I doubt most of them question what they are told about places outside of their borders. I sometimes wonder what I would be like as a “typical” American had certain events not occurred that put me where I am today…

Geeez, I disagree. Some of my siblings live in California and I have been having this discussion about tax systems with them for decades. If I say “but we have VAT too” they say “we have sales tax too”, “and property tax”. Besides, it is the income tax that is the most odious of all and skipping out all together by going to a no-income-tax haven makes homelander’s look like fools. Not good for tax morale at all. Obama also said this exactly when he said he wanted to raise capital gains taxes even if it reduces revenue. It’s about “fairness” he said. And Romney also won’t dare risk his political neck for expats by being seen as spending the peoples money giving expats “tax cuts” right when taxmeggadon is happening to everyone else in 2013:

“Wave one is as we talked about last week is simply the expiration of

the Bush 2001 and 2000 tax relief bills. And very simply, the 10

percent rises to 15; the 25 percent bracket goes to 28; the 28 goes to

31; the 33 goes to 36; and the 35 percent bracket rises to 39.6. The

marriage tax penalty comes back, and the estate taxes come back. The

estate tax rates goes from 35 to 55 percent and the exemption drops from

5 million to 1 million.

And then the second wave we talked about

were the Obama tax hikes and that is the capital gains rate will go

from 15 percent to 23.8; taxes on dividends will go from 15 percent to

43.4; on top of that, you’re going to have the special needs tax go

away. There will be an increase in the Medicare payroll tax from 2.9

percent to 3.8 percent. There will be an excise tax at 2.3 percent on

medical devices and your itemized deductions for medical expenses are

going to be limited. Right now, you can deduct anything over 7 ½

percent of your adjusted gross income; the figure rises to 10 percent.

And

then the third wave of taxes that go into effect will be the

alternative minimum tax, which will probably impact about 31 million

families.

And Wave Four which we talked about — we didn’t go

through all of them — it’s a 46 page document from the Joint Committee

of Taxation and it’s expiring tax benefits to businesses. In 2012,

there’s five pages of tax deductions that will go away for businesses,

and there’s about another four or five pages in 2013, and it goes all

the way to 2014. “

When I can get back to my home PC, I did some similar analyses and found that the average On-Shore American earning 100kUSD in 1999 enjoyed a 6% reduction in their US income tax because of the Bush Tax cuts, while the average American in Switzerland saw a 21% increase in US federal income tax. I did that analysis independent of the FEIE and just based on Foreign Tax Credit (FTC). (Remember, that the Bush Tax Cuts extension (TIPRA) offered Americans on-shore generous tax breaks by raising taxes on Americans off-shore through cost-of-living caps, but mostly through the stacking provisions.)

This difference was largely created by foreign exchange issues faced by Americans Abroad. Unlike Americans On-Shore, we do not enjoy income tax rates that are based on actual higher earnings. They, at least have the solace of having more net income as their tax rates climb due to higher actual earnings. Our US tax rate is much more dependent upon the value of the US dollar against our home currency and it has consistently declined in value, so we face ever higher tax rates without the corresponding increase in real income.

If you take Jeff’s analysis and follow it for, say a decade, you will find that the American off-shore is pay a substantial tax premium to the US Federal Government. On top of this, some of the States take advantage of the opportunity to tax Americans Abroad. The FEIE generally protects low-income Americans Abroad from the States’ additional expropriation, but once an American Abroad’s income is driven above the FEIE, they get a dose of State income tax as well. Note also, that some states have opted out of FTC so that they can get access to the full income of the American Abroad.

On top of this, pay attention to your retirement savings and your home. The decline of the USD has created artificial capital gains for Americans Abroad. You will be taxed by the US Fed for these artificial gains. What would be interesting is to do Jeff’s analysis on an American On-Shore saving into a 401k account that earns zero percent interest and gains and compare that to an American Off-Shore saving into third pillar (Swiss, tax deferred savings account) also earning zero percent interest over the last decade. I am sure that what you will find is shocking.

Let’s call the on-shore American Homer and the off-shore Gomer. Let’s say Homer can save 5kUSD pa and that it is matched 1:1 by his employer. That’s 10kUSD pa. Let’s say Gomer makes the same rate of savings in his 3rd Pillar (which is a mandatory programme as Jeff mentions). To keep this honest, let’s use the 2002 USD to CHF Exchange Rate of 1 USD = 1.65 CHF. This will mean that Gomer is actually depositing 16,500 CHF each year.

First, Homer gets a generous tax break on his savings. All 10k will go into his 401k, undiminished by State and Federal taxes. Gomer is not so fortunate. His 10k will be taxed at the highest marginal rate by both the Fed and his State. For this example, let’s say that would be 28% for the Fed and 5% for the state. What goes into his 3P account the first year will be 6,700 USD of 11,055 CHF. The USD savings will vary from that year forward because of exchange rate.

In 2012, Homer has 100,000 USD in his account and he can begin withdrawing that money for this retirement. Of the original 165,000 that Gomer invested, he has only 110,550 left, but his US tax nightmare is not over. The US will add about 23,000 in artificial capital gains and the tax on that (before 1/1/13) will be 3,450 USD. So, his net available for his retirement will be about 107,000 CHF. The total taxation from the US and before any Swiss tax is 54%.

But Homer also has another generous tax break from Uncle Sam that his countryman, Gomer is denied. His house is protected from US capital gains tax if it is under 1 million USD. A 500k USD home in Peoria, IL will buy quite a spread. However, 1 million USD will get Gomer a nice 1500 square foot apartment to squeeze his family into and… that 1 million USD home purchased in 2002 is now worth 1.65mUSD assuming that there has been no actual price appreciation. Gomer cannot qualify his entire mortgage for US mortgage deduction and he will face more US capital gains when he sells it. And… heaven forbid that he leave it to his non-US spouse when he dies. She may as well just give the keys to the US Treasury and leave their furniture in it…

@zuludogm The 2nd pillar is mandatory, the 3rd is not, but if one doesn’t invest in it, retirment would not be feasible. 3rd Pillar accounts can earn well over 1%, depending upon the bank. There are also minimum rates for the 2nd pillar.

Pingback: The Isaac Brock Society - Reps. Maloney, Honda, Rangel introduce bill to create bipartisan commission on how U.S. government serves Americans living overseas