(Source http://www.taxesforexpats.com/expat-resources/foreign-tax-credit-american-expats.html)

(Source http://wikiposit.org/)

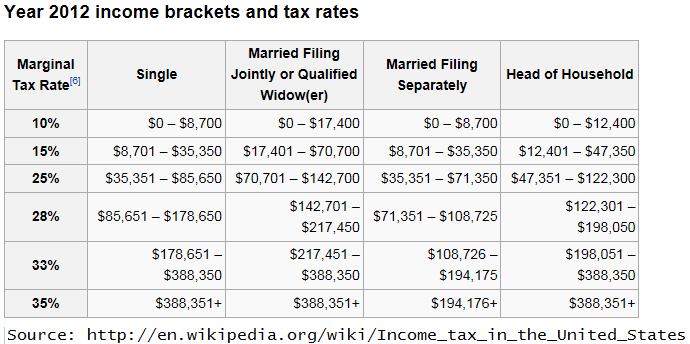

Now look at the US Federal Brackets for 2012

Just looking at these charts shows that the effect of the FEIE has been progressively eliminated both by the failure to index it to the CPI and by the collapsing dollar.

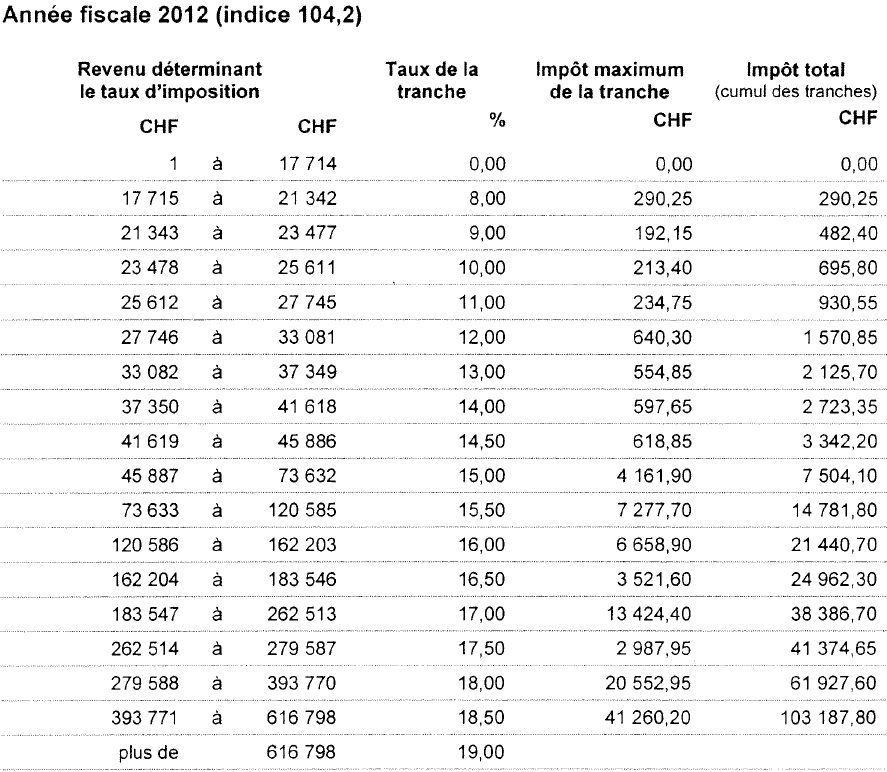

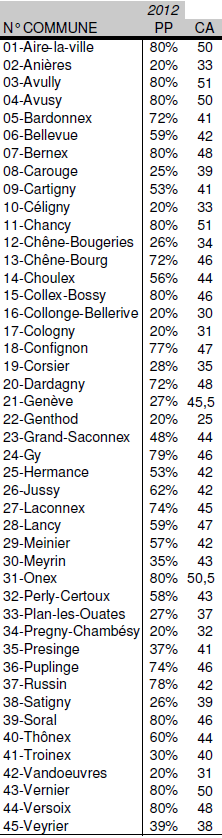

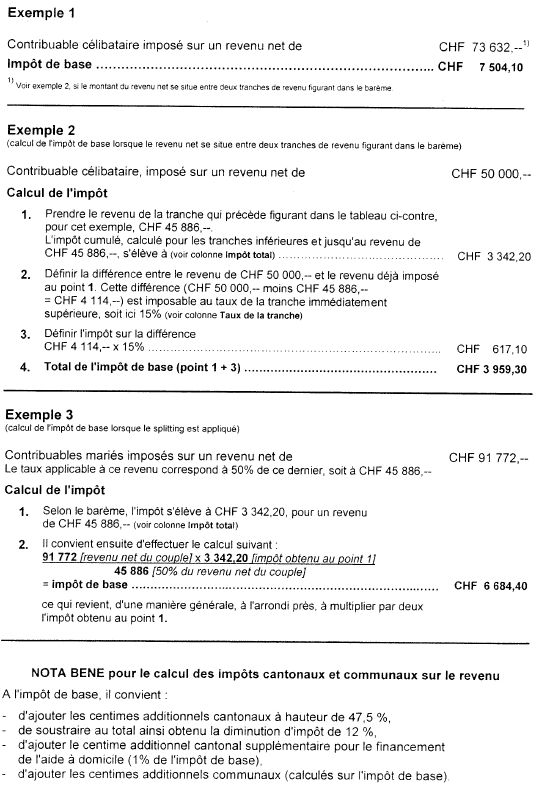

Now, let’s consider how much worse it would be if the FEIE were eliminated. Here is the calculation method for Geneva taxes (Complicated, first determine the Cantonal Tax, then the additional communal tax, then figure in the tax rebate voted some years ago to provide relief from the high cost of living). Source: http://ge.ch/impots/bareme-impot-cantonal-communal-2012

Let us use Example 3. Assume that the family has one breadwinner, a USP (Mr. Johnny Gringo), and a wife (Sophie DuPont Gringo), a non-USP who is going to school to gain skills before having a baby so as to be able to work later. The wife has no income. The family lives in Meyrin, a commune with both expensive villas and duplex homes, as well as high-rise rental blocks.

With help from @Shadow Raider (see below) we calculate base tax of 6684, add 47.5% (3175), subtract 12% (802), add 1% (67), and add the communal tax of 43% for Meyrin (2874), plus 25. 6684+3175-802+67+2874+25=CHF 12023

There is still federal tax to pay:

Source http://ge.ch/impots/bar-mes-pour-limp-t-f-d-ral-direct-sur-l

With CHF 91,772 in net income, this makes 1557 in federal direct tax. CHF 13580 total Swiss Income Tax

But wait, the base income of 91,772 was a net taxable income ! This was after deduction of social charges such as accident insurance, AVS (social security), unemployment, maternity tax, and mandatory 2nd pillar pension contribution, as well as a portion of the mandatory health insurance policy (8500-12000 per annum for the couple together, depending upon which options chosen). The gross income was probably more like CHF 110,000-120’000.

Lets say that after the standard deduction and dependant deduction of approximately USD 13,000, the USD taxable income comes to roughly USD 100,000.

Total US Tax 21890 -13580 Swiss Tax paid (assuming the near parity we have now).

————

US Tax payable after FTC 8310

And we haven’t even figured any effects of the AMT. We didn’t even count the additional US tax on the employer’s contribution (50%/50%) to the mandatory pension plan. Already, this family (if compliant) is paying 1000 Swiss Francs / Dollars extra to the US per month!!! And no housing exclusion because they don’t live in Geneva proper, Meyrin doesn’t count.

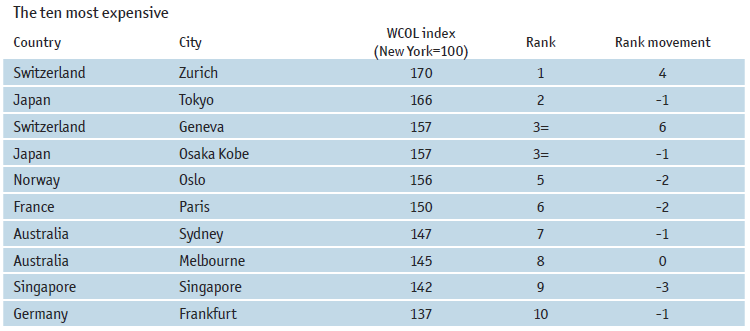

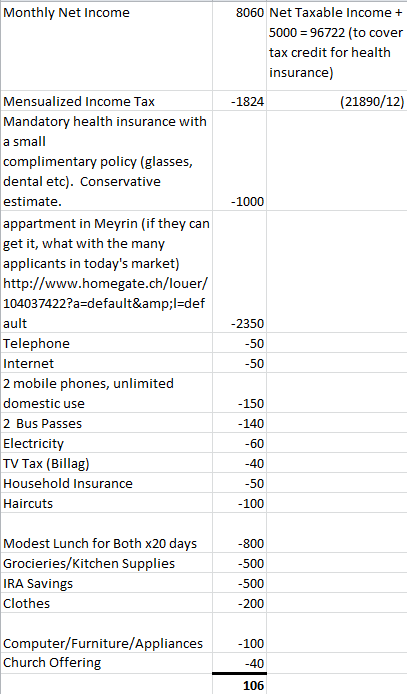

Now that you’ve calculated the tax, look at the cost of living. Geneva is more than 50% more expensive than New York, probably the US most expensive big city:

Source: http://tinyurl.com/chtdhur

Now, let us figure a sample monthly budget for the couple. Payroll deductions such as pension plan and accident insurance, AVS have been deducted already. I added 5000 per annum for the effect of the tax deduction available in Geneva for health insurance (this is probably an overestimate):

It looks like that there are no vacations in the works, what with some 1200 francs left over per year. I forgot even to count bank fees for credit card, account, etc. And their health insurance has a 300 franc deductible, each, with 10% participation up to a few thousand francs.

This couple doesn’t have a car. Add 500 francs per month at least for the cost of the car, parking, gas and insurance– and that is a modest estimate. So, if they have a car, they pack their lunches and pay less for lunch but their grocery bill goes up. They haven’t paid the church tax to an official Swiss church (much more than 10 francs per week) because they attend an Anglophone Episcopal church in Geneva and put some money in the plate. They haven’t made any charitable contributions to Red Cross or such. Where is the money for vacation? Not much left with some 2100 francs per year. What about the baby clothes and pram? How about a ski weekend here or there? What about trips to the “homeland”. Forget it.

Oh, and Mr. Johnny Gringo becomes Swiss. He is now 28 years old. He pays about 1500 francs for the whole process. (Naturalization fee, plus all of the fees for the documents that he has to present, fees for new arrival in Geneva–wife is from the Swiss Canton of Vaud so he needs to reregister himself as a non-Genevan resident of Geneva, passport and ID fees). At the end of the year, guess what, he gets his draft book stamped “NOT CONSCRIPTED”. He is considered too old to start out as a recruit. Violà= bill of 1500 bucks more per year until age 31 for the military.

We haven’t considered another possibility. This is the real 2012 universe and the FEIE hasn’t been repealed (yet). Mr. Gringo got laid off from his job in Geneva. The unemployment office pays him 77,000 for a year. This is unearned income, so the FEIE doesn’t apply. Now has to pay USD 15270 in US taxes with only about CHF6000 in Swiss taxes to set it off. His tax bill is 1310 per month instead of 1824. Result, even if we convert lunches to grocieries at a lower rate, the couple is pretty much in the red, because he is also earning some 1600 less per month.

Swiss law states that Mr. Gringo has to look for work within 4 hours round trip of his residence, or lose his benefits. After a year, Mr. Gringo has only 6 months left on his unemployment benefits, and he manages to find a job in Lausanne that is more challenging and better paid but there are commuting costs involved. Mr. Gringo goes to work for a company in Bussingy Vaud, earns 30k more and the train/bus connections are not so hot so he buys a car. His hours are variable and sometimes he has to stay late or come early to have phone calls with other time zones. He is able to deduct the 30kCHF from his taxes in Geneva, as this is what his kilometer-based commuting expenses come to, so he still basically pays CHF 12023 in Swiss income tax as before. The 30k bascially goes for the purchase of the car amortised for the year over 6 years, gas and insurance. This is the real 2012 universe so we can write off his original 90k-odd income via the FEIE. But now he’s got 30k more not covered by the FEIE, and not taxed by Switzerland because Geneva allows deduction of commuting expenses (the US does not). That 30k is taxed between the 28% and 33% tax brackets in the US. Oops, now Mr. Gringo is NEGATIVE 10 grand per year. He is now earning less than before, and can’t even pay the bills. Then the baby comes. 2013 has already come and gone and 2014 is well underway and FATCA is starting to catch up with them.

Mrs. Gringo gets her account at Raifeissen cancelled because Mr. Gringo had signatory authority on it and the bank caught on. She is forced to sell her stocks at a loss. Mr. Gringo gets screwed around by another bank and has to bank in the Canton of Vaud at a smaller bank who only takes him because he has become Swiss. Then they discover that they were never tax compliant because they didn’t count the employer’s pension contributions as taxable income in the US. There is no money left each month after paying basic expenses to survive, and now they are in debt. The family allocations they now get for the baby are taxed by the US as unearned. The rent and health insurance go up a few hundred a month. Mr. Gringo’s company isn’t increasing salaries and bonus was nonexistant this year.

Mr. Gringo checks with the US consulate. The waiting list for renunciation is 1 year. He is not sure that he wants to give up US citizenship either and doesn’t see how he can survive in Switzerland under this double tax regime. Mrs. Gringo goes apeshit. She divorces Mr. Gringo, who finally flees to the US because he can’t make ends meet anymore. He now lives in a tiny appartment in New York with the IRS on his back, and oh, there is still the Swiss military tax to pay, and he didn’t know that New York wanted to tax his Swiss earnings as well (he grew up in New York and was resident there before moving to Switzerland with his wife who had studied in New York). New York is trying to screw him for taxes, and is even trying to go after ex-Mrs. Gringo as somebody found out that they had a standard communal property marriage. (The Swiss divorce court, in its ignorance, didn’t take into account the double tax liability). And Ex-Mrs. Gringo is now on welfare in Geneva because Mr. Gringo can’t pay the child support and she can’t find a good enough job that would cover child care, and what’s more is cronically depressed that all of this happened.

She writes the New York congresscritters, who tell her to buzz off because she is not American. She writes her swiss deputés, who snub her. She is ruined. She is now 30, has finished her education, but is essentially unemployable. She will likely never be able to work in Switzerland as she has little work experience, and if she can’t get child care now, she certainly isn’t going to get any experience before she is too old.

The Swiss bill collectors are pounding on her door for unpaid taxes and health insurance. The state of New York is even trying to collect from her via the Swiss debt collection authorities. The IRS is calling her every other week. Mr. Gringo forgot to un-register himself from Geneva so even though they are now divorced, the Swiss police are knocking on her door because he has been taxed automatically by Geneva (“taxation d’office”) as if he still had the same job, and they want to know where the hell he is, after all, he is Swiss. Mr. Gringo tries to write the Geneva autorities to get them to stop, but they are asking him for a document of population office registration in New York, which he does not have, because this does not exist in New York, all he has are his tax returns from his new job in New York. He gets responses back in French that he doesn’t understand because his wife always filled out the taxes in Switzerland.

Why has all of this happened? Why was this young couple destroyed? American extraterritorial hubris and Swiss authorities and parliamentcritters who lack nuts and conviction.

Interesting juxtaposition of the falling dollar vis-a-vis CHF and the falling adjusted value of the FEIE. The FEIE is like any other measure–apparently generous at start, but eventually devalued to next to nothing through relentless inflation. The same is true of tax brackets. The same is true of the so-called risk, when Obama says for example that the rich make 250K+. That’s not rich. That’s barely enough to pay your mortgage payments, your student loan payments (because presumably you have 250K in student loans) and save a little for retirement.

The same is true of the so-called $10,000 aggregate. In 1974 when the Bank Secrecy Act was passed, $10,000 was the equivalent of $50,000 today. Still a trivial sum, but at least it wasn’t a ridiculously pitiful amount of US dollars (with zero intrinsic value).

Geneva is one of the most overpriced and most socialist cantons in Switzerland and the Genevois are known for being as arrogant as the Parisians. Zug or Schwyz have much lower tax rates and the size of the US rape would have been even higher there.

My impression is that most of the Canada based expats here could care less about problems that Swiss expats are facing as long as Obama/Geitner are willing to provide OVDI/FATCA/FBAR relief for Canadians. My impression is that most of the Canada based expats here have no problem with the US income tax system as it is as long as they are exempted from it.

And this is the problem with articles like this that shed light on instances of US income tax injustice: they are merely pin pricks. Just look at what the Fed has been doing since its inception: counterfeiting money and stealing wealth from Americans for a century. Every gain in productivity for a century has been stolen by the Fed through its “inflation targets” and money printing. FDR even seized the peoples gold in 1933 when it was still constitutionally the only form of money the federal government was allowed to issue. Even now if some US citizen happens to hold real money (gold) the IRS claims 28% of any “capital gains” on this constitutionally specified real money. How the f*** does that work, capital gains on money? How about the draft and selective service (the US Military were after my son before he died)? How about all those non-defensive wars of choice? How about Posse Comitatus? How about Obama care?

The US government is an illegitimate thugocracy but they are the ones who get to decide what constitutes “fair” taxation on the slaves. As long as you allow yourselves to remain chained to this slave state and are not willing to take measures to free yourselves, then really you are Selberschuld. Vote with your feet. Right now you can still free yourselves, but how much longer is not clear.

Why I’m leaving America

@ConfederateH This site is not just about Canadian USPs, but a place for everyone to share their cases. We are talking about destroyed lives here. Canadians’ major issues are probably FBAR and FATCA (less so double taxation, except perhaps where real property and self employment are concerned). But Canadians would have more arguments if they use the cases in other countries, which show that US policy is unjust, discriminatory, and vile.

@Jeff, thanks. It has been our editorial decision from the onset of this website to promote our international writers–meaning that it is very important to us to have these international, non-Canadian writers who have been making extremely fine contributions to the Isaac Brock Society.

Canada has very high income tax rate that is comparable to the US, so it is true that our major concerns are FBAR and FATCA; and other bank accounts whose earnings are not sheltered by the long arm of the IRS: TFSA, RESP, and RDSP. Also, an investor like me must renounce citizenship because the most important shareholders (in the words of Warren Buffet) are your C shareholders, local, provincial and federal governments, who expect a dividend, but normally provide no capital and do not share in any losses that you might have. The last thing I need is a D shareholder (US government) to glean anything left over after the Canadian government has had its pickings of the first fruits. What would be left for me?

@ Petros

As a frequent Canadian visitor to IBS and infrequent poster, I am extremely interested in the issues facing USPs around the world. Frankly, I am somewhat horrified by what Swiss residents are going through with their banks.

It would be great if IBS could reach out to USPs (or former USPs) in places we haven’t heard from, especially Mexico.

@Confederate H,

Talk about a life-changing experience! I’m one of the approx 117,000 former US citizens in Canada that the US has basically tried to re-claim as citizens retroactively!

That doesn’t mean I don’t care about what the US is doing to its citizens in Switzerland, which you guys are bringing to our attention. It’s egregious, and I read that the US ambassador there seems to ignore it! And I certainly see the relevance and connectedness of your situation to ours, both former and current USCs in Canada.

Each of us can’t fight on every issue. But we’re all learning the big picture from each other.

I am horrified by what I read about the everyday banking/mortgage problem in Switzerland and have forwarded links on it to a friend in US … that’s not much, I know, but I’m trying to help get more info into the US about what these policies are doing world-wide. I definitely feel that any aspect of these policies has relevance beyond the borders of any one country.

Because of my personal nightmare, I had to focus on researching DOS expatriation issues, particularly as related to persons who relinquished years ago under the former law. I got my case straightened out, but I continue to research this topic, and also relinquishment/renunciation in general, and share this research with others. Some people focus on tax issues, some focus on green card issues, etc. We put our energies into the tentacle of this matter that directly affects us, learn from each other, and collectively are attacking it on all fronts.

It would be a little easier to show that the exemption does nothing for international oil workers or salesmen in Kazakh, Saudi, Kuwait, Egypt, UAE, Singapore. These are all tax-free/reduced areas where USA has a vested business, cultural, and military interest in having motivated citizen ambassadors. However, there is no sense going there when the IRS is tagging along and taking out any of the gains.

@hazy2, I think our ability to reach out to Mexico is related to the linguistic barrier of Spanish. I said that, as matter of coincidence, just yesterday. But it also means that those Spanish only speakers are somewhat insulated from the some of the most harmful aspects of the IRS’ propaganda war.

Juxtapose the Gringo families treatment with this comment from a Bruce Krasting article on ZH:

Lets see, the legal US person who can vote is located overseas and who is getting raped is not of color. The illegal future democrat is living high on the hog and is a core Democrat party interest group and is of color. Racism? Discrimination? Bigotry? Unfairness?

@ConfederateH Another reason why USPs abroad should not pay.

We have are own burdens here such as the Roms and asylum seekers who beg, steal, and sell drugs. We can’t pay for the US handouts to cheaters as well.

I would be very interested to see connections to the immigrant situation into USA. To date, I have only surfed across chats from Indian immigrants wading through the FBAR mess. Also, I spoke to a European neighbor who is now establishing a business in New York city. His accountant informed him that his smartest option is to move in all of his financial assets along with him to USA.

The number of immigrants ought to surpass the number of americans abroad. Their stories would affect Senators in Florida, Texas, California, and now there are also immigrants spreading out through all the regions. Combine their voices with all of the Dream Act hullabaloo and maybe someone will start listening.

P.S. The Swedish ambassador is a lawyer specializing in anti-corruption. I wonder why Obama chose him—-was it because of all the corruption and FATCA tax haven cases he was going to route out together with the prime minister of Sweden?

@ConfederateH – I do care, very much, what is happening in other countries. Part of it is selfish, I admit, because I’m afraid that what is happening to the Swiss (and others) will be happening to Canadians very soon. But not all of it is selfish, I do have empathy and compassion for others, whether it directly affects me or not.

@Jefferson, There are a few problems with your calculations. According to explanation at the end of the examples, you have to take the base tax of 6684, add 47.5% (3175), subtract 12% (802), add 1% (67), and add the communal tax of 43% for Meyrin (2874), plus 25. There is an explanation with examples here: http://ge.ch/impots/calcul-et-paiement-des-impots.

6684+3175-802+67+2874+25=12023.

To calculate the Swiss federal tax, you used the table for single people. Using the table for married people, the tax is lower, 1557. The total Swiss tax is then 13580.

****JDT: Thanks Shadow Raider for this recalculation, I will integrate it into the top of this post.****

(It’s interesting how in Switzerland the local tax is much higher than the federal tax, the opposite of what happens in the US.)

To calculate the US income tax, you forgot one more bracket, 28% for income above 71350. The total US tax would actually be a little higher, 21890. This is using the table for married filing separately. Using the table for married filing jointly, the tax would be lower, 17060, and using the table for head of household, 19645. (A US person can elect to treat the non-US spouse as a US resident and file a tax return with the income of both, as married filing jointly. This would be a benefit in this example as the wife has no income. Also, if the US person doesn’t want to treat the non-US spouse as a resident, but has at least one child or other dependent, the US person may use the table of head of household, which is better than single or married filing separately.)

As married filing separately, and using the foreign tax credit, the tax to be paid to the US is 21890-13580=8310. Lower than what you calculated, but still a lot. (I also used the approximate exchange rate 1 USD = 1 CHF.)

Anyway, I’m surprised to see that the income tax in the US is higher than in Switzerland. It’s even higher if you add the state income tax, which varies from 0 (Florida, Texas) to 11% (New York City). However, I suppose that the income tax in the US is still lower than in Canada and in most of Western Europe.

@ Petros

While there may be many USPs in Mexico that do not have English language skills, I can’t help but think that Mexico has a large number of English speaking Americans who have retired to Mexico due to weather and cost of living considerations. But, you make a good point about the possible lack of attention in the Mexican media to the scare tactics of the IRS

@Mark Twain, According to the US census and the Department of Homeland Security, there are about 47 million people living in the US who were not born there. 4 million are US citizens by birth (born in US territories or abroad from US parents), 17 million are naturalized US citizens, 13 million are legal immigrants (not yet naturalized), 2 million are nonimmigrants (like visitors, students and temporary workers), and 11 million are the “unauthorized population” (illegal immigrants).

I would count as immigrants the legal immigrants and the naturalized citizens, so 30 million people. Any way you want to count it, the number is much higher than the estimated 6 million Americans abroad.

Google analytics says that we’ve had 18,671 visits from Canada on our dot.ca website (since early June); only 24 visits from Mexico with population of 112 million; 1711 visits from Switzerland, population 8 million. I really do think that the linguistic barrier makes a difference–it’s not just the Canadian orientation of this website but the fact that it is in English. Quebec has a lot of so-called Americans too, but I think far fewer of them are really aware of the problem. The ones who frequent this site are very proficient in English.

UK is next with 1056 hits. Switzerland is there because of the US harassment of Swiss banks and the banning of US person from opening accounts. UK is there however, as the fourth country (after Canada, US, Switzerland) perhaps as a populous anglophone country. (Next Germany, France, Australia).

OFF TOPIC: Mitt Romney CORPORATE tax stance: SWITCH TO A TERRITORIAL TAX SYSTEM

How close is that to the stance needed on personal tax?

http://www.mittromney.com/issues/tax

How many hits from USA?

@Mark Twain, It’s very close, but I think he is just not aware of the problem. I and others have already sent him emails and letters but I don’t think he read them. I hope someone talks to him about the issue during his trip abroad.

@Mark Twain, google analytics say 5460. Now, I think these are all really good relative numbers. But it requires analysis to determine what our overall impact is.

@ Confederation H

“My impression is that most of the Canada based expats here could care less about problems that Swiss expats are facing as long as Obama/Geitner are willing to provide OVDI/FATCA/FBAR relief for Canadians. My impression is that most of the Canada based expats here have no problem with the US income tax system as it is as long as they are exempted from it.”

How presumptive of you. My stomach was in knots reading about the fictional Mr. & Mrs. Gringo. Of course we care about everyone affected by this horrible system. Every country has different conditions and specific challenges and it may be hard to grasp all those details but we still care. This has to be fixed for everyone, everywhere and the only way I see for this to happen is for the USA to stop citizenship based taxation. Fixing a bit here, a bob there will not work. The only fair solution is for the USA to stop, PERIOD.

@EM:

“This has to be fixed for everyone, everywhere and the only way I see for

this to happen is for the USA to stop citizenship based taxation. “

Switzerland’s issue is also very much about financial privacy. The author of this article says that it is unsafe for any Swiss banker who advised US clients to travel anywhere around the world. I doubt many Canadians are willing to take on the evil empire for financial privacy, and its a gigantic pity that only the Swiss (SVP) have been fighting for it for decades.

Do you really think that they will simply drop citizenship based taxation? One tax-specialist interview posted here at IBS went into the “tax morale” issue and how the homeland slaves get upset when they think expats are getting any kind of a sweet deal (ie. paying no income taxes when they live in Caymans, Paraguay or Dubai). Plus taxes are such a convenient wedge issue for demogogs. They say what they want to gain power, but what they actually do will be completely different (hope and change).

Franky, I don’t think you have a prayer of significantly changing US tax policy, your best chance would be some kind of “tax simplification” in an economic crisis. But if you think simplification would mean the dropping citizenship based taxation you are whistling dixie.

Hopefully, it is the political strategists and the dirty rotten tax cheats.

My grammar is worsening with the years away—that sentence is: Hopefully it is the political strategists who are the dirty rotten tax cheats.

@ Confederation H

“I doubt many Canadians are willing to take on the evil empire for

financial privacy, and its a gigantic pity that only the Swiss (SVP)

have been fighting for it for decades.”

Presumptive again. It was the privacy issue, specifically the change in the FBAR form, which drove me to contact my local bank manager, my local MP and try to contact the IRS itself (only to end up talking to a guy in the forms warehouse). I had always hated the FBAR but when it changed in 2008 I was absolutely appalled and did my best, on my own, not knowing of anyone else who was concerned about this, to express my concern to whoever would listen, all the while knowing I could do nothing about it. And no I don’t think the USA will change, it never does, but that doesn’t change my assertion that the only fair solution is for the USA to stop citizenship based taxation.