Monty Pelerin shared some comments and a video which explains why the United States government is going to collapse economically. This is why the new Obama ad, in which President Obama says that he will tax the wealthy to “pay down our debt”, is utter mendacity. This video shows that the United States Federal budget cannot be balanced. It is mathematically not possible without some maturity. Going after US expats around the world will not solve the problem. But we can be sure that as long as the USA cannot get its fiscal house in order, the federal government will continue to demagogue against expats.

It’s the numbers, stupid, by Monty Pelerin

Most people have no idea of the unsustainability of government spending. The path which the government blindly follows ensures a complete and total collapse of the US. What has happened in Greece (and things will get much worse there) is exactly what will occur in the US. A complete and total economic collapse is inevitable.

The reasons for this ending and its inevitability are explained in this short (5 minute) presentation by Hal Mason in an email that has been circulating. The simplicity of his presentation allows understanding for even the economically illiterate. Simple arithmetic is sufficient to understand the impossibility of our current path and our inevitable ending.

This short video should be watched by everyone, including those not yet old enough to vote. It should be shown in every high school and college classroom. Anyone that cannot understand this presentation should not be allowed out without a guardian.

It’s the numbers, Stupid and the people who elect the corrupt, self-serving politicians in Washington who continue down this road to destruction.

Two words: HOLY SH*T!

Romney can’t solve this problem either. His half-hearted attempts to cut 5% from non-discretionary spending will not do anything. Even if he cut 5% of the total budget the US would still have a deficit of over 1 trillion dollars. The US is going off the fiscal cliff. With the pending food crisis caused by drought in the US (and the Federal government is too stupid to cut ethanol requirements so that food will stop being burnt in cars), QE 3 will be coming at harvest to pay off the bank loans from the zero yield crops. Then, expect massive dollar devaluation.

When Americans are starving, maybe they will see Canada as its bread basket the way that Rome saw Egypt.

*

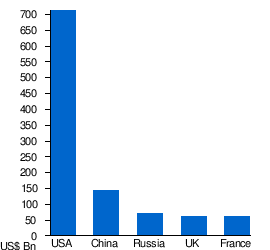

SIPRI Yearbook 2011 – World’s top 15 military spenders The world’s top 5 military spenders in 2010.

The world’s top 5 military spenders in 2010. United States711.04.7417112

United States711.04.7417112 Chinay143.02.08.22283

Chinay143.02.08.22283 Russiay71.93.94.193.74

Russiay71.93.94.193.74 United Kingdom62.72.63.657.55

United Kingdom62.72.63.657.55 France62.52.33.650.16

France62.52.33.650.16 Japan59.31.03.444.77

Japan59.31.03.444.77 Saudi Arabiaz48.28.72.858.88

Saudi Arabiaz48.28.72.858.88 India46.82.52.71129

India46.82.52.71129 Germanyy46.71.32.740.410

Germanyy46.71.32.740.410 Brazil35.41.52.033.811

Brazil35.41.52.033.811 Italyy34.51.62.028.512

Italyy34.51.62.028.512 South Korea30.82.71.842.113

South Korea30.82.71.842.113 Australia26.71.81.516.614

Australia26.71.81.516.614 Canaday24.71.41.419.915

Canaday24.71.41.419.915 Turkeyy17.92.31.025.2

Turkeyy17.92.31.025.2

Figures sourced from the SIPRI Yearbook 2011.RankCountrySpending ($ Bn.)[1]% ofGDPWorld Share (%)Spending ($ Bn.PPP)[2]—World Total1,6302.61001562.31

*http://en.wikipedia.org/wiki/List_of_countries_by_military_expenditures

If you want to see one of the main causes of the US decline, look no further than this!

http://costofwar.com/

@Petros…

You are right about Romney. He doesn’t want to cut anything from the military, and won’t raise taxes at all to pay for anything, so somehow magically he is going to do what? I don’t know, as he won’t say. Both the candidates are missing the Big picture in this campaign so far. As we all know, you can cut all the discretionary spending to zero and the entitlements still balloon out, and there is no touching them by Romney either…

I see France is going after the Rich too, and in a much more aggressive way than so called “socialist” Obama wants to. And inspite all of this, the Euro goes down and the dollar goes up, Germany braces for a downgrade, and the 10 year treasury falls to new lows.

@Joe, Just Me, well they can’t rightly cut military spending, eh? Otherwise, they won’t have any means of annexing Canada.

Seriously, though. I think that the point of not being able to kick the can down the road will soon be reached, and it will not because the US gets serious about its problem, but because the dollar collapses. Neither Romney nor Obama has a plan to avoid that collapse. Ron Paul was the only candidate who I consider serious, and he would have greatly reduced the US military. That’s why he couldn’t win over the Republican party.

*The only way to fix the US deficit problem is through a three letter acronym well known to Canadians called GST something both the left and the right in the US will fight to their dying breadth.

To this day I love it every now and then when I hear some crusty old fart going on about f-yin Mulroney and his f-yin GST or on the radio call in shows when people talk about the GST as government highway robbery.

*More to the point the problem isn’t income tax evasion its legal income tax avoidance engaged in by a considerable amount of the citizenry in the context of the “voluntary” “self assessment” system of income tax(this occurs in Canada too). Under the GST there is no avoidance you simply have to pay when you consume(Government robbery so to speak). In Canada they only real way around the GST is to consume a lot of Basic Groceries in leau of other items in New Zealand even this isn’t an option.

@Tim…

You are right about GST in NZ. It is only in the trades and small biz where everyone has two prices for everything, with or without GST.. 🙂

Canada is not really comparable to the United States, at least in the scale of the problem. Canada, for example, has a viable Canada Pension, which is relatively well-funded compared to the Social Security Program which holds only worthless US treasury notes–the only way that they can pay out benefits is if the US government finds new taxes because it has already spent all the money. So the regressive GST works well for a country that isn’t already a total fiscal basket case. But the US can’t solve its problems by raising taxes OR cutting spending. Both must be done. A regressive GST–i.e., a consumption tax, is likely a good place to raise taxes on the majority of Americans who pay little or no income taxes.

*Looks like those trips to Disney World are about to get a lot cheaper, though we’ll need to hire a private army to protect us on the Mad Max road trip to get there and a tractor trailer to carry all the devalued U.S. cash we’ll need for incidentals.

It’s just astonishing how quickly now the American Dream is spiralling out of control towards its inevitable conclusion. The new Weimar Republic is about to take its place in history.

@Deckard, ‘it’s a dream because you have to be asleep to believe in it’ – George Carlin.

It’s as though he’s speaking to us from the grave, complete with head stones…’the best 3 minutes of his career’:

*It’s rather scary reading this. Yesterday, I was reading an FBAR article which was filled with tons of threats against Americans abroad. I should probably change my title to “OMyGodImStillAnAmericanToo”. Crazy as it may sound, I’ll still use my US inheritance to get a US mortgage buy a US house, increasing my total debt to about $600k. Afterwards, I’ll examine investing in Africa or Asia. Yet, all of these US rules and regulations on having stocks while living abroad as a US citizen really discourages that idea too.

Just stumbled upon this web site tonight…

http://www.gettingoutofamerica.com/

What, me worry?

Treasury Yield 30 Years

Oh my, that had me choking over my coffee/croissant this morning.

I’ve talked to friends and family back home about this and the answers are interesting:

“It’s not at all like Greece.”

“You just don’t understand the nature of sovereign debt.”

“If everyone just pays their fair share there will be no problem.”

“There is no problem. We can grow our way out of it.”

I’m not an economist and frankly I don’t know what to think except that it does look uncomfortably like Greece, it clearly *is* a problem and those who tell me that I’m failing to grasp the subtleties of the situation need to start explaining themselves.

*Victoria, that’s the same thing that I was told 12 years ago, and I felt like the only one then who thought that $4 trillion national debt was troubling. It seems that nothing has changed other than the debt quadrupling. This means that the US democracy can only be saved if the demorepublican monarchy becomes more of a dictatorship and then voluntarily disbands itself after cutting spending and paying off the national debt. In the mean time, I’ll have to construct an escape-to-Africa life-saver in the case that Europeans don’t start producing more social security contributing babies.

Petros, you love the doom and gloom stuff! I know the US stuff is a problem, but this is not just a US problem. Whatever happens in the US tends to spillover to other countries. Trivia: What was the last major currency to drop the Gold Standard?

Way back in 2004-2006, I watched as the dollar started dropping like a rock against most major currencies. The US was devaluating, so other countries had to find ways to do the same. Then came the Euro crisis…. People flooded into Swiss francs and then recently, the Swiss central bank pegged the franc to the Euro. All this happened over the course of the last 8 or so years. It was all US-initiated, but it affected (and continues to affect) the monetary policy of almost every country in the world.

My point is that there is a ripple effect to everything. If the US falls, you can bet that there would have to be some major structural changes everywhere, especially in Canada due to its proximity and more importantly, based on the huge volume of trade with the US.

Geeez, you are right that this is not just a US problem. Here some more reasons:

The US dollar is the world’s reserve currency. Many of the world’s currencies are backed by US reserves in their central banks. When the US dollar exports inflation to other countries it creates food crises. US dollar devaluation has help contribute to the Arab spring and instability in many countries.

Currencies in other countries are hardly better than the US dollar. But they do not enjoy reserve currency status and have few markets into which to export their inflation. Monty Pelerin has called world currencies debris floating in sesspool. Sometimes its one that floats to the top, sometimes its another. But they are made of the same shit.

Gold is experiencing a ten-year bull market thanks to dollar devaluation. Many central banks around the world (not US or UK) are increasing their gold reserves. Don’t forget, I have 1.2 billion dollars worth of gold in my 5 cubic foot safety deposit box. I am thus hedged against inflation. But you are right. Canada will be harmed by the US economy as also much of the world. This is why the US dollar must inevitably fall. The other countries are going at first slowly to divest themselves of dollars (this is happening), and then quickly. Then the US dollar will lose confidence and hyperinflation will set in. The writing is on the wall.

Thanks for posting again, bubblebustin’!!! Every word is true and the US expat situation is one big example. We need to watch / listen to Carlin’s truth every day. Along with financial literacy, it should be required for high school graduation and life planning.

I have never had so much anxiety from a post before! I barely slept last night. So much regret about what I should and could have done to have avoided where I am today. Now I can’t get out of Dodge fast enough. What will happen when a nation’s exceptionalism is combined with extreme desperation? You will have a nation that believes it is above reprisal and justified in any act of self preservation. Like a child that has never learned that there are consequences to their actions. Reckless tyrants. We’ve all known some. I count my blessings however, I could still be under the same roof.

Bubblebustin –

Fatalism can do wonders for the sleep function. The standout figure for me in that brutal five minutes was the US level of military expenditure compared to the next howevermany few nations. The further the wounded beast slogs off into harsh trouble, the surer it becomes that its massive accumulated security stash can never be allowed to go to waste. Heh heh – well, anyway, not allowed NOT to produce the maximum detritus. Getting wasted can be just so much fun. Guns R drugs. Then just think of the corporate profit scamming possibilities in attempting to clean up the aftermath. Maybe use conscripts for the fatal tasks? Never mind that puny front-end buildup after all. That’s pure chicken feed. Sanity = blackest humor. I think I hear four horses galloping in from the horizon … The $64 trillion question is, who gets to be the

enemaenemy?@usxcanada

A mad gunman in the theatre of life? Time for a glass of wine (or two) and enjoy the weather that today brought.

BB – I done did them two thangs already! Onward into the night!