[Editor’s note: This post clears up the issue of whether 8854 is required for people receiving backdated CLNs: If your expatriation date is before 2004, the rules are different]

In this post, I want to point out a clear contradiction both in the logic and the wording of the instructions for Form 8854. This is a follow-up post to the question posed by USX about who must file the 8854.The instructions very clear state that the date of relinquishment is operative for if you need to file form 8854. The instructions first say as follows:

Form 8854 is used by individuals who have expatriated on or after June 4, 2004.

The date on which you are considered to have expatriated determines which Parts of the form you must complete. You are considered to have expatriated on the date you relinquished your citizenship (in the case of a former citizen) or terminated your long-term residency status (in the case of a former U.S. resident). If you expatriated after June 3, 2004, and before June 17, 2008, complete Parts I, II, and V. lt you expatriated after June 16, 2008, and before January 1, 2011, complete Parts I and III. lt you expatriated in 2011, complete Parts 1, IV. and V.

Expatriation. Expatriation includes the acts of relinquishing U.S. citizenship and terminating long-term residency.

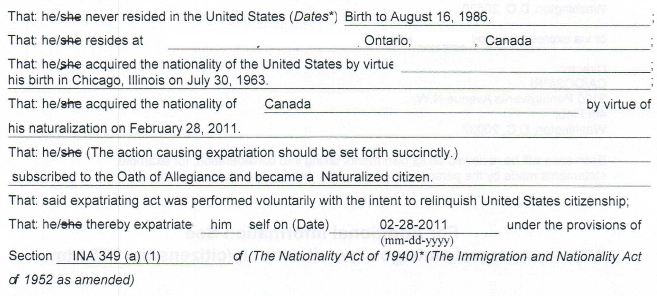

Here the language is unequivocal: You have expatriated on the “date you relinquished your citizenship”. Now, this is quite easy to figure out. Get out your CLN and look at the middle part of the form. On mine it looks like this:

Now clearly the date of expatriation is February 28, 2011, the date that I committed the expatriating act. That is the day that Section INA 349 (a) (1) says that I ceased being a United States citizen. Thus, it would make sense that if that date precedes 2004, then I shouldn’t have to file Form 8854. However, the IRS code redefines the date of expatriation as follows, as indicated by the instructions of Form 8854:

Date of relinquishment of U.S. citizenship. You are considered to have relinquished your U.S. citizenship on the earliest of the following dates.

1. The date you renounced your U.S. citizenship before a diplomatic or consular officer of the United States (provided that the voluntary renouncement was later confirmed by the issuance of a certificate of loss of nationality).

2. The date you furnished to the State Department a signed statement of your voluntary relinquishment of U.S. nationality confirming the performance of an expatriating act (provided that the voluntary relinquishment was later confirmed by the issuance of a certificate of loss of nationality).

3. The date the State Department issued a certificate of loss of nationality.

4. The date a U.S. court canceled your certificate of naturalization.

I would venutre that the IRS will likely believe that people–who obtain a CLN today, even if their expatriation date on their CLN is before 2004–that such people are required to file Form 8854. This is despite the clear contradiction in the tax code–first with itself. The definition of a United States person who is subject to taxation does not include non-resident former citizens; then with the INA 349 (a) which clearly defines the date of expatriation as the day on which a person commits a relinquishing act, not the date of informing the Consulate.

If I had relinquished before 1995, I would under no circumstances yield to any of these filing requirements. It may be necessary to obtain a CLN to prove to the bank that one is not a US citizen and to idiot US border guards who insist that you are US citizen because of your place of birth. But I wouldn’t give even one single inch of latitude to the lame brains in the IRS. Why? Because I don’t see how the Form 8854 requirement could stand scrutiny of jurisprudence, since the requirement clearly contradicts itself. But then, the courts are known for making lame decisions.

But while the IRS may wish to press the issue, a court challenge of Form 8854 should argue that it is a violation of numerous other laws and rights. I wrote in a comment earlier: We first have to understand is that the 8854 is abridgement of liberty no matter who has to do it. It is a violation of the 4th amendment: A man’s home is his castle. No one who is under the king must enumerate his assets for the king, because the man is king over his possessions within his own home. Thus, it is none of the king’s business. This is a principle of English law since the Magna Carta and an even deeper law going back to the Ten Commandments at least–i.e., the finger of God wrote, “Thou shalt not steal”–this affirms the private property rights of all people–not merely those under the Torah, as it doesn’t say, “Thou shalt not steal from your brother”, but “thou shalt not steal”. There is only one reason the IRS needs you to enumerate all your assets in the 8854 and that is so they know how much to steal from you.

My hope is that someone will challenge Form 8854 as an obvious and clear violation of the right to expatriate.

Am just trying not leave a door opened!

You are right salary is low as there was only three working days before expatriation!!

As far the IRA withdrawal is concerned (done before expatriation) should it go under pension distribution??

Thanks!