[Editor’s note: This post clears up the issue of whether 8854 is required for people receiving backdated CLNs: If your expatriation date is before 2004, the rules are different]

In this post, I want to point out a clear contradiction both in the logic and the wording of the instructions for Form 8854. This is a follow-up post to the question posed by USX about who must file the 8854.The instructions very clear state that the date of relinquishment is operative for if you need to file form 8854. The instructions first say as follows:

Form 8854 is used by individuals who have expatriated on or after June 4, 2004.

The date on which you are considered to have expatriated determines which Parts of the form you must complete. You are considered to have expatriated on the date you relinquished your citizenship (in the case of a former citizen) or terminated your long-term residency status (in the case of a former U.S. resident). If you expatriated after June 3, 2004, and before June 17, 2008, complete Parts I, II, and V. lt you expatriated after June 16, 2008, and before January 1, 2011, complete Parts I and III. lt you expatriated in 2011, complete Parts 1, IV. and V.

Expatriation. Expatriation includes the acts of relinquishing U.S. citizenship and terminating long-term residency.

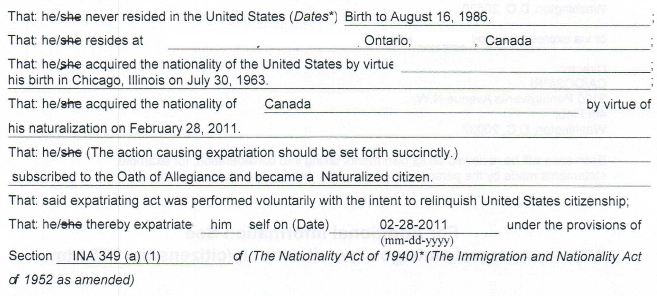

Here the language is unequivocal: You have expatriated on the “date you relinquished your citizenship”. Now, this is quite easy to figure out. Get out your CLN and look at the middle part of the form. On mine it looks like this:

Now clearly the date of expatriation is February 28, 2011, the date that I committed the expatriating act. That is the day that Section INA 349 (a) (1) says that I ceased being a United States citizen. Thus, it would make sense that if that date precedes 2004, then I shouldn’t have to file Form 8854. However, the IRS code redefines the date of expatriation as follows, as indicated by the instructions of Form 8854:

Date of relinquishment of U.S. citizenship. You are considered to have relinquished your U.S. citizenship on the earliest of the following dates.

1. The date you renounced your U.S. citizenship before a diplomatic or consular officer of the United States (provided that the voluntary renouncement was later confirmed by the issuance of a certificate of loss of nationality).

2. The date you furnished to the State Department a signed statement of your voluntary relinquishment of U.S. nationality confirming the performance of an expatriating act (provided that the voluntary relinquishment was later confirmed by the issuance of a certificate of loss of nationality).

3. The date the State Department issued a certificate of loss of nationality.

4. The date a U.S. court canceled your certificate of naturalization.

I would venutre that the IRS will likely believe that people–who obtain a CLN today, even if their expatriation date on their CLN is before 2004–that such people are required to file Form 8854. This is despite the clear contradiction in the tax code–first with itself. The definition of a United States person who is subject to taxation does not include non-resident former citizens; then with the INA 349 (a) which clearly defines the date of expatriation as the day on which a person commits a relinquishing act, not the date of informing the Consulate.

If I had relinquished before 1995, I would under no circumstances yield to any of these filing requirements. It may be necessary to obtain a CLN to prove to the bank that one is not a US citizen and to idiot US border guards who insist that you are US citizen because of your place of birth. But I wouldn’t give even one single inch of latitude to the lame brains in the IRS. Why? Because I don’t see how the Form 8854 requirement could stand scrutiny of jurisprudence, since the requirement clearly contradicts itself. But then, the courts are known for making lame decisions.

But while the IRS may wish to press the issue, a court challenge of Form 8854 should argue that it is a violation of numerous other laws and rights. I wrote in a comment earlier: We first have to understand is that the 8854 is abridgement of liberty no matter who has to do it. It is a violation of the 4th amendment: A man’s home is his castle. No one who is under the king must enumerate his assets for the king, because the man is king over his possessions within his own home. Thus, it is none of the king’s business. This is a principle of English law since the Magna Carta and an even deeper law going back to the Ten Commandments at least–i.e., the finger of God wrote, “Thou shalt not steal”–this affirms the private property rights of all people–not merely those under the Torah, as it doesn’t say, “Thou shalt not steal from your brother”, but “thou shalt not steal”. There is only one reason the IRS needs you to enumerate all your assets in the 8854 and that is so they know how much to steal from you.

My hope is that someone will challenge Form 8854 as an obvious and clear violation of the right to expatriate.

Petros: My hope is that someone will challenge Form 8854…

Mine too. I’m one of the “lucky few” who has to file Form 8854 not just once, but initially on leaving and then annually for ten years after leaving the US. So it’s an almost perennial thorn in the side. I’d love to see it taken into the woods and given a well deserved bullet in the head, along with much of the other crap the IRS foists on us all.

I won’t be challenging it personally, though. For all its unpleasantness form 8854 doesn’t and won’t ever result in any added real US tax liability. It’s just one another calculated and deliberate waste of time for both me and the IRS. Basically an IRS form-based attempt at an ankle monitor, and just more of The Process is the Punishment.

@Watcher Ankle monitor is an apt analogy.

Expatriation is not a crime. It is right.

*@watcher I thought that if you expatriated in 2011 or later, even if you are covered, you DON’T have to file 8854 for 10 years. The instructions look like the 10 year filing requirement is for earlier years of expatriation. Take another look at the instructions and see what you think. Hope I am right and you can at least take that thorn out of your side.

As Deckard and I both posted some months ago in other threads, my reading of a 1997 IRS bulletin says that if your expatriation (via relinquishment) was before February 9, 1994 (I’m not sure I got the month and day right but I know it was 1994), form 8854 does not apply. But I’m not a lawyer, and the bulletin is in the usual near-incomprehensible language used in IRS bulletins.

In any case, IRS going after someone who relinquished 30-40 years ago but didn’t file for a CLN until now because they had no idea what a CLN was or of why they’d need one, would be utterly absurd. In any case, IRS can’t enforce that requirement in Canada, they can potentially grab you at the border (or DHS can) but to do that they need a warrant and need to go through a legal process that involves contacting you a couple of times about your filing “requirement.” First step IMO would be do nothing unless you get a letter from IRS at some point after you get your CLN, asking for an 8854, in which case maybe reply politely by mail saying “I haven’t been a USC for 30-40 years, I don’t believe I owe you any filing requirements” and see what they say. Then if necessary consult a lawyer if they come back, or just don’t cross the border again if that’s an option. CRA can’t and won’t collect anything for IRS on this if you’re a Canadian citizen, which presumably you are if you relinquished 30-40 years ago. That’s very clear in the Canada-US tax treaty and in statements from our Finance Minister in letters I’ve seen and that have been posted elsewhere on this website.

@iamquincy, you’re right on your understanding. However, I “expatriated” — actually gave up a green card, never was a citizen — after June 2004 but before June 2008. Hence I’m stuck with the old rules. Believe me, I wouldn’t fill out this POS form every year if I could easily avoid it!

@schubert1975

Steven Mopsick certainly seemed to agree with your above remarks. I believe he told those of us who had performed expatriating acts decades ago, resulting in the relinquishment of our US citizenship, that we should most definitely NOT file tax forms.

@ Watcher

Obviously you must keep your options open for visiting the USA. I do not intend to ever go there so no matter what the convoluted 8854 rules may be, I will not be doing that form either. It will get the same treatment I have given FBARs — I am Canadian and I will not share that information with a foreign country. The IRS already had access, upon request, to our taxable income status, nothing I could do about that, so we have up to this point filed jointly but if and when I get that stamped I-407 it’s goodbye and good riddance to the IRS for me and my husband will file separately until he too is free. I hope I’m as brave as all that sounds … we’ll see.

@Em,

It’s not so much about keeping my options open to visit — I don’t, no particular reason to — as it is that they hold my 401k hostage. I saved into that when I worked in the US. It’s something I’ll need to rely on when I stop working. And it can’t be moved out of the US (no QROPS, of course) but has to remain there until I can draw on it. If I had the time over again I would avoid saving into anything that’s captive like that, but what’s done is done.

So I complete and send an almost entirely pointless 8854 year after year after year. I’ll leave you to guess how much time and effort I expend in making sure its totally, completely, absolutely accurate! I also have to send a 1040NR every year, even if I have no US source income. And generally I don’t, pretty much — last year I earned a whopping around $3 from the US in bank interest! So more wasted time, money and effort for me and for the IRS. I console myself by sending in paper forms, handwritten where possible so that they have to input them manually.

@ Watcher

“I console myself by sending in paper forms, handwritten where possible so that they have to input them manually.”

There you go — make ’em work to get those numbers into their antiquated computers which I hope crash frequently. I am so grateful now that my husband doesn’t have an IRA. All I can say is a pox on all their papers! BTW I hope you deliberately make your penmanship just short of illegible so the paper pushers have to get reading glasses.

*A relative, who’s a retired tax accountant, does his taxes in TurboTax (for the calculations), prints the forms out, copies the information on to fresh forms in blue pen, and mails those.

As I understand it form 8854 relates to the exit tax only, and for the purpose of the exit tax the IRS says the expatriation date is the date of notification to the DOS. But what of the person that relinquished 30 or 40 years ago? If they notify DOS in 2012, the date of expatriation is 2012 for exit tax purposes. But if the CLN says 1982 on it, then that person had no tax or FBAR obligations for 30 years. Can they certify they have complied with all tax obligations for the past five years because they had no obligation at all. Might this fictional date of expatriation apply to the exit tax and only the exit tax?

I am a first time poster. With some initial reluctance I finally decided that having my financial security dependent on discovering, translating and sometimes filing every obscure IRS non tax form was too high a price to pay to retain my US citizenship and as of late 2013 am no longer a US citizen.

Having filed the deadline extension, I am now struggling with the 8854 and its baffling lack of instructions. Hoping someone who has already been there can answer these.

Am I correct that Social Security and CPP are not entered on lines 6 & 7? Ditto a small RRSP?

I am well under the $2 million threshold and my homes value comes in at under $250,000. Is there any reason to worry about the cost basis on the house?

Finally a question on the 1040 NR. In a couple of years I will begin collecting Social Security. Will I have to file a 1040NR for that? The only place I can see it possibly being entered onto the 1040NR would be Line L of Schedule OI

ehFreeMan: Your confusion is quite understandable. This form was also used under old rules where expatriates were supposd to keep filing for 10 yrs. Hence the title “Initial & Annual’ Luckily you only get to do it once.

Your question is incomplete. When you ask ‘line 6 &7,’ which section are you referring to?

You do NOT have to fill in part IV section B because your taxes owing in the past 5 yrs. and your net worth are under the threshold.

US social security benefits are taxable in Canada but not in the US if you reside in Canada . Therefore 1040NR will not be required. If you reside elsewhere, I have no idea.

http://www.taxplanningguide.ca/tax-planning-guide/section-2-individuals/us-social-security-payments/

Thanks,

Sorry about omitting that, I should have specified lines 6 & 7 of part V of that form. The question about cost basis applied to part V as well.

Good to know I will not have to file a 1040NR on Social Security. :-D, at least ’till some Congress creep decides they are being to easy on us expats.

ehFreeMan. O.K. with the caveat that I’m not an accountant—- It is not clear what to do with part V. Since you won’t owe a dime ,it doesn’t hurt to fill it in. There is no way to know the cost or value of CPP or OAS. I would not put anything for either.

You can enter the present value of your RRSP and your house. Your RRSP statement should have a number for book value or adjusted cost base. You don’t need a formal evaluation of your house. Since you are under the threshold, there isn’t anything to worry about.

Hello,

I am just in the process of renouncing my US citizenship. I have asked for a interview with the Vancouver Consulate but had not heard back from them yet.(30 days) I have filed my tax returns for the last 5 years (2009-2013) in preparation of this process. I have the necessary forms filled out ( Loss of Nationality Questionnaire, DS4079, DS4080) but not the Form 8854. Do I need this one when I have my interview or can it be completed at a later date?

Also, in form 8854 where they ask in Part IV, question #1 regarding “US income tax liability for the 5 tax years ending before the date of expatriation”. What exactly are they asking here? Within the 5 year period (2009-2013) I had to pay a total of 84.00 in taxes to them. ???

I would appreciate any help you could give.

Thanks

PL

@PL, you will be more likely to get some answers on this thread as it is read more often:

isaacbrocksociety.ca/renunciation

see the link in the righthand column entitled:

Relinquishment and Renunciation of US citizenship

@PL,

Form 8854 has to be completed after you renounce, as the 8854 has questions about things such as net worth on the date of renunciation (8854, part 4(A)(2)) and value of assets the day before renunciation (8854, part 4(B)(8)). It’s due by June 15th of the following year.

Your “US income tax liability” for a year is the amount of income tax you had to pay in a year.

PL. you won’t get an appointment until 2015.

Therefore the 5 years are 2010 to 2014. Enter the tax owing for each year.

I am just completing form 8854 and am stuck due to lack of any useful information in the IRS instructions!

Any one here has already completed this form?

My question relates to PArt V schedule B “Income statement”

– Where do you put slary? Under others?

– If you took a (taxable) distribution from an IRA does it go under “Pension distribution”?

Thanks!!

@calgary

Thanks for your comment.

I am talking about schedule B “Income statement” and not schedule A “Balance sheet” -:)

I see that now. Sorry. Back to my 8854 and now Part B, which shows only a total in Gross Income from Other Sources. ” 0 ” for all other parts of B. I am retired and would now be getting distributions from my RRIF (don’t know if that would have to go there), but that just started at age 71, this year. My 8854 is done/ fini / filed. I was receiving income from my work defined benefit pension though and CPP / OAS from Canada. My 8854 was done by a cross-border US tax compliance firm after my 2012 renunciation.

Leroy More info needed. Salary from where? Are you under the exit tax threshold ? If you aren’t, you should get professional help.

If you are, it doesn’t matter much what you put.

Thanks for following up.

Yes I am under the 2 M$ thredhold.

Salary is from non-US employer.

Leroy I’m not an accountant and the form and instructions are incomprehensible. However, all references to income in lines 1 a-e refer to US source income. So why put your salary down at all? You could put the IRA distribution under 1d. All you can do is make your best effort. If the amounts are small, you won’t hear anything from them.