This is a cross post from the Righteous Investor.

Americans keep repeating the meme that Federal deficit spending is borrowing from the next generation. This is not entirely true. Deficit spending creates more debt, and debt creates a larger money supply, and a larger money supply is the quintessential definition of inflation. Inflation soon results in increased prices for everything.

Henry Hazlett wrote in his important primer, Economics in one lesson (pdf), p. 19-20 (emphasis mine):

Everything we get, outside of the free gifts of nature, must in some way be paid for. The world is full of socalled economists who in turn are full of schemes for getting something for nothing. They tell us that the government can spend and spend without taxing at all; that it can continue to pile up debt without ever paying it off, because “we owe it to ourselves/’ We shall return to such extraordinary doctrines at a later point. Here I am afraid that we shall have to be dogmatic, and point out that such pleasant dreams in the past have always been shattered by national insolvency or a runaway inflation. Here we shall have to say simply that all government expenditures must eventually be paid out of the proceeds of taxation; that to put off the evil day merely increases the problem, and that inflation itself is merely a form, and a particularly vicious form, of taxation.

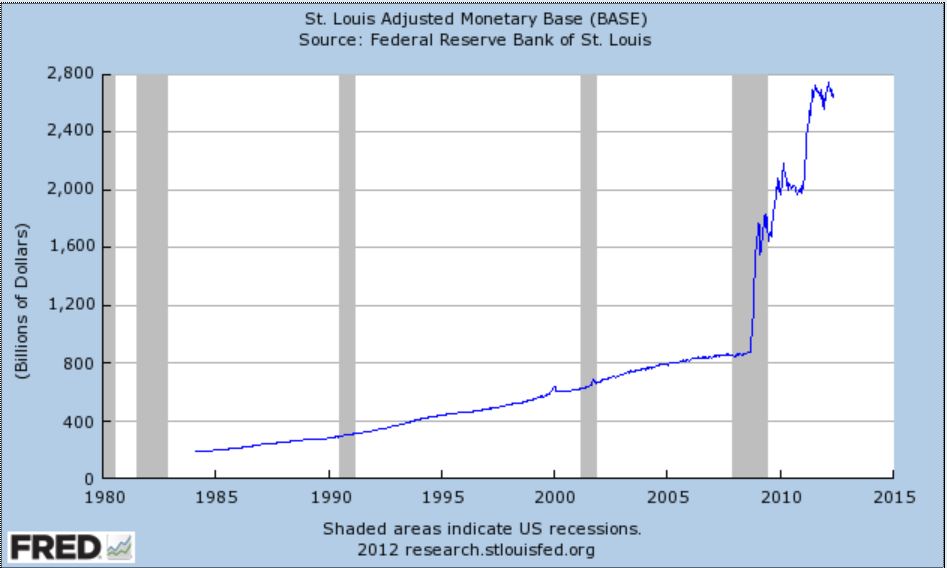

The premise of Hazlett’s one lesson in economics is that one must always look to the unseen, indirect side effects of economic policy–the law of unintended consequences. With regard to deficit spending, the immediate benefit that policy makers hope for is a stimulus that primes the pump of the economy and stimulates growth. Furthermore, politicians themselves wish to postpone making painful decisions such as government cutbacks, at least until the next election, so that they may maintain voter support. Thus, in the United States, deficit spending is spiraling completely out of control and the end result is the debauching of the currency. We can see the resultant dollar inflation in the Federal Reserves adjusted money base:

But if inflation is a tax–who is it taxing? It is a tax on all who are holding the dollar or receive payments in dollars. Who is affected by this? Wage earners, savers, retirees, and private companies. These are the domestic losers in the Federal deficit, whose money is subject to effective taxation caused by the dilution of the currency. But there are also some very important foreign holders of US dollars that I wish to point out.

Since World War II, the dollar has become the world’s reserve currency. Most central banks, some foreign corporations, and even many foreign individuals hold physical US currency, electronic US currency, and United States treasury debt. Nearly all transactions for commodities on international markets settle in dollars. The Chinese alone hold about a trillion in United States treasury debt. The deficit spending of the United States is an effective tax on all these foreign holders of the dollar.

So when the trolls around the internet point out that everyone should pay their share, we can remind them that the budget deficits of the United States are a form of taxation on the world. Since Barack Obama has come to power, the federal deficits have been in the range of 40 cents or more on every dollar. This means that Americans, as a class of people, are not paying their “fair share” by 40 cents on every dollar, but they are expecting others, including foreign holders of US currency to pay their “fair share” for them. The not-so-easy solution to this taxation via inflation is the complete and utter rejection of the US dollar as the world’s reserve currency. I believe that this rejection of the dollar will probably take place soon, perhaps within the next five years. Sooner or later it will happen. But the world will not stand to be taxed by the whiners in the United States who think that the way to solve the problems of the budget is to go after the bank accounts of expats.

Neither of the two political parties, Republican or Democrat, has the will to change this problem, and as long as they can lay their deficit spending on the backs of the entire world, they will do so. It is time that our central banks, our people, and our corporations, reject wholesale the dollar and require that the Americans be honest about their effective extra-territorial taxation.

As an investor, I’m doing my part. I have a significant short position in my dollar accounts.

On top of this, the US has the most massive trade defict in the world. It is 60% of the total trade deficits of the 130 countries of the world that have trade deificits. Since the US trade balance was transformed from positive to negative in 1976, the US has never once since recorded a single trade surplus. Since then the cumulative trade deficit is now $8.6 trillion, which is about 7 times the total US Treasury borrowings from China. The US must borrow dollars from China to pay for what it imports from China. The US trade deficit last year with China was $300 billion

The only way a country pays for its imports is through its exports. The US 12-month trade deficit currently is $746 billion. Canada’s current 12-month trade balance is +$2 billion. Why the big difference? Very simple. Canada encourages its citizens to relocate abroad to sell Canadian exports, while the US does just the opposite. The US punishes its citizens with double taxation, requires the submittal of massive report forms on foreign bank accounts and submits them to horrendous fines and penalties if every jot and tittle on these submitted forms is not 100% accurate, even if they are totally up-to-date on their US tax obligations. And because of FATCA, Americans who live abroad are having their foreign bank accounts closed down because it has become far too costly for foreign banks to comply with FATCA, and it also requres that they viiolate the privacy laws of their own countries to comply with US tax law.

So Americans stay home and US products do not get sold in foreign markets.

The US has a trade surplus for 95 of the 100 years up to 1975, the year it recorded its largest trade surplus in its history. But not satified with this success Congress decided that having US citizens abroad served no useful purpose in insuring domination of the world export market. Congress knew that the rest of the world would keep crawling on bended knee to beg to buy American products.

So it really soaked it to the “tax evading” Americans living abroad with the Tax Reform Act of 1976. The effect on US exports was both immediate and dramatic. Hundreds of thousands of Americans living abroad sucessfully selling US exports came home and the bottom literally dropped out of the US trade surplus.

Congress has still not figured out what happened, and it apppears that they could care less, just as long as they get reelected when it is time for the next election.

@ Roger, exactly right. This is the other side of the equation. The United States imports goods from the rest of the world buying it with printed dollars. Then it devalues those dollars through deficit spending. It is a lose-lose situation for the other side of the trade deficit. This is why I think the rest of the world needs to reject the greenback out mere self-preservation. It will take some time, for the big players have too many dollars and so they are trying to wind down their position without devaluing it.

Two new articles on FATCA:

1. Financial Post: “Canadian bankers head to Washington to object to U.S. tax regulations”

http://business.financialpost.com/2012/05/15/canadian-bankers-head-to-washington-to-object-to-u-s-tax-regulations/

2. Bloomberg: “Global Bankers Air Concerns to IRS on Rules for Accounts”

http://www.bloomberg.com/news/2012-05-15/global-bankers-air-concerns-to-irs-on-rules-for-accounts.html

Bill Clinton says hike taxes across the board.

This should go over well with the folks who think raising taxes only on the rich will solve their problem.

@FromTheWilderness, do you know what? The US has got to stop its wild spending spree, because taxing everybody more; poor, middle classand Wealthy is not going to produce enough revenue to even stop the bleeding, let alone reverse it.

Washington has become a bottomless pit into which money is being poured as if there were no tomorrow. And if it does not stop there will be no tomorrow.

Not only is America as a whole parasitic on the rest of the world, but the large number of U.S. Homelanders who don’t pay Income tax are parasitic on the rest of the country.

http://isaacbrocksociety.com/2012/01/30/irs-hunts-u-s-citizens-residing-outside-the-u-s-while-many-u-s-residents-pay-no-income-tax/

There is no chance that the dollar is going to maintain its status as the world’s reserve currency – something that will be hastened by FATCA.

Does anybody know if the US or Europe are propping up the dollar at approx .90 to the Swiss Franc (the Swiss Central Bank has effectively locked the Franc to the Euro at CHF1.20 =EUR1.00 through their own “quantitative easing” i.e. printing francs to purchase lots of EUR. I suspect that some of these EUR could subsequently be used to finance the purchase of Gripen single-engine fighter/interceptors from Sweden, but Sweden uses their own currency so that brings in another variable. The Swiss are expecting to bring some of the manufacturing and assembly of the fleet to Switzerland, but I imagine that there may be some EUR zone subcontractors to pay as well. Still, the national bank is exposing itself to a big risk. Although the EUR was nearing parity before the intervention started occuring last year and the Franc was too costly, I am afraid Switzerland is creating a vulnerable bubble.

Pingback: U.S. seeks to impose FATCA on the rest of the world – will the world really comply? | The Isaac Brock Society

Pingback: U.S. seeks to impose FATCA on the rest of the world – will the world really comply? « Renounce U.S. Citizenship – Be Free

Pingback: The Isaac Brock Society