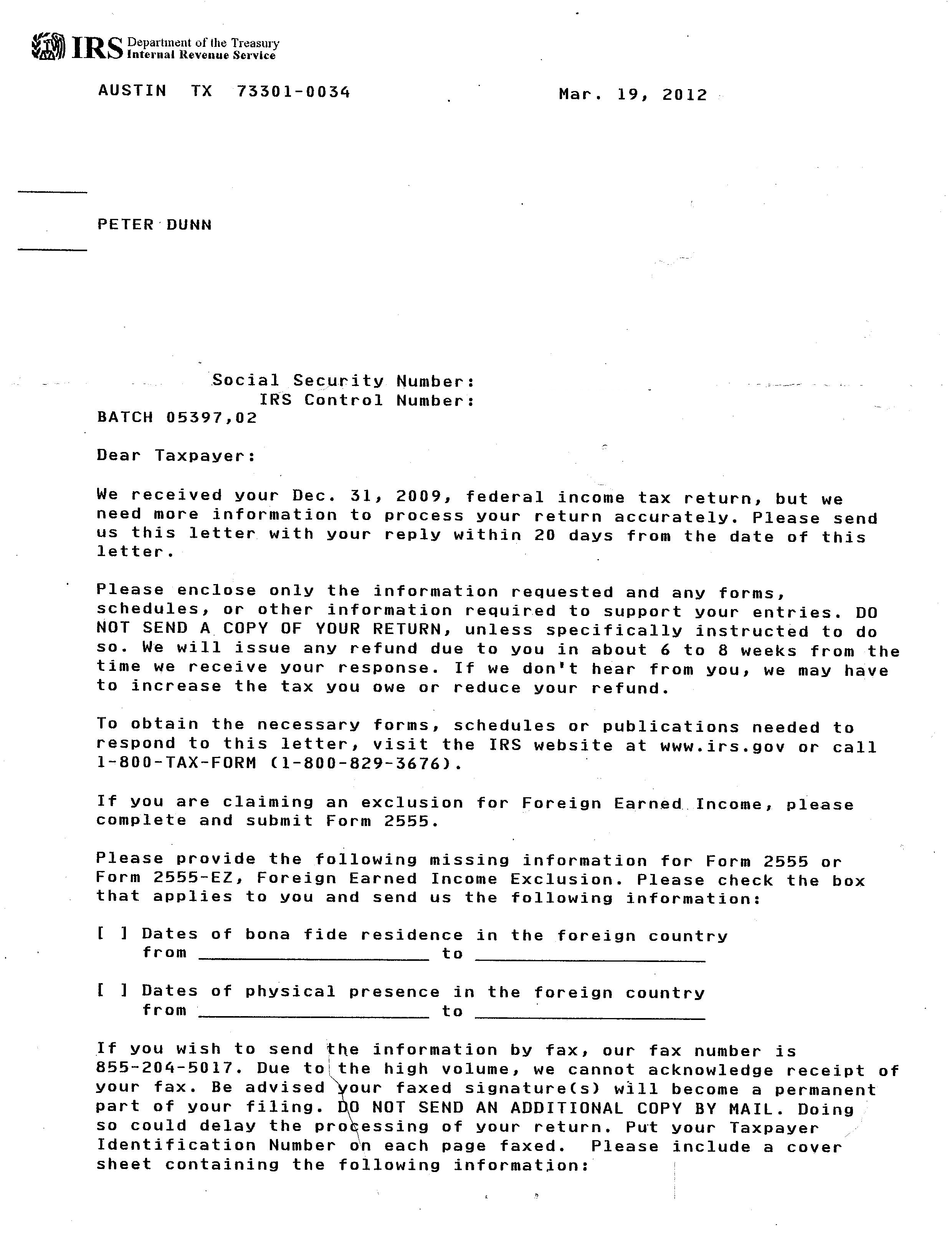

As I reported earlier, I sent my 2009 tax return to the IRS and this is the letter that I received back in duplicate. I suppose I just have to fill out the dates in the space provided on page one, send one copy of the form back, and that’s it. Not sure what to do. IRS speak (a.k.a. gobbledygook) is not always so clear.

Of course, it seems that they need my verification that I’ve lived in Canada in 2009, even though my accompanying letter indicated that I had become a Canadian citizen last year, and of course, my address is in Canada, whence I’ve filed at least ten years worth of returns. What gives?

And they wonder why about 70% of US citizens who live abroad become non-filers? Who in their right mind would want their name to be put on some computer generated list that ends up in wasting time and money to prove they owe ZERO tax.

And what’s worst it wastes the IRS’s resources as well. They could be putting that resource going after more collectible domestic taxes than giving some IRS agent entertainment dealing with “foreigners” and struggling to understand foreign address formats and telephone numbers.

Petros, did you e-file or did you send by mail? How long did it take to receive an acknowledgement after sending those documents?

Doesn’t make sense that they would ask for information that would already be in your return… but not surprising considering everything we’ve read about the IRS.

I doubt anything gives. This is “Form Nation”. Therefore, the issue is NOT the facts but the “form” itself. Regardless of what the facts in your file reveal, you have committed the sin of not completing the form properly!

To borrow from a Clintonism:

“It’s the form stupid!”.

What I would do is this:

Complete, the form properly. Send it back registered mail (reinforcing you are in Canada). Let them close your file and live happily ever after. I think you have received a wonderful opportunity to:

1. Reinforce that you live in Canada; and

2. Close the file.

Get the form back to them ASAP!

@zucchero81

On the contrary, it makes perfect sense. The issue is the form itself! This is why you get 10,000 penalties for not filing the form itself.

@renounce I think this is letter indicates that I only have to fill out the dates, which is the missing information on 2555. I don’t think it’s saying that I have to redo 2555. That would also be the reason I was sent to copies of the letter, so that I would have a copy of it too (because photocopiers probably don’t exist in Canada, my alleged country of residence).

The request appears routine. From some comments you made previously, you can probably exempt your earned income, or a part of it, up to the 2009 FEIE limit, from US taxes. Did you attach Form 2555 to your 1040 in order to be able to claim the exemption? That’s the normal way to get it. A letter does not do the job.

If you did attach 2555, then did you answer the question about your physical presence or residence overseas on Form 2555? You have to specify on 2555 either how long you were physically outside of the US during 2009, or if you are a bona fide foreign resident. The FEIE can only be claimed if you meet the physical presence test for being outside of the US, or if you are a bona fide foreign resident.

As you have been a long term resident of Canada, you probably should check the box for this and fill in the dates your residency began and write that it still continues. If you haven’t filled out Form 2555, then you need to do it if you want your earned income to be eligible for exemption.

@Petros

Then you should:

1. Fill out a new form.

2. Complete the omissions in the form that you filled out.

Send both.

I think we all need a laugh at FATCA and the US’s attitude towards its ex-pats and how many “domestic” Americans still live in 1955 – click on the link below:

Another funny video – there are those who believe US politicians are going to repeal FATCA when they run election campaigns aimed at half-witted voters.

Who in the US is going to know or care about FATCA when they can’t even name a country that starts with “U”

I found a copy of my return and it includes form 2555 but the dates of residency are clearly omitted.

I think I will just send a copy of that 2555 and the letter with the dates filled out. But notice that the letter tells me not to send anything I’ve already sent, but also to fill out 2555 in case I claim the FEIE–as if I hadn’t already filled out 2555 (which I did). Thus, the letter is actually a “form letter”, which is giving me bullshit instructions, making it therefore impossible to know how to respond.

As I said:

1. Photocopy the form 2555 and fill in the omission – by sending the copy you are not sending something you have already sent.

2. Send a brand new completed form which is NOT something you have already sent.

This way you are completely covered. Close your eyes and imagine this from the perspective of somebody who is just interested in the form.

You are taking this far too seriously. This is an opportunity to get your file closed – which is a good thing.

Stop thinking like a rational human being. You are dealing with “Form Nation”.

@ renounce I’m really not that concerned. Even the 20 day limit is not really that serious in my mind. I came back from vacation to find this piece of s— among my mail. Opened it up and was happy to see that they only wanted some trivial information about my dates of residency. No big deal.

The title of this blog post, however, is the key line in the letter: even asking for the most trivial of information, for a person with insignificant income, the IRS uses threats and extortion. I am glad to not be an American any more. The stress of dealing with the CRA alone suffices for one life time.

Ms Floyd: And don’t forget – as an American you have a privileged life, much better than the ignorant people of Switzerland. For example, if you get in trouble, we will send an aircraft carrier to rescue you.

Ralph: I didn’t know Switzerland had oceans.

Ms. Floyd: …

That was too funny!

One real bizarre thing about the “Form Nation” is how they cannot handle duplicate copies of forms. For example, with the FBAR, I saw that I had transposed a number and immediately sent an amended FBAR in. My tax professional went wild, like I had committed a crime. He told me that I should not have sent the amendment for at least 90 days. I still don’t understand why. Will I break the IRS computer systems? Will I receive a huge fine? Can’t their systems hold two scans? Is it that difficult for them to work with the latest input when processing a case? From your letter, the duplicate form problem seems to be widespread.

@John: Yikes!! That second video would be funny if it wasn’t so scary in the ignorance it portrays.

Petros, The second video John posted could probably use a thread of its own, too.

Rick Mercer did a very similar segment on his show once.

http://youtu.be/KKh0P9o6y18

hmmm.. I didn’t know that Canadians use “square feet”. I thought that was just the crazy Americans….

@john, someone along the way referred to them as “low-information voters”.

I posted on an older thread a little idea I had about forms. I’ll just put the link in so I don’t use up space here while Petros tries to figure out what to do. I’m afraid I’ve messed up too many forms myself to be able to offer and credible advice.

http://isaacbrocksociety.com/2012/03/18/us-tax-policies-margaret-thatchers-poll-tax/

Sorry, make that … “any credible advice”. Looks like forms are not the only thing I mess up.

Petros, this is a standard computer-generated response letter from the IRS – two copies is standard, truly from many years of experience, I can tell you it is best to fill in the info required, send the letter, end of story,

@ Carol I am afraid that the United States is the Hotel California when it comes to citizenship and taxation. So there is no “end of story”. I just have to resign myself to the fact that the United States is the world biggest bully, with a bully running the place. Oh, I will send in the missing information, but I do not believe that this story ends here. Not by a long shot.

What they don’t understand is that they are not my master any more. I have a new taskmaster: the Canada Revenue Agency. Now if the United States wants me to serve them again, I suggest that they annex and occupy Canada. Until then, I am not going to fret over the b—–ds* at the IRS. I have other things to do.

*Editor’s note: Originally I used a bad word. I changed my mind and have decided not to lower the level of rhetoric here at Isaac Brock. Petros

@ Petros who wrote: “Now if the United States wants me to serve them again, I suggest that they annex and occupy Canada.”

It’s a horrible thought but sadly it seems to me that Canada is already becoming occupied by the USA in a subtle, secretive, deliberate creep towards the North American Union. My only hope is that the process is slow enough that I can die as the Canadian I have been since birth and that I will never witness the day that we are North Americanized.

http://presscore.ca/2011/?p=2250

I’ll second that! The thought the US taking over Canada (and Mexico) in a merger makes me feel physically ill.

http://en.wikipedia.org/wiki/North_American_Union

FAQ #9 is the way to go. I would have looked at the buissens operations income/expense situation as a first step. Assume that the net additional income reportable for the early years = zero. Translation: you run at a loss.OK. Now you can show the IRS that they didn’t lose any taxes because of nonreporting. That’s half the battle. But the other half is that the income (loss, actually) should have been reported on a U.S. tax return but wasn’t. That part you fail.This is where I think that FAQ #9 is all janky. I think FAQ #9 should cover anyone where there is no tax lost to the government. You filed and reported, you didn’t file and report the income. You had income but it’s offset by the foreign earned income exclusion. You had income but it’s offset by the foreign tax credit. There are all sorts of ways you can come out with a no tax due situation.However, FAQ #9 is narrowly written: in order to qualify you have to (1) report the income each year in the year it was earned; and (2) have paid tax in the U.S. on that income. Technically your case fails that.However I am perfectly willing to push a sausage through that pipe and try to make it work. You are within the spirit of what FAQ #9 is intended to do. You’re a grownup and if you want to give it a shot, I am with you.Short cut answer: yes, I might have done this with you. We’d look at it, weigh the expected outcomes, and choose an action. If you’re going in with your eyes open, that’s all we need.