Yesterday I received a computer-generated letter from the IRS regarding the first of four 1040 returns I sent in mid-December. I check the mailbox everyday, thinking the notice from hell may arrive, though I really did not expect to hear a word for months. So I wondered before opening it, am I about to lose my sense of calm gained by renouncing and trying to focus, at least occasionally, on something else. I posted a bit about this yesterday but was unable to copy/paste the letter; Petros asked today that I include it in a new post.

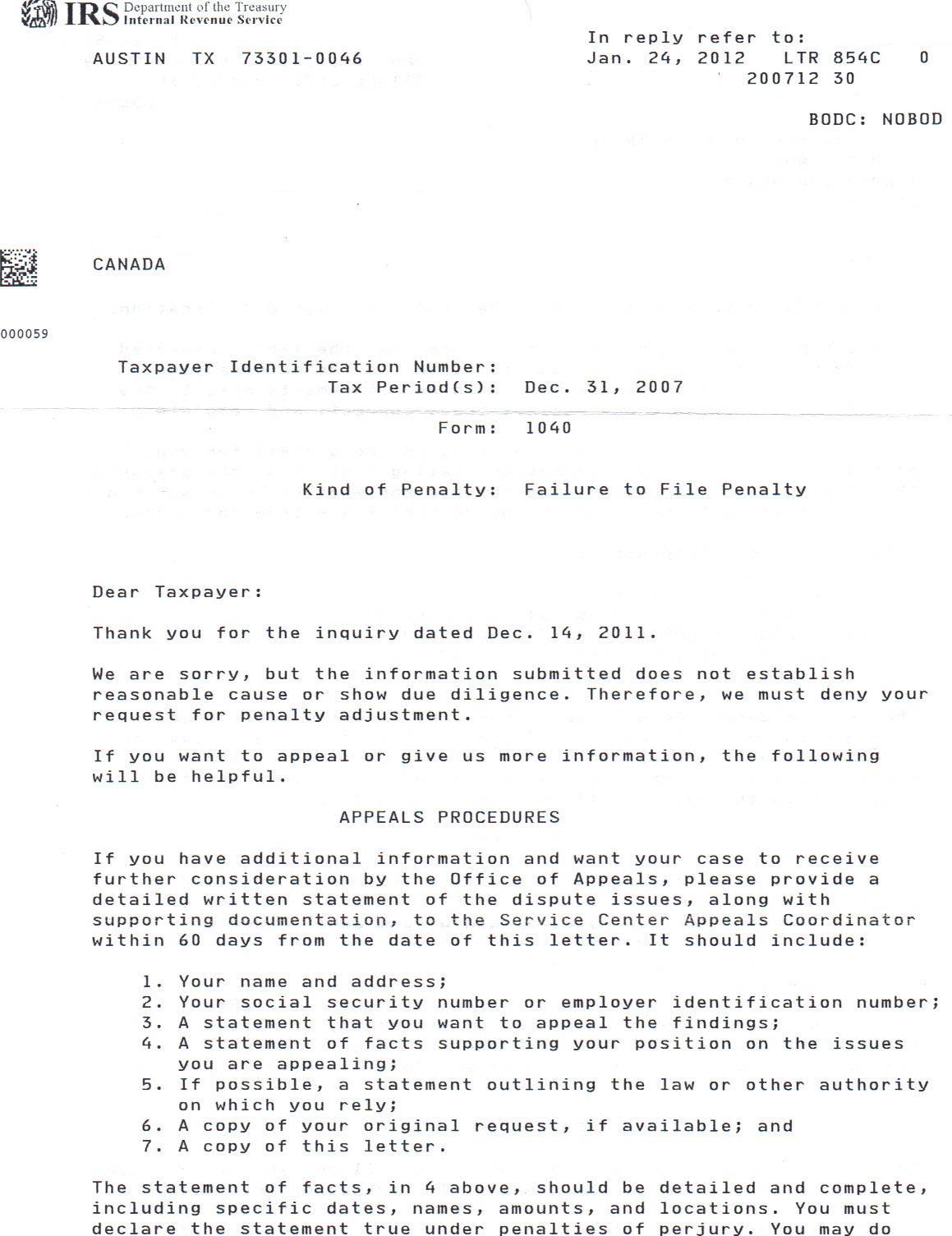

For starters, I am not alarmed about this letter and I don’t think anyone else should be either. While it is clear that someone must have read my letter (see original letter), the rest of it is obviously computer-generated. It is a mistake as I clearly do not owe any taxes. What is rather odd is the fact that nowhere in the letter, is any figure given for the failure-to-file penalty.

I wasn’t quite sure about it at first so phoned my sister who is a CPA. She said it was strange that there was no penalty amount, considering the type of letter it is; a standard, 854C which is sent to inform a taxpayer that they have the right to appeal and explains how to do it. She has better and quicker access to the IRS than I do and she was going to phone and see if she could get a general explanation as to why it was issued in the first place with no taxes due and why would it be sent without a penalty figure included.

I am posting it because it brings up the question of how is IRS going to treat our incoming returns, in light of the December 7, 2011 Info Statement issued by the IRS. While many feel it was less-than-enlightening, since my particulars are almost exactly as in “Example 4,” and I felt okay about sending the returns wanting to get the next layer of this unending, unnerving, anxiety-producing mess over with. My sister indicated that it was unusual to think the IRS would treat the returns any different than anyone else’s (in the US) notwithstanding the Canadian address. Not as an excuse but simply as a possible indication that the word has probably not trickled down to the worker bees yet. She indicated that the return might simply be scanned and entered into the system while the human doing it paid no attention at all to any details. Hopefully, she’ll be able to to find something out soon. She is rather busy, tax season and all.

What I am hoping, is that anyone with a similar situation to mine, will feel reassured, once this is clarified. The other positive, is that I see nothing about being automatically put into the “new and improved” 2012 OVDI. I was afraid that it was implied in a few things I had read on lawyer and accountant sites, that they may start to do this. I do expect that at some point, that may be the only option they offer and it was one reason I wanted to act right away with filing and then renouncing. One of the sites indicated that by leaving any closing date open, it allowed them to avoid raising the penalty of 27.5%. At the moment, I don’t remember which one it was but I can look for it if anybody needs that information.

What do you think?

A Bit of Good News from the IRS

Yesterday I received not one, but four letters identical to the one nobledreamer got from the IRS, one for each of the returns I had filed for the years betwen 2005-2008. I expect the letters for the 2009 and 2010 returns are in the mail. The only difference was that the heading listed both “Failure to File” and “Failure to Pay” Penalties. I had also attached a copy of my reasonable cause letter to each return. It contained all the points in nobledreamer’s letter, with different dates, along with the argument that I had never sought to renew my U.S. passport.

I immediately emailed a copy of one of the letters to Elena Henson at KPMG in Hamilton. KPMG had prepared my tax returns, FBAR’s and provided me with a framework for my reasonable cause letter. Within 24 hours, Henson got back to me with the following message:

“We spoke with the IRS today. They could not give us any legitimate reason or explanation for why this notice was issued. The agent we spoke with said that your records on file with the IRS indicated zero balances for 2005-2010. No notices are pending to be sent out either. The IRS agent said to not worry about this notice or responding as there are no penalties associated with your account.”

As we suspected, the notice must have been an automated or thought-less response by someone indifferent or oblivious to the emotional response we would have to such a notice. There appears to be no judgment made on the reasonable cause letter itself, if it was even read.

@Expat94

Thank you so much! It’s so much better to hear directly that it can just be ignored. My accountant had no response and I really didn’t want to ask her to check up on it at that point, since I *should* receive at least 3 more. You have made my day!

Do you mind if I ask when you sent your FBAR’s? Last I heard something, the fellow had filed in September and they were telling him he should hear something by January. By that timeframe, I won’t hear anything until at least April. And no clue when CLN will arrive.

Thanks again! 🙂

How many others have got letters like that from the IRS? That would make my heart stop to get such a letter being as I owed no tax and I as well received a 300.00 refund in October. That is utterly ridiculous to put more panic into our lives. Shame on them!

@lovecheese.. I love the name… too funny! but how did you receive a return. Please do tell? The US rules are really set up for you never to receiive a return…

@nobledreamer, lovecheese

You’re welcome. If you had not posted your letter a week earlier I would indeed have panicked when I read the words: “We are sorry, but the information submitted does establish reasonable cause or show due diligence. Therefore we must deny your request for penalty adjustment.” Having read nobledreamer’s post my anxiety stopped short of panic.

Given that nobledreamer has received this response to only 1 of the 4 returns submitted, and I received it for only 4 or the 6 I submitted, I wonder if only some of the IRS workers are hitting the Form 854C button.

If the people in Detroit processing the FBAR forms are operating in the same way, panic may be unavoidable. We really don’t need this, nor should we have to put up with it.

I submitted both my tax forms and FBARS at the end of December.

When I gave notice of my relinquishment to the Consulate, they said I should expect a six month wait for my CLN.

It is useful, for better or for worse, that we continue to share whatever responses we get from the IRS, Treasury or State Departments. Let’s hope this continues to be a source of relief.

IRS Seeks Some PR Help

“Public relations experts said it would be an attractive challenge, given the agency’s unpopularity.”

http://blogs.wsj.com/washwire/2012/02/17/irs-seeks-some-pr-help/

“For the IRS, the first thing to do would be to change your name,” said David Bauman…

I say they change their name from the IRS to WDTFA short for We Don’t Tax Foreigners Anymore.

Any other suggestions for what the IRS should change their name to?

International Robbers Society

@OMG: LOL.

Yeah, Ron Artest should have changed his name to Twinkle Bell; then maybe the fans at his games would be afraid that he’d run up into the stands and clobber them (if the brawl had just been the with Detroit Pistons it wouldn’t have been so bad). Maybe the IRS should change its name to something like this: “Cuddly Bears” with the slogan: “We are from the government and we are here to help you.”

I’ve relinquished my citizenship; and I don’t go to Laker games (Artest’s current team).

The Ron Artest fight is still available on Youtube:

By the way, apparently Artest’s new name is: Metta World Peace

http://www.opposingviews.com/i/sports/nba/which-lakers-players-are-badmouthing-metta-world-peace-aka-ron-artest-media

@OMG: How about ITS: International Theft Services.

Can you believe $15 million for public relations?!? Now we know why they’re after us! They need foreign money for PR because American residents would be outraged at this.

I hope IRS Vet will tell us how all the great folks at IRS came up with this!

One of the best comments to the article was:

“The act of using taxpayers’ money to fund its PR should itself be a PR problem.

Once again proving that government can not spend money wisely.”

The IRS needs much more than “re-branding”.

What they need is to see how a civilized revenue service works. They should all be sent to Canada for training with the Canada Revenue Agency.

Pingback: Isaac Brock Society is the Best PR for Canada Revenue Agency: Open Thread | The Isaac Brock Society

I am a Candian married to a US citizen and filed my wife’s returns this june. I just received a similar letter for only 1 of the 6 years in which I filed about a month after filing. I can’t believe that they would generate and send these out without bothering to check if any tax was even owing for the year in question. Now I am very worried about what I will see in regards to FBAR penalties.

Hi Evan

In my own case, since I knew I didn’t owe any tax and checked with several reasonable sources who have experience with the IRS, I ignored the letter. I never received another. I sent my FUBARS at the same time and have never heard a word about them either.

While this is in no way official, the general gist seems to be that they are simply accepting returns/FUBARS from Canadians with no problems as long as no tax is owed. In just the last couple of days, another poster (on another post, will find it if you need), pointed this out, that to date, there are no known cases of CDNs who come forward and file, having received any fines/penalties.

It was suggested to me that because I included a letter with my returns, indicating I should qualify for “reasonable cause”, the letter was generated. Technically, that letter should only apply to FUBARs. I sent it anyways. Again, I’ve heard nothing since then filed on time for this year and have already renounced. Are you familiar with the official CDN position that no tax will be collected from any duals who were CDN at the time the tax was incurred and most importantly, NO FUBAR penalties will be collected by the CDN govt, CRA, etc.

I hope your wife is a CDN citizen and that if necessary, crossing the border isn’t an issue. Please keep writing if you need more info. Believe it or not, the horrid fear and anxiety does go away. Hope this helps.

*Thanks for your reply nobledreamer… It helps relieve some of the uncertainty. As soon as all of these issues came to light I told my wife to apply for Canadian citizenship, hopefully her application is approved shortly. While I am not sure if she will renounce her US citizenship or not, I think going through all of this has made her think seriously about going that route. I also don’t want our children to be saddled with these issues in the future, which I think as the law stands now they would techinically be American citizens. I am pretty sure that if hefty FBAR penalties were being assessed we would be hearing about it online or through the press and I can’t find reports of it anywhere.