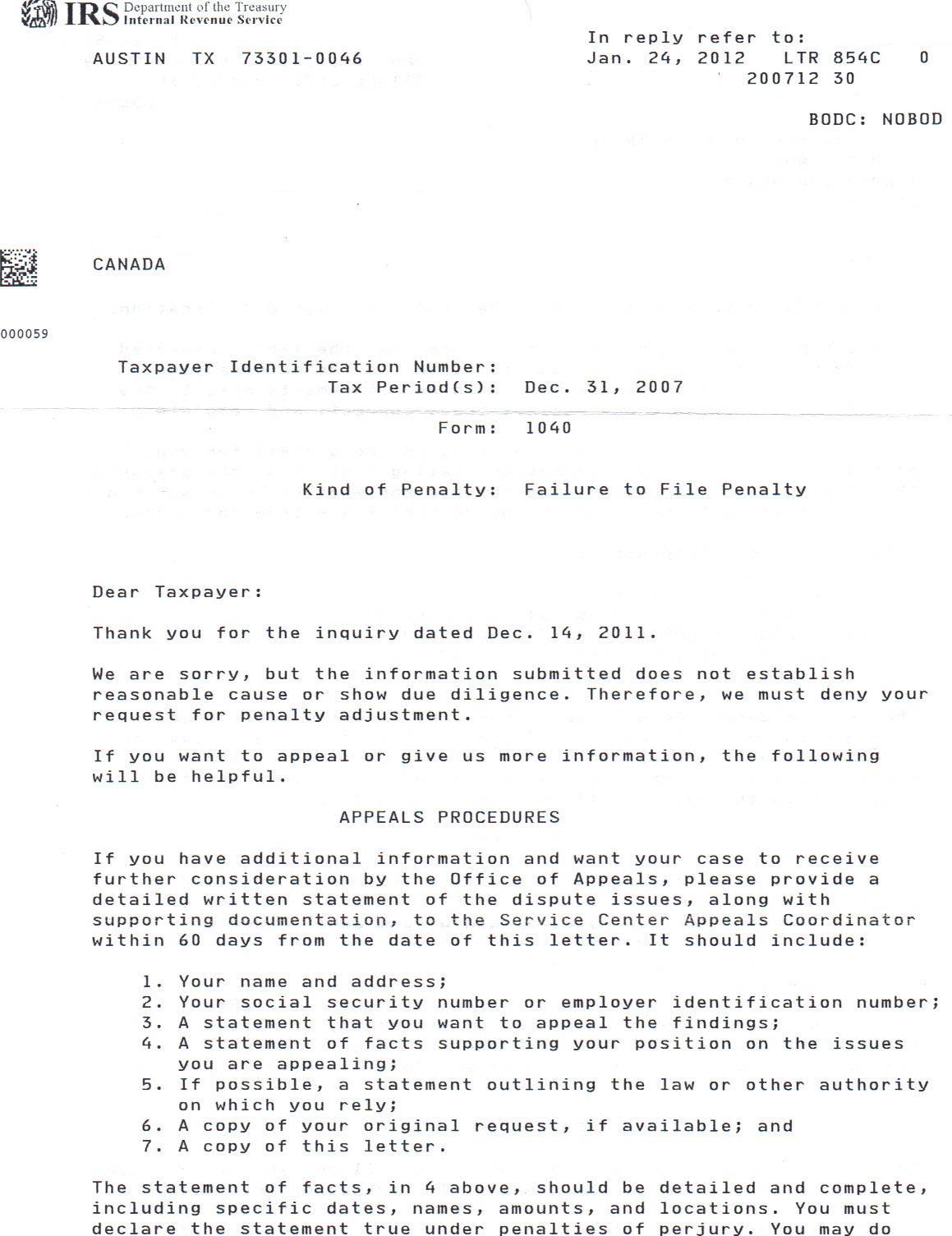

Yesterday I received a computer-generated letter from the IRS regarding the first of four 1040 returns I sent in mid-December. I check the mailbox everyday, thinking the notice from hell may arrive, though I really did not expect to hear a word for months. So I wondered before opening it, am I about to lose my sense of calm gained by renouncing and trying to focus, at least occasionally, on something else. I posted a bit about this yesterday but was unable to copy/paste the letter; Petros asked today that I include it in a new post.

For starters, I am not alarmed about this letter and I don’t think anyone else should be either. While it is clear that someone must have read my letter (see original letter), the rest of it is obviously computer-generated. It is a mistake as I clearly do not owe any taxes. What is rather odd is the fact that nowhere in the letter, is any figure given for the failure-to-file penalty.

I wasn’t quite sure about it at first so phoned my sister who is a CPA. She said it was strange that there was no penalty amount, considering the type of letter it is; a standard, 854C which is sent to inform a taxpayer that they have the right to appeal and explains how to do it. She has better and quicker access to the IRS than I do and she was going to phone and see if she could get a general explanation as to why it was issued in the first place with no taxes due and why would it be sent without a penalty figure included.

I am posting it because it brings up the question of how is IRS going to treat our incoming returns, in light of the December 7, 2011 Info Statement issued by the IRS. While many feel it was less-than-enlightening, since my particulars are almost exactly as in “Example 4,” and I felt okay about sending the returns wanting to get the next layer of this unending, unnerving, anxiety-producing mess over with. My sister indicated that it was unusual to think the IRS would treat the returns any different than anyone else’s (in the US) notwithstanding the Canadian address. Not as an excuse but simply as a possible indication that the word has probably not trickled down to the worker bees yet. She indicated that the return might simply be scanned and entered into the system while the human doing it paid no attention at all to any details. Hopefully, she’ll be able to to find something out soon. She is rather busy, tax season and all.

What I am hoping, is that anyone with a similar situation to mine, will feel reassured, once this is clarified. The other positive, is that I see nothing about being automatically put into the “new and improved” 2012 OVDI. I was afraid that it was implied in a few things I had read on lawyer and accountant sites, that they may start to do this. I do expect that at some point, that may be the only option they offer and it was one reason I wanted to act right away with filing and then renouncing. One of the sites indicated that by leaving any closing date open, it allowed them to avoid raising the penalty of 27.5%. At the moment, I don’t remember which one it was but I can look for it if anybody needs that information.

What do you think?

While definitely not a fan of this whole thing, I did file a quiet disclosure and am now caught up….I had a CPA in Wenatchee file the past 6 years….Found out I owed 225.00 in 2008, got a bill from the IRS for $32.00 in interest owed from that year….and that was it….have toyed with the idea of renouncing, but my financial situation is not such that I am ever going to owe much…(other than the cost of filing)…so at this point will remain a dual citizen (Canada/US)

Hi noble: Thanks for sharing this. I wonder if you had shared your original letter with us before. If not, could you tell us what it said so that we can see what does not constitute reasonable cause.

What an odd business. It’s not clear to me that they’re asking you to *do* anything.

If I understand correctly, the non-filing penalty on a nil return is nothing –

@Nobledreamer,

I am curious that you sent a ‘reasonable cause’ letter with your 1040 filing.

Maybe I did mine wrong, but in conversation with a number of Accountants prior to my filing…because I asked the question like 20 times….(PTIN#s and the like), the “reasonable cause” letter was to be filed with my FBARs only and not my 1040s.

When I asked the question regarding this, they all stated that the ’cause’ letter was to be attached to the FBAR filing…and not the tax return.

Also, they CANNOT push you into the OVDI program. This is something you have to request yourself.

@Paul Mend,

I am curious to your post as well. Did you file a reasonable cause with your returns?.

Also, it has been 3 months for me and have not heard a peep…supposedly they owe me $300 for year 2009,…but I am thinking now maybe they won’t send a cheque because they will not pay out if you dont work and live in the US?

In other words, does anyone know if the US will give us a refund if the numbers work out that way?

Any thoughts on this?

I’m just curious — the letter is signed by an Operation Manager, Document Perfection? What is that? Layer upon layer of mystery is the IRS.

@halifax There is a possibility of late filing penalties for null returns.

Nice of them to send you an envelope. They are so considerate!

@Petros

Maybe the penalties for late filing are ‘standard’ in the case of a Nil return. In other words you look it up, write a check, and mail it out?

@Mach7 I may be wrong about the penalty. I thought it was $135, but I read now that it is:

http://www.taxguideformorons.com/irs-problems/7-avoiding-the-irs-late-filing-penalty

This site suggest what that if you are in a coma, you might have reasonable cause. Perhaps if you were kidnapped too or taken hostage by terrorists.

@Petros

So what you are saying is…since i didn’t file a reasonable cause letter for my back filings i should expect a bill for $810 USD….(135X6years) 🙂

@Mach7, it appears if you owe zero, the penalty is the lesser of $135 and 0.

This gets more confusing all the time. I filed three returns in August (that is what my accountant recommended that I file in order to get “caught up” – I have never filed a U.S. return before). I haven’t heard a thing. I thought that since I don’t owe anything, and won’t no matter how many returns they ask for, I was in the clear.

This makes me think that maybe that is not the case?

Also, I don’t really understand why people are getting any money back. I can’t imagine why the IRS would owe me any money. It as unfathomable as the fact that they would think I owe them anything.

@TooMuchcoffee United States money is like most currencies, fiat currency. That means it symbolizes the good faith of the United States, but it has nothing except symbolic value. It can be created at will by the United States Federal Reserve Bank. The US gives money back to people who never paid anything because they think, as a result of a late form of Keynesianism (e.g., Paul Krugman), that they can stimulate the economy by creating more US dollars and giving it to people to spend. The end result, however, is not necessarily to kick start the economy but rather to simply devalue the currency. It also a form of redistributionism. They must tax the rich so that they can redistribute it to the poor. If you get any refund, it is because they are trying to get you to vote for the party in power–redistributionism is a vote getting measure.

@TooMuchCoffee

Actually, i haven’t received a dime yet, and I don’t know of anyone who has.

My question would be…if the IRS owe’s you a refund, will you get it due to the fact you do not reside in the US and have never worked or paid into there system.

I am not sure why my Accountant worked the math for a return for 2009….however there must be a method to his madness.

@TooMuchCoffee,

I would also think that if they had a problem with you filing…you would have heard something by now as it has been over 6 mos for you.

Usually if the IRS has an issue, you will hear something soon….as least that is the information I was told today.

Actually, I remember someone on the expatform saying he had received a refund – he lived in France, and said he got enough money back to pay the accountant he’d hired to do his return.

@Petros

I just tried to add the letter I wrote but it keeps showing up at the top. 🙁

The letter was very short and touched upon things I had in common with Example 1 and Example 4 from the FS-2011-13, December 2011:

Example 1:

*Taxpayer complied with Country A’s tax laws and properly reported all his income on Country A tax returns.

*After learning of his U.S. filing obligations, Taxpayer filed an accurate, though late, federal income tax return showing no tax liability

(Taxpayer is not liable for a failure to file penalty, since the amount of tax required to be shown on the federal income tax return is zero).

(You may have reasonable cause for noncompliance due to ignorance of the law if a reasonable and good faith effort was made to comply with the law).

Example 4:

*Taxpayer is a United States citizen who lives and works in Country B (married to Canadian)

*The aggregate balance of the checking and savings accounts is $50,000

*Taxpayer complied with Country B’s tax laws and properly reported all his income on Country B tax returns

* After reading recent press and thus learning of his federal income tax return and FBAR reporting obligations, Taxpayer filed delinquent FBARs, reporting both foreign accounts, and attached statements to the FBARs explaining that he was previously unaware of his obligation to report the accounts on an FBAR. Taxpayer also filed federal income tax returns properly reporting all income and no tax was due.

( the unreported account was established for a legitimate purpose and there were no indications of efforts taken to intentionally conceal the reporting of income or assets, and that there was no tax deficiency).

Here is my letter:

12 December 2011

Department of Treasury

Internal Revenue Centre

Austin, TX 73301-0215

USA

Dear Sirs,

Enclosed are my US tax returns for 2007, 2008, 2009 and 2010. I am a United States citizen from birth (xxxx) and lived in the US until I immigrated to Canada on xxx, xx, 1982. I married my (Canadian) husband on xxx, xx, 1982 and became a Canadian citizen on xxx, xx, 2008.

I was not aware I was required to file US tax returns. I have been filing and paying my taxes in Canada and it simply did not occur to me that I was also supposed to file US tax returns.

I first became aware of this regulation in mid-September 2011. I promptly asked my accountant to begin preparing these returns. I received them in their final forms on Wednesday, December 7, 2011.

I have complied with all tax filings and payment obligations in Canada. I have no record of criminal penalties of any kind. I had no willful intent to evade or escape any taxes due to the United States.

I hope that my situation will meet your definition of reasonable cause and respectfully request the abatement of any penalties.

Regards,

Toronto, ON

CANADA

.

@Mach 7

I know that it was indicated that the letter should accompany the FBARs and by doing so, it would not be a “quiet” disclosure. However, I could see no reason why not to add the letter, so I did. Perhaps I should not have asked for abatement of penalties- maybe whoever saw that didn’t bother to look at whether I owed tax or not and just tagged the 854C to be sent. ???

@Paul Mend

I also would likely never owe taxes however, it is the looming possibility of making mistakes on the FBAR and incurring their loathesome penalties that continued to bother me as well as the fact accounts that were not even mine had to be reported and the penalties were thus, on my husband’s money. I would have loved to remain dual but there was just too much uncertainty and anxiety about the whole thing.

@TooMuchCoffee

You probably are in the clear.

I didn’t think I would be because I never added my name to my Social Security number and wasn’t about to do that on top of all the other nonsense. So on the one hand, I am glad to see that they don’t seem to care about that.

People mentioned being due refunds on the old Forum and I think the reason is partially the “stimulus” bill plus, there are always little tricks to engage that give you the possibility of a refund. I would imagine they see it as this is what the form says, therefore, they send a refund. It doesn’t matter where you live or whether you are actually paying anything.

@ Noble I put a link in the original post to your comment with the letter in it. Thanks. It is very clear that the ambassador Jacobson was full of B.S. when negotiating with Canada.

Mach7 asks: My question would be…if the IRS owes you a refund, will you get it due to the fact you do not reside in the US and have never worked or paid into their system.

If the IRS owes you a refund, you will receive the money. Your address inside/outside the U.S. has no effect. The IRS is bad, but not that bad.

@Mach7 I got a cheque for US$300 a couple of months after filing my returns. Unlike what the CRA would do, there was no context or explanation at all. It took a while to figure out. (It was an economic stimulus cheque for 2007).

@Petros

Thanks again my friend, sorry I am still so inept with this machine….yes, I guess that is what the letter does demonstrate – somebody wasn’t being straight with us. If that didn’t follow as closely as possible, what was indicated, what on earth would?