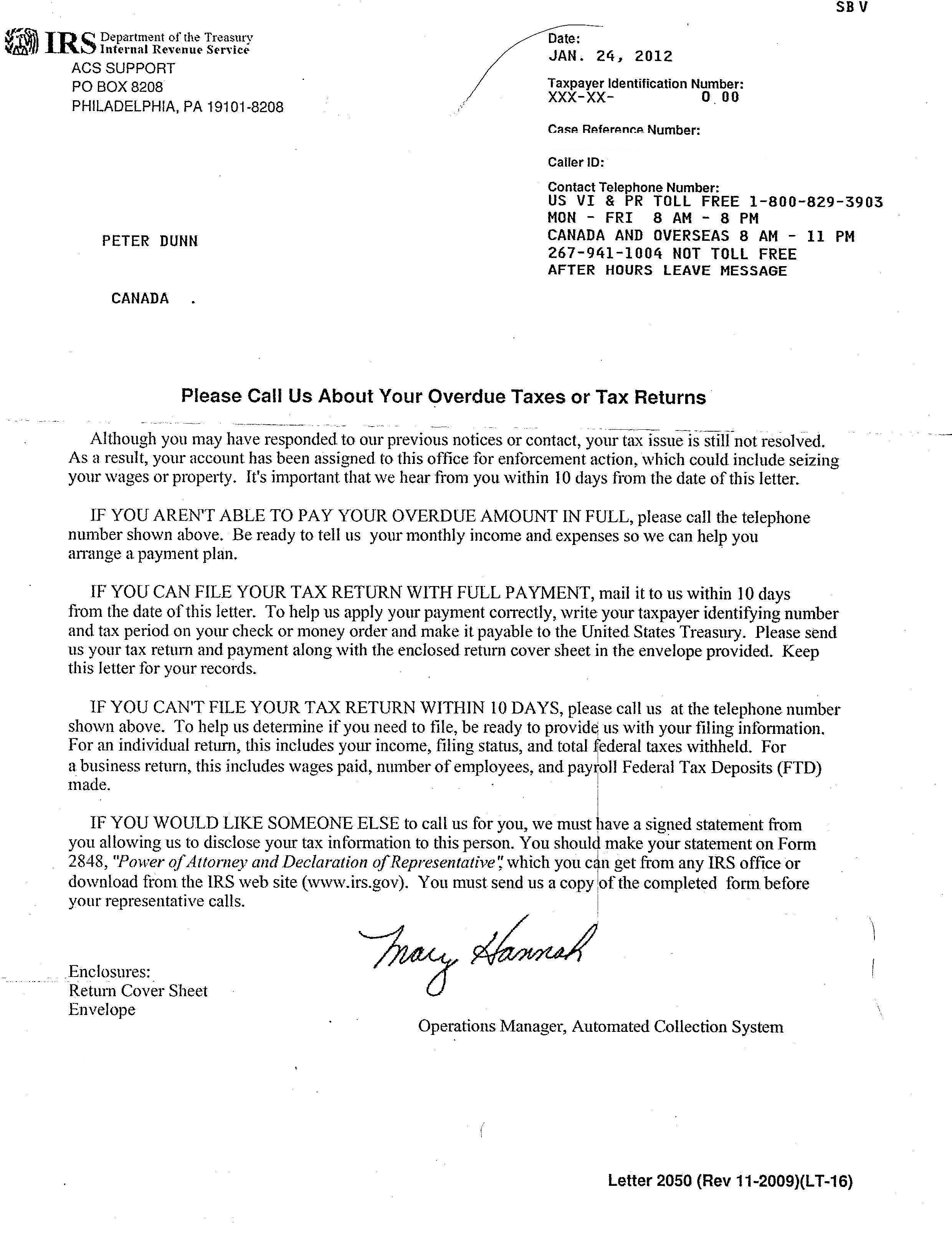

For those of you thinking about filing US income taxes for the first time, I suggest you read the following letter that I received from the IRS in the mail today. I sent my zero return for 2009 last week with a letter explaining why it was late (evidently it did not arrive on time to prevent this mail out). I am on the IRS radar, because I was compliant for about the previous ten years. Moreover, they are apparently aware of certain securities I traded in the US. But I didn’t owe anything on my income tax return. So this is the trouble that they will go to harass Canadian residents who are late filing.

I’m not clear on how much they’re demanding, or why –

@Halifax I don’t owe them anything. Apparently, they didn’t get my return that I sent last week. It came out to zero. I think. But I haven’t had a priest from the IRS pronounce absolution yet.

They have too much time on their hands. If they were a business they would go broke since they obviously do not know how to allocate their labor according to which activity would bring the highest return on labor.

@recalcitrant: I have a file full of 1040s from 2008 and earlier in which I paid no taxes. ZERO. But I’ve been told this is a computer generated letter. So it’s not a real person sending me this.

@Petros, Please keep us posted. Meanwhile, perhaps you could send them a check for zero dollars. But remember in must be zero US dollars and not zero Canadian dollars, since US taxes on foreign income can only be paid in US dollars.

First let me say that Petros and I do not have an attorney client relationship and what follows is not tax advice to anyone but simply comments and observations from a 30 Year IRS VET. Petros has not shared any of his personal facts vis a vis the IRS with me so be warned that what I am writing below is not written with his specific facts in mind, simply because I do not know them.

The letter from the IRS you published is likely a computer generated letter from the Automated Collection Service which is likely to be the first of a series of increasingly more menacing letters.

Although the letter calls for a ten day response time, it is not uncommon in these situations for a period of months to go by before you hear from them again. It could be sooner if they think you need special attention right away. That said, it is always advisable to reply on a timely basis to the IRS, even if it is to ask for more time to reply!

In dealing with the IRS it is always the client’s choice as to how to respond to an IRS inquiry once the client has all the tools and knowledge at his disposal before he makes his next move. An attorney cannot tell you what to do. An attorney can only tell you what will happen if you do X, Y, or Z.

People should be cautioned and be reminded that in a situation like this, what Petros is doing now is crafting or building a file with the IRS which will follow his case from the filing of the last return to however far this goes. People should know that years ago, before the major 1998 reorganization, the IRS used to be able to group taxpayers of interest into what they were allowed to call “Tax Protestors.” In classic Orwellian 1984 double speak, IRS employees are no longer even allowed to utter the words, “Tax Protestor” but they have obviously put in place systemic alerts so that IRS enforcement people can identify those WHOM THEY PERCEIVE TO BE people who are thumbing their noses at the IRS to see if they can take a joke, or are counseling others to disobey the tax laws. I am not suggesting this is what Petros is doing. I am talking about how people at the IRS are trained to look at similar situations.

It is one thing to exercise our freedom of speech and say almost anything we would like to say to the IRS in a public forum like, “The IRS is wearing a funny hat,” but it quite another to file, tender, or submit papers to the IRS which sound like there is a possibility that they are tax protest materials which are directly related to YOUR personal tax account or tax year under audit or investigation.

Those who would like to take on the IRS directly which Petros is apparent doing should be cautioned not to paint themselves as Tax Protestors or Tax Protest Leaders which simply put, are people in the view of the IRS, who are violating tax reporting requirements based on legal theories which the IRS believes have been discounted or rejected by the courts, or are counseling others to do so. Once the IRS computers put a taxpayer in the group FORMERLY KNOWN AS TAX PROTESTORS, they will direct their enforcement personnel directly at them and they will seek to make a public example of them including the possibility of a criminal investigation.

If you put a target on your back and tell the IRS to “go ahead, make my day” you need to be very careful about what you wish for.

Respectfully submitted

30 Year IRS VET.

@ Steven Thanks for this timely reminder of the modus operandi of the IRS. I am very happy that you’ve written this all down, and it is very kind of you to write these warnings. I understand you want to help us, and I like very much what you are trying to do. I understand your good intentions, and that is very welcome.

Let me ask you: Do you think that this is a battle that the IRS wants? I am wealthy by my standards–but I don’t need much–I have more than I need to live on. As a result I have an full-time assistant (not well paid) and a once-a-week housekeeper. My Canadian wife’s family company employs about 25 people full-time with benefits. I.e., we are employers in Canada. Do you think that they want to go after a Canadian employer and put my assistant out of work and make my housekeeper find a new client? What about the ramifications for my wife’s family business? Does the IRS have a right to pillage her too? And over what? A late 1040 return showing zero taxes owed? You just told us that the IRS is scared of us. Are they really scared of us, or should we be scared of them?

Everything I own, everything I have made is Canada source income and it is doubtful in my mind that the IRS would want to go after me and lose the good will of an entire nation to the North. I pay a lot of taxes in Canada, and my taxes goes to pay for our health care system, our military, our roads and our education system. Remember, you guys down south need Canada. Something like 40% of your oil imports come from us.

Is this a battle that the IRS wants? Do you think that they would make an example of me, when all I am saying to Canadians is to take seriously the protections that our government has promised: (1) not to collect US taxes from a Canadian citizen; (2) not to collect FBAR fines from anyone ever. This is what I constantly remind people–now do you think the IRS wants to criminalize my reminding folks daily on this blog that they live in Canada and the Canadian government has promised certain protections?

If my becoming the target of the United States means that my government Canada will come to the aid of all the innocent people here in Canada, then I will consider it a job well done. Isaac Brock gave his life for Canada, and when I took the oath to the Queen of Canada I pledged to be willing to do the same.

Here is a good post that renounce wrote that I think is a good reminder: http://renounceuscitizenship.wordpress.com/2011/11/29/the-irs-attack-on-u-s-expats-will-become-a-diplomatic-issue/

If this current attack escalates into a major diplomatic issue–then the Canadian government will step in–otherwise the IRS will continue to plunder us one at a time.

http://righteousinvestor.com/2011/11/15/pillaging-one-person-at-a-time-why-im-coming-out-in-the-open-with-my-fight-against-the-irs/

Steven Mopsick:

I am thoroughly enjoying your contributions/insights to IsaacBrock, but I have to tell you you are indeed painting a picture of 1984 that makes me never want to get closer than shouting distance to the US border.

What in god’s name happened down there? How could Americans — of all people in the world — allow such a rogue bureaucracy to grow so powerful and so vindictive that it would literally take candy from a baby and demand that last piece of liquorice as interest for taking too long to hand over the jujubes.

At least in the Spanish Inquisition, if you confessed right away, they would quickly put you out of your misery.

Petros, yours is a VERY IMPORTANT POST. It underscores the why the “reasonable cause” argument for not filing on time is one that must not be taken lightly.

Certain arguments under “reasonable cause” are supported by case law and statutory law (e.g., reliance on advisors, information unavaiable, ignorance, etc.), but the elements of these defenses must be set forth in the accompanying letter. Without addressing the elements of the defense, the IRS can easily deny the defense.

Likewise, certain arguments under “reasonable cause” are NOT SUPPORTED in the law. If you don’t use the correct argument, the IRS WILL deny the defense and assert penalties.

Further, if the facts used to support reasonable cause argument are false or misleading, that can constitute criminal conduct.

Finally, as Mr. Mopsick notes, there are additional penalties ($5,000 in fact) for advancing a frivolous position.

Everyone needs to be advised to proceed with extreme caution.

Excellent post Petros.

Man all I have to say is I love Canada Revenue Agency!

I’ve owned two businesses and in the past have had serious disagreements with them and never felt like I would be made an example of for expressing my sincerest thoughts. I could argue with the CRA like I argue with my brothers with no fear of retribution.

I once threatened to shut down my business, have 10 kids and go on welfare if they didn’t leave me alone. They took it all in stride and decided to call my accountant from then on instead of calling me directly. My accountant said she and the CRA agent had a good laugh about my threats.

The IRS is a rogue organization that wants to operate outside of US borders as if the sovereignty of other countries doesn’t exist. They want to violate the privacy laws of every country on earth and they get to give lectures about obeying the law?

I think the countries of the world should challenge the legality of citizenship based taxation in a world court.

@Roy, thanks for your comment. My reasonable cause, if you look at my letter to the IRS, is that I was scared shitless by their threats. I suppose they could levy any fine they want at me, for not filing my zero return. It would just prove that my reason was reasonable.

How many of us ever thought we would honestly say that we love the CRA?!?

@Stephan Mopsick; your comments are very clear and much appreciated. Given you extensive experience I have a question which, if you could answer, would be most appreciaed. In an earler post which Petros posted it was commented that it is recognized there are problems which are currently being faced by non-resident dual US-Canadian citizens which were not anticipated. My question is are there any problems for US-Canadian dual citizens that are uniquely different from those of non resident US citizens who are dual citizens of countries other than Canada? Any light you could shed on this would be much apprecated siince contributors to these blogs in similar situations live all over the world – Europe, Asia, South America, New Zealand, etc.

Many thanks in advance.

@arrow- I see it this way. Dealing with the IRS would be like dealing with a traffic ticket if the police were the ones who wrote the traffic laws, enforced the laws and also staffed the courts where judgements on the violation of the law were determined.

When it comes to the tax code the IRS is a one stop shop from which there is no escape. The T.A.S. is a toothless tiger that the IRS can ignore at its leisure.

The powers of the IRS are an assault on the Constitutional rights of the American people and on the sovereingty of the nations of the world.

@Petros,

In the iRS letter they elude to the fact that they will sieze your accounts etc.

Can they do that to a Canadian financial institution….i thought only CRA could excercise that sort of threat!

@ Mach7 It is a form letter which apparently is unaware of my Canadian context, despite the Canadian address.

I don’t have any accounts in the US, so my accounts are out of their reach.

@Petros,

I am still confused as to why they sent you this letter advising you as if you owed tax and did not pay.

Clearly they must have a different type of form letter, computer generated or not.

It seems to me that they didn’t even review your return before mailing this response…..or better yet used the ‘shoot and ask questions later’ approach.

@ Mach7 The letter covers both late filing and overdue tax. Obviously it is scarier to include all kinds of threats then if it just said, “Please send your tax return. We are still waiting.”

omg: I agree. Who would ever think Canadians would be praising CRA, but that’s exactly what I’m doing with all of my Canadian friends, colleagues, neighbours, etc, as well as my American family. CRA is prompt, professional, respectful, courteous, rational, logical, fair and straight-forward. In over 40 years, I have never received one single intimidating, harassing or mixed message from CRA.

In fact, a few years ago, months after I had received my refund, I received a letter from CRA. I thought “Oh, Oh.” I was pleasantly surprised to find a letter advising of an error in my return–meaning I was entitled to an additional $230 refund. That money was in my bank account through direct deposit before I even received the letter by mail.

IRS on the other hand is painting anyone who lives outside US and has not filed FBAR as “tax cheats” and “tax evaders”–even those of us who have been citizens of other countries for decades (and we’re called “traitors” by some US politicians and media).

US Consulate neglected to give me a Certificate of Loss of Nationality almost 40 years ago when I renounced to become Canadian. Because they did not give me a form, IRS now wants to reclaim me and my money and penalize my life savings–all earned, saved, invested and taxed in Canada–all because I have not–and will not–fill out a form telling them about all of my assets.

IRS Vet, are you able to tell us how such an approach is “reasonable?” I really appreciate your commenting and cautioning Petros, but he is simply stating the obvious. He doesn’t owe them any $$$!

Have you read the posts by JustMe or Calgary411? How are their experiences reasonable?

How much money is IRS spending chasing people like this and letting Mitt Romney pay 15% taxes–with some of his assets in the Cayman Islands? Can’t anyone see the insanity of this?!?

Wasn’t a Revolutionary War fought and won 236 years ago over taxation without representation? What happened?!? It’s too bad the name Tea Party is already taken by a group I don’t agree with on any level. We need a new Declaration of Independence!

As Arrow said, what is the world has happened down there?!? Actions. attitudes and words of IRS do not reflect the US I was raised in–or the country my father and grandfather fought for in two World Wars!

Well….i filed in November…all 6 back returns and the IRS owes me just under 300 dollars….

Wonder what kind of letter I will get…

@Arrow

Eisenhower warned against cozy relationship between departments, suppliers and congresscritters. Instead of restraining these, the MIC model was replicated in Dept of Justice, Homeland Security, Treasury, Energy etc

The common thread being any pet project however assinine was framed as a new loyalty test.

I’ve never seen such high penalties for the smallest of mistakes in my life! If the IRS was a private company it’s executives would be in jail for racketeering.

The US government wants to control how much banks can charge you for different things like interest rates on credit cards which I agree can be very high.

Imagine if the IRS was a bank and they issued their own brand of credit card. They’d probably charge you a $10,000 penalty for exceeding your credit limit by $50.

My one piece of advice is I would contact CRA rather than sending off a nasty letter to the US. While the Government of Canada has made public statement over the collection provisions of the US Canada double taxation convention if just for curiosity I would contact CRA and describe your situation of a Canadian taxpayer in good standing and ask what THEY would do if they were in your situation given Government of Canada policy. Even though you will be dealing with CRA at a fairly low level I know of several cases where people brought some fairly technical issues up to their local tax service office and CRA upon realizing the complexity involved escalated them all the way to a ministerial ruling made at the CRA head office in Ottawa. All without having to hire a high priced tax lawyer.

I would also bring to CRA copies of the public statements we have discussed made by Flaherty, Kenney, et all

@Tim I wasn’t planning on responding at all. I’ve sent the overdue return last week, as I said. I think I should wait until I have something more than a automatically generated letter. That said, your advice is excellent, and if I receive any fines or tax assessments, I will certainly consider it. What do you think? I mean at this point, I don’t want to trouble the CRA over a letter that is about nothing more than a late zero return. But should they assess a fine, such as the $5000 dollars that Roy Berg mentions, then the CRA route would make a lot of sense.

I think that there may be a lot of people out their lurking, not showing their faces or telling us their stories, whose situations are more serious than mine. Perhaps they would take up your advice. I’d sure love to hear about it if anyone decided to take an IRS concern to the CRA for an opinion.

One way to informally approach CRA would be attend one of their tax “seminars”. Normally though they are on GST/HST not Income Tax(other than business) or International matters. I agree if you don’t have an actual “problem” no need to bother CRA at this point.

These are the currently scheduled CRA “events” in Ontario. A lot of GST/HST for example but not a whole else relevant short just attending something completely irrelevant to the issue and seeing if CRA presenter has an answer.

http://www.cra-arc.gc.ca/vnts/on/menu-eng.html

They do offer this seminar below on as needed basis to new immigrants to Canada.

http://www.cra-arc.gc.ca/vnts/on/scrbrgh-nwcmrs-eng.html

Perhaps the contact person might be a good name to keep handy in the future.