Just Me provides a case study report of his experience as a 2009 OVDP victim. It includes his letters to the IRS Commissioner, Douglas Shulman and his entire OVDP correspondence file including his TAS appeal. It is offered as an insight and warning on what to expect should you choose this route back to U.S. Citizenship taxation compliance. Updated March 19, 2012

This will be a lengthy post, as it includes 2 letters to IRS Commissioner Douglas Shulman followed by my entire IRS communication file. I apologize in advance for such a long posting, and you have my permission not to read all of it it! 🙂

It is a follow-on, to my previous post entitled OVDI Drudgery for Minnows where I offer my recommendations for those agonizing over what to do now that they have discovered their Citizenship tax filing failures, or FBAR and/of FATCA form filing non compliance.

I am prompted to share these letters, after hearing the 30 year IRS Vet say… “The IRS does read these comments and each one is carefully considered. I can assure you that simply by the volume of your comments, you will be heard.”

I have been thinking about doing this for sometime, but his comment has stirred me to do it sooner, rather than later.

Communication or feedback to a huge bureaucracy always, on the face of it, seems fruitless. What’s the point, you might ask? What is the chance that you will be heard, or that someone will act on what you say? Frankly, even now, after all my efforts, I do not have the answer to those questions, but I do know that without it, nothing will happen. So, with this post, I am going to focus on my past idealistic communication efforts to Commissioner Shulman.

One is my original letter to the Commissioner immediately after joining the 2009 OVDP.

Two is my final letter to him when I was facing an unknown OVDP outcome and no penalty relief was in sight. I had not yet appealed to the Tax Advocate Service (TAS) for a modified result which I will explain later in this piece.

I will let you read these letters, look over my attempts to communication through out the OVDP, and you can judge for yourself if you think I was heard or if my comments were “carefully considered”.

Also, this might give you a deeper understanding of the process one goes through when they “Voluntarily Disclose” in an honest and forthright attempt to come back into compliance with tax requirements not previously known. While life does go on after the trauma of the experience, and you may find some positive aspects later, while you are going through it, it is hell. The expense in life credit units (LCUs) is never tallied on any reconciliation spreadsheet! 🙁

Note: I don’t expect very many of you will want to read everything here. I am putting it up on the blog for a historical reference. Consider it a case study of a OVDP participant. It should be a warning to any thinking of moving abroad, of the practical implications of failure to be compliant with the unique Citizenship taxation and all the forms that are required. Only the most nerdy amongst you will have the staying power to read the whole thing. I may add more letters of communication later, as these 2 are just the tip of the iceberg. If I do, I will put a note here to point a person to the additional information. (update: I added everything)

The important thing to acknowledge at the outset is that these letters to Commissioner Shulman did generate a response from the IRS. None of the responses came under Shulman’s name, so not sure he ever saw them. However, in the respect that I got an answer you can say they listened and did respond. Were my pleas “carefully considered”? I am not for sure. I would tend to think not, judging by the outcome. However, without this effort, I may not have generated the attention of the TAS that I did. The TAS is an office inside of the IRS, so in that regard, someone did listen. Now will the Commissioner listen to Nina Olson’s Tax Advocacy Directive (TAD), or her report to Congress any more than they listened to me? The jury is still out. (update 5/5/2013: Since the first writing in Feb of 2012, I think the jury is in and the answer is NO!)

Bottom-line, I do think the exercise was worth the effort, if for no other reason then to demonstrate my good faith efforts to be compliant with laws now discovered, and to communicate the fears I had about the unintended consequences of the OVDP program. I would encourage you to take the time to communicate in written letter form also. Realistically, you may never really know what they will ‘take on board’ from your letter, or what they will just ignore. But even if they ignore it, you have to do it, in my opinion. You must make a record of your concerns and protest. In this I join with 30 year IRS veteran to encourage you to write the Commissioner, although I understand that those struggling with the decision on what to do now, and who have not yet done their OVDI Drudgery assignment might be reticent to write.

At the time I wrote my letter to Shulman, I was ‘all in’, so to speak. I had nothing else to lose, or so I thought! Little did I know what lay ahead in the agony of the process, lack of discretion that would hamstring reasonableness, and the surprise penalty assertion that came later as a ‘kick in the gut’ that just stunned me.

So, if you are all ready in the OVDI, use whatever ideas you want from my letters to construct your own to the Commissioner. If you are not residing in American and an accidental US citizen or dual citizen and you are not going to comply with FBAR and income tax reporting requirements; or if you are an immigrant now leaving the country and your Green Card behind; or if you are in the process of relinquishment or renouncing of your US citizenship and you feel safe enough in your decision, you definitely need to write the Commissioner in addition to posting your story on this blog. If you are in or were in one of the VD programs, you definitely need to write. He needs to hear directly from you about the impact his broad brush jihad is having on you personally. It would be nice if he read comments online, but I doubt he will be reading the Isaac Brock blog.

One thing my experience confirms, a letter sent to his office does get read somewhere in the IRS upper/middle management ranks. There are humans there, with feelings, and have real blood traversing their veins just like us. They are not monsters. They might be out of touch, or operate in a technocrats bubble that you and I don’t relate to. However, I cannot characterize them with the same broad brush generalities that their programs and press releases have characterized us. They might even empathize with the impacts this program has had on your life once they become aware of them. Those feelings might actually become part of some executive summary that is prepared for Shulman about the letters that have come in. It might be discussed in a staff meeting on the unintended impacts of their program. He, like Obama, may actually select a few letters to read personally, and maybe it will be yours! Your unique persuasion or point of view could be the one that alters the course of this gigantic misguided bureaucratic ship! You just never know. Nothing ventured, nothing gained!

First Letter response and outcome:

My first Shulman letter was responded to by letter about 6 months later. It came from Kevin McCarthy, The Acting Director, Fraud/BSA Small Business/Self-Employed Division, Department of Treasury, IRS. It was an unsatisfactory reply, but I wrote back with respectful appreciation of the response and consideration.

In his letter, Kevin acknowledged my letter to the Commissioner, apologized for the tardy response, restated the FAQs of the program including the infamous FAQ 35, and restated assertions about the uniform penalty structure designed for predictability and consistency. Further, he said I could reject the 20% penalty and go a standard audit route with implications that this would be much more severe. (No procedures on how to do this were provided until June 1, 2011.) He concluded that no provisions were being made inside the OVDP for two-track process for Minnows, so to speak. Only outside the program where heavier civil penalties and criminal prosecution can occur was this even considered. The message was clear. Stay in the program!

Second letter response and outcome:

The response to my second letter to Shulman came via email from a Kurt E Branning, Territory Manager SB/SE Exam Western Area and after I had already appealed to TAS. It basically acknowledged my letter to Commissioner Shulman, told me to make a FAQ 35 appeal via the TAS, and if examination did not produce a different penalty option then I should Opt Out. At this time there were only rumors of one person Opting Out to date. Neither my examiner or her manager knew what that outcome was or what to expect out of the new Opt Out procedures just released. There was no other anecdotal evidence of how the process was preceding. It is only recently that Moby and Sally have reported back on their Opt Outs. Those are the only two I have seen. The results are encouraging even if the time and energy it takes to get to the point that you can is very draining in LCUs.

Impact of letters combined:

In the end, it was the first letter response by Kevin which ended up being my ticket out of OVDP hell. It was on the basis of his restating FAQ 35 that allowed Kurt, to instruct the examination department to allow the consideration of a lower penalty structure using FAQ 35 guidelines.

It is important to note, that this instruction came only after the TAS had agreed to take my case. Kurt decided to allow that relief under FAQ 35 retroactively. At the time of the TAS appeal, FAQ 35 had been rescinded and examiners were not allowed to use it. The letter rescinding FAQ 35 was still secret and not published. At the time my examiner was unable to produce the guidance in writing, much to my frustration as well as the TAS. She could only tell me verbally what it said. She could only say that my application for FAQ 35 consideration was rejected. No penalty discretion was to be allowed!

Did Shulman have any knowledge of my letters?

Unknown. I have no assurance that Commissioner Shulman ever saw my letters or really considered them. Also, I do not know, if the actual decision makers that sat around a conference table somewhere in DC and came up with the OVDP program in the first place ever considered what I had to say.

A “why did I join?” preface to the letter contents:

I have been asked many times why did I join the OVDP? Knowing what I know now, would I do it again? What would I recommend people to do now? I have answered this before elsewhere, and again can only speak to my flawed thinking about process at the time. My information was limited when I made the decision, and I might do it differently today? Not sure. Maybe my decision process bears repeating here. I am not saying it should be followed or providing advice on what one should do.

Rightfully or wrongly, I came to the conclusion that joining the OVDP was my only option. My logic was probably flawed, but it went like this…

When I first became aware of my non compliance and that there was this program designed for Whales, I began to view it as the IRS fisherman encircling me with his seine net. It never occurred to me prior to then, that I was a fish to be caught. I had naively never thought about offshore accounts as something that I needed to report. Stupid me!

I had a hard time getting my Aussie wife to understand that this program (net) that the IRS marketed via NPR for rich evading Whales hiding funds in secret offshore accounts was encompassing us too. Frankly she was dismissive of the NPR story we heard as having no bearing on us. However, we did have so-called ‘offshore’ accounts in NZ where we were residing. She did have an account in Australia. The net was not just for the rich Whales. It was drawing around us too, and we had to take notice. Reluctantly she began to understand that the US treats her differently than Australia does.

While I suppose I could have just ignored my new-found knowledge and pretended I hadn’t heard the story. I could have taken evasive action and dived deeper to escape the net through the hole in the bottom by doing either nothing except becoming compliant from the date of my knowledge forward. I could have done a Quiet Disclosure (QD) to clean up past sins in spite of the warnings by the IRS not to do that. However, any escape attempt now, it seemed to me, was a willful decision brought on by the presence of the net as cast. I feared that doing anything but entering the OVDP could come back against me in future arguments in an audit were I had been discovered via a QD (diving deep) or by sudden filings of FBARs, those heretofore unknown administrative form from Hell.

Maybe I was too passive in allowing myself to be netted. Maybe I was too fearful and risk averse. I like to think I was just a good citizen that wants to be compliant with laws and regulations, no matter how ill logical or egregious they seem to be. I should have noticed the IRS vessel on the horizon long before the net was set and swam clear to safer harbors. However, I began to recognize that this fisherman has other fishing skills and other nets to come, (as shown by FATCA which came later), and with the Big Criminal Harpoon it was swinging around as its marketing tool of choice to threaten everyone into the net, I figured I had to join.

Months later, my examiner tried to tell me that I didn’t have to join. It was voluntary decision on my part, so I must be a criminal, so to speak. “Just pay up and quit protesting” was the basic message, as there was nothing she could do. My response was an emphatic “Bull S…. this is not voluntary!”. Just because you put ‘voluntary’ in the title, doesn’t make it so. That is like calling deregulation of the coal industry a “Clean Air Act.” Sure, I voluntarily decide daily not to kill the annoying kids doing wheelies out front in the gravel turnout, but that voluntary decision is very much coerced by the penalties for disobeying the “Do not Kill” statutes to say nothing about the moral strictures of society and Ten Commandments. I know it is a bit of convoluted logic, but that was how I saw it at the time.

Prior to the moment I heard about the IRS program on NPR during the family visit back to the Seattle area, I didn’t know that a FBAR existed or understand foreign income reporting requirements. Those considerations never enter your mind when you are sailing the Pacific in a small yacht, or gardening in NZ. Maybe that represented some due diligence failure on my part for not staying fully aware of all the complex tax rules and reporting requirements even for my simple existence. I had never visited the IRS.gov web site in my life.

From that moment in late September, 2009, until I submitted my letter in October 12th there was a very stressed and compressed journey. First I had to convince my wife this was something that we could not ignore and had to do. There was the scramble for knowledge. I had to search out attorneys, and CPAs for a cram course of discovery of what my obligations were. There were returns to amend, and the almost unfathomable foreign tax credit form 1116 to complete that the CPA couldn’t even do correctly. There was a long distance bank record compilation effort that was extremely difficult to do in the time frame I had. There was the embarrassment of your predicament which meant you didn’t want family and friends to know. Then came the very hard, emotional and lonely decision which ended with you walking into the Seattle IRS Criminal Investigation (CI) division offices feeling like a criminal. I did all that, because I had reluctantly came to the conclusion, that once I was aware of my failures and aware of the IRS program, I had knowledge and could not escape it.

I KNEW! Therefore, now, I had to do the right thing.

At that point, I had to decide if I was going to cross the line into willful behavior (ie dive deep) or willing swim into the net of disclosure. QDs which seemed the reasonable and logical thing to do for any other homeland tax failure like Geithners, were ruled out by IRS language. Offshore account failure was being treated more harshly and differently than any other category of tax failure. By any rationale reading of the FAQs you knew they were strongly discouraging it with implied criminal prosecution threats.

So, what was the choice given my knowledge? To me, None! I had to enter the OVDP. My big mistake was assuming that the IRS would realize that I was a Minnow and not subject me to the harsh 20% penalties. I naively thought my appeals to Shulman would result in logic and reason prevailing. They would do the right thing, and not treat me as a Whale. How wrong I was!!

In the end, it was the “discretion” implications of FAQ 35 that finally got me some relief with the much appreciated help of the TAS. It took 26 months from entry in the OVDP to 906 closing agreement signatures. Without the TAS, I was fish fertilizer!

I fully understand that other Minnows in similar circumstance saw the issues differently than me, and made other decisions. Today many more are struggling with the OVDI decision, as they are just now becoming aware of FBARs and this offshore jihad. If they make decisions different from mine, I can not fault them. If they go the QD route, or decide just to be compliant from now onward, I hope the IRS just leaves them well enough alone. It is a total waste of limited IRS resources that rightfully should be targeted at Homeland residing Whales engaged in actual tax evasion.

Ok… End of preface. Sorry I am so wordy.

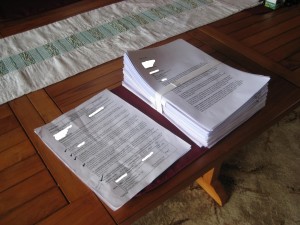

Here is the picture of what an OVDP Examiner submission looks like, for a simple financial life without a lot of complexity. All elements of this stack of paper will be discussed as Exhibits below.

Now, here are my letters. You can read them for yourself to see if Shulman was listening and if my comments were “carefully considered’.

First Letter to Commissioner Douglas Shulman-October 18, 2009

Dear Commissioner Shulman,

This letter is a plea for reconsideration of Voluntary Disclosure penalties for “some holders” of overseas bank accounts.

We are writing to you as a mixed nationality couple, married for 30 years and from the Washington State area. We have spent extended periods of time outside the US for much of the last 20 years, and now have a home in New Zealand. Marvin is a US citizen, and Sue is an Australian with US green card.

At the outset, let us state that we can understand and support the efforts that are being directed against deliberate tax evasion by those using the secrecy laws of certain countries banks to shelter funds in so-called “hidden offshore accounts.”

This letter is not about them, or a defense of their evasion. This letter constitutes a plea for fairness for a much larger class of non compliant with much less sinister failures. These are more average US persons, like us, who in all likely hood, didn’t realize these rules applied to them.

We are asking you re-consider the severity of the penalties for ordinary Americans of modest means like expatriates, resident aliens, and immigrants who prior to this time have been generally unaware of the FBAR and income tax requirements for normal and mundane overseas bank accounts like checking and savings. At the very worst, they have been benignly negligent non compliant rather than overt evaders looking for tax shelters. In spite of IRS publicity efforts, the story has been mis-characterized by the media. Millions are still unaware of the requirements to disclose.

Yes, millions, and I think you know that to be true.

These are not the high roller rich that are overtly hiding money in secret offshore Swiss Bank accounts that the press is talking about and focused on. That story line did not resonant with average folks. It did not raise much awareness of the larger story. These were efforts directed at even ordinary folks who have ordinary, non sophisticated banking in their home countries.

It is only by luck or fate during a recent visit back to the States that we heard the story September 22nd on the radio. It was a painful discovery process that brought us to the understanding that this wasn’t just about the Rich. We almost wished we hadn’t heard it. We are now dealing with what we think are the severe, and unintended consequences of our voluntary actions to do what is right. It has been a highly stressful 3 weeks sorting it all out.

We are now one couple of a very select minority that came to realize that this was a story of millions of average US persons being caught up in a regulatory process they don’t understand or realize applies to them.

Arguably yes, they/we should have been aware, but for multiple reasons didn’t or still don’t understand. There are some real “Questions” in these requirements that don’t make logical and rationale sense to average the US person (IRS Technical definition), let alone immigrants and resident aliens of which my wife is one.

The Voluntary Disclosure process was designed for so-called “Offshore tax shelters”, and for those that didn’t disclose, the door has just closed on October 15th. Very few in the larger category we are referring to have come into the fold either because of fear and intimidation of the process and penalties, or general lack of understanding that yes, these rules apply for all overseas accounts, not just the Rich using hidden accounts in countries with secrecy laws.

You are recently quoted as saying “7,500 have come forward.” I assume this adds to the 345,000 that Senator Levin said had complied in 2008. If you compare this total number to the pool of millions who should have declared, the compliance rate is running in the low single digits (<3% by my math). That 7,500 must not give you comfort as to the success that is being publicly trumpeted.

What about the 6.6 million expatriates the State Department thinks they are. They probably all have normal overseas banking arrangements. It is what normal people do. Do you think they should have all understood and come into the fold by now? 7,500 applications for current VDP implies that they don’t, and it appears that you are well short of a reasonable compliance goal on that number alone.

…and I haven’t even mentioned the 37.5 million immigrants and or resident/work visa holders that may have bank accounts in their home countries.

Those, that have declared, like us, have joined a very self selected minority that are now facing some pretty draconian penalties that were certainly designed for the Big Tax Evaders. Surely it did not envision ordinary folks being caught in this net cast by the IRS.

These penalties are too severe for the alleged crimes of ignorance, benign negligence or omission.

Our plea is NOT to make exceptions for us in the FBAR or income tax rules, although we do think the whole program should be resigned and updated for a financially connected and flat world. In 1970, having overseas accounts was exotic. Today, I reckon it is pretty mundane and mainstream.

We plea with you instead to just consider a two tier penalty process that better accounts for those overtly evading taxes using banks with secrecy protection versus just benign negligence or omission by ordinary folks. I would think that the majority of the non compliant are in the latter group of modest means. They really are not the high rolling overt offenders that you were originally targeting.

We now understand the errors of our ways. We now understand the need to clean up our past. We will pay past taxes due, and file forms as required going forward. We will never be non compliant again! Fear has been instilled, and a big lesson has been learned. It is a very painful one emotionally, financially and in hours devoted to make everything right. It is especially hard on my green card-carrying Australian wife.

To hit us with a 20% penalty on aggregated high account amounts for 2003-2008 on top of interest and 20% tax penalty from 6 years of amended returns is a LOT OF MONEY, and it feels like it is being openly taken from us unnecessarily and unfairly.

My Australian wife says, “It is like England sending convicts to Australia for stealing a loaf of bread!” These extra penalties are over-the-top retribution, in our opinion, and not commensurate with the nature of the failure.

In this regard the IRS is using a hammer to kill fleas.

For many of us otherwise law-abiding ordinary people, the embarrassment of not understanding what we needed to do or benignly overlooking some rule that didn’t seem important or relevant; the extreme anxiety, fear, and hassle of the past few weeks trying to gather together all the required information; the cost of hiring CPAs, Attorneys and amending the necessary returns; the cost of paying back taxes, plus interest, plus normal penalties; and the threats of prosecution and imprisonment is severe enough of a lesson without piling on more!

Please! With this letter we are just asking for some empathy, understanding, and reconsideration of the negative impact of this process on us ordinary people.

Currently, we are living in fear of the coming financial impact for doing what is right, and voluntarily declaring our errors. The financial pain inflicted will be severe!

Thank you for your kind consideration of this plea. You hold the power for compassion and can modify the application of penalties. We hope you can find it in your heart to apply some discretion.

Sincerely yours,

CC

Honorable Senator Levins

Honorable Senator Baucaus

Honorable Senator Patty Murry

Honorable Senator Maria Cantwell

Honorable Representative Rick Larson

Secretary of Treasury Tim Geithner

Honorable Representative Charlie Rangel

My second letter to Shulman came at the end of the process some 21 months later. I was struggling to get someone to apply some discretion, and Opting Out was still a BIG unknown. The main plea of the letter was 3 pages, but it is actually much longer with all the all the documentation and summary statements I provided for all the attachments I included. It made for a thick file. I wanted someone to see all the excruciating detail a Minnow was put through by outlining each and every letter and contact I had with the IRS. I just am putting this up here, for those IRS nerds to see the efforts at communication I made, all of which, inside the OVDP, were to naught.

Second Letter to Commissioner Douglas Shulman-June 29, 2011,

Dear Commissioner Shulman,

I am writing you as a follow-up to my letter dated October 18, 2009. It was written a few days after I had applied for entrance into the 2009 OVDP. (Exhibit B is enclosed for reference.) At that time, I was hoping for reconsideration of the onerous penalty structure that was being applied. Now, 21 months later, that process is still incomplete, and I want to express my experience, frustrations and suggestions related to the program.

I know you can not personally read all letters that you receive from tax payers. However, I hope someone will review my file as case study of a program with good intentions, run amuck, and arriving at ridiculous outcomes. I will try to brief in summary (3 pages max), as much of a struggle as it is. However, I will attach the entire history that maybe someone will review, please!

Current Situation: After a long distance drawn out process, via mail and phone calls to and from New Zealand (no email allowed), I am now in the 20 day countdown (12 days left) to decide to “Opt Out”, or be thrown out of the OVDP into an “irrevocable” program of great uncertainty.

My current 906 settlement statement calls for an OVDP penalty of ~$172,000 for a tax failure of <$21,000 over a 6 year period. The taxes have been paid in full with interest and penalty.

We were not the target client of the OVDP program, as we have repeatedly pointed out. We were not deliberately moving ill-gotten gains or unreported income to foreign accounts for the purpose of hiding funds in secret Swiss UBS like accounts out of reach of the IRS.

Instead we were just simple expats and immigrants who are not financially sophisticated and weren’t aware of the rules. I understand the IRS position, that arguably, we should have been. That is your world. You are the technocrats that live your lives immersed in rules and regs at IRS.gov. We do not. We were living plain vanilla non extravagant lives in semi-retirement in New Zealand, which is not exactly a banking haven for tax cheats as there are no bank secrecy laws. We were negligent, maybe, but not criminal and never heard of a FBAR prior to September 2009.

Now setting aside any technical or legalese considerations of willful vs non willful, or reasonable cause vs just plain negligence, does the amount of $172,000 seem like a reasonable penalty for a tax failure less than $21,000 that was voluntarily disclosed and paid? Really?

The reason my OVDP penalty seems extreme as compared to the tax errors is technical. The rules of the program allowed (actually required) the “Technical Adviser”, who has no discretion, to include my retirement home, where I am living, in the highest gross aggregate calculation! Why? Because it generated some non substantive holiday rental income in 2003, 2004, 2005, so it is included. If there had been no income, it was not included. There are no de minimis rules, or intent of ownership. If there is $1 of income, it is included. End of Story! Black and white! No Discretion!!

It is the total removal of discretion in the OVDP or ability to make reasonable determinations if results come out as absurd, as in our penalties, which is the major fault of the program, I think.

I understand the IRS goals as stated in the 2009 OVDP was a “uniform and coordinated approach which was designed to make exposure to civil penalties more predictable and offer uniform penalty structure.” However, at the end of the process, prior to issuing a 906 is where discretion could and should have been applied. That would have assured that someone, somewhere did the “penalty reasonability test” as related to the compliance objective that is so much part of the letter and spirit of IRM 4.26.16.4.

What the IRS is doing with the application of OVDP penalties, such as in our case, seems just punitive in application, confiscatory in practice, and not positively corrective in its compliance objective.

The IRS, to its credit, has attempted to modify the OVDP program since I first wrote you in 2009 with my concerns about the misdirected efforts. There are new provisions in the 2011 OVDI that attempts to eliminate some sinners from the egregious penalty structure. I think that you have realized your OVDP was bringing in a lot of small fish which were not the target of the program in the first place. That is why I was asking for relief back then, as that is what I feared.

However, the approach of using additional technical adjustments still doesn’t address the core problem of lack of discretion somewhere, anywhere in the process. It is just adding some pretty arbitrary thresholds to re-define the penalty application. It doesn’t work!

Case in point: The new 2011 OVDI has provisions for 5% or 12.5% penalties for lesser amounts, or new thresholds like < $10K income earned in US, or < $75K in overseas accounts to apply different penalty levels. That seems better, but again, that leaves it to a “Technical Advisor” to apply a ‘non thinking’ approach to penalty application. If it is less than $75K, one penalty applies, but heaven help you if it is one dollar over $75K, full-blown penalty applies. No discretion! Black and White!

A home value is brought into the penalty structure for calculating a high aggregate amount even though it wasn’t an account the FBAR penalties are supposed to be all about. If there is even the most minor or non substantive income, it is included. $1 dollar of rental income or $100,000 of rental income, it doesn’t matter. Black and White! No discretion allowed! End of discussion!

You know, I was actually in sympathy with the intent of the program when it started, and its attempt to get the big tax cheats into the system. For the cheating “Whales” that have come into compliance it is a great and fair deal. However, it is a “Minnow” fertilizer factory for us. I think the IRS has gotten hung up on “uniform” penalties when they should have been focusing on an ‘appropriate and reasonable” penalties. Justice is never uniform, and each circumstance is different. There is nuance. In America, we don’t punish jay walkers and bank robbers with the same sentence. Do we?

It is this lack of discretion that produces over-the-top absurd results that is in total opposition to your compliance objectives, and I state again, not representative of the spirit and the letter of IRM 4.26.16.4 penalty guidelines.

In the current 2009 OVDP program, the IRS created penalties totally divorced from the tax or compliance failure. It is just a uniform 20% of the high aggregate account balances and some assets. That is why we now find ourselves subject to a non discretionary penalty for a tax failure of < $21K over 6 years as compared to, say, Tim Geithner’s tax failure of >$42K. His penalty – nothing. Ours – $172K. I hate to bring in this example, but what is wrong with this picture? Why is one tax failure better than the other? Where is the uniformity? Missing FBARs makes that magnitude of difference? Was that really the intention of Congress and the Statutes enacted?

If the OVDI or OVDP process provided an avenue for a Big Picture “reasonability test” on the penalties (management discretion to adjust) before a field agent sent out the 906 closing agreement I would have less complaints. I may still not like the result, but at least I would know that someone was using the discretionary guidelines that are in the IRM. At least I would know that there was measured, nuanced justice, not a so-called “uniform” justice-by-the numbers.

Does my logic make sense to you? Am I connecting? Can you empathize with that perspective at all? Can you feel our pain and hear our frustration?

To their credit, my examiner and her manager spent a lot of time trying to determine if they could remove my house value from the penalty structure because they wanted to be reasonable on penalty application. But they were over ruled by the “Technical Adviser.” No discretion allowed! And, no one else, it seems, in the IRS hierarchy has the power or wishes to apply the discretion of a reasonability test to the ridiculous OVDP penalties which the process produces.

Pleas for discretion within the process, as I have documented in the enclosures, have had no effect except to tire my examiner. The only option I now have after 21 months of expending 100s of LCUs (Life Credit Units) and providing full audit disclosure and open cooperative effort, is to “pay up”, “Opt out” or get “kicked out”. Given the unknown IRS mindset outside the program, it is a very risky decision considering how FBAR penalties can technically be assessed per CD or term deposit account. Additionally it is a very expensive in LCUs and money to now be forced to go through more audits and rely on an appeal process outside the OVDP as your only avenue for relief. I can not possibly afford the huge attorney fees that would require. It would also consume a lot of IRS resources, needlessly, to re-discover what you already know. I am a Minnow.

So, maybe you understand why I writing once again, to see if there was another way. Maybe not. I fear not. Maybe I have to be the collateral damage of the OVDP drone program, however, I went into this process naively thinking reason or logic will prevail in the end, but so far, it has gone the opposite direction. Frustrating!

Sincerely yours,

Enclosures:

Cc President Obama

Senator Patty Murray

Senator Maria Cantwell

Representative Caroline Maloney, Co-chair Americans AbroadCaucasus

Representative Joe Wilson, Co-Chair Americans AbroadCaucasus

Marylouis Serrato, Executive Director, American Citizens Abroad

Jacqueline Bugnion, BOD, American Citizens Abroad

Case study chronology of the 2009 OVDP process for just me with documents.

Below is the sequence of major events in this entire OVDP process with event dates that has brought us to this point. I have included all relevant correspondence. A lot of LCUs (Life Currency Units) have been expended here that don’t figure into penalty calculations.

September 22nd, 2009. We first learned of our liabilities and the OVDP program from a story on NPR about UBS tax cheats the IRS was going after. That led us to consult with an attorney and a CPA for the first times in our lives. Thus began an education on a world of regulations and rules we never knew existed. It was the beginning of a long and frustrating process.

October 8th, 2009. We submitted an amended 2008 tax return which was done by the first CPA we have ever used in our life, and paid the additional $904 of taxes due on an amended 2008 1040. We were introduced to the form 1116, Foreign tax credits. What a complicated form that is! We didn’t get credit for all the tax we paid in New Zealand for reasons our CPA could not explain. We also mailed in all 2003-2008 FBARs after a lot of hard work gathering banking records. Our files were at our home in New Zealand, and we were just temporarily in the States visiting our family. We had to get this done by the new Oct 15th deadlines we just discovered..

October 12th, 2009. We applied for inclusion into the OVDP program following the required submission guidelines. Boy were we naive in thinking our pleas for re-consideration of the penalty levels would have any effect. (See attached Exhibit A)

Exhibit A- Oct 12 2009 -OVDP Final Version – Redacted

October 18th, 2009. We wrote Commission Shulman a letter pleading our case that we were not the target audience of the OVDP. We feared we were entering a process designed for “Whales”. However, it had a net mesh so fine, and was cast so wide, that the “Minnows” like us were going to be caught, placed on a “uniform” conveyor belt process and spit out the end as fish fertilizer.

(See included Exhibit B… Letter produced above.)

Oct 18th, 2009. We wrote letters to all our Legislators and Legislators on various committees with IRS oversight. They were Representative Charles Rangel, Senator Patty Murray, Representative Rick Larsen, Senator Baucas, Senator Cantwell, Senator Levin and Tim Geithner. Only heard back from one. Rick Larsen. Nothing happened of course. We are just a small voice drowned out in a sea of special interest cries for assistance. We don’t have a big lobbyist firm with lots of money to get us special attention for excluding offshore income like GE. (See attached sample letter Exhibit C)

Exhibit C – Oct 18, 2009 – Rep Rick Larsen – Redacted

November 2009– February 2010. We spent a lot of LCUs collecting all the data required to amend our 2003 – 2007 returns. We had to wait for a copy of a lost return from the IRS before we could finish. While we waited, we sent in estimated tax payments way in excess of our failures just to be sure that we stopped the clock on interest penalties. Which by the way, the estimated payments for 2003 were sent back to us, as the IRS couldn’t process them beyond the statute of limitations (SOL), and we had to return them again, pleading with them to hang onto them so we could stop the penalties from accruing

Also, on one of our amended returns, 2006, they took the money, but sent a letter which said since our income tax failure wasn’t substantive, they couldn’t accept it, again, due SOL. We could apply for a refund if we wished by December 2012.

With our amended tax returns finally finished, we waited for the fateful call from an IRS examiner.

April 7th, 2010. We received a reply letter from a Kevin McCarthy dated April 1st. He was, at the time, the Acting Director of the Fraud/BSA, Small Business , Self-Employed Division. In it, he acknowledged my letter to Commissioner Shulman, and basically re-stated the 2009 FAQ 35 as my solace for relief, while maintaining the IRS position that this was a “uniform penalty structure to be sure taxpayers are treated consistently and predictably”. (See attached Exhibit D)

Exhibit D- Apr 1, 2010-Kevin McCarthy Letter -Redacted

April 18th, 2010. I replied to Kevin, expressing my disappointment in the letter’s message, but did appreciate a response to my letter to Commissioner Shulman. I was actually surprised that my letter must have been read. The letter from Kevin had the feel of a form letter, but there was still enough personal details referenced from my letter to Commissioner Shulman to convince me that at least some momentary consideration was given. Don’t really know how much they digested of the points I was trying to make. (See attached Exhibit E)

Exhibit E- Apr 18, 2010 -Letter back to kevin McCarthy-Redacted

Then I waited, again. Tension building!

In early June, 2010, I received the first phone contact from a very congenial audit agent out of Phoenix. It was followed a few days later by the standard IRS form letter requesting that we produce a lot of material for auditing. Boy was that fun! Not.

June 9th, 2010. Contacted my examiner by phone after receiving the letter, to let her know that I would not be able to met the deadline for submission, as the data requested would take a lot of time to compile and audit before I could send to her.

Went to work collecting, organizing, auditing and detailing a comprehensive response package.

August 15th, 2010. I produced and mailed an the incredibly comprehensive pile of paper required to be disclosed including all by bank records, tax returns (original and amended) all FBAR copies, my calculations of the highest aggregated account balance, calculations of all interest payments received in NZ and Australia, and express mailed it from New Zealand to Phoenix. It was a BIG package and cost $80 to send.

In my production and review, I went back over all my amended returns, to be sure they were accurate and re-audited it in detail putting myself, into an examiner’s mindset. If I was doing my examiner’s job, how would I want to see the information? That uncovered a few minor errors which when both ways, in my favor, and in the IRS favor. I disclosed and corrected them, even a mistake made by our CPA on the handling of my minor US pension payment which he mistaken listed as tax exempt in 2008. Not sure how that happened, but for that, I had paid him over $1000. I shook my head in wonder. At least I got an education that allowed me to follow his work on the form 1116 for subsequent year amendments which I did myself to avoid more expense and costly errors.

I also went over my all bank CD/Term account statements in detail, and highlighted ever deposit and withdrawal with a comprehensive legend so an examiner could follow it.

I also created a fund flow sheet to be able to follow the movement of term deposits we had which matured and were moved to new accounts based upon the interest rates available at the time. It was all the same money, but each time a maturity was reached, often a new two number suffix was assigned to a bank account number, creating a new technical account which, don’t you love it, the IRS could assess a separate FBAR penalty, as I learned painfully later.

Finally, as support to ridiculously complex form 1116, Foreign Tax Credits, (which no human alive could read the instructions and understand them in full) I detailed every interest payment and tax deduction which showed up on our bank accounts to assure that each of those tied to the actual bank records and the form 1116. Boy, was that exhaustive effort. I am not a CPA, or even an accountant. I did not play one in the movies. I have never had an accounting class in my life, but I have learned to work a spread sheet, and though it is not my favorite activity, I can do the Drudgery of the Numbers if it is required. I can’t imagine how much this would have cost me if I had a Practitioner or a POA (my examiner’s preference, btw) do all of this. I saw on a blog that some poor fool (I use the term affectionately because I include myself in that characterization) had to put on adult diapers when he got the bill from his Attorney for $200,000. At least I have avoided that expense by doing all of this detail drudgery myself.

However, a real deficit of LCUs was created with all the hours of effort. At least 120 or more were expended, but I lost count.

I also pleaded my case again that this penalty structure seems inappropriate for me. (see attached Exhibit F.)

Exhibit F – Aug 15, 2010-Audit Response Letter – Redacted

Then I waited again.

October 22nd, 2010. I received in the mail a request to sign a SOL extension for 2007 taxes. Didn’t quite understand what this was all about, as I had already agreed to amend taxes as part of the OVDP program. Without Council advice I decided to sign it, as didn’t want to upset the IRS. They say I was not required to do it, and would not be held against me if I didn’t, but… So we played the game that it was a voluntary act on my part. I wanted to be sure I did not give the IRS any excuse to say we were not cooperative. Took the opportunity to point out what I was seeing around the web about the problems with the OVDP penalty process. (See attached Exhibit G)

Exhibit G – Oct 22, 2010 -Letter To Examiner – Redacted

Then I waited again.

After Christmas 2010, I received a call from my examiner, that due to IRS workload, my files had not yet been reviewed, (I imagined a BIG stack of papers sitting on the floor in a corner someplace) but would I please provide the valuation on my house so the form 4549-A, Income Tax Discrepancies and form 906 Closing Agreement could be prepared. I got my first hint that something was going sideways, when the examiner said my home value might have to be included, but I wasn’t to worry yet as she was reviewing with her “Technical Adviser”, as that didn’t seem right. Could I please provide more information about the circumstances of acquisition of my home and the reasons for our holiday rental income, non substantive as it was.

December 29, 2010. I replied to her request. It was a pretty comprehensive history of how we came to retire in New Zealand starting with our cruising life on a small sailboat in the Pacific beginning in 1989. My wife is an Australian, so moving to NZ is like you moving to Oregon. She is also a 30 year US Green card holder, but wanted to settle back in her neighborhood come retirement, and so we did. (see attached Exhibit H)

Exhibit H – Dec 29, 2010-Letter to Examiner – Redacted

February 2011. John McDougal removed the discretionary provisions of FAQ 35 from use in the field for the OVDP program. Have just seen this reported on the web and in blogs, but have never seen it in writing from the IRS. As of this date the provisions of the 2009 FAQ 35 is still on the IRS.gov site. It has been stated that there was mis-communication in the agency about application of penalties, that caused the confusion in the field. It was always the “intention” of the Commissioner (blame Shulman?) to compare OVDP penalties to the Maximum penalties allowed under the Statues. But, of course, that is not what FAQ 35 said. If you got in your request for FAQ 35 consideration before February, it would be honored. If it was after this date. Tough. Another technical barrier, added to the program after the fact without any written documentation.

March 10th, 2011. We received the preliminary form 906 Closing Agreement. Our proposed penalty was to be ~$172,000 plus interest and 20% accuracy penalties on our amended returns.

Our hearts stopped and the fish fertilizer fear appeared as a very possible outcome. I was STUNNED!!

Up to this point, I had been figuring worse case scenario the OVDP penalty would be around $80K. That had given me enough heart burn that I had written Commissioner Shulman at the beginning of this process asking for relief as mentioned previously. (Exhibit B) Now this? What could I do?

March 11th ?, 2011. Finally broke down and contacted a well know and well-regarded Tax litigation attorney Jack Townsend to review our case and explore other avenues available to us to mitigate penalties. We also reviewed the implications of an Opt Out including the legal processes for appeal. That conversation was very helpful, but VERY EXPENSIVE too.

He said maybe I would have to consider an Opt Out and take my lumps. That was the first I had heard that was even possible. What did that mean? We had thought, that once we had learned of our FBAR compliance failures, we had no option but to voluntarily disclose via this OVDP program. To do differently, like just doing a silent disclosure was dangerous. We would certainly guilty of a “willful” action if we did that. I hadn’t felt that our failures were of the willful type the IRS was going after in this program, but now I was beginning to understand, that in the legal and technical world the IRS lives in, the IRS was defining “willful” in some pretty broad terms. While the burden of proof was on the IRS to prove “willfulness”, fighting that determination, and even with court cases going against the IRS on their “willfulness” determination, you could burn up more time (LCUs) and more legal expense than the OVDP penalty in the first place. Very, very frustrating.

March 14, 2011. I wrote back to my examiner about the errors and omissions in the 4549-A Adjustments after I had done a detailed audit. To do this I had to take all her numbers, and create a spread sheet. I had look at each amended return to figure out how she came up with each numbers. I had to determine what formula was behind a calculation in a box. Also I had to research what FX rate she was using as it was different from mine. In this day and age, it is just stunning that she can’t send me a spread sheet by email, so we can work from the same document. If this had been a business review, it would not have taken long to do. If I had the same spread sheet she was working from, it would have been much easier. But… given the IRS restrictions on email modernity, it took quite a few hours to reproduce her work. More LCUs expended. (See attached Exhibit I)

Exhibit I – Mar 14,2011 – 4549-A Letter – Redacted

Below I have attached a 4549-A Excel workbook that you can use to audit the Examiner’s work. I highly recommend that you audit it line by line, as I did find errors. The Work book comes with a summary sheet which is linked to each year’s tab. All sheets are protected, but no password is used, so you can un-protect it to add additional rows if necessary, or add and link up additional years sheets.

4549-A Audit adjustment workbook

March 29th, 2011. I wrote my examiner about the 906 calculation to inquire how she had determined the highest aggregate. (See attached Exhibit J) Frustration is building here, and there is a long editorial on the process. That now just sits in a file somewhere without seeing the light of day, or getting any management review and discretionary consideration. It is not allowed in the process.

April 13th, 2011. Left our home in New Zealand and traveled via Australia on our way back to the States. Had advised my examiner of our travel plans in Exhibit J, and via phone conversations. Arrived back in Seattle, April 22nd, and continued my phone contact with discussions about 4549-A and the 906.

April 14th, 2011. Received several voice mail messages in Australia about my audit of the 4549-A.

After telephone tag, we agreed to talk in detail when back in the States and I had my spread sheet and her documents in front of me for review.

May 3rd, 2011. Had a lengthy phone conversation about the form 4549-A and the 906. We resolved our differences on the 4549-A, but not the 906. Discussed Opt Out, and what that meant. She strongly advises that I get legal advice, if I thought that I wanted to do that.

In the intervening days, I spent a lot of time reading Legal Blogs on the OVDI and OVDP processes. I also printed and studied the IRM 4.26.16 on FBAR laws and penalty application. I was trying to self educate, as attorney costs for this specialized area of tax compliance is very expensive. I reached out to American Citizens Abroad for attorney suggestions, as I probably did need some more advice.

May 12th, 2011. I contacted another Attorney, Hale Sheppard, who was referred to me by American Citizens Abroad. He has a long history in FBAR compliance issues, and is extensively published on this subject. He gave a very sobering assessment of my situation, and practical advice about the application of FBAR penalties outside the OVDP. He also discussed the current hard-line mindset of the IRS and how the Appeal process works. Cost for him to represent me, should I decide to Opt Out, would be significant. (Exhibit J. Evolution of FBAR by Hale Sheppard)

Exhibit J Hale Sheppard Evolution of FBAR

May 13th, 2011. Decided to write another letter to my examiner and officially ask in writing for FAQ 35 consideration, even though she has verbally indicated before it wasn’t available to me. Still looking for where it is in writing that it was removed. (See attached Exhibit K ) Frustration with the process is really rising.

Exhibit K – May 13, 2011 -Opt Out and frustration letter – Redacted

In this letter, I re-produced a copy of the Daily Tax Report, 181 DTR J-1, 09/21/2010. It was written by Mark E. Matthews and Scott D. Michel. It is very good, and a fair representation of where we are now. I don’t know if IRS management has seen it. It should be required reading by all examiners and supervisors and managers in the IRS who are actively involved in this ODVP process. It speaks to many of the issues I have been experiencing. I have included it here. (See attached Exhibit K-1)

Exhibit K-1 TaxReport_OffshoreAccounts_21sept10

May 18th, 2011. New 906 issued and arrived in the mail to include changes I had made in the penalty calculations. 4549-A still not correct to show tax payments made in January of 2010 and not yet recorded properly. 4549-A form shows I still owe taxes, and actually I should have a balance due me, as I had over paid to stop penalty calculation.

May 27th, 2011. After further phone conversations, I wrote my examiner about the adjustments to the 4549-A and clarified my understanding of her verbal refusal to allow FAQ 35 review. She still can not produce that change in writing, and apparently, neither can her Technical Adviser. Also, she had mentioned that I had the right to Opt Out, so I requested more information on this. (See attached Exhibit L)

Exhibit L – May 27, 2011 – 4549-A revised again – Redacted

June 1st, 2011. I wrote my examiner to see if there was another technical definition of house value which could be applied and reduce the OVDP penalty. No Joy! Also informed her that I was going to contact Kevin McCarthy who had originally written me and had provided me the FAQ35 protection. Also would wait to see Opt Out guidelines when they are issued before deciding. See attached Exhibit M)

Exhibit M – Jun 1, 2011- House Value, FAQ35, Opt Out Questions

June 2nd, 2011. Downloaded latest OVDI and OVDP “Opt Out” procedures as issued by Stephen T. Miller, Deputy Commissioner for Services and Enforcement. Not much encouragement there. Lots of questions for my examiner as to what it means. There are some vague statements about “cases being assigned for other treatment.” Huh? What does that mean?

June 6th, 2011. Signed and returned statute of limitations for 2004 FBAR under threat that if I refused to sign, the IRS may assess 2004 penalties immediately. My examiner was under a lot of pressure by her managers to get this from me, as she called and asked about it multiple times. The request always came with the caveat, that it is voluntary, of course! The game continues. (See attached Exhibit N)

Exhibit N- Jun 6, 2011 – SOL Letter – Redacted

June 8th, 2011. Call with my examiner about the meaning and the unknown crocodiles in the new Opt Out Procedure. She doesn’t know what it means that “cases being assigned for other treatment.”

It is obvious, in the factual statement I have to produce for our Opt Out, in the key consideration, she and I disagree on what constitutes “willful”. I understand her perspective, but just disagree with it. She is taking the hard and fast / technical route that a checked box indicates “willfulness” not to file a FBAR.

There is a wide gulf here between us on what is considered willful. We have a spirited, but respectful conservation about the IRS perspective, versus the taxpayer who doesn’t live in her technical world. She does concede that we are not the same degree of willful as those hiding funds in Swiss Accounts. So are there degrees of wilfulness, in the IRS eyes? Is that considered in the Opt Out. Or is it black and white like everything else so far. Don’t really know.

Also, she advised that I should calculate FBAR penalties outside the OVDP as per the IRM based upon each account having a FBAR penalty. Would they double count? First she says, of course not, and then after a conversation with her “Technical Adviser”, she calls back to say, yes they will double count accounts. What?!

So, if the same money is in two different accounts in the same year, I am to calculate two FBAR penalties. Example. If my $10,000 CD rolled over to a new CD during a year, it would have to be counted twice as $20,000 in the high aggregate because technically two accounts apply when the new CD with new suffix is issued. Go figure.

When you apply that technical standard, penalties can shoot through the roof to absolutely ridiculously absurd amounts. It moves you into mitigation levels in the millions even though we didn’t even have $XXXX in retirement savings in NZ. Will the IRS insist on that level of penalty application outside the OVDP? Surely not, but it is unknown. Would you take that bet? How much money to you want to spend with an attorney fighting that? A big risk to the Opt Out.

June 21st, 2011. Received a new form 906 with an accompanying form letter 4564 which was dated June 20th. It basically informs me that if I want to Opt Out, I have 20 days to decide. I have two choices I can make, and one they will make for me. They can not provide advice as which way to go.

- Go the irrevocable (another technical hurdle to deal with) “Opt Out” route with all its uncertainty and take the lumps as they fall, or

- Sign the 906 and pay up the Over-the-Top penalty, or

- Failing to do either, get kicked out of the OVDP program involuntarily and end up in step 1 anyway

June 22th, 2011. Called my examiner and her manager for a long conversation about what additional visibility they might have as to application of discretion outside the OVDP. They were polite and professional. They stated that they had heard that the very first Opt Out had just been processed, but no idea of the outcome by the Management Committee given this task. They were in the dark as much as me. As an aside, I wonder who is in the Management committee. If it includes John McDougal, you don’t have a chance, as he is too much immersed in defending all the rules and regs that seem to emanate from him. I could be wrong in my impression.Also discussed what payment programs are available if I am forced to pay this $172K. I don’t just have that money sitting in a checking account. It will take a little while to raise it. I will have to liquidate retirement savings, and maybe transfer funds from NZ. That all takes time. Examiner and her manager don’t seem to know what flexibility is allowed, as they just turn it over to Collections, and have nothing more to do with it after that. I called the Tax Advocacy office, and they think it is a standard 120 days, but I should contact them myself to be sure. I am now thinking the unthinkable as time ticks away, so need to do some contingency planning.

June 25th, 2011. We are at the end of the line, so now time to go back to the beginning and the top of the hierarchy. I have tried working within the system, and have had zero success. I called Kevin McCarthy who was the original responder to my letter to Commissioner Shulman. Got an empathetic hearing and a promise that one Victoria Gally would review our case and call me on the 27th.

June 27th, 2011.No call from Victoria Gally today. Down to 14 days until decision time. Wrote a letter to Kevin McCarthy, thanking him for his time and interest. (See attached Exhibit O)

Exhibit O -June 25, 2011- Thnx to Kevin McCarthy-redacted

June 28th, 2011. No call from Victoria Gally today. Letter sent to my examiner updating her as to our decision process and confirming my understanding of the deadlines. I have included a copy of Tax Analysis document service DOC 2011-9908, written by a Jeremiah Coder. (See attached Exhibit P.)

Exhibit P – June 28 2011- Respone to Letter 4564 Opt Out-redacted

Exhibit P-1 MCDOUGAL announcement TND Doc 2011-9908

13 days left until execution date. (That is how it feels to me.)

Personal note: I have an abscessed tooth and having a hard time concentrating on this. Popping antibiotics and Advil pills.

June 29th, 2011. Still no call from Victoria Gally today. Finish up and sent this letter Express mail to Commissioner Shulman.

Final Comment: Hope is running out that any reason will prevail within the OVDP. Outside it is so very uncertain, and why does it have to be that way?

12 days now left until my execution date.

Side note: Is this how the Empire slips into decline? Mindless audit processes that bludgeon the middle class while the oligarchy of Corporations and Financial elite just get richer. The deficit widens while Republicans refuse to consider new sources of tax revenue via simplification of tax codes or elimination of Corporate loopholes. So, the IRS is left to try to increase intake, via OVDP and OVDI penalties without any discretionary review. And who is the unintended target? The least powerful of society are the pasties, while at the same time the IRS is giving $3 billion in Tax refunds to GE and they pay no taxes at all. Unbelievable.

And you wonder why it is hard not to be cynical.

End of letter.

…………………………………………………………………………………………………………………………………

Additional correspondence Documents that followed my Shulman letter above.

After I mailed my letter to Shulman, and with 11 days left to “Opt Out” or be “kicked out” decision , on June 30th, I emailed the TAS offices of Nina Olson. 24 hours later I received a call back setting up a conference call. Also on the 30th, I finally got a hold of Victoria Gally and she arranged for a conference call on July 5th. The TAS joined in, and that was the beginning of the end of my ordeal. Below is the correspondence that followed.

July 2nd, 2011. Letter to Examiner advising her of my decision to contact the TAS and provided a copy of the letter I had sent to Commissioner Shulman (See attached Exhibit Q.)

Exhibit Q- Jul 2, 2011 – Letter about Shulman and TAS appeal – Redacted

July 11 th, 2011. Letter to Examiner post Conference call with all IRS parties including TAS. I confirmed 30 day extension to “Opt Out” deadline, and FAQ 35 understandings plus “willfulness” disagreement. Included in the letter was the article called “Checking No isn’t Apropos” by Daniel L. Gottfried, September 20, 1010 ( See attached Exhibit R.)

Exhibit R- Jul 11, 2011 – Followup Letter post Conference -Redacted

August 5th, 2011 Below is a copy of the TAS FAQ35 appeal made by the TAS on my behalf to the IRS Examiner. After the TAS issued a Tax Advocacy Order (TAO) shortly after July 11th, my examiner suddenly found some discretion, and offered to lower my penalty from $172K to $115K . The Advocate Case Officer did not think that was good enough, and it was their opinion that the maximum penalty should be $25K as probably the best deal they could get out of the IRS examination department. It was their decision to counter the $115K with a $25K offer. Here is the letter they used for that argument. There maybe language or references that others could use in their Opt Out appeals. (See attached Exhibit S.)

Exhibit S – TAS FAQ 35 appeal – Aug 5,2011 – Redacted

August 23rd, 2011. I wrote a letter to my examiner and sent a check for $25K, which was the negotiated settlement between the TAS and her office on August 18th. Given the stress and the high level of penalties that I was staring at, $172, I was so relieved that I felt that this was the best deal I was going to get, thus it was probably reasonable and fair, given the IRS FBAR environment and mindset. As time as passed, I now think I left too much money on the table. It wasn’t fair, but in the end, mine was a business decision to bring the nightmare to an end. Reading back on it now, I was probably too patronizing to my Examiner. There is something intimidating about the whole process that makes you feel guilty, even when you know you are not. My approach through out the process was to keep it from becoming personal and stay away from acrimony that might add to my problems. So, at times you have to grovel. 🙂 (See attached Exhibit T)

Exhibit T- Final Settlement payment -Aug 23,2011 – Redacted

Sept 7, 2011 I sent in my final signed 906 which had inaccurracies, and made comments about that as well as faults on the final 4549-A which was still wrong. Also had to add my editorial comments. I am always amazed how the IRS is willing to be sloppy with their own work, and not be correct, but that is ok form them, but let you fail to file an FBAR, and katie-bar-the-door! (See attached Exhibit U)

Exhibit U-MVH 906 Signing Statement-Sep 7 – Redacted

November 15, 2011. This is my final letter and parting shot to my Examiner. In it I advise I am returning to New Zealand and point out everything that is wrong with this friggin’ process. Also included a copy of an excellent Tax Notes written Scott D. Michel and Mark E. Matthews, titled “OVDI Is Over — What’s Next For Voluntary Disclosures?” Then I couldn’t help but point out all the negative press the IRS is getting in Canada and gave her tons of references should she want to look up from her auditing desk and smell the stink of what she was participating in. Probably not. (See attached Exhibit V)

Exhibit V-Final Letter to Examiner-Nov 15,2011 – Redacted

and this is what I sent as an attachment in Exhibit V

OVDI Is Over — What’s Next For Voluntary Disclosures? by Scott D. Michel and Mark E. Matthews

Final Closure: I wanted to make reference to the final chapter in this entire processes. On Feb 12th or there about, I posted this on Jack Townsend’s blog, and thought I would also put it here…

Just a note to mark the final final end of the OVDP process for me. I guess this particular thread is as good a place to record it as any, as my story transverses multiple threads.

After 851 days, from entering the OVDP in 2009, I was informed by the TAS officer today, that the IRS has issued a refund check to clear all reconciliation items from the OVDP examination. Tomorrow they are mailing me a check for ~$3000 dollars which includes roughly $250 of interest for overpaid taxes. (actually received two treasury checks yesterday for $3925.01 which was more than I expected. Don’t know why. Some computer decided I am sure.)

So, that is it! I am done. I guess I can stop blogging now. What a wonderful educational process it was, and what a model of efficiency it has been! Can I have my LCUs back please?

You know, if it only takes 851 days to process a Minnow, wonder what it takes for a Whale? The question now to be asked what did it cost the IRS in time, energy and dollars to extract the fish oil they squeezed out of me? I can guarantee you that no business would be able to survive on the ROI for this misguided adventure.

If you wonder why nothing productive gets done in government and why America is in such a fiscal mess, well wonder no more. If this isn’t a prime example of how to not to run a country, then there isn’t one. It doesn’t give you much faith for the future when the IRS still won’t acknowledge TAS Director, Nina Olson’s TAD. The response was due January 26th, but so far nothing. Probably nothing will come from her report to Congress either, where she so clearly pointed out how egregious their process was for the Minnows.

Then to think, 2 and ½ years later, the press has yet to write one meaningful story of what it is like for a Minnow to be involved in a program marketed as an amnesty for catching tax cheating whales, that was then proclaimed a marvelous success with nary a skeptical question from the MSM reporter scribes. (Amy Feldman from Reuters, the sole exception.) Sorry if this drips with cynicism.

All the best to the rest of you in the process. Hang tough and “Illegitimi non carborundum”, as they say! Please excuse my mock Latin! If you don’t know what that means, google it.

Thanks Jack for the outlet and the forum. Your blog has helped me immeasurably with your sage advice, and providing a sharing outlet for other Minnow’s out there. There was some small comfort in knowing that I was not the only fool netted! 🙂 I hope they all have better outcomes just like Moby and Sally did.

PS… I heard from my TAS officer that they are still helping Minnows trapped in the OVDP/OVDI. She had 4 cases herself that she was working on. So, if you are running up against the wall, I would try calling the TAS DC office and explore your options. They are good people, and do restore your faith in what good government should look like.

Nothing ventured, nothing gained.

Last comment: If you have read this far, and I not sure what this says about you, but thanks! 🙂 Looking back on it, the journey seems even longer than the correspondence that is represented here.

Last comment: If you have read this far, and I not sure what this says about you, but thanks! 🙂 Looking back on it, the journey seems even longer than the correspondence that is represented here.

@Kiro…

Well, I don’t know that it was so much of brow beating, a negotiating tactic, or just an honest disagreement as how she generally saw things. I had written her many times in my previous correspondence with my “non willful” assertions. Since those arguments weren’t getting anywhere with her, and since she wasn’t giving me FAQ 35 consideration, I went to the TAS with my problem.

Actually, she was just trying to get me to sign the 906 and pay up like all her other Minnows had. I came to understand that. It is part of the game, I suppose. It did bother me too that she thought of me as some degree of “willful”, but in the end, it really isn’t for her to decide. It is just a negotiating tactic, is the way I came to look at it. It almost worked, as after 2 years, a certain fatalism began to creep into my thinking and had me start planning for the worst case scenario. Frankly it was my Auzzie wife that bucked me up, with adamant refusal to accept what was happening.

Once the Opt Out became available, I read the procedures. I saw what was required and decided to confront her with the practical problems of the process that would create extra work for her. In spite of all my correspondence with my “non willful” assertions through out the entire process, I was unsure how she was really thinking until that phone call you mentioned. Up until that point, she was working in a non discretionary world, and pretty much dismissing my long letters. She was within the confines of a rigid program, and so from her perspective, it didn’t matter what I said up to that point. She wasn’t really giving it much consideration. I was in the program. It was voluntary. I must therefore be guilty, and she was just going to process me without thinking that much about it. That was the way it worked.

So, since I was obviously getting no where, and I was thinking of going outside the process, I asked directly what would she find if she had discretion which the OVDP did not allow. I did that, because, I thought that if I laid out my facts and case for penalty mitigation consideration in the Opt Out, we would need to be in sync. If my representation of FAQs and assertions were in conflict with what FAQs and recommendations she would have to make, i.e., if we were in strong disagreement, she would trump me. Now maybe that is really NOT the case, but I did not know enough about the Opt Out at that time to tell. Remember, there were no reported Opt Out cases up to that point, and no transparency about the process. I thought my previous pleas on “non willful behavior” had resonated with her, but when I actually asked her directly what she would determine, I realized that she was holding to a “willful finding”, although she would admit that I was not “willful” to the same degree that the Whales were. It was not year specific, but a generalized finding that she holding to.

I pointed out, that while I appreciated that she did recognize that I wasn’t a whale, (at one point she even said, that I shouldn’t have been in the program in the first place.) I didn’t see where there were “degrees of willfulness” provided for in the IRM, and not sure how that would help me. I was NOT willful, and so, I could not accept her “degree of willfulness” finding. Obviously, in the final TAS negotiated agreement, all ‘willfulness” was dropped, as in the end, it isn’t she who determines that.

So, I wouldn’t get too hung up on what an agent thinks. Obviously it is better if you can help shape their opinion of you and get them to see it through your eyes and find you non willful. That makes the Opt Out decision easier, but an DOJ attorney is going to decide the real “willfulness” standard in the end, and that is a high hurtle for them to cross. If you really think you are ‘non willful’, stick to your guns, and not get too concerned about the examiner. They are just the first minor cog in the wheel, and they don’t turn the wheel of justice on their own.

Just me

My agent doesn’t seem to have thought much of my situation either. I think many may have the IRS mentality (having with dealt with lots of tax cheats) that all ‘foreign’ account holders are tax evaders.

But I sent in a request to opt out, and am preparing an RC letter. One thing I did notice in your TAS letter — it mentioned that you were ‘not consciously aware’ of your reporting requirements. I was reading Jack Townsend’s blog, and he seemed to have a lot of discussion of ‘willful blindness’, conscious avoidance etc. etc. Could saying that one was not consciously aware of something lay one open to the charge of so-called willful blindness and hence willfulness ? I apologize since thats more of a lawyerly question and anyway it seemed to work for you, so maybe the IRS is more focused on the bottom line number rather than parsing one’s RC letter carefully.

I don’t know which to do after reading all of what you have written here. (I have still to go through the letters and sheets that have downloaded). It was terrifying to read of your ordeal and at the same time I admire the way you have interjected humour in it too. In your place, I would have been one hopping mad minnow, but you have maintained your grace and generosity, even trying to find the human side of the IRS and your examiner who was bent on finding you willful. Gives me some guidance on how we should be going forward on this.

And here you are still helping us minnows, who did not know we were minnows until just 3 weeks ago. 🙂

I am doing as you suggested and trying to read up as much as I can and getting lost in all the sub links that pop up. At times it almost feels like I am preparing for college exams and the examiner is out there to fail me, however well prepared I am. :O

Thank you soooo much @JustMe for taking the time out to pen down the minute details of what you had to endure “voluntarily”.

While reading your file I came across the case of that immigrant who was penalised $14,000 for a $218 tax default. I feel, I am going to be in the similar scenario and that is giving me the jitters. Although I have never filed a Sch B(since foolish me was told by my ignorant accountant in my country that since I was paying taxes where the interest income was earned, I would not be paying interest here…) so no question of marking “no” on that form.

I just wanted to ask you two things, if you know about them or feel like answering them.

a) When you called up TAS, did they have any limitation on how much (unjust) penalty you were facing, before deciding to take your case?

b) Have you ever come to know, being in this OVDI mess so long and on this and Jack T’s blog too, if TAS takes up cases of people who do QD’s and the IRS comes back for audit?

@Emma: We’re learning from you as well. You say you are neither a citizen nor a green card holder, but have “significant presence” in US. Does that mean you live in another country, but spend several months per year in US?

I don’t even begin to know what to say to help in your situation, but if your legal residence is elsewhere and you’re not a citizen nor a green card, why do you have to file FBARs or returns? I hope I’m not confusing you even further with my questions!

Emma,

Blaze asks a good question. If you are not a legal resident, I am not sure that the FBAR requirements apply to you. Maybe I don’t full understand your status. I am not an attorney, so not qualified to say one way or the other, but that is the first question I would want to get answered by an expert.

Secondly, yes, it is a bit like cramming for a college course. I do think as the fog of all this begins to clear in your mind, and given the fact that you never ever filed a Schedule B before, you have some very good reasonable cause justifications for not knowing about the FBAR if you tax status really requires you to file one.

Regarding your questions about the TAS… Generally they respond to help Tax payers who are running up against road blocks in the due process of dealing with the IRS. Penalty levels are not the consideration, lack of reasonableness, injustice or undue burden by the IRS is more the criteria.