Dear friends:

This morning, I received the following message from the Expat Forum:

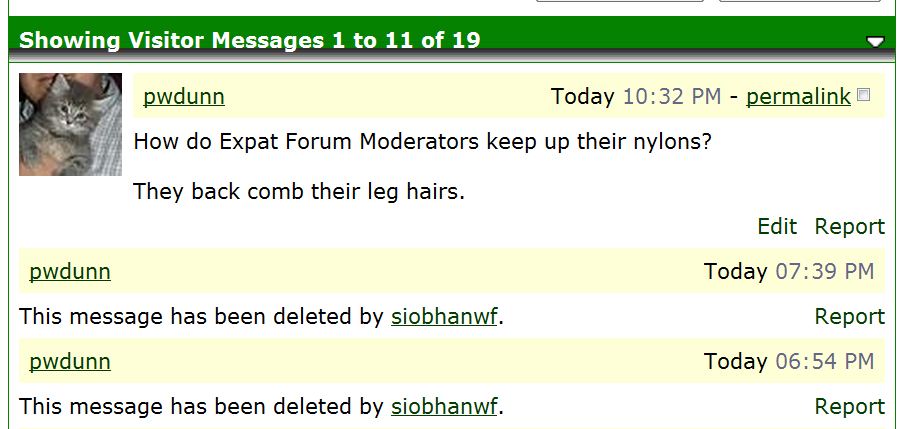

As you can see here, I spent the last hours of my life, poking fun at the censorship of the Expat Forum moderators. My last visitor message, that I put up while Europe slept, was this:

This was after a series of visitor messages (all deleted). I take pride, though, in only having one infraction, for putting up a French post (in the Nanaimo Cookie thread) which is a violation of Rule #6. Moderators can’t read foreign languages so they have a strict zero tolerance for them.

Here are the admittedly abusive messages that I wrote in my visitor messages (as you know, the Tax Forum where I was a frequent contributer is now closed), all of which were deleted by JoJo or siobhanwf :

“A stitch in time saves nine.”

“Give me liberty or give me death.” Patrick Henry

In Canada a knit cap is called a tuque; an Eskimo is called an “Inuit”.

“How do you catch a squirrel? Climb a tree and act like a nut.”

Once there was an Expat Forum Moderator whose husband, on his way to work, said, “Look, over there is a can of paint, please paint the living room.” She said, “I don’t know how to paint.” So he says, “Look, just follow the instructions on the side of the can.” So he comes home and she is painting away, but he notices that she has her parka and her fur coat on, sweating and getting paint all over her beautiful coat. So her husband says, “Why are you wearing your parka and your fur coat.” “Because,” she says, “The paint can says ‘best if applied with two coats’”.

Why did the Expat Forum Moderator cross the road? An Expat Forum Moderator doesn’t have to explain her actions.

How many Expat Forum Moderators does it take to change a light bulb? THAT’S NOT FUNNY!

We started a Nainamo cookie recipe thread, but it was smothered in a heavy helping of censorship. They took down that thread. Meanwhile, I think the last straw was my complaints in private messages to siobhanwf about the ban of French language. Sure they have rule #6, but I am Canadien writing in Canada, don’t I have the right to write in French? No, said he. You agreed to rule #6 when you signed up to the Expat Forum. So I responded thus,

HI Mr. siobhanwf: It may be true that the Expat Forum has a rule #6, but I am writing from Canada. Therefore, je crois (I believe) that French language rights trump your rule. I suggest if you want to do further business in Canada that you realize that it is improper to sanction a person in Canada who choses to use the French language. It can lead to bad dreams in which Pierre Trudeau visits you and speaks only French.

In any case, I was wondering how many points I can actually get before my account is suspended. I mean, if I get points on against my drivers license I could lose the privilege to drive. It seems that I have no longer any right to put up visitor messages, because all my visitor messages have been erased by either you or JoJokins. Just let me know.

Thanks,

PetrosResearch

I don’t know whether they feared the Trudeau curse, or whether they didn’t like my affectionate name for JoJo. Perhaps it was my company name, my old ID at the Expat Forum, which was subject to ban after two months, because it violated Rule #11. Apparently my flaunting of Rule #11 in a private message is the straw that broke the camel’s back.

Hey folks, I’m cut up about this. Really. Please light a candle for me when you say your prayers.

Anyhow, as soon as I learned that I hadn’t been compliant, I sorted it out because I am an honest person. I have lived in the United Kingdom since my early 20s so hadn’t fully understood my continued American obligations; after all, I’ve made my life in England with a British husband.

Neither of us are high earners; in fact, he suffered a stroke in his early 40s and was given an early retirement from his local government position when he turned 50. He has diabetes and has to live on his small pension and modest inheritance. He is ok now but at 60, I have to be realistic and realize that I will probably be widowed before I reach the official retirement age, which could be 67 or even 68 due to only being 46.

I suffer from Asperger’s Syndrome so am ‘different’ and consequently haven’t found it easy to cope; I was lucky that he so kindly invested into mutual funds and a stakeholder pension for me because I have never been abke to cope well enough to make a full-fledged living.

The point is, these assets uthat I’m having to pay thousands in US taxes came from my British husband’s own assets, not American sourced money. So this whole unfortunate situation seems like an attack on his wealth. He should have kept it all in his name but he thought he was protecting me in case he ever winds up in a nursing home, whereby all his assets could be taken from him to pay for his longterm care costs. He quite understandably feels like his assets are being attacked. We both feel bewildered and vulnerable but I feel bitterly resigned to having to pay it all and be fully compliant from now on. It’s cost me about three years’ net earnings in both back taxes, interest and penalties, and professiional fees. And all cometely innocently. Had we known, we would have done our financial planning completely differentky; I feel like a fool. :'(

Hi everyone. I was Schubert on the Expatforum site, I’m now Schubert1975 here (1975 is the year I became a Canadian and expatriated myself from the US).

I was part of the Nanaimo Bar thread that Petros started, and I deliberately pushed the envelope as did a few others here, with the results we all know. Unlike Petros I didn’t get a lifetime ban, gee I’m jealous, but I sent the administrator the following Contact note.

“I strongly object to the censorship that has been applied to some posts and to some members of the Canada forum, including Peter Dunn’s “ban,” surrounding the expat forum threads which have now been moved. Peter has made significant contributions to the previous discussions and to many expats who have had very serious concerns about the issues raised on that forum. I hereby require you to remove my account and profile from this website. I will never visit it nor post on it again. I think what you have done is shameful and unacceptable. I’m sure you disagree with me, that’s your right, as it is my right to have nothing further to do with you.”

I received an email (normal email to my ISP account) about half an hour later, confirming my account has been deleted.

I’ve done a quick final check of ExpatForum, spot-checking some of my own posts. They now have me listed as “guest” but so far at least some posts are still there, though of course none in the renounce and relinquish threads that were deleted. My FATCA/FBAR thread under General is still there, though I’m listed as a guest and no one can see a profile or easily cross-reference my other posts. A search for my old user name does pop up a number of surviving threads and quotes by others. And at least one link I posted to this (Brock) website is still visible on my original post, so far they haven’t done a search-and-destroy mission on Brock society cross-refs.

I only mention the latter point, as it indicates that a determined newbie to Expatforum might still get the idea of coming over to our Brock site. For now, anyway.

I’m happy now only to visit the Brock site, it feels free-er, all the really useful information that ever was posted on ExpatForum is here or the posters have moved over, so this is going to be a lot more congenial and useful anyway.

Good riddance to bad rubbish, as they say …

“I fear that Britain has become the USA’s poodle.”

Mona, for your info I’m located in the UK also. Although not a US citizen (by luck, as much as anything else; long story), I have written to my MP on three occasions regarding FATCA, because I object to the US riding roughshod over the UK/US tax treaty, and also the sovereignty of the UK and other countries. His replies indicate, admittedly in somewhat veiled terms, that the UK govt are not all that keen on it, and are working to find a “more proportionate solution”.

Now, I’m old and wise enough not to believe any politician’s words at face value. However, the UK govt is at least aware of FATCA as being a problem. Who knows what they’ll actually do about it, but if there’s enough noise maybe something. Write to your MP also, and/or get family and friends to do the same. Create a stir. Maybe the UK press will be interested in the story. There’s a decent amount of anti-US govt sentiment around in the UK at the moment for various reasons. Even if that’s unjustified you could still use it to your advantage.

BTW, you’re thinking of Tiananmen Square 🙂 Not a bad analogy.

Well, I deserved it didn’t I? I made up a whole new genre of joke, the Expat Forum Moderator joke. But I must move on, eh? So I will go back to telling IRS agent jokes.

Hmmm. I asked about how to delete my account, and no one ever got back to me. I wasn’t asking out of anger though – the embarrassing thing is that I think I was asking out of fear. (“Did I say anything wrong? Something so out of line that it would need to be deleted? I am at risk in any way?”).

I know that sounds really paranoid but, well, I’ve also thought all along that I’m a pretty rule-abiding tax-payer (in fact, lately I’ve been getting refunds every year because I pay too MUCH in taxes).

So this whole “Boy are you in trouble” stuff I’ve been reading with regards to forms that I never even knew existed…gah. It all just makes me super nervous. I’ve sent all the info, so I think I’m OK now, but — what if I misinterpreted something? What if my accountant was wrong? It’s endless. I don’t like it.

Mona, have you tried to talk to someone at the HMRC to explain the situation? Since it’s your husband’s money, it really is an attack on a US person…

sorry.. attack on a British subject.

Send them an email saying “Viva Peter Dunn” and I bet they delete your account real quick!

Geeez, to be frank, I don’t think hmrc would want to take it up. Once he put it in my name it was no longer his money but now my money.

The UK wouldn’t go out of their way to enforce US taxes or fines but wouldn’t intercede either. I think because of the savings clauses that allow for Americans to still be doubly taxed by the US as though the treaty didn’t exist.

We were simply both stupid, looking back. We should have sought specialist financial advice but instead I went native and mistakingly assumed I could invest like the British, especially as I even hold dual nationality. That I could live by the law of the land I lived in; instead, I effectively face discriminatory treatment by both governments. I am an anomaly.

Life’s a bitch sometimes.

As for the other place, I can understand why they want to cover their backs. I felt that Bev gave a very reasoned response but also felt her hands were tied.

Unlike some here, I am not a tax protestor. I hope the fatca laws will be repealed or at least modified and I want residence-based taxation but until then will report everything and pay all the US taxes too.

While it is a very unrelated issue maybe you should get in touch with these people in the UK as they don’t in the least take a favorible view of the US government. I know this case in pecularily gets a lot of attention in the Daily Mail but not the Murdoch owned papers.

http://freegary.org.uk/

I’ll note the aforementioned Gary Mckinnon also has Asperger’s syndrome

http://travel.state.gov/law/citizenship/citizenship_5199.html says that a child born out of wedlock to a female US citizen is only a USC “if the mother was physically present in the United States or one of its outlying possessions for a continuous period of one year prior to the person’s birth.” I read it that if you left the US when you were 20 and had a child at age 25 then the child is not a US citizen. In contrast, if you had been married then the child would be a US citizen so great job by not being married at the time!!

The bit about renunciation being “illegal” on the new expat tax forum really bothered me too. I just send the following pm to Bev. Feel free to borrow.

Dear Bevdeforges

I’m trying to understand why it is now forbidden to discuss renunciation on the Expat forum. None of the previous topics were about renunciation to evade taxes, since in all probability none of the posters ever owed taxes to the US. I certainly don’t, not after the FEIE and tax credits. Most of the posters were talking about renunciation because of the stess and expense of filing and the risk of penalties and fears about what future laws may be enacted. There is nothing illegal about that.

Nor is renunciation necessarily political–I didn’t see any US-bashing, only IRS-bashing, which is understandable given the level of stress many of the posters are experiencing.

I am renouncing for purely practical/psychological reasons. I am a worrier and it is important for me to be in compliance with the law. As a US citizen abroad I was having a very hard time figuring out how to stay complant. I have decided that living under one set of laws is enough. It doesn’t mean I don’t love the place I came from.

I was glad to finally find a place where renunciation could be discussed openly, where I wasn’t accused of “betraying my country” and gasps of “How could you do such a thing!”. But now it has become a taboo topic on this forum as well. A step backwards. It is a shame.

Best Regards,

Rødgrød

I sent her a private msg about the new rules.

which were renunciation was about tax evaison.

I pointed out that pre-existing tax obligations were still binding. Then she said it off topic as “political.”

It will not matter how you present the topic, new reasons will be created to ban renunciation.

I just sent a request to have my account deleted as well. Here is what I sent in the feedback form (Its 2 in the morning where I am so its the best that I could come up with..)

“Dear Forum Administrator,

I find the censorship on this forum to be completely over the top. You haven’t even properly informed the user base of where the new “forum” is located, and even my post in the Canada forum which kindly pointed out the new location was censored within two minutes. You clearly do not want to host any discussion AT ALL related to US taxes or citizenship, so why not just delete forum as I recommended and simply ban ALL discussion relating to tax and citizenship if that is what you want to do.

The Tax Forum is now absolutely pointless – I and many others would never have joined nor posted here had I been confronted with such a draconian list of rules. The ONLY reason I registered on this website was to be able to discuss the topic of US citizenship renunciation, the FBAR and the effects of FATCA. Your new guidelines imply that it is now forbidden to discuss renunciation at all and that we can mention the others but not have any opinion on them whatsoever. Renunciation is hardly an extreme measure in the US case since for many it is the ONLY measure that can be taken to be able to live a normal life. 1000 people renounce Singaporean citizenship annually to evade military service – Is this illegal to mention on the Singapore board or is a hypocritical double standard in place where you can criticise the questionable doings of any government except the US one? In case you weren’t aware, you cannot renounce US citizenship if you are not tax compliant, and most people aren’t renouncing US citizenship because of taxes!

You have seriously disappointed me and countless others who came to value this website as a support network and place where a free exchange of information could take place. I enjoyed using this forum and also posted in several other ones on the website, but do not wish to be associated with this website from this point forward and require you to delete my account immediately.”

Won’t do anything of course 🙂 I want to thank the creators of this website again for taking the time to put this together and giving us a truely FREE forum where we can discuss our thoughts and concerns.

I am late in finding out this news…..I had happened to copy something yesterday and know my post count was 379. I just looked and it is at 230. I asked to have the account deleted.

Good riddance Expat Forum.

Mine is now deleted as well, but it took overnight for me to hear back.

I’ll put it here too — from an email from my sister who lives in the States. I hate to have her worrying about me. I actually worry about her more that she lives within the boundaries of the US, but our locations are where our life paths led us.

“Just a short note to say that on the news last night they showed a bunch of people that had just taken their oath to become U.S. citizens and the special meaning it had to them since it was done on MLK’s birthday. I just looked at them with pity because I know they know nothing about these issues.”

One the one hand, “just because you’re paranoid, doesn’t mean they aren’t actually out to get you.”

On the other hand, and I say this after decades of working in the Canadian federal government (now retired) and often going through Statistics Canada (the only legal way it can be done) to do statistical analysis of large government databases and computer systems, I know from experience that the bigger the organization and computer system, the harder it is to do anything reliable with it, without a substantial expenditure of resources (both money and staff time). IRS and all US federal departments are facing cuts of about 10% or more both in staff and funding. There are limits to what even they can do given resources and other priorities. Yes if they really want to target someone or something they probably can and probably will, but as in any organization there is the question of costs versus benefits.

My suspicion is that what’s happened on ExpatForum is that the admin and moderators are either pro-American (or anti-American-expats-especially-in-Canada-which-harbored-draft-dodgers-decades-ago), or (as others have suggested on this thread) they themselves are paranoid about having their website targeted by IRS or other US agencies once someone identifies that website as having a lot of pro-renunciation, anti-IRS posts on it (which is going to be relatively easy to do on Google). I think part of what happened is the former bias, and part of it is the admin and moderators scaring themelves (or maybe being warned off by someone).

For the IRS, going after individual posters, or identifying all “unfriendly” posters, on a specific website is feasible but is that going to be a real priority, given other priorities and demands on diminishing resources?

The answer to that latter question is anyone’s guess, but I’m not losing sleep over it.

We can spin all sorts of Big Brother nightmares, and some of them may actually be real, but don’t live your life in fear of things that probably aren’t realistic. And if push comes to shove, we still do live in a country that still does have a functioning legal system that is still sovereign and governed by rule of (Canadian) law. Even if there are some disturbing indicatations that our present government wants to erode some of that … this is still a better place to be living in than is the US, IMO.

I’d say it is no great loss to have been banned from the expat forum. It has no real information of benefit. I’m glad I found the Isaac Brock Society!

Well i agree with you, the moderators at Expatforum.com suck. , When ever you post anything there they will be the first one to jump and answer – disagree to it or criticize.

It is unacceptable to comment on or criticise information other members have posted. They have all the answers and if you disagree you get banned . I guess the companies pay huge money to the moderators to criticize fellow contributors.

Expatforum.com used to be once a very helpful resource for expats however, a lot of the community, I talk to are unhappy with the recent goings on Expatforum.com and say they’ve left for other forums and groups where life is simpler and more pleasant. Thanks to the Moderators.

The Moderators also have access to your private messages. it’s difficult to speak freely on this open forum. So be careful,i say.Soon, there will be no-one left but the moderators and their bffls

JS – Welcome to Brock. You may not get a lot of response on this older thread. Proud to state that way back when, latter 2011, usx “participation” at Expat was deliberately limited to lurking only. The stench of control and censorship was apparent, even before the sudden deletion of two large and active threads. Sketch of that history at USxCanada InfoShop. Shortly after Brock launched, usx came in out of the cold.